- Home

- »

- Food Additives & Nutricosmetics

- »

-

Fragrance Fixatives Market Size, Industry Report, 2033GVR Report cover

![Fragrance Fixatives Market Size, Share & Trends Report]()

Fragrance Fixatives Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Sclareolide, Ambroxide, Galaxolide, Iso E Super, Sucrose Acetate Isobutyrate), By End-use (Fine Fragrances, Homecare Products, Color Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-723-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fragrance Fixatives Market Summary

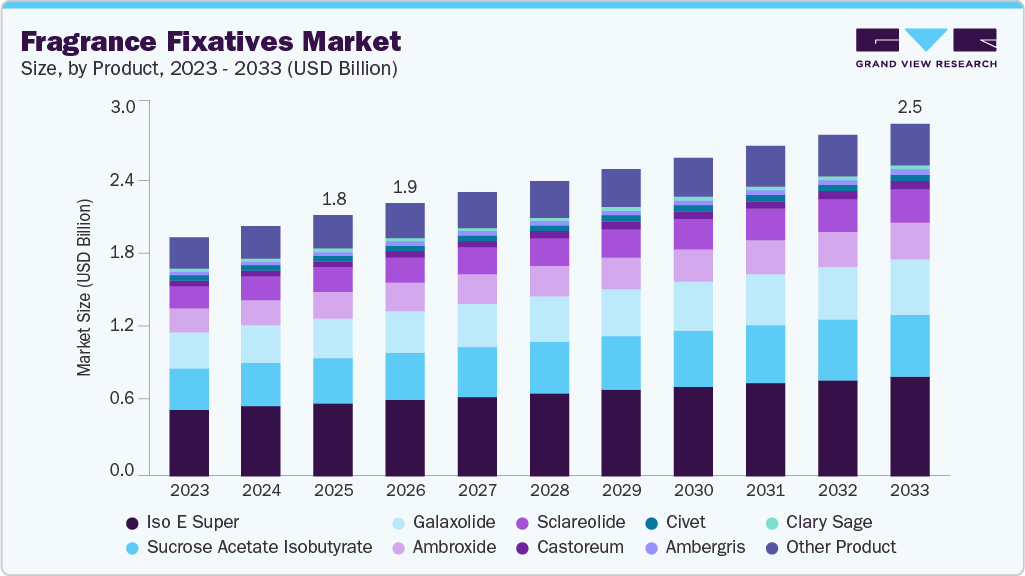

The global fragrance fixatives market size was estimated at USD 1,791.6 million in 2025 and is projected to reach USD 2,421.9 million by 2033, grow at a CAGR of 3.7% from 2026 to 2033. As consumer expectations rise for lasting sensory experiences across personal care, cosmetics, and home products, fixatives have become indispensable ingredients shaping fragrance performance and commercial value worldwide in competitive global consumer goods industries.

Key Market Trends & Insights

- Europe dominated the fragrance fixatives market and accounted for the largest revenue share of 42.0% in 2025.

- France held over 40.0% revenue share of the Europe fragrance fixatives market.

- By product, the Iso E super product segment dominated the market and accounted for the largest revenue share of 28.0% in 2025.

- By application, the skincare products segment is expected to grow fastest with a CAGR of 3.9% from 2026 to 2033.

Market Size & Forecasts

- 2025 Market Size: USD 1,791.6 Million

- 2033 Projected Market Size: USD 2,421.9 Million

- CAGR (2026-2033): 3.7%

- Europe: Largest market in 2025

- Latin America: Fastest growing market

The fragrance fixatives market forms the backbone of modern perfumery by ensuring scent longevity, balance, and consistency. Fine fragrances, toiletries, detergents, candles, and air care products rely on fixatives to control evaporation and maintain scent identity. Rising disposable income and lifestyle orientation toward premium experiences have increased demand for long lasting fragrances. Brands seek consistent olfactory signatures across regions, encouraging higher usage of reliable fixative materials. This demand is reinforced by the growth of organized retail and e-commerce channels, which expose consumers to a wider range of fragranced products and intensify competition based on scent quality and durability. Manufacturers respond by reformulating products to meet evolving sensory expectations across diverse cultural and climatic consumption environments around the world.

Regulatory frameworks governing ingredient safety and environmental impact shape formulation choices and sourcing strategies. Pressure to reduce allergenic or animal derived materials has shifted focus toward synthetic and plant based alternatives. Cost stability, supply reliability, and performance consistency strongly affect purchasing decisions by fragrance houses. At the same time, brand owners demand fixatives that perform well across different product bases such as alcohol, water, and solid matrices, creating complexity in formulation and encouraging collaboration between ingredient suppliers and perfumers. These interactions define competitive positioning and determine long term success within the value chain as expectations for transparency and compliance continue to rise across global fragrance markets today.

Demand for natural origin ingredients and biodegradable solutions is encouraging investment in new extraction methods and green chemistry. Growth in emerging economies expands consumption of personal care and home fragrances, widening the customer base. Customization and niche perfumery trends also create space for specialized fixatives that deliver unique scent behavior. Together, these dynamics indicate a resilient market with long term potential driven by creativity, compliance, and the pursuit of differentiated sensory experiences. Strategic partnerships, research intensity, and portfolio diversification will shape future competitive trajectories as companies align innovation goals with regulatory and consumer expectations across both mature and developing regions globally today.

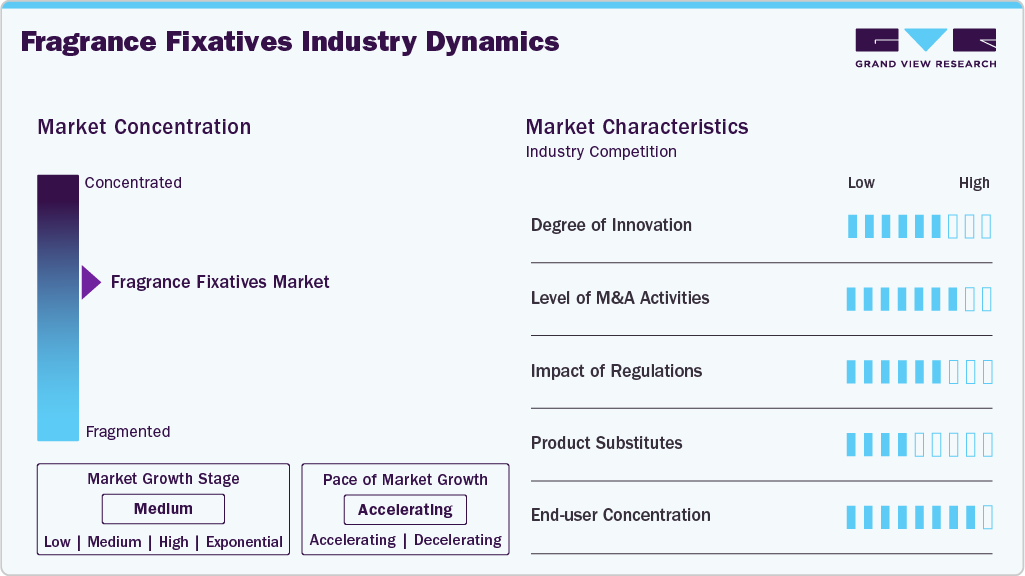

Market Concentration & Characteristics

The fragrance fixatives market shows a moderately concentrated structure shaped by a mix of established ingredient manufacturers and specialized fragrance solution providers. Large companies benefit from long standing relationships with fragrance houses, broad product portfolios, and strong formulation expertise, which creates high entry barriers for new participants. At the same time, smaller players operate by focusing on niche applications, natural alternatives, or customized solutions, allowing them to remain competitive through flexibility and innovation rather than scale.

Market characteristics are defined by strong emphasis on performance reliability, regulatory compliance, and consistency across applications. Buyers prioritize fixatives that deliver predictable scent behavior under varied conditions while meeting safety and sustainability expectations. Product differentiation is driven more by functional effectiveness and formulation compatibility than by branding alone. Long development cycles, close collaboration between suppliers and perfumers, and strict quality standards shape competitive behavior, resulting in a market where trust, technical support, and long term partnerships play a central role in sustaining demand.

Product Insights

Iso E Super dominated the fragrance fixatives market and accounted for the largest revenue share of 28.0% in 2025, due to its versatility and strong performance across fragrance categories. Its ability to enhance diffusion while providing long lasting woody notes makes it widely preferred in fine fragrances, personal care, and home applications. Consistent quality, formulation stability, and broad acceptance among perfumers have reinforced its extensive use, supporting sustained demand across global fragrance production.

Galaxolide is expected to grow at the fastest rate with a CAGR of 4.2% from 2026 to 2033, driven by rising preference for clean, musky, and skin friendly scent profiles. Its effectiveness as a fixative in detergents, fabric care, and personal care products strengthens its commercial appeal. Expanding consumption of everyday fragranced products and growing focus on scent retention in mass market applications are encouraging wider adoption, supporting its accelerated growth outlook.

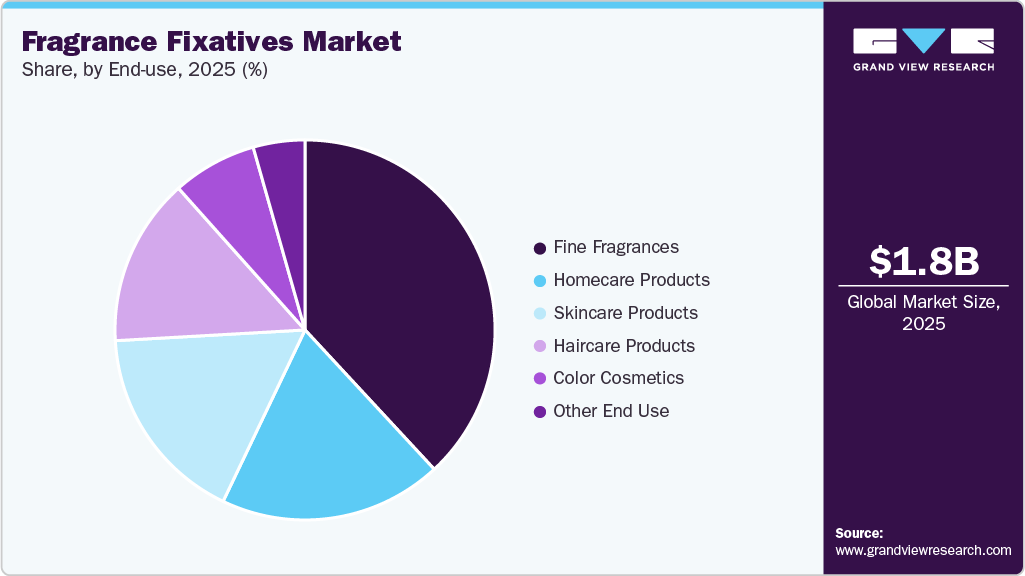

End-use Insights

The fine fragrances application segment dominated the market and accounted for the largest revenue share of 38.2% in 2025, due to strong consumer emphasis on scent longevity, complexity, and signature appeal. Premium and luxury perfumes rely heavily on fixatives to preserve top, heart, and base note balance over time. Continuous product launches, brand differentiation through olfactory identity, and rising demand for high quality perfumes have reinforced the dominant position of this segment.

Skincare products are expected to grow at the fastest rate with a CAGR of 3.9% from 2026 to 2033, supported by increasing use of fragranced creams, lotions, and serums. Consumers associate subtle, long lasting scents with product quality and sensory comfort, driving demand for mild yet effective fixatives. Expansion of daily skincare routines and premiumization trends are encouraging manufacturers to invest in improved fragrance performance within skin compatible formulations.

Regional Insights

Europe dominated the fragrance fixatives market and accounted for the largest revenue share of 42.0% in 2025, due to its long established perfumery heritage and concentration of leading fragrance houses. Countries such as France, Germany, and Switzerland serve as formulation and innovation hubs, driving consistent demand for high performance fixatives. Strong consumer preference for premium fragrances, strict quality standards, and continuous product refinement have reinforced Europe’s leading position.

France Fragrance Fixatives Market Trends

France held over 40.0% revenue share of the Europe fragrance fixatives market, and represents a cornerstone of the global industry due to its central role in fine fragrance creation. The presence of renowned perfume houses and skilled perfumers sustains continuous demand for high quality fixatives. Emphasis on craftsmanship, scent structure, and longevity drives consistent use of complex fixative compositions. Strong export orientation of French perfumes further reinforces the need for fixatives that maintain fragrance integrity across global distribution channels.

Asia Pacific Fragrance Fixatives Market Trends

The Asia Pacific market is expanding as fragrance adoption increases across personal care, skincare, and home products. Diverse cultural scent preferences encourage formulation variety, increasing demand for adaptable fixatives. Rising awareness of grooming and hygiene products supports fragrance usage in daily routines. Regional manufacturers focus on affordability combined with performance, creating steady demand for fixatives that deliver lasting scent without overpowering profiles across varied consumer segments.

China fragrance fixatives market is influenced by growing interest in premium personal care and fine fragrances among younger consumers. Increasing brand consciousness and gifting culture support demand for products with refined and persistent scents. Domestic manufacturers are investing in improved formulation quality to compete with international brands, increasing fixative usage. Preference for subtle yet enduring fragrances shapes demand for fixatives that offer softness and controlled diffusion.

North America Fragrance Fixatives Market Trends

The North America fragrance fixatives market reflects strong demand from personal care, home fragrance, and premium perfume segments. Consumers in the region value product consistency and long lasting scent performance, encouraging manufacturers to rely on effective fixatives. Well established cosmetic and household brands emphasize formulation stability across varied climates and usage patterns. Mature retail networks and frequent product reformulation cycles sustain steady demand for fixatives across both mass and premium applications.

The fragrance fixatives market in the U.S. is shaped by high consumption of fragranced personal care and lifestyle products, supported by strong brand influence and marketing driven product differentiation. Consumers show preference for distinctive yet wearable scents, increasing reliance on fixatives that balance projection and longevity. Regulatory scrutiny encourages careful ingredient selection, influencing demand toward compliant and well tested fixative materials. Innovation in niche and artisanal fragrances also supports diversified fixative usage.

Latin America Fragrance Fixatives Market Trends

Latin America is expected to grow at the fastest rate with a CAGR of 3.9% from 2026 to 2033, supported by rising consumption of personal care and fine fragrance products. Expanding middle class populations and growing interest in branded and aspirational products are increasing fragrance usage across daily applications. Regional scent preferences that favor long lasting and expressive profiles are encouraging greater incorporation of fixatives, strengthening market expansion.

Middle East & Africa Fragrance Fixatives Market Trends

The Middle East and Africa market is characterized by strong cultural appreciation for intense and long lasting fragrances. Traditional perfume practices and high usage of concentrated scents increase reliance on robust fixatives. In Middle Eastern countries, fragrance plays a central role in daily life and social identity, sustaining high consumption. Growing availability of branded perfumes and personal care products across Africa supports gradual expansion of fixative demand.

Key Fragrance Fixatives Company Insights

The two key dominant manufacturers in the market are Givaudan S.A. and DSM-Firmenich.

-

Givaudan S.A. is a globally recognized fragrance ingredient manufacturer with deep roots in perfumery science and creative innovation. The company is known for developing high-performance aroma molecules that enhance scent longevity, diffusion, and balance across fine fragrance, personal care, and home applications. Its strength lies in combining advanced chemistry with sensory expertise, allowing it to create distinctive fixative ingredients that support complex fragrance structures. Continuous investment in research, sustainability initiatives, and proprietary ingredient technologies has positioned the company as a central force shaping modern fragrance formulation standards worldwide.

-

DSM-Firmenich represents a powerful combination of scientific excellence and fragrance craftsmanship, formed through the integration of complementary expertise in chemistry, biotechnology, and perfumery. The company develops a broad range of fragrance ingredients, including fixative materials that improve scent stability and performance across diverse product bases. Its approach emphasizes innovation through biotechnology, natural ingredient transformation, and responsible sourcing. By aligning ingredient development with evolving consumer preferences and regulatory expectations, the company plays a significant role in advancing fragrance quality, functionality, and sustainability across global markets.

Key Fragrance Fixatives Companies:

The following are the leading companies in the fragrance fixatives market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan S.A.

- DSM-Firmenich

- International Flavors & Fragrances (IFF)

- Symrise AG

- Takasago International Corporation

- Sensient Technologies Corporation

- Robertet Group

- Aroma Ingredients

- Alpha Aromatics

- Eastman Chemical Company

Recent Developments

-

In March 2025, Mane, a French fragrance and flavor manufacturer, completed the acquisition of Avoca from Ashland Inc., strengthening its capabilities in fragrance fixatives through the addition of production facilities and specialized expertise in the United States.

-

In January 2025, LANXESS launched new high‑purity benzyl benzoate fixative grades, including Ultrapure Scopeblue® variants, offering long‑lasting fragrance performance and reduced environmental impact for fine fragrance, personal care, and home scent applications.

Fragrance Fixatives Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,872.1 million

Revenue forecast in 2033

USD 2,421.9 million

Growth rate

CAGR of 3.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Givaudan S.A.; DSM-Firmenich; International Flavors & Fragrances (IFF); Symrise AG; Takasago International Corporation; Sensient Technologies Corporation; Robertet Group; Aroma Ingredients; Alpha Aromatics; Eastman Chemical Company

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fragrance Fixatives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fragrance fixatives market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

Sclareolide

-

Ambroxide

-

Galaxolide

-

Iso E Super

-

Sucrose Acetate Isobutyrate

-

Ambergris

-

Castoreum

-

Civet

-

Clary Sage

-

Other Product

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

Fine Fragrances

-

Homecare Products

-

Color Cosmetics

-

Haircare Products

-

Skincare Products

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fragrance fixatives market size was estimated at USD 1.31 billion in 2019 and is expected to reach USD 1.36 billion in 2020.

b. The global fragrance fixatives market is expected to grow at a compound annual growth rate of 4.1% from 2019 to 2025 to reach USD 1.79 billion by 2025.

b. Europe dominated the fragrance fixatives market with a share of 44.1% in 2019. This is attributable to rising demand for men’s fragrances and perfumes in the region.

b. Some key players operating in the fragrance fixatives market include Eastman Chemical, Tokos BV, Lotioncarfter LLC, Paris Fragrances, SVP Chemicals, Synthodor Company, PFW Aroma Chemicals, Zaki.

b. Key factors that are driving the market growth include rising awareness regarding the therapeutic effect of fragrances influencing the psychological and emotional well-being of consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.