- Home

- »

- Medical Devices

- »

-

Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Report 2030GVR Report cover

![Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Size, Share & Trends Report]()

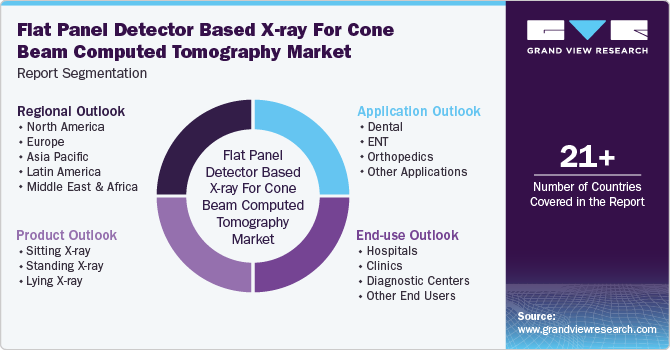

Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Dental, ENT, Orthopedics), By Product (Sitting X-ray, Standing X-ray), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-471-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

FPD Based X-ray CBCT Market Trends

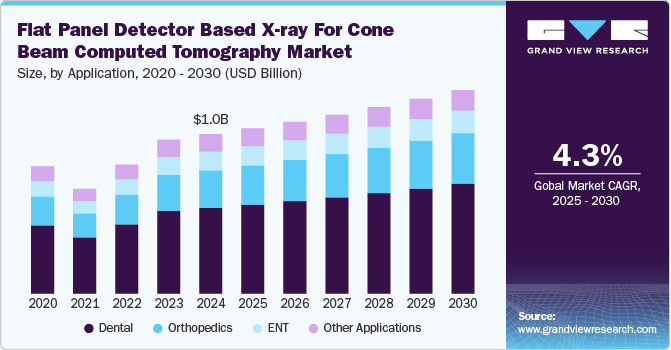

The global flat panel detector based x-ray for cone beam computed tomography market size was estimated at USD 1.03 billion in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. Major factors contributing to the market growth include the rising demand for dental imaging, the prevalence of orthopedic conditions, and the adoption of cone beam computed tomography (CBCT) systems in ENT applications. Technological advancements in detector technology are also driving market growth, also the expanding geriatric population, which creates a higher need for diagnostic tools. For instance, according to the Population Reference Bureau, the population of Americans aged 65 and older is expected to grow from 58 million in 2022 to 82 million by 2050, marking a 47% increase. Additionally, the share of this age group in the total population is projected to rise from 17% to 23%.

Technological advancements in Cone Beam Computed Tomography (CBCT) are enhancing the performance, precision, and efficiency of imaging systems. These advancements include improvements in flat panel detectors (FPD), which have led to higher image resolution and lower radiation exposure, benefiting both patients and clinicians. Additionally, faster scan times and enhanced software for image reconstruction are improving diagnostic workflows, making CBCT systems more accessible and easier to use in various medical fields. Integration of artificial intelligence (AI) into CBCT systems is also revolutionizing diagnostics by improving accuracy in image analysis and enabling automated detection of abnormalities. These innovations are driving the widespread adoption of CBCT in areas like dentistry, orthopedics, and oncology.

The rising prevalence of chronic diseases and conditions, such as dental disorders, orthopedic issues, and cancer, is significantly increasing the demand for advanced diagnostic tools like Cone Beam Computed Tomography (CBCT). As these health issues become more common, particularly in aging populations, there is a greater need for precise imaging technologies that offer high-resolution, 3D visualizations with minimal radiation exposure. This trend is further driving the adoption of CBCT systems in medical practices, particularly in specialties like dentistry, orthopedics, and oncology, where accurate diagnostics and treatment planning are essential.

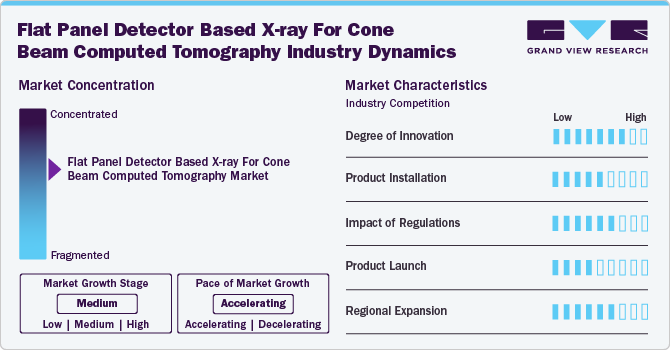

Market Concentration & Characteristics

The flat panel detector-based X-ray for Cone Beam Computed Tomography (CBCT) industry is accelerating at a high pace, driven by the growing demand for advanced imaging technologies across medical fields such as dentistry, orthopedics, and oncology. The increasing preference for minimally invasive diagnostic tools, coupled with advancements in flat panel detector technology that offer higher resolution and reduced radiation exposure, is fueling this growth. Additionally, the rising prevalence of chronic diseases, the expanding geriatric population, and ongoing technological innovations, including the integration of artificial intelligence for enhanced image analysis, are further propelling the industry's rapid expansion

Leading companies in the industry are consistently involved in activities such as developing innovative technologies, expanding product portfolios, and enhancing imaging capabilities to maintain a competitive edge. They are also focusing on strategic partnerships, mergers and acquisitions, and collaborations to strengthen their market position and broaden their geographic reach. Additionally, companies are investing in research and development to improve the safety, efficiency, and usability of C-arms, while also incorporating advanced features like AI-driven image analysis. Continuous efforts in obtaining regulatory approvals and ensuring compliance with international safety standards further highlight their commitment to staying at the forefront of the industry.

The level of innovation in flat panel detector-based x-ray for cone beam computed tomography is remarkable, fueled by advancements in detector technology that offer higher image resolution and lower radiation exposure. Additionally, the integration of artificial intelligence (AI) for enhanced image analysis, machine learning for automated diagnostics, and the development of faster, more efficient imaging workflows are driving significant progress.

The increasing demand for CBCT from end users, such as hospitals, clinics and diagnostic centers, is playing a significant role in the growth of this industry. As healthcare providers and researchers seek more advanced imaging capabilities, particularly for complex conditions like dental disorders, orthopedic injuries, and cancers, CBCT systems are becoming essential. For instance, in August 2024, The Military Dental Centre (MDC) in Meerut Cantt, India, has made a major advancement in improving oral healthcare services by installing a state-of-the-art Cone Beam Computed Tomography (CBCT) machine.

Regulations governing Flat Panel Detector (FPD)-based X-ray for Cone Beam Computed Tomography (CBCT) play a critical role in shaping the market. Regulatory bodies like the FDA and CE require stringent compliance with safety standards, particularly concerning radiation exposure and image quality. These regulations ensure that CBCT devices are safe and effective for clinical use. Additionally, obtaining necessary approvals, such as 510(k) clearance, can impact the time-to-market for new CBCT systems.

Manufacturers are actively involved in launching new products to meet evolving industry demands and technological advancements.

The geographical reach of the Flat Panel Detector (FPD)-based X-ray for Cone Beam Computed Tomography (CBCT) market is expanding rapidly, with growth seen in both developed and emerging regions. In developed markets like North America and Europe, advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and strong regulatory frameworks drive demand.

Application Insights

The dental segment dominated the market by capturing the largest revenue share of 53.8% in 2024. This is primarily attributed to the increasing demand for advanced imaging solutions in dental practices, such as for implant planning, orthodontics, and endodontics. The growing prevalence of dental disorders, coupled with the rising awareness of oral health, has driven the adoption of Cone Beam Computed Tomography (CBCT) in the dental field. Additionally, CBCT's ability to provide precise, high-resolution 3D images with lower radiation exposure has made it a preferred choice among dental professionals for accurate diagnosis and treatment planning.

The orthopedic application segment is expected to grow at the fastest CAGR of over 5.1% over the forecast period. The growing demand for advanced imaging technologies in orthopedic surgeries, driven by the increasing incidence of musculoskeletal disorders, fractures, and joint-related conditions, is a key factor behind this growth. Additionally, the need for precise, real-time imaging during complex orthopedic procedures, such as joint replacements and trauma surgeries, is fueling the adoption of Cone Beam Computed Tomography (CBCT) in this segment. Technological advancements in CBCT, including enhanced 3D imaging and reduced radiation exposure, further contribute to its increasing use in orthopedic applications.

Product Insights

The standing x-ray segment dominated the market with a revenue share of over 52.7% in 2024. This dominance is attributed to the increasing preference for standing X-rays in orthopedic and musculoskeletal imaging, where weight-bearing images provide more accurate diagnostic information, especially for spine, hip, and lower limb conditions. The ability to capture detailed images in a natural, upright posture helps in better assessment of joint alignment and other structural issues. Additionally, standing X-ray systems are gaining traction due to their ease of use, reduced scan times, and enhanced patient comfort during procedures.

The lying x-ray segment is expected to grow at the fastest CAGR of over 4.6% during the forecast period, this is attributed to its increasing use in trauma and emergency cases where patients are immobile or unable to stand. Lying X-rays are essential for obtaining clear, detailed images in situations involving severe injuries, fractures, or post-operative assessments, particularly in critical care settings. The growing demand for advanced imaging in operating rooms and intensive care units, along with improvements in image quality and portability of X-ray systems, further drives the adoption of lying X-rays in healthcare facilities.

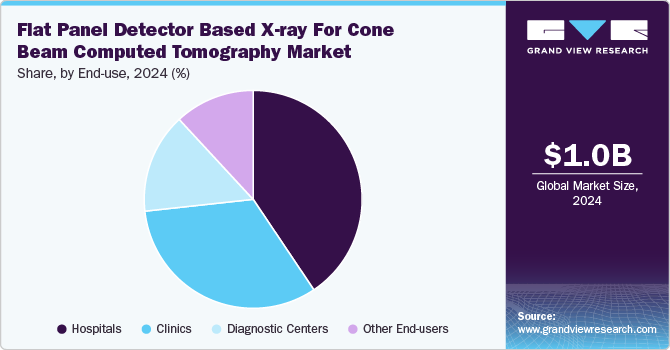

End-use Insights

The hospitals segment dominated the market with a revenue share of over 40.6% in 2024. This dominance is attributed to the high demand for advanced imaging systems in hospitals for a wide range of diagnostic and surgical procedures. Hospitals typically have larger budgets and more extensive infrastructure to accommodate high-end imaging equipment, enabling them to perform complex procedures across specialties like orthopedics, cardiology, and oncology. Additionally, the increasing number of patients requiring diagnostic imaging, along with hospitals' ability to provide comprehensive care, further contributes to the segment growth.

The other end use segment, which includes research centers and ambulatory surgery centers (ASCs), is expected to grow at the fastest CAGR of 4.9% over the forecast period due to the increasing focus on research and development in medical imaging technologies and the rising demand for outpatient procedures. Research centers are increasingly adopting advanced imaging solutions to facilitate clinical studies and improve diagnostic accuracy. Furthermore, ASCs are experiencing growth as healthcare providers shift towards more cost-effective, efficient, and patient-centered care models. The preference for minimally invasive surgeries performed in ASCs, combined with the need for high-quality imaging during these procedures, drives the demand for this market.

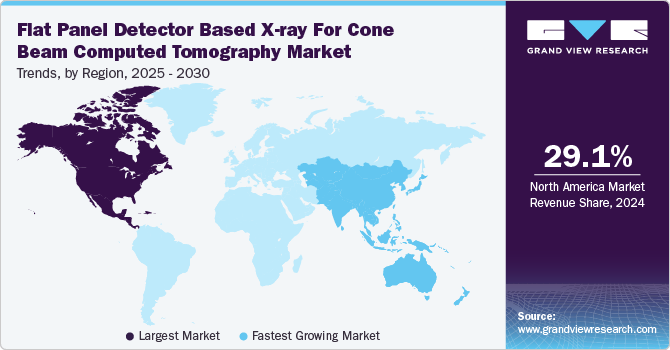

Regional Insights

North America flat panel detector-based x-ray for cone beam computed tomography market held the largest share of 29.1% in 2024. This can be attributed to the presence of a well-established healthcare infrastructure, coupled with high adoption rates of advanced imaging technologies across various medical fields. The region benefits from significant investments in healthcare technology, robust reimbursement policies, and a growing emphasis on research and development. Additionally, the rising prevalence of chronic diseases and an increasing number of diagnostic procedures drive demand for CBCT systems in hospitals, clinics, and specialized imaging centers throughout North America.

U.S. Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Trends

The FPD based X-ray CBCT market in U.S. held the largest market share in 2024 in the North America region. This is owing to the presence of advanced healthcare systems, which emphasizes the adoption of advanced imaging technologies and high-quality patient care. The U.S. has a large number of hospitals and diagnostic centers equipped with the latest medical imaging devices, driven by significant healthcare expenditure and strong support for research and development in medical technologies.

Europe Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Trends

The FPD based X-ray CBCT market in Europe held a significant market share in 2024. Europe's aging population and the rising prevalence of chronic diseases are contributing to the growing demand for precise and early diagnostic devices. Additionally, the focus on preventive healthcare and early detection strategies is further accelerating the adoption of these technologies throughout the region.

The UK FPD based X-ray CBCT market is anticipated to expand due to the increasing demand for advanced imaging solutions in both dental and medical applications. Factors such as the growing prevalence of chronic diseases, an aging population, and the rising number of diagnostic procedures are driving the need for high-quality imaging technologies. Additionally, government initiatives promoting healthcare modernization and investment in innovative medical devices are expected to further boost market growth.

The FPD based X-ray CBCT market in France is expected to grow over the forecast period due to the rising prevalence of chronic diseases. As the incidence of these conditions increases with age, there is a growing need for advanced imaging solutions that can provide accurate diagnostics and treatment planning. Additionally, the French healthcare system's focus on improving patient outcomes through innovative medical technologies and early detection strategies further contributes to the demand for CBCT systems.

The Germany FPD based X-ray CBCT market is expected to grow over the forecast period this can be attributed to the country’s robust healthcare infrastructure and a strong emphasis on advanced medical technologies. The rising prevalence of chronic diseases and an aging population are driving the demand for accurate diagnostic imaging solutions. Additionally, Germany's commitment to research and innovation in healthcare, along with favorable reimbursement policies for advanced imaging procedures, further supports the adoption of CBCT systems.

Asia Pacific Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Trends

The FPD based X-ray CBCTmarket in Asia Pacific is estimated to witness the fastest CAGR of 5.3% during the forecast period, primarily due to the rapid development of healthcare infrastructure in emerging economies such as India, China, and Indonesia. The increasing investments in healthcare facilities, coupled with a growing demand for advanced diagnostic imaging technologies, are driving this growth. Additionally, rising awareness of the benefits of early disease detection, along with the expansion of medical tourism in the region, is further propelling the adoption of CBCT systems.

The China FPD based X-ray CBCT market is expected to grow at notable growth rate over the forecast period, driven by the rapid expansion of the healthcare infrastructure and increasing investments in advanced medical imaging technologies. The rising prevalence of chronic diseases, along with a growing aging population, is fueling the demand for accurate and efficient diagnostic tools.

The FPD based X-ray CBCT market in Japan is expected to grow, over the forecast period. This growth is attributed to the country’s advanced healthcare system, which emphasizes the adoption of advanced imaging technologies for improved patient outcomes. The increasing prevalence of chronic diseases and the aging population are driving the demand for accurate diagnostic imaging solutions.

Latin America Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Trends

The FPD based X-ray CBCT market in Latin America market is anticipated to undergo moderate growth throughout the forecast period. This is due to the increasing demand for advanced medical imaging technologies in healthcare facilities, driven by the rising prevalence of chronic diseases and the need for accurate diagnostic solutions. Additionally, improving healthcare infrastructure and increasing investments in the medical sector are contributing to market expansion. The growing awareness of the benefits of early disease detection and preventive healthcare practices, along with a rising middle-class population seeking quality healthcare services, further supports the growth of the CBCT market in the region.

MEA Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Trends

The FPD based X-ray CBCT market in MEA is anticipated to witness growth owing to the increasing focus of this region in R&D. Governments and private sectors are investing significantly in enhancing medical infrastructure and adopting advanced imaging solutions to improve diagnostic capabilities. Additionally, the rising prevalence of chronic diseases and a growing demand for quality healthcare services are driving the need for efficient imaging technologies.

Key Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Company Insights

The major players in the flat panel detector-based X-ray for Cone Beam Computed Tomography (CBCT) market are actively enhancing their product portfolios through various strategies to maintain competitiveness and increase their market share. These strategies involve collaborating with research institutions, expanding the range of applications, and pursuing government approvals for their products, as compliance with regulatory standards is essential.

Key Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Companies:

The following are the leading companies in the flat panel detector based x-ray for cone beam computed tomography market. These companies collectively hold the largest market share and dictate industry trends.

- Planmeca Oy

- VATECH

- Dentsply Sirona.

- Carestream Dental

- NEWTOM

- PreXion Inc

- Owandy Radiology

- Varex Imaging

- Curvebeam

Recent Developments

-

In February 2024, Carestream Dental launched the CS 8200 3D Access, an advanced four-in-one CBCT system designed with user-friendly imaging technology that enables more confident diagnoses, expands treatment options, and promotes increased business growth for dental practices.

-

In May 2024, Detection Technology, a global provider of X-ray detector solutions, launched indium gallium zinc oxide thin-film transistor (IGZO-TFT) flat panel detectors (FPD) to enhance dental imaging. The latest additions to the company’s FPD portfolio include the X-Panel 1717z FDM, designed for cone beam computed tomography (CBCT) and panoramic imaging, as well as the X-Panel 3030z FDM-TG-X specifically for CBCT applications.

Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.07 billion

Revenue forecast in 2030

USD 1.31 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Planmeca Oy; VATECH; Dentsply Sirona; Carestream Dental; NEWTOM; PreXion Inc.; Owandy Radiology; Varex Imaging; Curvebeam

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flat Panel Detector Based X-ray For Cone Beam Computed Tomography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flat panel detector-based x-ray for cone beam computed tomography market report based on application, product, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental

-

Implantology

-

Orthodontics

-

Oral Surgery

-

Endodontics

-

Periodontology

-

Other Dental Applications

-

-

ENT

-

Orthopedics

-

Other Applications

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sitting X-ray

-

Standing X-ray

-

Lying X-ray

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Diagnostic Centers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

Who are the key players in flat panel detector based x-ray for cone beam computed tomography Market?b. Some key players operating in the flat panel detector based x-ray for cone beam computed tomography market include Planmeca Oy, VATECH, Dentsply Sirona., Carestream Dental, NEWTOM, PreXion Inc, Owandy Radiology, Varex Imaging, Curvebeam

b. Key factors that are driving the flat panel detector based x-ray for cone beam computed tomography market growth include significant advantages of CBCT over other radiographic imaging systems, technological advancements in radiology and increased adoption of low radiation X-ray imaging systems.

b. The global flat panel detector based x-ray for cone beam computed tomography market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.07 billion in 2025.

b. The global flat panel detector based x-ray for cone beam computed tomography market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 1.31 billion by 2030.

b. North America dominated the flat panel detector-based X-ray for CBCT market with a share of 29.1% in 2024. This is attributable to the well-established supply network of major players, adoption of new technology, and Medicare coverage for CBCT scans.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.