- Home

- »

- Animal Health

- »

-

Foot And Mouth Disease Vaccine Market Size Report, 2030GVR Report cover

![Foot And Mouth Disease Vaccine Market Size, Share & Trends Report]()

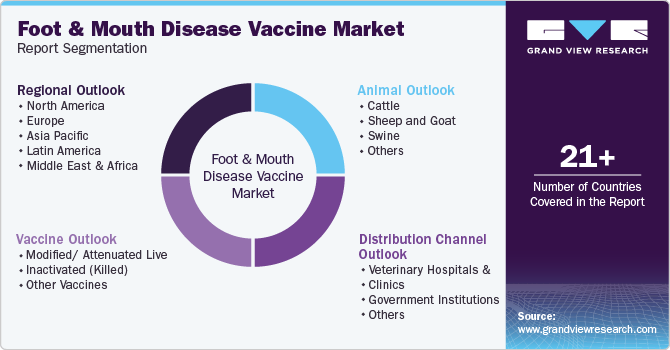

Foot And Mouth Disease Vaccine Market Size, Share & Trends Analysis Report By Animal (Cattle, Sheep & Goat, Swine), By Vaccine (Modified/Attenuated Live), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-656-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

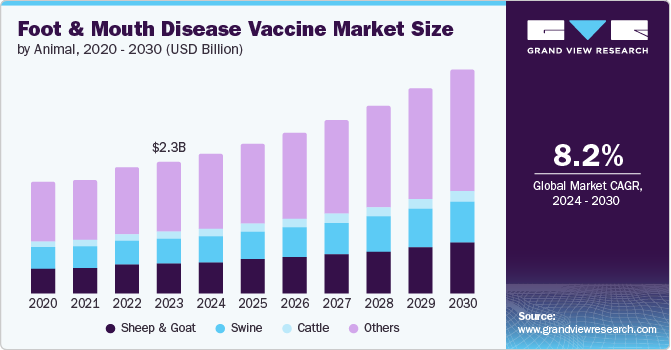

The global foot and mouth disease vaccine market size was valued at USD 2.27 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. The increasing population of livestock and demand for animal products are the significant factors contributing to the market growth. In addition, with rapid globalization and climatic transformations, livestock diseases have been increasing over the past few decades and to mandate safe healthcare practices for companion animals and livestock, the government has undertaken various initiatives and programs. Thereby, contributing to the growth of the veterinary vaccine market, of which foot & mouth disease (FMD) vaccines capture a significant share.

The growing human population has driven the demand for animal products such as milk, chicken, eggs, and meat. Vaccines help minimize animal loss and ensure their safety, which is likely to drive market growth over the forecast period. The increasing production and consumption of milk and milk products in countries such as India is further expected to add to the market growth. For instance, according to a report published by the U.S. Department of Agriculture in October 2023, FAS New Delhi forecasted the consumption of fluid milk at 90 MMT, butter at about 6.9 MMT, and nonfat dry milk at 0.7 in MY 2024 compared to 2023 volumes.

In developing countries, one of the GDP contributors is livestock, and hence there is an increasing demand for efficient animal healthcare practices, which is expected to drive this market to grow positively over the forecast period. For instance, according to the information published by the Ministry of Finance (India) in July 2024, 4.66 percent of the total GVA in 2022-23 was contributed by the livestock sector, helping to boost the per capita availability of milk, egg, and meat. The livestock population has increased rapidly owing to the adoption of advanced medication and vaccination facilities to maintain healthy livestock. For instance- the global cattle population amounted to about 943 million heads in 2023.

Various government initiatives and programs have boosted this market to grow positively. According to the Food and Agriculture Organization of the U.S. and the World Organization for Animal Health, SEACFMD 2021-2025 was launched to increase productivity and economic output in the livestock sector by managing and eradicating FMD, thereby enhancing food security and supporting rural smallholder farmers. Investments made by government institutions have supported the production of FMD vaccines and boosted the market growth. For instance, in December 2023, Indian Immunologicals Limited announced an investment of 700 crore on its new greenfield veterinary vaccine facility to manufacture the foot and mouth disease vaccine.

Animal Insights

Cattle dominated the market with a market share of 53.5% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Cattle are highly prone to contracting FMD and experience severe symptoms such as blisters inside the mouth and on the feet, fever, and reduced milk production. Even subclinical infections can cause milk yields to drop by 30-40%. Outbreaks in cattle herds have major economic consequences for farmers due to loss of productivity, the high costs of control measures, and culling infected animals. Hence, there is an increased demand for improved healthcare practices such as vaccination. For instance- the National Animal Disease Control Programme in India works to control FMD by 2025 and eradicate it by 2030 with vaccination. All these factors have contributed to the growth of this segment in the food & mouth disease vaccine market over the forecast period.

The swine segment is expected to grow at a significant CAGR over the forecast period. It is attributed to the rising demand for pork as it is a good source of protein and income source in many developing countries across the world. This growth necessitates enhanced vaccination efforts to prevent FMD outbreaks, which can severely impact production and drive market growth. For instance- in August 2023, according to the Philippines Statistics Authority, the country’s total swine inventory was estimated at 10.07 million heads.

Vaccine Insights

The inactivated (killed) vaccine segment dominated the market and accounted for a market share of 53.0% in 2023. It is attributed to its high efficacy and safety, longer duration of immunity, regulatory approval and acceptance, and the need for preventive health measures that contribute to the dominance of inactivated vaccines in the FMD vaccine market.

The modified/attenuated live segment is expected to grow at a significant CAGR during the forecast period. This can be attributed to its strong immune response and cost-effectiveness. In addition, many governments are implementing vaccination programs to control FMD outbreaks, and modified live vaccines are often a preferred choice due to their effectiveness. Increased funding and initiatives to improve livestock health are further expected to drive the growth of this segment over the forecast period.

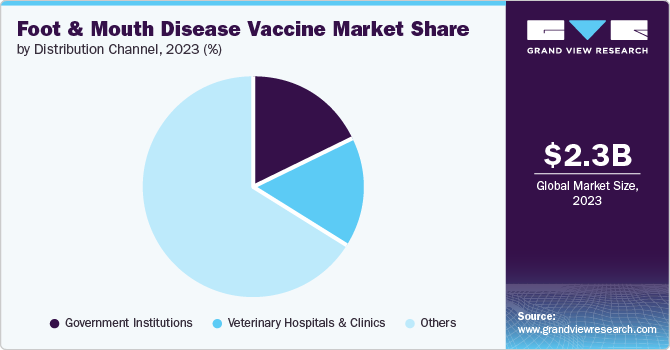

Distribution Channel Insights

Government institutions accounted for a significant market share in 2023 attributed to its strong regulatory framework, public health and economic stability, and funding/support for vaccination programs. Many governments provide funding and resources for FMD vaccination initiatives, especially in regions where the disease is endemic. This support includes the development and distribution of vaccines, which enhances access and increases vaccination rates among livestock populations. Thereby boosting the market growth positively. For instance, in July 2023, the Government of Canada (Canadian Food Inspection Agency) announced a budget of USD 5.6 million to develop FMD response plans and to establish an FMD Vaccine Bank for Canada.

The veterinary hospitals & clinics segment is expected to grow at a significant CAGR during the forecast period. It can be attributed to the increasing demand for animal health services, focus on preventive care, and growing awareness amongst livestock owners. In addition, many governments and animal health organizations are implementing programs that promote vaccination through veterinary clinics. This support includes funding for vaccination campaigns and training for veterinary professionals, which enhances the capacity of clinics to provide FMD vaccines. Thereby fueling the market growth over the forecast period.

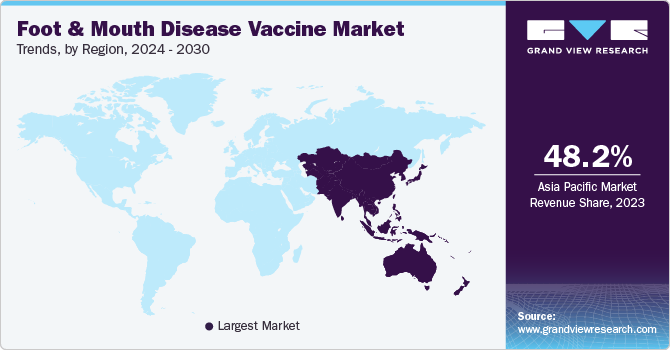

Regional Insights

Asia Pacific Foot And Mouth Disease Vaccine Market Trends

Asia Pacific foot & mouth disease vaccine market dominated with a revenue share of 48.2% in 2023 owing to the growing livestock population and high prevalence of FMD in this region. The developing healthcare sector and the funding/investment done by governments have contributed to driving the market growth over the forecast period. In addition, the rising awareness among livestock owners plays a significant role. The governments of the Asia Pacific countries have been involved in creating awareness about the importance of treating FMD and its eradication.

India foot & mouth disease vaccine market is expected to grow significantly over the forecast period. Government initiatives play a significant role in boosting market growth. For instance- in June 2023, the Animal Husbandry Department of Ladakh launched the 3rd phase of Foot and Mouth Disease vaccination under the National Animal Disease Control Program to eradicate it by 2030. In addition, the government’s initiatives and fundings in India during 2022-2023 include Accredited Agent for Health and Extension of Livestock Production (A-HELP), Mobile Veterinary Units (MVUs) to increase accessibility of veterinary services at farmer’s doorsteps, and Animal Health Support System for One Health for five years in five states of India - Assam, Karnataka, Madhya Pradesh, Maharashtra, and Odisha.

Europe Foot And Mouth Disease Vaccine Market Trends

Europe foot & mouth disease vaccine market is anticipated to witness substantial growth over the forecast period due to the reactive vaccination strategy. Various government strategies have helped control FMD in European countries. For instance, the European Commission adopted the Move FAST strategy (2023-2027) aiming to improve protection of livestock, respond to crises, improve resilience of livestock, and greater control of FAST diseases. Such strategies are expected to drive the market growth in the region

Latin America Foot And Mouth Disease Vaccine Market Trends

The Latin America foot & mouth disease vaccine market was identified as a lucrative region in 2023. Latin America has a substantial livestock population, particularly cattle, which are highly susceptible to FMD. This large population creates a continuous demand for effective vaccination to prevent outbreaks and maintain herd health. Thereby boosting market growth in this region. Government programs have contributed to a significant change in animal health practice in Brazil. For instance- in April 2023, according to a report of the Ministry of Agriculture and Livestock, the Strategic Plan for the National Foot and Mouth Disease Surveillance Program (PE-PNEFA) ensures the status of a country free from foot-and-mouth disease.

MEA Foot And Mouth Disease Vaccine Market Trends

MEA foot & mouth disease vaccine market is anticipated to witness significant growth over the forecast period. The growing livestock population in the MEA region increases the risk of FMD outbreaks and the need for vaccination. As livestock farming becomes more intensive, the demand for effective vaccines to protect these animals rises. In addition, as countries in the MEA region seek to enhance their livestock exports, maintaining FMD-free status becomes crucial. Vaccination is a key strategy to achieve this status and governments have implemented various promotional strategies to further drive the demand for FMD vaccines. For instance, in May 2024, the Uganda government and Egyptian government partnered to start local production of vaccines for the Foot and Mouth Disease (FMD).

Key Foot And Mouth Disease Vaccine Company Insights

Some of the companies in the foot & mouth disease vaccine market include Merck & Co., Inc., Biogenesis Bago, Zoetis Inc., Boehringer Ingelheim International GmbH, and others. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Merck & Co., Inc. operates in the animal health field and is engaged in developing and producing vaccines for various diseases affecting livestock, including FMD. The company also engages in the research and development of FMD vaccines.

-

Biogenesis Bago produces high-quality, effective, and safe FMD vaccines to improve worldwide animal health and food safety. In November 2023, the FMD vaccine developed by the company BIOAFTOGEN obtained prequalification from EuFMD.

Key Foot And Mouth Disease Vaccine Companies:

The following are the leading companies in the foot and mouth disease vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Biogenesis Bago

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Indian Immunologicals Limited

- Bayer AG

- Hester Biosciences Limited

- Inner Mongolia Biwei Antai Biotechnology Co., Ltd.

- Brilliant Bio Pharma Limited

- Biovet Private Ltd

Recent Developments

-

In July 2024, Biogénesis Bagó opened a vaccine production plant in Brazil with an annual production capacity of live attenuated virus vaccines for FMD of over 10 million doses.

-

In March 2023, the European Commission supported Türkiye in strengthening the animal health situation in the region with the FMD SAT-2 vaccine.

-

In 2022, Indian Immunologicals Limited expanded its operations through its subsidiary Pristine Biologicals in New Zealand to meet the vaccine security of the nation against diseases such as foot and mouth disease.

Foot And Mouth Disease Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.42 billion

Revenue forecast in 2030

USD 3.88 billion

Growth Rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, vaccine, distribution channel, region

Regional scope

Europe, Asia Pacific, Latin America, MEA

Country scope

Russia, France, Japan, China, India, South Korea, Indonesia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait, Egypt, Turkey

Key companies profiled

Merck & Co., Inc.;Biogenesis Bago, Zoetis Inc.; Boehringer Ingelheim International GmbH; Indian Immunologicals Limited; Bayer AG; Hester Biosciences Limited; Inner Mongolia Biwei Antai Biotechnology Co. Ltd.; Brilliant Bio Pharma Limited; Biovet Private Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foot And Mouth Disease Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the foot and mouth disease vaccine market report based on animal, vaccine, distribution channel, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Sheep and Goat

-

Swine

-

Others

-

-

Vaccine Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Government Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

Europe

-

Russia

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Egypt

-

Turkey

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."