- Home

- »

- Consumer F&B

- »

-

Foodservice Market Size, Share And Trends Report, 2030GVR Report cover

![Foodservice Market Size, Share & Trends Report]()

Foodservice Market (2024 - 2030) Size, Share & Trends Analysis Report By Restaurant Type (Street Food, Cafes and Bars, Quick Service Restaurants, Full Service Restaurants), By Category (Independent, Chains), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-447-3

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foodservice Market Summary

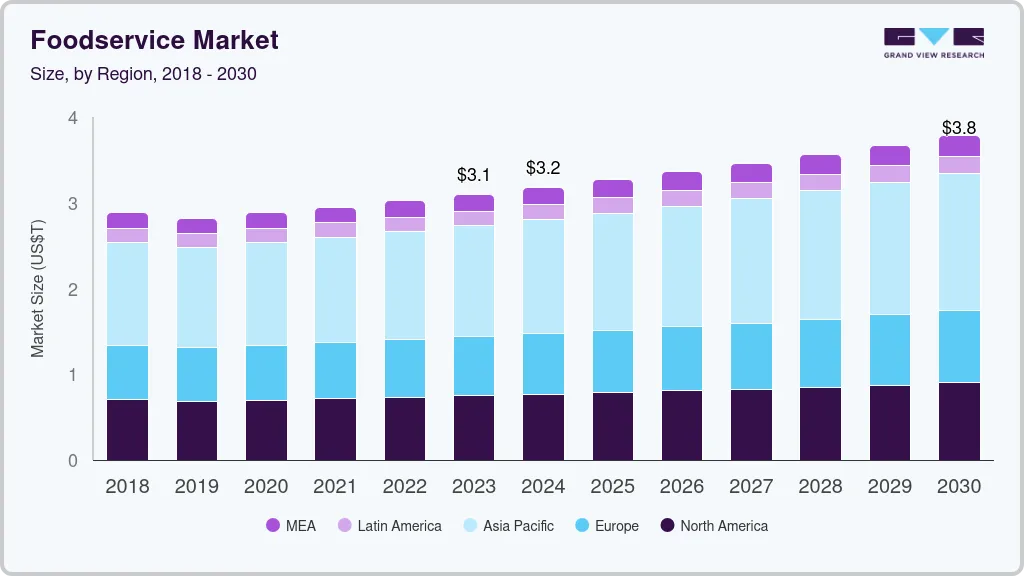

The global foodservice market size was estimated at USD 3,099.66 billion in 2023 and is projected to reach USD 3,787.47 billion by 2030, growing at a CAGR of 3.0% from 2024 to 2030. Rapid urbanization is driving the demand for food services, with urban areas having a higher concentration of restaurants, cafes, and other food outlets.

Key Market Trends & Insights

- The foodservice market in North America captured a revenue share of over 24.09% in 2023.

- The foodservice market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.

- By restaurant type, full service restaurants segment accounted for a share of 48.98% of the global revenue in 2023.

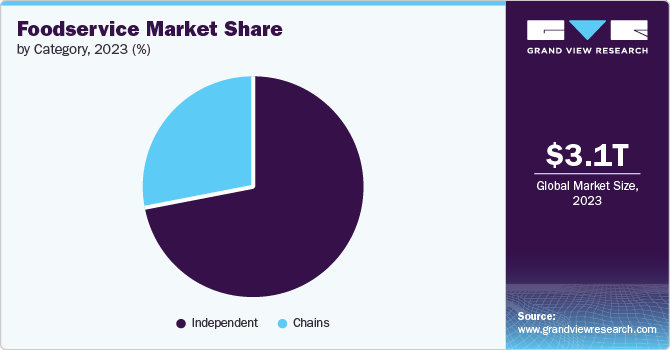

- By category, independent food service segment accounted for a revenue share of 71.52% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3,099.66 Billion

- 2030 Projected Market Size: USD 3,787.47 Billion

- CAGR (2024-2030): 3.0%

- North America: Largest market in 2023

Busy lifestyles, especially in urban areas, are leading to an increase in demand for convenience foods, boosting the foodservice sector. The integration of technology, such as online ordering, delivery apps, and digital payment systems, has made food services more accessible, enhancing market growth. Consumers are increasingly seeking healthier options, leading to a rise in demand for organic, plant-based, and low-calorie meals in the foodservice sector. There is a growing emphasis on sustainable practices, such as reducing food waste, using eco-friendly packaging, and sourcing locally, which is shaping the industry. Cloud kitchens, which operate solely for delivery without a physical dining space, are becoming increasingly popular, driven by the growing demand for online food delivery.

The globalization of food cultures is leading to the introduction of international cuisines in local markets, driving the growth of foodservice businesses. Developing countries, particularly in Asia and Africa, present significant growth opportunities due to their large populations and rising middle-class incomes. Leveraging technology to enhance customer experience, streamline operations, and reduce costs offers a substantial growth opportunity for foodservice providers.

Digital transformation is especially evident in the burgeoning food delivery segment. The pandemic accelerated the shift towards delivery services, with many consumers now preferring to enjoy their favorite meals at home rather than dining out. This trend is expected to persist, highlighting the necessity for foodservice operators to establish strong partnerships with delivery platforms while also considering the development of in-house delivery systems.

Changing consumer behavior is one of the foremost drivers in the foodservice market. Today’s consumers are increasingly health-conscious, seeking out dining options that align with their desire for nutritious, ethically sourced food. With a rise in awareness about health and wellness, restaurants and foodservice providers are under pressure to adapt their menus to focus on fresh ingredients, lean proteins, plant-based options, and transparency about sourcing.

In addition to health, sustainability has become a critical concern among consumers. The demand for eco-friendly practices-ranging from sourcing local ingredients to minimizing waste-has led foodservice companies to rethink their operations. A commitment to sustainability not only addresses environmental challenges but also serves as a powerful marketing tool to engage the modern consumer increasingly drawing upon their purchasing decisions to reflect their values.

Restaurant Type Insights

Full service restaurants segment accounted for a share of 48.98% of the global revenue in 2023. Full-service restaurants typically offer a wide variety of dishes, catering to diverse tastes and dietary preferences. This diversity attracts a broad customer base, from families to business professionals. These restaurants focus on providing a complete dining experience, including ambiance, table service, and customer engagement. This emphasis on experience makes them a preferred choice for special occasions, social gatherings, and business meetings.

Quick service restaurants segment is expected to grow at a CAGR of 3.2% from 2024 to 2030. QSRs are designed to serve customers quickly, making them a preferred option for people with busy lifestyles. The demand for fast, convenient meals continues to rise as consumers seek quick dining solutions that fit into their hectic schedules. They typically offer meals at a lower price point compared to full-service restaurants, making them accessible to a broader audience, including students, families, and budget-conscious consumers. The surge in online food delivery platforms has significantly boosted the QSR segment. QSRs are well-suited for delivery due to their standardized menus and quick preparation times, making them a popular choice for consumers ordering food online.

Category Insights

Independent food service segment accounted for a revenue share of 71.52% in 2023. Independent food service establishments often have a strong connection to their local communities, catering to the unique tastes and preferences of local customers. This close relationship fosters customer loyalty and repeat business, contributing to their dominant market share. Independent establishments are often seen as trendsetters in the foodservice industry, offering innovative and creative dishes that may not be found in chain restaurants. This uniqueness attracts food enthusiasts looking for distinctive dining experiences.

Food service chains is expected to grow at a CAGR of 3.5% from 2024 to 2030. Food service chains are often at the forefront of adopting new technologies, such as mobile ordering apps, loyalty programs, and self-service kiosks. These innovations enhance customer convenience and engagement, driving sales growth. Chains continuously innovate their menus to stay relevant and cater to changing consumer preferences, such as healthier options, plant-based meals, and international flavors. This adaptability ensures they remain competitive and appealing to a broad audience.

Regional Insights

The foodservice market in North America captured a revenue share of over 24.09% in the market. The North American foodservice market is one of the largest in the world, with the U.S. and Canada being major contributors. The market includes a wide array of foodservice establishments such as restaurants, cafes, fast-food outlets, catering services, and institutional foodservice. There is a growing demand for healthier menu options, including plant-based dishes, organic ingredients, and low-calorie meals. Foodservice providers are increasingly catering to health-conscious consumers by offering more nutritious and sustainably sourced options.

U.S. Foodservice Market Trends

The foodservice market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.The U.S. foodservice market is one of the largest in the world, with a vast array of establishments including full-service restaurants, quick-service restaurants (QSRs), cafes, bars, catering services, and institutional foodservice. The market is a vital part of the U.S. economy, generating substantial employment and contributing significantly to GDP.

Europe Foodservice Market Trends

The foodservice market in Europe is expected to grow at a CAGR of 3.0% from 2024 to 2030. European consumers are increasingly prioritizing health and wellness, leading to a growing demand for healthier menu options. This includes an emphasis on organic, plant-based, low-calorie, and gluten-free foods. Restaurants and foodservice providers are expanding their offerings to cater to this health-conscious demographic. There is a growing expectation for nutritional information and transparency in foodservice. Consumers are more interested in understanding the ingredients, calorie counts, and sourcing practices behind their meals, prompting many establishments to provide detailed menu labeling.

Asia Pacific Foodservice Market Trends

The foodservice market in Asia Pacific is expected to witness a CAGR of 2.7% from 2024 to 2030. The quick-service restaurant (QSR) segment is expanding rapidly across the Asia Pacific region. The demand for convenient, affordable, and fast dining options is increasing, particularly in urban areas. Major global QSR brands like McDonald’s, KFC, and Subway are continuously expanding their presence, while regional chains are also gaining popularity. QSRs are increasingly localizing their menus to cater to regional tastes and preferences. This includes offering items that incorporate local ingredients or flavors that appeal to the cultural palate of specific markets.

Key Foodservice Company Insights

The foodservice market is highly competitive and diverse, with key players ranging from global chains to regional brands. These companies dominate the market through their extensive reach, brand recognition, and ability to adapt to changing consumer preferences.

McDonald’s is one of the largest and most recognizable foodservice brands globally, with a significant market share in both the quick-service restaurant (QSR) segment and the overall foodservice industry. Moreover, Starbucks focuses on providing a premium customer experience, with high-quality coffee, personalized service, and a comfortable environment. This strategy helps it maintain a strong brand loyalty.

Key Foodservice Companies:

The following are the leading companies in the foodservice market. These companies collectively hold the largest market share and dictate industry trends.

- McDonald’s

- Starbucks

- Restaurant Brands International Inc.

- Costa Limited

- Tim Hortons

- Dominos

- KFC Corporation

- Supermac’s

- Jollibee

- Baskin Robbins

Recent Developments

-

In January 2024, Restaurant Brands International announced its intent to acquire all outstanding shares of Carrols Restaurant Group in a cash-only transaction. As the largest franchisee of Burger King in the United States, Carrols operates over 1,000 Burger King location and more than 50 Popeyes restaurants across 23 states nationwide. This acquisition represents a significant move for Restaurant Brands International as it seeks to enhance its footprint in the fast-food industry.

-

In September 2023, Fat Brands, a well-known player in the polished dining sector, announced the acquisition of Smokey Bones Bar & Fire Grill from Sun Capital Partners for USD 30 million. This strategic move is anticipated to significantly bolster Fat Brands' financial performance, with projections indicating an increase in EBITDA by approximately USD 10 million.

Foodservice Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,181.02 billion

Revenue forecast in 2030

USD 3,787.47 billion

Growth rate

CAGR of 3.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Restaurant type, category, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa

Key companies profiled

McDonald’s; Starbucks; Restaurant Brands International Inc.; Costa Limited; Tim Hortons; Dominos; KFC Corporation; Supermac’s; Jollibee; Baskin Robbins

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Foodservice Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global foodservice market report based on restaurant type, category, and region:

-

Restaurant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Street Food

-

Cafes and Bars

-

Quick service restaurants

-

Full service restaurants

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent

-

Chains

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global foodservice market size was estimated at USD 3,099.7 billion in 2023 and is expected to reach USD 3,181.0 billion in 2024.

b. The global foodservice market is expected to grow at a compounded growth rate of 3.0% from 2024 to 2030 to reach USD 3,787.5 billion by 2030.

b. Full service restaurants segment accounted for a share of 48.98% of the global revenue in 2023. Full-service restaurants typically offer a wide variety of dishes, catering to diverse tastes and dietary preferences. This diversity attracts a broad customer base, from families to business professionals.

b. Some of the key players in the food service market are McDonald's, Starbucks, Restaurants Brands International Inc., Costa Limited, Tim Hortons, Domino's, KFC Corporation, Yum! Brands, and others

b. The growing number of women participating in sports, fitness routines, and other physical activities is a primary driver of the food service market. This increase is fueled by a broader trend towards healthier lifestyles and the rise of fitness culture worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.