- Home

- »

- Plastics, Polymers & Resins

- »

-

Food Wrap Market Size, Share And Trends Report, 2030GVR Report cover

![Food Wrap Market Size, Share & Trends Report]()

Food Wrap Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Aluminum Foil, Paper), By Application (Food Service, Online, Institutional), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-428-1

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Wrap Market Summary

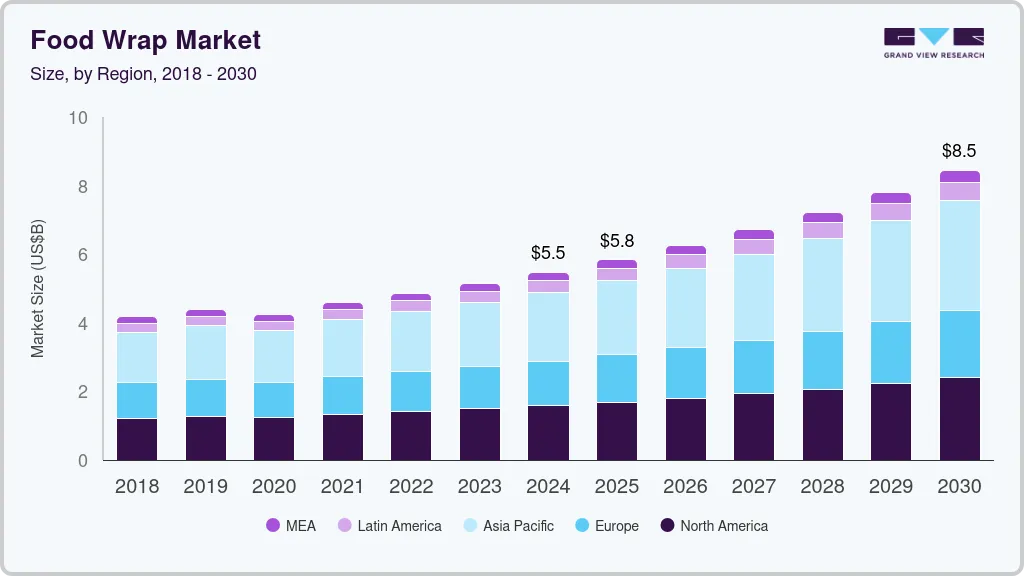

The global food wrap market size was estimated at USD 5.15 billion in 2023 and is projected to reach USD 8.45 billion by 2030, growing at a CAGR of 7.5% from 2024 to 2030. The food wrap market is driven by rising consumer demand for convenience, sustainability, and food safety.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2023.

- China food wrap market is primarily driven by the growing food service industry in the country.

- Based on material, the paper segment dominated the overall market with a revenue market share of over 54.0% in 2023 and is expected to witness robust growth with a CAGR of 6.5% over the forecast period.

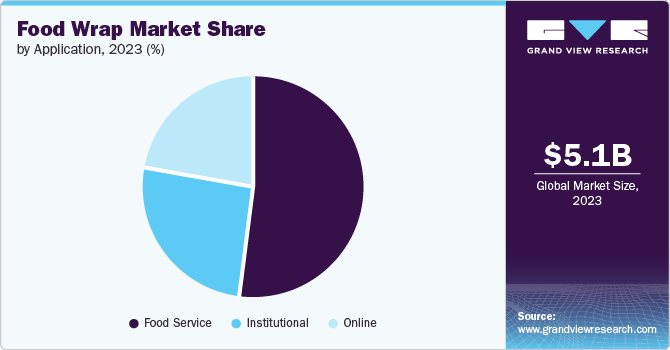

- Based on application, the food service segment dominated market and accounted for largest revenue share of over 52.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.15 Billion

- 2030 Projected Market Size: USD 8.45 Billion

- CAGR (2024-2030): 7.5%

- Asia Pacific: Largest market in 2023

Besides, increased awareness of eco-friendly packaging, growing online food delivery market, and advancements in materials that extend shelf life are also contributing to the food wrap market growth. Additionally, the rising trend of on-the-go food consumption is significantly driving the demand for food trucks, which are becoming increasingly popular as they offer convenience, variety, and affordability. As more consumers seek quick, portable meals, food trucks are thriving in urban areas, festivals, and events. This surge in food truck activity directly boosts the demand for food wrap, which is essential for ensuring freshness, portability, and easy handling of various food items.Food wraps, made from materials like paper, aluminum foil, and plastic, are crucial in maintaining the quality of food during transit and are often customized to enhance branding for food truck businesses. As food trucks continue to grow in popularity, the need for effective and sustainable food wrap packaging is also on the rise, driving innovation and expansion within the packaging industry.

Moreover, the rise of online food delivery services has significantly transformed the food industry, creating a ripple effect on related sectors, including food packaging. As consumers increasingly opt for the convenience of ordering meals through platforms such as Uber Eats, DoorDash, and Grubhub, restaurants, and cloud kitchens are adapting to meet this demand. This shift has driven a surge in the need for efficient, reliable, and sustainable food wrap packaging solutions.

Furthermore, the growing awareness of environmental issues, which has led to a surge in demand for sustainable and eco-friendly packaging options, positively influencing the food wrap market. Therefore, this trend has pushed manufacturers to develop biodegradable and compostable food wraps made from materials such as plant-based plastics, beeswax, or cellulose. For instance, companies such as Abeego and Bee’s Wrap LLC offer reusable food wraps made from organic cotton and beeswax as an alternative to single-use plastic wrap.

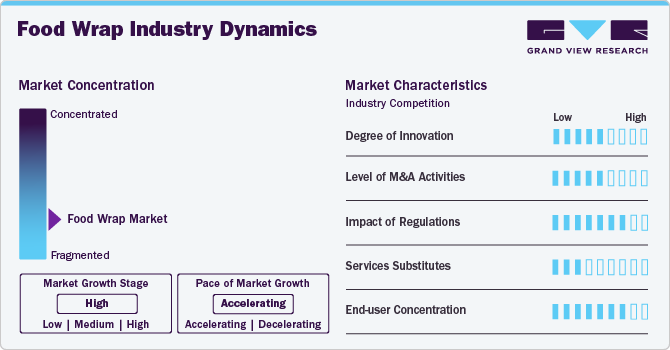

Market Concentration & Characteristics

In food wrap market, food wrap manufacturing companies are actively launching new products to meet evolving consumer demands, regulatory requirements, and market trends. For instance, in April 2023, Amcor plc partnered with Tyson Foods to launch a new sustainable packaging solution for Tyson Foods' Jimmy Dean egg bites and frittatas. The package is made from Amcor's AmPrima recycle-ready forming/non-forming flexible film and offers significant sustainability benefits compared to conventional packaging.

In February 2023, Koehler Paper introduced a new sustainable packaging paper, Koehler NexPure OGR, for the fast-food market. This product was designed to meet the increasing consumer demand for eco-friendly packaging solutions. Koehler NexPure OGR is oil- & grease-resistant, making it suitable for various food items such as fries, sandwiches, wraps, and burritos.

Material Insights

Paper dominated the overall market with a revenue market share of over 54.0% in 2023 and is expected to witness robust growth with a CAGR of 6.5% over the forecast period. The paper material segment is gaining traction due to rising environmental awareness and the shift towards sustainable packaging. Consumers and businesses are increasingly seeking eco-friendly alternatives to plastic, driving innovation in paper-based wraps.

Furthermore, aluminum foil is a versatile food wrap made from thin metal sheets. It is excellent for heat conduction, making it ideal for cooking and baking. Aluminum foil provides a complete barrier against light, oxygen, and moisture, which helps preserve food freshness. It's also recyclable and can be used for both cold storage and high-temperature applications.

Moreover, plastic food wrap is a thin, flexible film made from materials like polyethylene or PVC. It's widely used due to its ability to create an airtight seal, preventing moisture loss and protecting food from contaminants. Plastic wrap is transparent, allowing easy viewing of the wrapped contents, and can be used in the microwave.

Application Insights

The food service segment dominated market and accounted for largest revenue share of over 52.0% in 2023. The food service segment of the food wrap market caters to restaurants, cafes, hotels, and other food establishments. This positive outlook can be attributed to the growing of the restaurant industry, increasing demand for takeout and delivery services, and a focus on sustainable packaging options.

The online application segment is expected to grow at the fastest CAGR of 7.7% during the forecast period. The online segment is driven by the rapid growth of e-commerce and food delivery services, accelerated by the COVID-19 pandemic. Consumers' increasing preference for contactless shopping and meal options has led to a surge in demand for packaging that can protect food during transit.

Moreover, the institutional segment includes schools, hospitals, nursing homes, and other large-scale facilities that require food wraps for their foodservice operations. These institutions typically purchase food wraps in bulk quantities and prioritize cost-effectiveness, hygiene, and ease of use. The institutional segment often demands specialized wraps that comply with specific health and safety regulations.

Regional Insights

North America region is characterized by the presence of major food service companies such as KFC Corporation, Domino's, Starbucks Corporation, McDonald's, Dunkin' Donuts, Tim Hortons, Taco Bell IP Holder, LLC, Wendy's, Burger King Company LLC, Subway, Chick-fil-A, and Arby's IP Holder, LLC. These companies operate many restaurants and outlets, serving a wide range of foods to customers. The sheer volume of food sold, especially fast-food items such as burgers, sandwiches, and wraps, in these outlets is creating a substantial demand for food packaging solutions, including food wraps. Thus, the overall outlook is benefiting the food wrap market in the region.

U.S. Food Wrap Market Trends

Food wrap market in the U.S. is a dynamic and ever-evolving industry, driven by increasing food expenditure and rapid growth of e-commerce food delivery platforms in the country. According to the U.S. Department of Agriculture (USDA), in 2023, U.S. food expenditures reached USD 2.6 trillion, with food-away-from-home spending at 58.5% of the total, reflecting a shift in consumer behavior. This rise in out-of-home dining is expected to boost growth opportunities for QSRs, cafes, and food kiosks, driving demand for various food wraps such as plastic, aluminum, and paper-based wraps to maintain food freshness during transit.

Asia Pacific Food Wrap Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2023. This positive outlook can be attributed to the increasing population, rapid urbanization, rising disposable incomes, and expanding food service and delivery sector in the region.

The Asia Pacific Employment and Social Outlook 2024 report states that the total employment in Asia Pacific is expected to grow by approximately 15 million annually, driven by the rising working-age population. Therefore, the increasing working population of the region is expected to fuel the demand for on-the-go and ready-to-eat food, which, in turn, is anticipated to drive the demand for convenient packaging products, including food wrap, across the region.

China food wrap market is primarily driven by the growing food service industry in the country. The food service industry in China has experienced rapid growth and transformation in recent years, driven by urbanization, rising disposable incomes, and changing consumer preferences. The sector encompasses a wide range of establishments, from traditional street food vendors and small family-run restaurants to high-end dining establishments and international fast-food chains. The industry continues to evolve with an increasing focus on convenience, quality, and diverse culinary experiences. This overall food service outlook is anticipated to benefit the food wrap market in the country.

Europe Food Wrap Market Trends

The food wrap market in Europe held a revenue share of over 23.0% in 2023. This outlook can be attributed to a combination of consumer preferences, stringent regulations, and the region's strong focus on sustainability. European consumers are increasingly conscious of food safety and hygiene, which has led to a high demand for effective food wrapping solutions that prevent contamination and help preserve freshness. This demand is bolstered by the well-established food industry in the region, which is one of the largest in the world. Countries such as Germany, France, and Italy, with their rich culinary traditions, emphasize packaging that maintains the quality of food products, thus driving the adoption of food wrap solutions in the region.

UK food wrap market is witnessinga rise in fast-casual dining in the UK and expecting the growth of food service industry in the upcoming years. Chains such as Pret A Manger, LEON, and Itsu have found success by offering high-quality, freshly prepared meals in a more casual setting than traditional full-service restaurants. These concepts have appealed to busy consumers who prefer a quick but satisfying dining experience. Another trend that has gained significant traction is the growth of food delivery services such as Deliveroo and Uber Eats. These platforms have transformed the way consumers access restaurant meals, allowing them to enjoy a wider variety of cuisines from the comfort of their own homes.

Central & South America Food Wrap Market Trends

Food wrap market in Central & South America is experiencing steady growth, driven by the expanding food service, retail, and supermarket industries in the region. In the retail food sector, there is an increasing demand for convenient, on-the-go food options. This trend is especially prominent in urban areas where busy lifestyles drive consumers to seek quick meal solutions. As a result, supermarkets and convenience stores are stocking more pre-packaged sandwiches, wraps, and ready-to-eat meals. Food manufacturers are responding by using food wraps as an effective packaging solution that maintains freshness while allowing for an attractive presentation. For example, in Brazil, companies such as Sadia S.A. and Perdigão offer a variety of wrapped sandwiches catering to the increasing demand for quick meal solutions. This is expected to contribute to the growth of the food wrap market in the region over the forecast period.

Brazil food wrap market is driven by the expansion of the food & beverage sector. In urban centers, the demand for convenient, ready-to-eat meals, and takeaway options is rising, driven by the growing middle-class population and their increasingly busy lifestyles. This trend is particularly evident in major cities, such as São Paulo and Rio de Janeiro, where the proliferation of fast-food chains and casual dining establishments is creating a substantial need for food wraps.

Middle East & Africa Food Wrap Market Trends

The food wrap market in the Middle East & Africa is experiencing significant growth, driven by its expanding food service industry. In the MEA’s food service industry, there is an increasing demand for convenient and hygienic packaging solutions. Restaurants, cafes, and hotels are adopting food wraps for takeaway and delivery services, which have seen a surge in popularity. For example, in countries such as the UAE and Saudi Arabia, the booming food delivery market has led to greater use of food wraps for packaging sandwiches, burgers, and other fast-food items. This trend is further amplified by the growing tourism industry in these countries, where food wraps offer a practical solution for on-the-go meals and snacks.

South Africa food wrap market dynamics are shaped by growing urban population and changing lifestyles. In addition, the expanding hotel industry in the country is also positively influencing the food wrap market. As per the USDA, in 2022, South Africa's hotel, restaurant, and institutional sector grew by over 20% to USD 4.3 billion, driven by a shift toward convenience foods and fast-service restaurants. The robust fast-food sector, featuring both domestic and international franchises, is boosting demand for standardized food wrap packaging solutions for items such as burgers and sandwiches.

Key Food Wrap Company Insights

The global food wrap market is highly fragmented due to the presence of numerous established players as well as emerging companies. Major players dominate the market owing to their extensive distribution networks, advanced manufacturing capabilities, and strong brand recognition. These companies focus on innovation, sustainability, and product differentiation to maintain their market share, often introducing eco-friendly wraps and recyclable materials in response to growing consumer demand for sustainable packaging solutions. The market also sees competition from regional and local players, particularly in emerging markets, who offer cost-competitive alternatives and cater to specific regional preferences. This competitive landscape is further intensified by continuous investments in R&D, strategic mergers and acquisitions, and the expansion of product portfolios.

Key Food Wrap Companies:

The following are the leading companies in the food wrap market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Berry Global Inc.

- Abeego

- Huhtamaki

- Bee's Wrap, LLC

- Reynolds Consumer Products

- Specialty Polyfilms India Pvt. Ltd.

- ProAmpac

- OX Plastics

- McNairn Packaging

- Mitsubishi Chemical Group Corporation

- Polyvinyl Films, Inc.

- Georgia-Pacific Consumer Products LP

- Veritiv Corporation

- Anchor Packaging LLC

- Pixelle

- Ahlstrom

- Gator Paper

- Seaman Paper Co.

- Ronpak

Recent Developments

-

In March 2024, Berry Global Inc. announced a significant increase in its recycling capacity for flexible films as part of a pan-European project aimed at expanding its Sustane range of recycled polymers. This initiative involves enhancements at three of its recycling facilities located in Heanor (UK), Steinfeld (Germany), and Zdzieszowice (Poland). The expansion is expected to boost the production of recycled plastic by approximately 6,600 metric tons per year, addressing the rising demand for high-performance films made with recycled content.

-

In March 2024, ProAmpac acquired UP PAPER LLC, a Michigan-based producer of recycled kraft paper. This acquisition is expected to enhance the company’s portfolio of sustainable packaging products and strengthen its presence in the U.S.

Food Wrap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.48 billion

Revenue forecast in 2030

USD 8.45 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Berry Global Inc.; Abeego; Huhtamaki; Bee's Wrap, LLC; Reynolds Consumer Products; Specialty Polyfilms India Pvt. Ltd.; ProAmpac; OX Plastics; McNairn Packaging; Mitsubishi Chemical Group Corporation; Polyvinyl Films, Inc.; Georgia-Pacific Consumer Products LP; Veritiv Corporation; Anchor Packaging LLC; Pixelle; Ahlstrom; Gator Paper; Seaman Paper Co.; Ronpak

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Wrap Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the food wrap market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Aluminum Foil

-

Paper

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Full Service

-

Quick Service

-

Others

-

-

Online

-

Institutional

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food wrap market was estimated at USD 5.15 billion in 2023 and is expected to reach USD 5.48 billion in 2024.

b. The global food wrap market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030, reaching around USD 8.45 billion by 2030.

b. The paper wraps segment dominated the market with a revenue market share of over 54.0% in 2023. The paper material segment is gaining traction due to rising environmental awareness and the shift towards sustainable packaging.

b. Key players in the market include Amcor plc; Berry Global Inc.; Abeego; Huhtamaki; Bee's Wrap, LLC; Reynolds Consumer Products; Specialty Polyfilms India Pvt. Ltd.; ProAmpac; OX Plastics; McNairn Packaging; Mitsubishi Chemical Group Corporation; Polyvinyl Films, Inc.; Georgia-Pacific Consumer Products LP; Veritiv Corporation; Anchor Packaging LLC; Pixelle; Ahlstrom; Gator Paper; Seaman Paper Co.; Ronpak.

b. The food wrap market is driven by rising consumer demand for convenience, sustainability, and food safety. Growing online food delivery and advancements in materials that extend shelf life are also contributing to the market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.