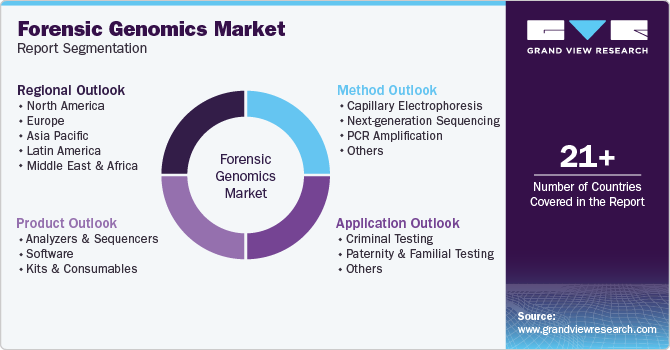

Forensic Genomics Market Size, Share & Trends Analysis Report By Product (Software, Consumables & Kits), By Method (NGS, PCR Amplification), By Application (Paternity & Familial, Criminal Testing), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-989-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Forensic Genomics Market Size & Trends

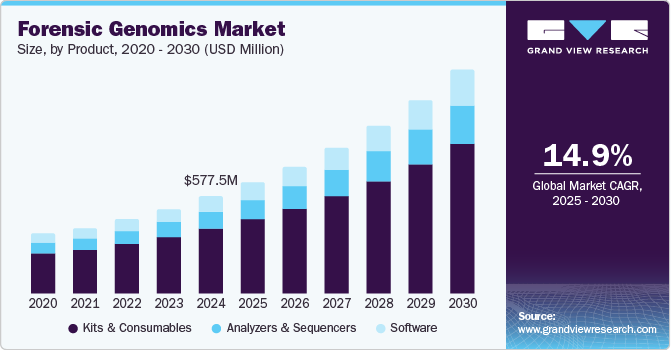

The global forensic genomics market size was estimated at USD 577.5 million in 2024 and is expected to expand at a CAGR of 14.92% from 2025 to 2030. The growth of the industry is driven by swift technological progress, rising funding from both private and government sources aimed at developing affordable forensic testing methods, and a growing incidence of crimes, including homicides, kidnappings, and sexual assaults. For example, in January 2022, the National Institute of Justice announced USD 13 million in funding to support five projects under its research and evaluation program for testing and analyzing physical evidence in publicly funded forensic laboratories. The COVID-19 pandemic had a detrimental effect on the global industry.

Local restrictions on the movement of goods have impacted the operations of forensic laboratories worldwide. Additionally, the heightened risk of contracting the SARS-CoV-2 virus when handling biological samples, such as tissues and bodily fluids, has reduced the demand for DNA forensics. Forensic investigators face an increased risk of infection since biological materials like semen, blood, saliva, and other evidence from crime scenes can carry the virus. Moreover, limited laboratory budgets have slowed the industry's growth.

However, various areas within forensic science, including DNA analysis, are evolving globally. Innovative techniques are being developed, implemented, and validated to aid criminal investigations. Researchers often encounter challenges related to the validity and accuracy of both current and older methods. For example, in May 2021, Verogen Inc. partnered with the forensic division of Eurofins Scientific to launch the ForenSeq MainstAY Workflow, which aims to enhance support for sexual assault cases and volume casework.

The application of criminal testing is expected to grow rapidly in the coming years. As global crime rates rise, the demand for forensic genomics is projected to increase significantly. Statistics Canada reported approximately 743 homicide cases in 2020, with homicide rates rising by 7%, from 1.83 to 1.95 per 100,000 people—the highest level since 2005. These factors are likely to further propel market growth.

Product Insights

In 2024, the kits & consumables segment dominated the market, accounting for 67.23% of total revenue. It includes items such as needles, reaction tubes, clippers, pipettes, fingerprint powders, vials, labels, brushes, and crime scene kits. Factors driving the growth of this segment include the rising number of criminal investigations, increased governmental efforts to address crime case backlogs, growing awareness of DNA profiling in criminology, and investments from both public and private entities in forensic sciences.

The software segment is expected to grow at the highest CAGR from 2025 to 2030. The need for accurate and reliable forensic analysis is driving investment in software solutions that improve the efficiency and accuracy of DNA profiling and other forensic techniques. The integration of artificial intelligence and machine learning in forensic software is also revolutionizing case investigations by providing predictive analytics and pattern recognition capabilities. Moreover, regulatory requirements and the push for standardized processes in forensic labs are leading to increased adoption of software solutions that ensure compliance and quality control. These trends collectively contribute to the robust growth of the segment.

Method Insights

The capillary electrophoresis (CE) segment dominated the market in 2024 with a revenue share of 36.96% due to its fully automated processes for sample injection, separation, and detection. Ongoing advancements and new product launches from industry players are further fueling the growth of this segment. For example, in May 2022, Promega Corporation launched the Spectrum CE System designed for forensic laboratories. This CE device offers a modern solution for forensic labs engaged in human identification for database and criminal casework, enhancing their operational efficiency.

The next-generation sequencing (NGS) segment is expected to experience the highest growth rate during the forecast period. This growth is primarily driven by NGS's cost-effectiveness and high throughput capabilities, making it a vital tool for various companies and genomic researchers. For example, in October 2020, Verogen Inc. partnered with Cellmark Forensic Services to launch an ISO17025-certified forensic NGS service in the U.K. The ForenSeq DNA Signature Prep Kit and MiSeq FGx Sequencing System from Verogen will help address complex relationship cases and investigations, providing the forensic community with enhanced phenotypic insights.

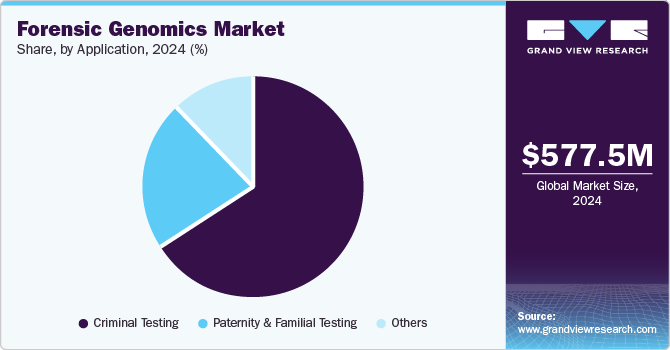

Application Insights

The criminal testing application segment held the largest share of over 66.15% in 2024, driven by the rising incidence of crimes worldwide. Advanced techniques like DNA profiling enable the identification of individuals based on their unique genetic makeup, effectively aiding crime resolution. Over the past few decades, DNA profiling has greatly impacted the criminal justice system, significantly increasing the accuracy of criminal identification. In October 2021, specialized DNA testing units were established in Mumbai, India, under the Nirbhaya scheme to address cases of sexual abuse against children and women.

Paternity and familial testing is projected to grow at the highest CAGR from 2025 to 2030. The rise in disputes over paternity and inheritance, coupled with the growing acceptance of DNA testing for family verification, has driven demand. Additionally, advancements in DNA analysis techniques have improved accuracy and accessibility, making these tests more reliable and affordable. The integration of these services into healthcare and legal frameworks further enhances their appeal, contributing to the rapid growth of this segment in the forensic genomics market.

Regional Insights

North America accounted for the largest market share of 49.61% in 2024. Increasing crime rates, along with a heightened focus on solving complex criminal cases, has led to greater demand for advanced forensic technologies. Additionally, substantial government funding for forensic research and development enhances laboratory capabilities. The integration of DNA analysis in legal systems and growing public awareness of genetic testing's importance further contribute to market expansion in the region.

U.S. Forensic Genomics Market Trends

The growth of the forensic genomics market in the U.S. is fueled by rising crime rates and the need for effective crime resolution techniques. Significant government investment in forensic science and law enforcement enhances laboratory capabilities and research initiatives. The increasing integration of DNA evidence in legal proceedings underscores the importance of accurate forensic analysis.

Europe Forensic Genomics Market Trends

The forensic genomics market in Europe is experiencing growth due to several factors. Increasing collaboration between law enforcement agencies and forensic laboratories enhances the effectiveness of criminal investigations. The region's strict regulatory framework encourages the adoption of advanced DNA testing methods, ensuring high standards in forensic analysis. Rising public awareness of genetic testing for paternity and ancestry also boosts demand.

The forensic genomics market in the UK held a significant share in 2024. Strong government funding for forensic science enhances laboratory capabilities, while public awareness of genetic testing drives demand for paternity and familial testing. Collaborations between law enforcement and forensic experts further improve the effectiveness of criminal investigations.

France forensic genomics market is influenced by its unique legal framework, which emphasizes the use of DNA evidence in criminal proceedings. Recent reforms aimed at modernizing forensic practices have led to increased investment in technology and training for forensic professionals. Additionally, France's commitment to combating organized crime and terrorism drives demand for advanced forensic techniques.

The forensic genomics market in Germany is anticipated to grow significantly over the forecast period. The country has well-established protocols for DNA analysis, supported by significant investment in forensic research and development. Germany's robust legal framework facilitates the integration of advanced genetic testing in judicial processes. Furthermore, rising public interest in ancestry and genetic health testing fuels demand for forensic services, making it a key player in the European market.

Asia Pacific Forensic Genomics Market Trends

The Asia Pacific forensic genomics market is projected to grow at the highest CAGR of 15.66% over the forecast period. The forensic genomics market in Asia-Pacific is rapidly growing due to increasing urbanization and rising crime rates, which drive demand for advanced forensic technologies. Countries in the region are investing in modernizing their forensic capabilities, often supported by government initiatives aimed at improving public safety. Additionally, the rising acceptance of DNA testing for paternity and ancestral research contributes to market growth.

The forensic genomics market in China is expected to grow over the forecast period. The country is modernizing its forensic capabilities, with a focus on advanced DNA analysis technologies to enhance criminal investigations. Increasing urbanization and a growing emphasis on solving complex cases further fuel demand. Additionally, public interest in genetic testing for familial and ancestry purposes is rising, contributing to the market's growth.

Japan forensic genomics market is witnessing significant growth over the forecast period. The Japanese government actively supports the development of advanced forensic technologies, including DNA analysis, to improve public safety. Rising public awareness of genetic testing for paternity and ancestry also contributes to demand. Additionally, Japan's unique legal framework facilitates the integration of forensic evidence in court proceedings, ensuring its effective use in solving crimes.

Middle East & Africa Forensic Genomics Market Trends

The MEA forensic genomics market is projected to grow significantly over the forecast period. the rise of organized crime and terrorism has intensified the focus on advanced DNA analysis. Public awareness of genetic testing is also increasing, driving demand for services such as paternity testing. Collaborations with international forensic organizations are fostering knowledge transfer and technological advancement, further boosting the market.

Saudi Arabia forensic genomics market is set to expand in the coming years. The country is modernizing its forensic capabilities, focusing on advanced DNA analysis technologies to enhance crime-solving efficiency. Growing awareness of genetic testing for paternity and familial relationships is also driving demand. Additionally, initiatives aimed at combating organized crime and terrorism are increasing the need for reliable forensic tools, while collaborations with international forensic experts are fostering innovation and expertise in the field.

The forensic genomics market in Kuwaitis also anticipated to grow in the near future. Increased investment in forensic technology, particularly in DNA analysis, is enhancing the capabilities of law enforcement agencies. Growing awareness of genetic testing for paternity and ancestry is driving public interest and demand for these services.

Key Forensic Genomics Company Insights

Companies in the market are focusing on expansion to enhance their product offerings. Additionally, many players are acquiring smaller firms to strengthen their market presence, diversify service offerings, and improve overall capabilities.

Key Forensic Genomics Companies:

The following are the leading companies in the forensic genomics market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Agilent Technologies

- Promega Corporation

- QIAGEN

- Bio-Rad Laboratories

- LGC Limited

- Tri Tech Forensics

- Verogen

Recent Developments

-

In October 2024, Promega Corporation announced the development of a new enzyme that significantly reduces stutter in forensic DNA analysis. This is expected to boost the growth prospects for the company in the coming years.

-

In May 2024, QIAGEN announced a collaboration with the FBI to create a novel digital PCR assay for use with the QIAcuity platform, aimed at enhancing DNA analysis from human samples in forensic applications. This DNA quantification will enable law enforcement and forensic researchers to analyze a wider range of evidence more quickly and reliably. The partnership further solidifies QIAGEN’s leadership in human identification and forensic science.

-

In February 2024, Bode Technology advanced the field of Forensic Investigative Genetic Genealogy (FIGG) by launching a range of validated genome sequencing options, providing access to its fully accredited, in-house forensic DNA services.

Forensic Genomics Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 660.0 million |

|

Revenue forecast in 2030 |

USD 1.32 billion |

|

Growth rate |

CAGR of 14.92% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billlon and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, method, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Illumina, Inc.; Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies; Promega Corporation; QIAGEN; Bio-Rad Laboratories; LGC Limited; Tri Tech Forensics; Verogen |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Forensic Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global forensic genomics market on the basis of product, method, application, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Analyzers & Sequencers

-

Software

-

Kits & Consumables

-

-

Method Outlook (Revenue, USD Million; 2018 - 2030)

-

Capillary Electrophoresis

-

Next-generation Sequencing

-

PCR Amplification

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Criminal Testing

-

Paternity & Familial Testing

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global forensic genomics market size was estimated at USD 577.5 million in 2024 and is expected to reach USD 660 million in 2025.

b. The global forensic genomics market is expected to grow at a compound annual growth rate of 14.92% from 2025 to 2030 to reach USD 1.32 billion by 2030.

b. North America dominated the forensic genomics market with a share of 49.61% in 2024. This is attributed to growing violent crimes and the subsequent rise in forensic analyses in the region. Moreover, companies operating in this region are engaged in novel product development to strengthen their market position.

b. Some key players operating in the forensic genomics market include Illumina, Inc.; Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies; Promega Corporation; QIAGEN; Bio-Rad Laboratories; LGC Limited; Tri Tech Forensics; Verogen.

b. Key factors that are driving the market growth include the rising number of crimes such as homicides, sexual assault, and kidnapping. Moreover, rapid technological advancements and increased private and government funding for developing cost-effective forensic testing techniques are some drivers that boost market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."