Food Waste Management Market Size, Share & Trends Analysis Report By Waste Type (Fruits & Vegetables), By Source, By Service Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-146-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

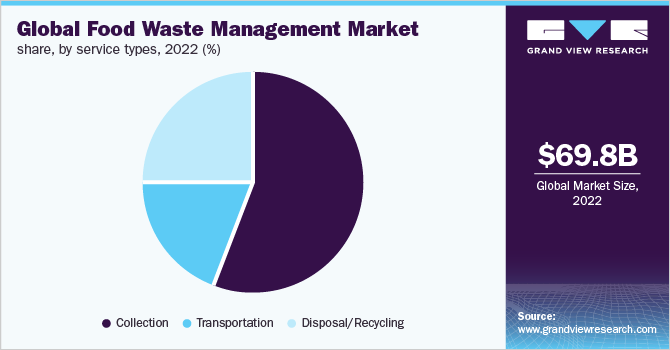

The global food waste management market was valued at USD 69.8 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Food waste has increased due to the rising population, coupled with an increase in manufacturing and consumption rates. Furthermore, the shift in customer tastes and preferences has fueled the expansion of the market. The COVID-19 pandemic has continued to wreak havoc around the globe, posing substantial difficulties to food security and nutrition in several countries like South Africa, UAE, and Saudi Arabia. Supply chain disruptions caused by roadblocks, transportation restrictions, and quarantine measures resulted in considerable increases in food waste, particularly for perishable agricultural items such as fruits, vegetables, fish, meat, and dairy products, thereby driving the market growth.

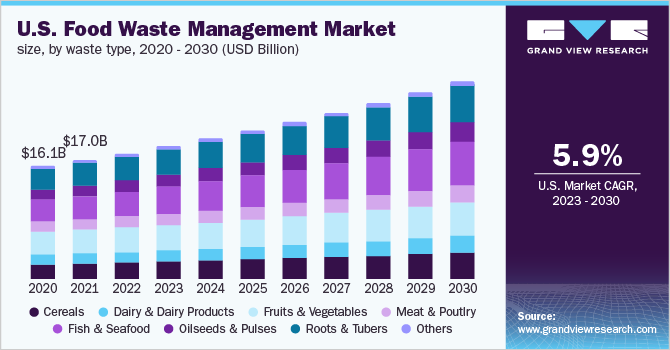

According to FAO, while around 1.4 billion tons of food is wasted globally each year, the U.S. discards between 40 and 80 billion pounds of food annually. The U.S. Department of Agriculture estimates that the amount of food wasted in the U.S. is equivalent to 219 pounds of waste per person, which will have a beneficial impact on the food waste management market.

The presence of health-conscious consumers in the U.S. is likely to boost the consumption of fruits and vegetables in the country, thereby resulting in increased food waste generated by it. Furthermore, increasing focus by the government on educating the people on appropriate storage methods for fruits & vegetables to prevent rotting is anticipated to impact the amount of waste generated.

Companies that produce food waste, such as food processing facilities, merchants, wholesalers, and food service providers, are required to inform the authorities of the source, amount, and disposal procedures. This helps businesses determine the cost of their waste and provides information to regulators about the amount and causes of food waste, both of which encourage waste reduction.

Increasing government support for waste disposal through the composting process owing to its environmental benefits is anticipated to drive the growth of the composting segment, which, in turn, is expected to drive the overall market. In addition, rising awareness regarding the recovery of biofuel and compost from food waste using composting is likely to drive the demand for aerobic digestion over the forecast period.

Waste Type Insights

The fruit and vegetable segment dominated the market and accounted for 20.3% of the total revenue share in 2022 owing to improper handling, storage, processing, and cultivation of the produce. Improper storage and handling of fresh produce lead to spoilage, which, in turn, is expected to lead to higher amounts of waste as compared to other segments, thereby driving the demand for the food waste management market.

Cereals are majorly consumed in the developed economies of North America and Europe as breakfast and snack items. Factors such as improper preservation and the negligent attitude of consumers toward product expiration dates are expected to drive the generation of cereal wastage. In addition, unawareness concerning food wastage is likely to drive the need for cereal waste management.

The dairy & dairy product segment is expected to register a CAGR of 5.2% over the forecast period, due to product spoilage brought on by unsanitary storage at the wrong temperature. The demand for the food waste management industry is anticipated to increase due to developing nations' lack of infrastructure for cold storage of dairy products.

Improper disposal of waste leads to the generation of Green House Gases (GHGs), which, in turn, leads to ozone depletion. As a result, governments across the globe are focusing on the waste management of meat and meat products to reduce the impact of GHGs on the environment. In addition, the inappropriate disposal of waste leads to the contamination of natural resources, which, in turn, is expected to trigger the demand for the management of meat waste and is expected to drive segment growth over the forecast period.

Source Insights

The residential source segment dominated the market and accounted for 44.2% of the total revenue share in 2022. Residential food waste is anticipated to increase due to the rapidly expanding population and changing lifestyles. Inadequate food management, excessive food preparation, excessive shopping, poor cooking skills, and inadequate storage are some factors that contribute to food waste in homes.

The Environmental Protection Agency (EPA) estimates that 63 million tonnes of food waste were produced in the institutional, commercial, and residential sectors, with about 32% being managed by biochemical processing, animal feed, codigestion/anaerobic digestion, land application, composting, donation, and sewer/wastewater treatment.

The commercial segment is expected to register a CAGR of 6.0% over the forecast period owing to several factors such as overstocking, inefficient production, unskilled trimming, unidentified demand, spoilage, expiration, and overproduction of food items by hotels, restaurants, street food vendors, and cafes.

The industrial segment includes companies involved in the processing of raw food obtained from primary food producers. Losses due to spillage during slicing, washing, and peeling by manufacturers are some of the reasons adding to food waste. In addition, trimming spillage during meat slaughtering contributes majorly to food waste generation.

Service Types Insights

The collection segment dominated the market and accounted for 55.8% of the total revenue share in 2022. Segregation of food waste, loading, and unloading of waste, selection of a suitable area for food waste storage at a minimum distance from where the food waste is created, and food waste upkeep are part of food waste collection. Food waste collection companies must consider frequent cleaning and maintenance of these storage areas.

There are several ways of food waste disposal such as landfills, incineration, open dumping, composting, incineration, and recycling. To prevent several illnesses and environmental deterioration such as hepatitis and HIV among the masses which is contributed by improper food waste disposal, appropriate food waste disposal/ recycling is necessary, thereby contributing to market growth.

The application of biogas adds to a small share of the applications segment on account of the complexity of the treatment process and its high cost. Furthermore, increasing awareness regarding the application of food waste in power generation is anticipated to contribute to the growth of the segment.

The other disposal/recycling segment is expected to register a CAGR of 6.8% over the forecast period on account of the varying crude oil prices and the rising awareness concerning the use of renewable energy. Favorable government regulation towards biofuel applications is expected to drive the application of food waste as biofuel.

Regional Insights

North America region dominated the market and accounted for 32.6% of the total revenue share in 2022. The factors contributing to food waste management in North America include damage to food products, overproduction, lack of cold-chain infrastructure, rigid food-grading specifications, standardized date labeling practices, and varying customer demand.

The EU member states are working to reduce food waste at the source while also investing in proper disposal ways to obtain beneficial goods like fertilizers and biogas from the processes. For instance, the EU is committed to fulfilling SDG Target 12.3 of halving per capita global food waste at consumer and retail levels by 2030. Moreover, strict food waste management rules are projected to drive the market in the region over the forecast period.

Asia Pacific region is expected to witness a CAGR of 5.9% over the forecast period. The food and beverage industry in Asia Pacific is a major factor in the economic development of the region. Substantial growth is expected in food trade with increasing levels of national and regional specialization. With a growing population and rising income, the food sector is likely to expand rapidly over the forecast period, thereby contributing to the market growth.

The advanced economies in the Middle East & Africa, such as Qatar, majorly contribute to the global food wastage on account of the lack of concern regarding losses associated with food. In addition, the unavailability of an adequate number of cold storage & warehouses and the lack of transportation facilities are the primary reasons for the generation of food waste in the region.

Key Companies & Market Share Insights

The market for food waste management is highly competitive in nature. Major companies in the market include Veolia, Suez, Waste Management, Inc., Republic Services, Inc., Clean Harbors, Inc., and Stericycle, Inc. The source of competition varies by region and type of service offered by the regional and local players.

Availability of skilled technical professional personnel, specialized equipment, quality of service, diversity of services, and prices are the key competitive factors in the industry. In addition, factors such as government policies, technology, high EPA fees, high capital investment, and the high cost of licensing restrict the entry of new players into the market. For instance, the U.S. has set a goal of reducing food waste by 50% by 2030 through its Department of Agriculture (USDA) and Environmental Protection Agency (EPA). Some of the prominent players in the global food waste management market include:

-

Veolia

-

Suez

-

Waste Management, Inc.

-

Republic Services, Inc.

-

Covanta Ltd.

-

Stericycle, Inc.

-

Remondis SE & Co., KG

-

Clean Harbors, Inc.

-

Biffa

-

Rumpke

-

Advanced Disposal Services, Inc.

-

Cleanaway

-

FCC Recycling (UK) Limited

-

DS Smith

Food Waste Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 73.5 billion |

|

Revenue forecast in 2030 |

USD 106.7 billion |

|

Growth rate |

CAGR of 5.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Waste type, source, service types, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; France; Germany; Italy; U.K.; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; UAE |

|

Key companies profiled |

Veolia; Suez; Waste Management, Inc.; Republic Services, Inc.; Covanta Ltd.; Stericycle, Inc.; Remondis SE & Co., KG; Clean Harbors, Inc.; Biffa; Rumpke; Advanced Disposal Services, Inc.; Cleanaway; FCC Recycling (UK) Limited; DS Smith |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Waste Management Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food waste management market report based on waste type, source, service types, and region:

-

Waste Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cereals

-

Dairy & Dairy Products

-

Fruits & Vegetables

-

Meat & Poultry

-

Fish & Seafood

-

Oilseeds & Pulses

-

Roots & Tubers

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

-

Service Types Outlook (Revenue, USD Million, 2018 - 2030)

-

Collection

-

Transportation

-

Disposal/Recycling

-

Landfill

-

Incineration

-

Composting

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are propelling the market growth include the growing customer preference for exotic foods like premium coffee, tropical fruits & vegetables, and imported goods, along with growing global concerns about food waste.

b. The global food waste management market size was estimated at USD 69.8 billion in 2022 and is expected to be USD 73.5 billion in 2023.

b. The global food waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 106.7 billion by 2030.

b. North America dominated the food waste management market with a revenue share of 32.6% in 2022. The factors contributing to food waste management in North America include damage to food products, overproduction, lack of cold-chain infrastructure, market fluctuations, and rigid food-grading specifications, standardized date labeling practices, and varying customer demand.

b. Some of the key players operating in the Food Waste Management market include: Veolia; Suez; Waste Management, Inc.; Republic Services, Inc.; Covanta Ltd.; Stericycle, Inc.; Remondis SE & Co., KG; Clean Harbors, Inc.; Biffa; Rumpke; Advanced Disposal Services, Inc.; Cleanaway; FCC Recycling (UK) Limited; DS Smith.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."