Forklift Market Size, Share & Trends Analysis Report By Class (Class 1, Class 2), By Power Source, By Load Capacity (Below 5 Ton, 5-15 Ton, Above 16 Ton), By Battery Type, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-754-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Forklift Market Size & Trends

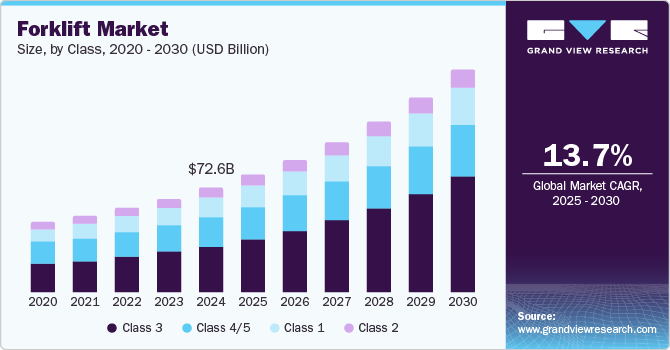

The global forklift market size is estimated at USD 72.59 billion in 2024 and is projected to grow at a CAGR of 13.7% from 2025 to 2030. The world is witnessing a significant increase in construction activities, highlighted by the expansion of road networks, the improvement of airports and seaports, and the modernization of rail systems. In the 2023-2024 annual budget of the Victoria state government in Australia, around AUD 9.3 billion (USD 6.18 billion) was projected to be allocated toward infrastructure and energy investments. This budget presents substantial prospects for the construction industry within the state.

The growing emphasis on sustainability and the rising environmental concerns have propelled the need for eco-friendly alternatives and triggered a paradigm shift from gas-fired or diesel-fired forklifts to electric forklifts. Governments across several countries are pursuing various initiatives to achieve a net-zero economy. For instance, in May 2023, the Federal Economic Development Agency for Southern Ontario announced an investment of USD 3.6 million in Stromcore Energy Inc., a forklift battery manufacturer, to add advanced manufacturing equipment and launch new products to promote a green economy. The company planned to introduce two energy-efficient products, namely Electric Cart, a zero-emission electric forklift designed in collaboration with Amazon.com, Inc., and Turbo Bank, an advanced AI-powered charger with enhanced efficiency. By assisting companies such as Stromcore Energy Inc., the government of Ontario is supporting green technology and manufacturing.

Efficient movement of goods and equipment is essential for developing and improving airports and seaports. Forklifts ensure seamless loading and unloading of cargo onto planes and ships, facilitating timely delivery of supplies and equipment for ongoing infrastructure projects. For instance, in June 2023, in New South Wales, NSW ports introduced a forty-year master plan for sustainable growth. The plan anticipates that population growth may triple the existing container trade at Port Botany and increase the volume of motor vehicles as well as machinery via Port Kembla.

In addition, the demand for construction materials would increase over the coming four decades to meet housing & infrastructure demand, while the shift to renewable energy would drive cargo trade projects, such as offshore and onshore wind farm components. Forklifts are well-suited for navigating the bustling environments of airports and seaports, effectively organizing, and distributing goods within these important transportation hubs.

However, raw materials such as steel, lead, and copper, and other products, such as rubber, are used to manufacture forklifts. These raw materials are sourced from different countries, and the supply of these materials is mainly vulnerable to fluctuations in the commodity markets and exchange rates. Such fluctuations may have negative effects on the supply chain and pose a challenge for the original equipment manufacturer operating in the market.

Class Insights

The class 3 segment accounted for the largest market share of 44.2% in 2024. Class 3 segment includes electric motorized hand trucks. These are hand-controlled forklifts, where the operator steers the forklift with a tiller from the front of the vehicle. Hand trucks are often controlled by a handle at the back of the truck, with a hand control used to steer as the driver rides or walks it to the destination. These forklifts are frequently used for moving items requiring low raises and can effortlessly transfer goods throughout the warehouse floor without requiring the product to be placed on a high shelf or rack.

The class 1 segment is expected to grow at the significant CAGR during the forecast period. The high demand for electric rider trucks across end use areas such as retail stores, factories, the food service industry, and chemical factories is expected to support the segment growth. These forklifts generally have fewer moving parts, thereby reducing maintenance requirements and overall expenses. The ease of maneuverability and quiet operations make class 1 forklifts suitable for diverse work environments, from warehouses to manufacturing facilities, where noise levels and space constraints are significant considerations.

Power Source Insights

The electric segment held the largest share of the forklift industry in 2024. Electricity is an eco-friendly alternative to gasoline and diesel-powered forklifts. Rising environmental concerns and depleting fossil fuel resources are driving the need for sustainable, efficient, and durable forklifts, which can also ensure a healthier, emission-free environment for employees. Advances in battery technology and the strong emphasis on ensuring a healthier working environment for employees are expected to play a potent role in driving the growth of the segment over the forecast period.

Several vendors are developing new electric forklift models as part of their efforts to expand their respective portfolios of material handling solutions. For instance, in May 2023, AB Volvo Penta, an industrial engine manufacturer, announced a partnership with FTMH Fantuzzi Team Material Handling Spa, a heavy equipment manufacturer, to develop electric forklifts. The partnership envisaged developing an electric forklift with weighing capacity up to 52 tons.

Load Capacity Insights

The 5-15 ton segment led the market in 2024. Forklifts with capacities between 5 tons and 15 tons are commonly used for handling a wide range of materials, including pallets, steel, and bricks. They can be considered highly efficient equipment for mechanized loading and short-distance transportation. They can be used both indoors and outdoors and can be fired by natural gas, liquid propane, or gasoline. These forklift trucks are usually sit-down models and happen to be the most common types of forklifts used to lift and position heavy objects promptly and with precision. This versatility is expected to create lucrative opportunities for the growth of the segment.

The below 5 segment is expected to register the fastest CAGR over the forecast period. These compact forklifts are highly versatile, allowing businesses to handle various load sizes efficiently. These compact forklifts facilitate the safe and easy movement of products across limited floor space. Manufacturing, warehousing, material handling, logistics, and freight handling are some of the application fields of these forklifts. Furthermore, when used to transport risky cargo in small warehouse spaces, these forklifts also protect the workforce.

Electric Battery Type Insights

The lead-acid segment held the largest revenue share in 2024. Lead-acid batteries can be considered a reliable energy source due to their ability to provide a high-power surge. Hence, they are popularly used in electric forklifts. Electric forklifts call for high current output to perform heavy lifting and maneuvering tasks. Lead-acid batteries can deliver the necessary power output, making them well-suited for these applications without confronting any significant voltage drops or power fluctuations.

The Li-ion battery segment is expected to register the fastest CAGR over the forecast period. Growing environmental concerns are prompting businesses to seek eco-friendly solutions to reduce their carbon footprint. Lithium-ion batteries offer a cleaner alternative to conventional lead-acid batteries, which feature toxic chemicals, such as lead and sulfuric acid. By adopting lithium-ion technology in electric forklifts, vendors are demonstrating their commitment to sustainability by abiding with the increasingly stringent environmental regulations, which bodes well for the growth of the segment.

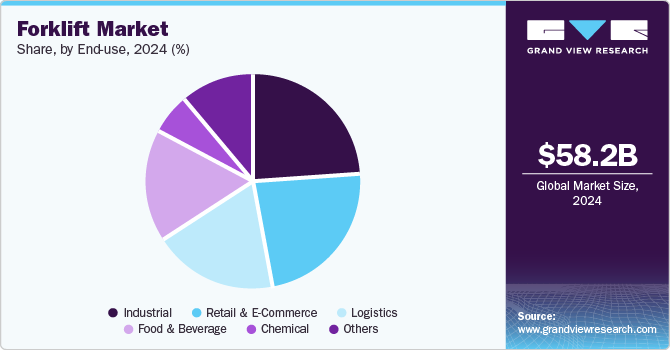

End Use Insights

The industrial segment dominated the market in 2024. Forklifts are extensively used for undertaking material handling and warehousing tasks in industrial environments. In manufacturing plants, forklifts play a crucial role in moving raw materials, intermediate products, and finished goods within production lines. Their ability to handle heavy loads and navigate tight spaces helps ensure a smooth material flow, reducing production bottlenecks and enhancing operational efficiency.

The retail & e-commerce segment has experienced a significant transformation in recent years, driven by changing consumer preferences and the rise of online shopping. The retail & e-commerce industry has been evolving significantly over the past few years, driven by changing consumer preferences and the growing preference for online shopping. In this dynamic landscape, forklifts have become integral to the industry, offering tailored applications to support efficient material handling and logistics operations. Forklifts play a vital role in streamlining warehouse operations and ensuring seamless movement of goods from order receipt to storage and order fulfillment. Their compact design and precise control enable agile maneuvering in tight spaces, optimizing space utilization and expediting inventory management.

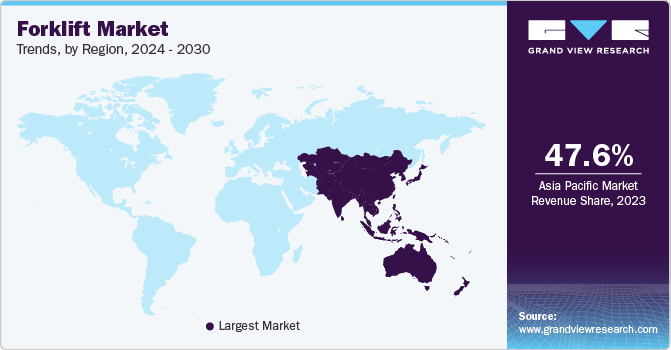

Regional Insights

The Asia Pacific forklift industry accounted for 48.4% share of the overall market in 2024. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness. As companies continuously develop advanced electric forklift models with enhanced performance and features, end use industries upgrade their fleets to remain competitive and efficient. As the market evolves, collaborations among governments, manufacturers, and businesses are expected to play a pivotal role in driving further advancements and widespread adoption of forklifts in Asia.

The China forklift market held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by industrial expansion, government policies promoting smart manufacturing, and the booming e-commerce sector. The country’s focus on sustainability and carbon neutrality is accelerating the shift from internal combustion engine (ICE) forklifts to electric and hydrogen-powered alternatives.

The forklift market in Japan held a significant share in 2024. In Japan, the market is evolving in response to an aging workforce and the increasing need for automation in logistics and manufacturing. Companies are investing in robotic and AI-driven forklifts to enhance operational efficiency and reduce dependency on manual labor. Sustainability goals are also shaping the industry, with a growing preference for electric forklifts over traditional fuel-based models.

Europe Forklift Market Trends

The Europe forklift industry was identified as a lucrative region in 2024. The Europe market is evolving in response to regulatory changes, technological advancements, and growing e-commerce activities. The push for sustainability is accelerating the transition from diesel and gas-powered forklifts to electric and hydrogen-powered models across various industries. Automation and robotics are gaining traction, with companies increasingly adopting autonomous forklifts to improve logistics efficiency and reduce labor dependency. The expansion of smart warehouses and digital supply chains is also driving demand for IoT-integrated material handling solutions.

The German forklift market is being shaped by its strong industrial base, stringent environmental regulations, and advancements in automation. As a leader in manufacturing and logistics, the country is witnessing increased demand for electric forklifts, driven by sustainability initiatives and the European Union’s carbon reduction goals.

North America Forklift Market Trends

The North America forklift industry held a significant share in 2024. The market in North America is being driven by rising automation, the expansion of e-commerce, and increasing demand for sustainable material handling solutions. With the rapid growth of warehouse and distribution centers, businesses are investing in electric and autonomous forklifts to enhance operational efficiency and reduce carbon emissions. Stringent environmental regulations and government incentives are also accelerating the shift from internal combustion engine (ICE) forklifts to battery-powered and hydrogen fuel cell alternatives.

U.S. Forklift Market Trends

The U.S. forklift industry held a dominant position in 2024. The market in the United States is witnessing significant transformation, driven by automation, sustainability initiatives, and the expansion of industrial and retail sectors. The surge in e-commerce has heightened the need for efficient warehouse management, increasing the adoption of electric and autonomous forklifts.

Key Forklift Company Insights

Some of the key players operating in the market include Toyota Motor Corporation (Toyota Material Handling); KION Group AG; Jungheinrich AG; Crown Equipment Corporation; and Mitsubishi Logisnext Co., Ltd.

-

Mitsubishi Logisnext Co., Ltd is engaged in developing, designing, and selling engine and electric-powered forklifts, local area networks, electric vehicles, automated warehouses, monorails, transportation robots, and other logistics equipment. The company has a strong market presence in North America, Europe, Asia & Oceania, and China. For the company Asia is the most potential market for future growth.

-

Jungheinrich AG is an intralogistics solutions provider offering a wide product portfolio comprising material handling equipment, digital solutions, automated systems, and related services, including rental services and aftermarket services. The company provides its customers with tailor-made solutions from a single source to help them expand their intralogistics services The company has developed an automated intralogistics workflow using various automated warehouse equipment, mobile robots, and software.

Key Forklift Companies:

The following are the leading companies in the forklift market. These companies collectively hold the largest market share and dictate industry trends.

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

View a comprehensive list of companies in the Forklift Market

Recent Developments

-

In August 2024, Crown Equipment Corporation opened a sales and service facility in New Albany, Ohio. This new facility is expected to offer material handling and warehouse solutions to customers in the area. The facility will also provide regional businesses with the necessary equipment and services to boost productivity and uptime, ensuring their material handling operations and supply chains remain efficient and effective.

-

In August 2024, SANY has launched the SCPE350, a 35-ton electric forklift truck, at its Zhuhai Industrial Park, marking its heaviest-rated capacity model to date. The SCPE350 boasts high performance with a full-loaded speed of 28 km/h, an empty-loaded lifting speed of 350 mm/s, and a rapid response time of under 400 ms. Despite its heavy load, it remains energy-efficient, consuming only 2.5 kWh of electricity per task, saving up to (200,000 yuan) USD 28,571 annually compared to fuel-powered alternatives. Its advanced 750V double-gun charging system allows for a full charge in just 1.5 hours, supporting up to 10 hours of continuous operation. Additionally, a smart client system with an HD screen provides real-time monitoring, fault diagnosis, and historical troubleshooting for seamless maintenance.

Forklift Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 81.44 billion |

|

Revenue forecast in 2030 |

USD 154.99 billion |

|

Growth rate |

CAGR of 13.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in units, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Class, power source, load capacity, electric battery type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Anhui Heli Co., Ltd.; CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Toyota Material Handling |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Forklift Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global forklift market report based on class, power source, load capacity, electric battery type, end use, and region:

-

Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

Class 4/5

-

-

Power Source Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Load Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

5-15 Ton

-

Above 16 Ton

-

-

Electric Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Li-ion

-

Lead Acid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Logistics

-

Chemical

-

Food & Beverage

-

Retail & E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global forklift market is expected to be estimated at USD 72.59 billion in 2024 and is expected to reach USD 81.44 billion in 2025.

b. The global forklift market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 in terms of revenue to reach USD 154.99 billion by 2030.

b. Asia Pacific dominated the forklift market and accounted for 50.49% share in 2024. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness.

b. Some key players operating in the forklift market include Anhui Forklift Truck Group Co., Ltd.; CLARK; Crown Equipment Corp.; Doosan Industrial Vehicle; Hangcha Group Co., Ltd.; Hyster-Yale Materials Handling, Inc.; Toyota Industries Corporation

b. Key factors driving the forklift market growth include development in the automotive industry; growth of warehousing and logistics; industrialization in emerging markets such as Latin America.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."