- Home

- »

- Consumer F&B

- »

-

Fortified Dairy Products Market Size & Share Report, 2030GVR Report cover

![Fortified Dairy Products Market Size, Share & Trends Report]()

Fortified Dairy Products Market Size, Share & Trends Analysis Report By Product (Milk, Yogurt, Cheese, Ice Cream), By Ingredient (Vitamins, Minerals, Probiotics), By Flavor, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-389-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Fortified Dairy Products Market Trends

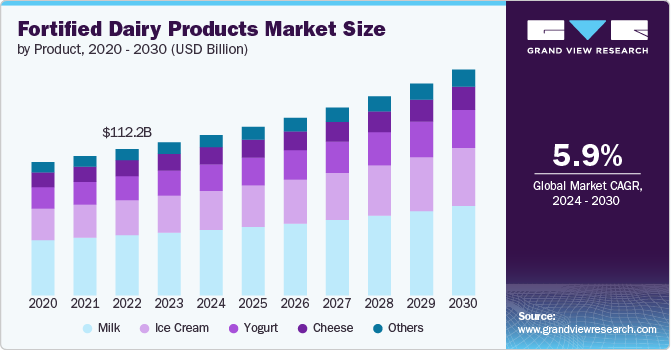

The global fortified dairy products market size was estimated at USD 117.34 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The growing health awareness, nutritional deficiencies, and evolving consumer preferences are accelerating the market growth over the forecast period. Fortified dairy products, enriched with essential vitamins and minerals, offer numerous health benefits, making them a popular choice among consumers.

According to a report by the International Food Information Council (IFIC), 85% of consumers are more concerned about the nutritional content of their food than they were five years ago. This shift towards health-conscious eating has significantly boosted the demand for fortified foods, particularly dairy products. Fortified dairy products are seen as an easy way to enhance daily nutrient intake without drastic changes in diet.

People are more aware of the importance of a balanced diet and the role of essential nutrients in maintaining good health. Fortified dairy products, which are enriched with vitamins such as A, D, and E, as well as minerals like calcium and iron, help bridge the gap between dietary deficiencies and nutritional requirements. As a result, health-conscious consumers are turning to these products to ensure they get the necessary nutrients without having to make significant changes to their dietary habits.

Globally, nutritional deficiencies are a pressing concern. The World Health Organization (WHO) reports that around 2 billion people suffer from micronutrient deficiencies, with iron, vitamin A, and iodine deficiencies being the most common. Fortified dairy products enriched with essential vitamins and minerals provide a practical solution to these deficiencies. For example, fortifying milk with vitamin D helps combat widespread vitamin D deficiency, which affects about 1 billion people worldwide.

Governments worldwide are implementing public health campaigns to promote the consumption of fortified foods. In the U.S., the National School Lunch Program (NSLP) ensures that schoolchildren receive milk fortified with vitamins A and D. Such initiatives have significantly increased the consumption of fortified dairy products among children. According to the USDA, over 30 million children participate in NSLP daily, highlighting the extensive reach of these programs.

Regulatory bodies in many countries have set standards for food fortification, encouraging manufacturers to produce fortified dairy products. These regulations ensure that fortified products meet specific nutritional criteria, thereby enhancing their credibility and acceptance among consumers. In addition, some governments offer subsidies or tax incentives to manufacturers to promote the production and distribution of fortified foods, further boosting the market for these products.

There is a growing trend towards premium and functional foods, driven by consumers willing to pay a premium for products that offer additional health benefits. Fortified dairy products fall into this ingredient, as they provide enhanced nutritional value compared to regular dairy products. This trend is particularly strong in urban areas and among higher-income groups, who are more likely to prioritize health and wellness in their purchasing decisions.

Product Insights

The milk segment led the market with the largest revenue share of 40.96% in 2023. Growing health consciousness among consumers leads them to seek products with added nutritional benefits, such as vitamins and minerals, which fortified milk provides. Health issues like osteoporosis and vitamin D deficiencies are becoming more prevalent, prompting consumers to look for preventative dietary options. In addition, parents are more aware of the importance of nutrition for their children’s development and often choose fortified milk to ensure they receive essential nutrients.

The ice cream segment is projected to grow at the fastest CAGR of 6.8% from 2024 to 2030. People are seeking indulgent treats that also offer nutritional benefits, such as added vitamins, minerals, and probiotics is propelling the market growth over the forecast period. Innovations in food technology have made it possible to create fortified ice cream without compromising taste and texture. The rise in awareness about gut health and the benefits of probiotics has further fueled interest in these products.

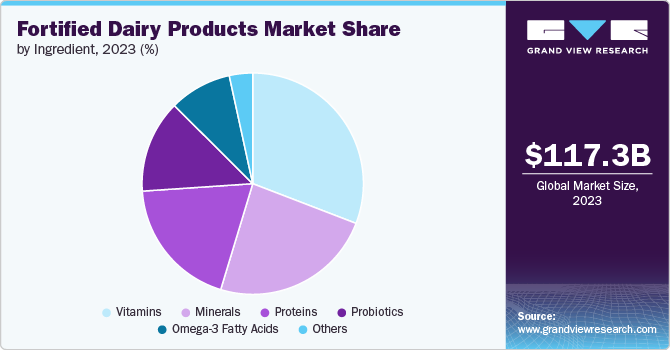

Ingredient Insights

Based on ingredient, the vitaminsegment led the market with the largest revenue share of 30.84% in the year 2023 owing to growing consumer awareness about health and nutrition. People are seeking products that provide additional health benefits, such as dairy items fortified with vitamins D, A, and B12, which support immune function and bone health. Moreover, there is a rising prevalence of vitamin deficiencies, and related health issues are accelerating the market growth. Innovations in fortification technology also make it easier to enhance dairy products with vitamins without affecting taste or quality.

The protein segment is projected to grow at the fastest CAGR of 6.9% over the forecast period. Growing health consciousness and the popularity of high-protein diets, such as keto and paleo, are driving consumers to seek out protein-enriched dairy products. Consumers are increasingly aware of protein's benefits for muscle growth, weight management, and overall health, prompting a shift towards high-protein foods. In addition, the fitness and sports nutrition sectors are contributing to this demand, as athletes and fitness enthusiasts prefer protein-fortified dairy for recovery and performance enhancement.

Flavor Insights

Based on flavor, the unflavored/natural segment led the market with the largest revenue share of 77.82% in 2023. Unflavored fortified dairy products offer a pure, versatile base that allows for greater flexibility in cooking and meal preparation. In addition, there is a growing awareness of the benefits of maintaining a natural diet, which boosts interest in dairy products fortified with essential nutrients without added flavors or sweeteners. The rise in dietary sensitivities and preferences for less processed foods also contributes to this demand.

The flavored segment is projected to grow at the fastest CAGR of 6.8% over the forecast period. Consumers are seeking both nutritional benefits and enjoyable taste experiences, driving interest in products that combine essential nutrients with appealing flavors.Flavored fortified dairy products cater to a wide range of taste preferences, making them more attractive to children and adults alike. Innovations in flavor technology allow for the creation of diverse and enticing options, from fruit-infused to dessert-inspired varieties. In addition, flavored fortified dairy products offer a convenient way to boost nutrient intake without compromising on taste, which is especially appealing to busy lifestyles.

Distribution Channel Insights

Based on distribution channel, the hypermarkets & supermarkets segment led the market with the largest revenue share of 36.98% in 2023. These retail channels provide a wide range of fortified dairy products, making it easier for consumers to access and choose from various options. Hypermarkets and supermarkets offer competitive pricing and promotions, which attract budget-conscious shoppers and drive sales. In addition, these stores often feature prominent displays and marketing strategies that highlight the health benefits of fortified dairy products. The high foot traffic and extensive reach of hypermarkets and supermarkets also contribute to increased product visibility and consumer awareness.

The online segment is estimated to grow at the fastest CAGR of 7.3% over the forecast period. Online shopping offers unparalleled convenience, allowing consumers to browse and purchase fortified dairy products from the comfort of their homes. E-commerce platforms often provide a wider selection and detailed product information, including nutritional benefits, which helps consumers make informed choices. The rise of subscription services and direct-to-consumer models allows for regular delivery of fortified dairy products, enhancing customer convenience and loyalty.

Regional Insights

The fortified dairy products market in North America held 24.84% of the global revenue in 2023. There is a growing focus on health and wellness, with consumers increasingly seeking products that offer additional nutritional benefits, such as vitamins and minerals. According to the International Dairy Foods Association, the rising consumer interest in health-oriented dairy products is propelling the market growth in the region. In addition, North American consumers are becoming more aware of the benefits of fortified dairy for addressing deficiencies and supporting overall health.

U.S. Fortified Dairy Products Market Trends

The fortified dairy products market in the U.S. is expected to grow at a CAGR of 5.8% from 2024 to 2030. Health consciousness among American consumers is at an all-time high, with many seeking products that offer added nutritional benefits such as vitamins and minerals. According to a report by the National Dairy Council, there is increasing awareness of the role of fortified dairy in supporting overall health, including bone density and immune function. The convenience of fortified dairy products, which offer an easy way to enhance daily nutrition, aligns well with busy lifestyles.

Asia Pacific Fortified Dairy Products Market Trends

Asia Pacific dominated the fortified dairy products market with the revenue share of 36.15% in 2023. Growing concerns about nutrient deficiencies, especially in emerging economies, are prompting consumers to seek out fortified options for essential vitamins and minerals. The expanding middle class and changing dietary patterns also contribute to higher consumption of dairy products. In addition, innovations in product formulations and flavors cater to diverse regional preferences, making fortified dairy more appealing.

Europe Fortified Dairy Products Market Trends

The fortified dairy products market in Europe is projected to grow at the fastest CAGR of 5.3% from 2024 to 2030. The European market benefits from strong retail networks, including supermarkets and health food stores, which offer easy access to a wide range of fortified dairy options. Innovations in product formulations and flavors cater to diverse consumer preferences, making fortified dairy more appealing. In addition, stringent regulatory standards and certifications ensure the quality and efficacy of fortified dairy products, boosting consumer confidence.

Key Fortified Dairy Products Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation in line with evolving consumer preferences. Leveraging extensive global distribution networks, these key players effectively reach diverse customer bases and tap into emerging markets.

Key Fortified Dairy Products Companies:

The following are the leading companies in the fortified dairy products market. These companies collectively hold the largest market share and dictate industry trends.

- Dean Foods Company

- Nestle S.A

- BASF SE.

- China Modern Dairy Holdings Ltd.

- General Mills Inc.

- Arla Foods UK Plc.

- Danone

- CMMF Ltd.

- Fonterra Group Cooperative Ltd

- Bright Dairy & Foods Co.

Recent Developments

-

In June 2024, Galaxy Foods, a Tanzanian producer of dairy and non-dairy products, has introduced a new fortified yogurt branded as "Kilimanjaro Fresh." This yogurt is developed with the assistance of Arla Foods Ingredients for product innovation and incorporates value-enhancing ingredients supplied by Promaco. The product is designed to provide essential nutrients to low-income families, with a particular focus on benefiting children

-

In May 2023, Aavin, a major state-run cooperative known for its large-scale production of pasteurized skimmed milk in India, launched a new fortified milk product in a purple sachet. Previously, Aavin offered its milk in green, orange, and blue sachets, each corresponding to different processing methods and price points. The introduction of the purple sachet represents an addition to their product line, with its own unique processing method and pricing structure

Fortified Dairy Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 123.04 billion

Revenue forecast in 2030

USD 173.19 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Dean Foods Company; Nestle S.A; BASF SE.; China Modern Dairy Holdings Ltd.; General Mills Inc.; Arla Foods UK Plc.; Danone; CMMF Ltd.; Fonterra Group Cooperative Ltd; Bright Dairy & Foods Co.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fortified Dairy Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fortified dairy products market report based on product, ingredient, flavor, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice Cream

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Minerals

-

Probiotics

-

Omega-3 Fatty Acids

-

Proteins

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Unflavored/Natural

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fortified dairy products market was estimated at USD 117.34 billion in 2023 and is expected to reach USD 123.04 billion in 2024.

b. The global fortified dairy products market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 173.19 billion by 2030.

b. Asia Pacific dominated the fortified dairy products market with a share of over 36.15% in 2023. The growth of the regional market is mainly driven by a growing awareness of nutrient deficiencies and their impact on health, and innovations in food technology and product formulations have made fortified dairy products more appealing to diverse taste preferences in the region.

b. Some of the key players operating in the fortified dairy products market include Dean Foods Company, Nestle S.A, BASF SE., China Modern Dairy Holdings Ltd., General Mills Inc., Arla Foods UK Plc., Danone, CMMF Ltd., Fonterra Group Cooperative Ltd, and Bright Dairy & Foods Co.

b. Key factors that are driving the fortified dairy products market growth include the rising health consciousness, a growing elderly population concerned with bone health, dietary trends favoring fortified products, regulatory encouragement for nutrient enrichment, and consumer preference for functional dairy products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."