- Home

- »

- Electronic Devices

- »

-

Frame Grabber Market Size, Share & Growth Report, 2030GVR Report cover

![Frame Grabber Market Size, Share & Trends Report]()

Frame Grabber Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Web Inspection, Transportation Safety and maintenance, Scientific), By End-Use (OEMs, Manufacturers, System Integrators), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-102-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frame Grabber Market Size & Trends

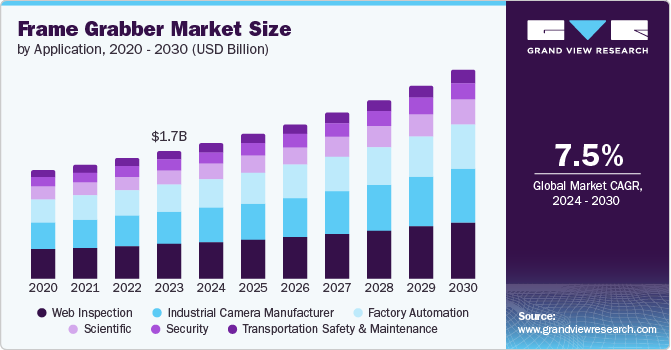

The global frame grabber market size was valued at USD 1.65 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. Frame grabbers are crucial components in various applications, from machine vision to medical imaging, and innovations in this field are continuously expanding their capabilities. As industries seek to leverage the latest imaging technologies for better performance and precision, the demand for sophisticated frame grabbers is poised to grow.

The rising adoption of machine vision systems in industrial automation has also contributed to the growth of the frame grabber market. Machine vision systems rely on frame grabbers to capture and process images for object recognition, defect detection, and barcode reading tasks. With the ongoing trend towards smart manufacturing and Industry 4.0, frame grabbers' demand for efficient image acquisition solutions is expected to continue driving market growth.

With the advancements in medical imaging technologies such as digital X-ray, ultrasound, and endoscopy, the need for high-speed and high-resolution image capture has grown substantially. Frame grabbers play a crucial role in these imaging systems, enabling the capture and processing of detailed medical images for diagnostic and surgical purposes.

Furthermore, expanding the gaming and entertainment industry has also fueled the demand for frame grabbers. With the growing popularity of virtual reality (VR) and augmented reality (AR) applications, there is a need for high-performance frame grabbers to capture and render immersive visual content. This trend has led to increased investments in frame grabber technology to support the development of advanced gaming and entertainment experiences.

Application Insights

Web inspection segment dominated the market and accounted for a share of 27.7% in 2023. Modern web inspection systems have evolved from basic visual checks to sophisticated setups capable of detecting minute defects in real time. This evolution has been driven by technological innovations such as higher-resolution cameras, faster frame rates, and advanced image-processing algorithms. These advancements allow for detailed and accurate inspection of web materials such as paper, film, and textiles. As industries demand higher quality and reliability from their products, the need for advanced web inspection solutions supported by state-of-the-art frame grabbers continues to grow.

The industrial camera manufacturer segment is expected to register the fastest CAGR of 7.7% during the forecast period. Advances in camera technology, such as developing higher-resolution sensors, faster image capture rates, and improved low-light performance, significantly boost the demand for industrial cameras. Innovations such as CMOS sensors, which offer high resolution and frame rates at lower costs, and advancements in lens technologies are enhancing the capabilities of industrial cameras. These developments not only improve the quality of images captured but also expand the range of applications for these cameras, creating more opportunities for industrial camera manufacturers to integrate their products with frame grabbers and capture high-quality data for various industrial applications.

End Use Insights

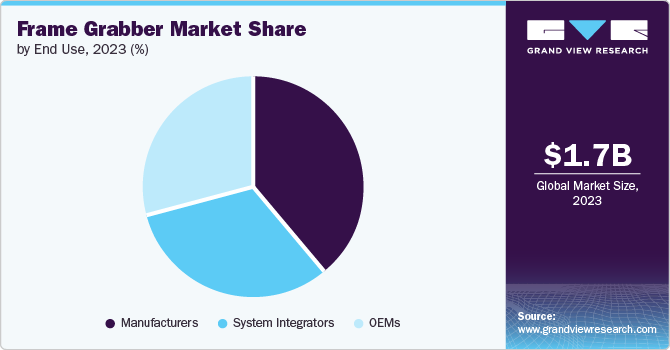

The manufacturers segment accounted for the largest market revenue share in 2023. Manufacturers across various industries invest in high-tech quality control solutions to ensure that products meet stringent quality standards and minimize defects. Frame grabbers are critical components in these systems, as they capture high-resolution images of products and facilitate detailed inspection processes. Innovations in machine vision technology, such as improved image processing algorithms and higher resolution cameras, are making these systems more effective.

OEMs segment is expected to register the fastest CAGR during the forecast period. As industries seek to enhance the functionality and performance of their equipment, OEMs are increasingly incorporating advanced vision systems into their products. Frame grabbers are essential to these systems, enabling high-quality image capture and processing for various applications. OEMs in the machine vision industry integrate frame grabbers into inspection systems for automated quality control, product sorting, and assembly line monitoring.

Regional Insights

North America frame grabber market is expected to grow at substantial CAGR during the forecast period. As manufacturers in the region adopt more automated processes to improve efficiency, reduce costs, and enhance product quality, there is a growing need for sophisticated frame grabbers. These frame grabbers are integral to machine vision systems used in quality inspection, robotic guidance, and process monitoring. The trend towards Industry 4.0, which emphasizes smart factories and interconnected manufacturing systems, is particularly strong in North America.

U.S. Frame Grabber Market Trends

The U.S. frame grabber market dominated the North America market in 2023. Technologies such as 4K and 8K resolution cameras, high-speed imaging, and improved low-light performance are pushing the boundaries of what frame grabbers can achieve. As U.S. industries seek to adopt these cutting-edge technologies for machine vision, medical imaging, and security applications, the demand for state-of-the-art frame grabbers is on the rise.

Europe Frame Grabber Market Trends

Europe frame grabber market was identified as a lucrative region in 2023. In Europe, there is a strong emphasis on quality control and adherence to stringent regulatory standards across various industries, including automotive, aerospace, and pharmaceuticals. This focus on quality assurance drives the demand for advanced frame grabbers that can be used in machine vision systems for visual inspection, measurement, and defect analysis tasks.

Germany frame grabber market held a substantial market share in 2023. Germany is home to some of the world’s leading automotive manufacturers, including BMW, Volkswagen, and Mercedes-Benz, and is at the forefront of automotive technology and innovation. These companies use frame grabbers as integral components of machine vision systems for applications such as quality inspection, assembly line monitoring, and automated testing of automotive components. The automotive industry’s emphasis on high product quality and safety standards drives the demand for advanced frame grabbers capable of high-resolution imaging and precise defect detection.

Asia Pacific Frame Gabber Market Trends

The Asia Pacific frame grabber market accounted for the largest market revenue share of 41.4% in 2023. As industries across the Asia Pacific region seek to improve the precision and speed of their imaging systems, there is an increasing demand for frame grabbers that offer high-resolution imaging capabilities and fast data processing speeds. This trend is evident in various sectors, including industrial automation, medical imaging, and scientific research, where advanced imaging solutions are needed to support complex tasks.

Japan frame grabber market is expected to grow rapidly in the coming years. Japan’s growth in robotics and automation applications is a significant factor driving the frame grabber market. Japan is a global leader in robotics technology, strongly emphasizing developing advanced robotic systems for various sectors, including manufacturing, healthcare, and service industries. Frame grabbers play a vital role in robotic systems by enabling high-resolution image capture for object recognition, navigation, and automated inspection. The increasing adoption of robotics for automation in production lines, research, and daily applications creates a growing demand for high-performance frame grabbers that can handle complex imaging tasks.

Key Frame Grabber Company Insights

Some of the key companies in the market include ADLINK Technology Inc., Advantech, Co., Ltd., Euresys S.A., ISRA Vision AG, and Teledyne DALSA Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

ADLINK Technology Inc. offers various products and solutions, including frame grabbers, which are essential components in machine vision systems. The company's frame grabbers are designed to provide high-speed data acquisition, real-time image processing, and reliable performance in demanding environments.

-

Euresys S.A. offers a wide range of frame grabbers designed to capture images from various types of cameras and convert them into digital format for computer processing. These frame grabbers enable high-speed image acquisition and analysis in the manufacturing, medical imaging, security, and transportation industries.

Key Frame Grabber Companies:

The following are the leading companies in the frame grabber market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Advantech, Co., Ltd.

- Euresys S.A.

- ISRA Vision AG

- KAYA Instruments

- Teledyne DALSA Inc.

- Pleora Technologies Inc.

- BitFlow, Inc.

- IDS Imaging Development Systems GmbH

- IMPERX, Inc.

- Matrox Imaging

- Active Silicon

- Comp13

- Comp14

- Comp15

Recent Developments

- In November 2020, Teledyne DALSA expanded its Xtium series by introducing advanced frame grabbers designed for various interface standards like CameraLink, CameraLink HS, and CoaXPress. These frame grabbers leverage the capabilities of PCI Express Gen 2.0 and Gen 3.0 platforms to provide rapid access to host memory, achieving bandwidths of up to 3.4 GB/s and 6.4 GB/s when utilizing PCIe x8 slots.

Frame Grabber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.75 billion

Revenue forecast in 2030

USD 2.70 billion

Growth Rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million, Volume in thousand units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

ADLINK Technology Inc., Advantech, Co., Ltd., Euresys S.A., ISRA Vision AG, KAYA Instruments, Teledyne DALSA Inc., Pleora Technologies Inc., BitFlow, Inc., IDS Imaging Development Systems GmbH, MPERX, Inc., Matrox Imaging, Active Silicon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frame Grabber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frame grabber market report based on application, end use, and region.

-

Application Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

Web Inspection

-

Transportation Safety and maintenance

-

Scientific

-

Factory Automation

-

Industrial Camera Manufacturer

-

Security

-

-

End Use Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

Manufacturers

-

System Integrators

-

-

Regional Outlook (Volume, Thousand Units) (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.