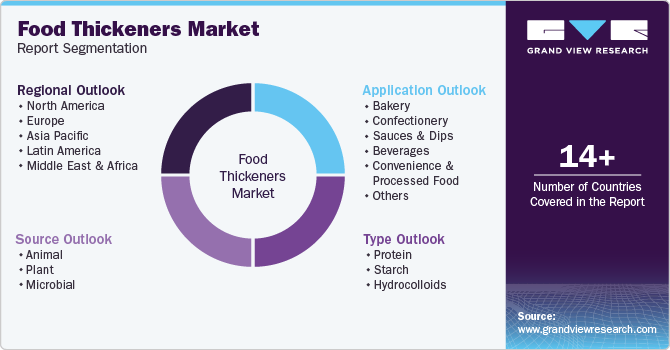

Food Thickeners Market Size, Share & Trends Analysis Report By Type (Protein, Starch, Hydrocolloids), By Source (Animal, Plant, Microbial), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-022-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Food Thickeners Market Size & Trends

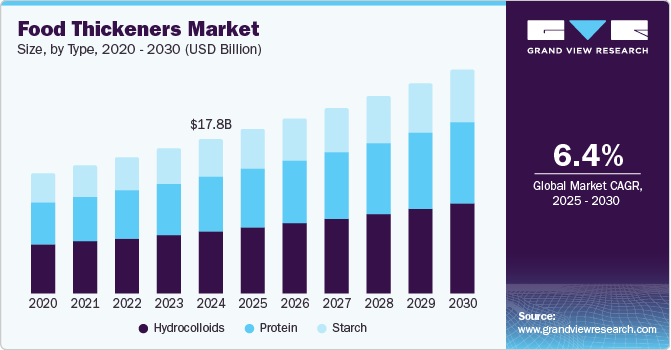

The global food thickeners market size was valued at USD 17.80 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030. This growth is primarily driven by the increasing demand for processed and convenience foods, as consumers seek products that offer enhanced texture and stability. As lifestyles get busier, the preference for ready-to-eat meals and snacks is increasing, prompting manufacturers to incorporate thickeners that improve the mouthfeel and overall quality of these products.

The growing consumer awareness about health and wellness is a key driver in the food thickeners industry. Food thickeners are often used to create texture-modified diets for individuals with swallowing difficulties, such as those suffering from dysphagia. For instance, thickeners such as xanthan gum are used in various food products to ensure the safety of patients and ease of consumption, thereby increasing their acceptance in healthcare settings and driving demand within the market.

Innovation plays a crucial role in the food thickeners industry, as companies continuously develop new products that cater to evolving consumer preferences. The introduction of plant-based thickeners reflects a shift toward healthier, more sustainable options in food production. This trend is increasingly important as consumers seek clean-label products that align with their dietary choices, further propelling the market's growth.

Regulatory support for food safety and quality is expected to enhance market growth prospects. Governments worldwide are implementing stricter regulations on food additives, encouraging manufacturers to invest in high-quality thickeners that comply with safety standards. This regulatory environment assures consumers about food safety and motivates companies to innovate and improve their offerings, thus fostering a positive growth cycle within the food thickeners market.

Type Insights

The hydrocolloids segment dominated the food thickeners industry with the largest revenue share of 40.8% in 2024, with increasing consumer preference for natural and clean-label ingredients, as hydrocolloids are derived from natural sources such as plants and seaweed. This shift aligns with the rising demand for healthier food options, prompting manufacturers to replace synthetic additives with hydrocolloids that provide similar functionalities without compromising the quality. For instance, guar gum, a popular hydrocolloid, is widely utilized in gluten-free baking to enhance texture and moisture retention, making it an essential ingredient for health-conscious consumers. The versatility of hydrocolloids in various applications, from dairy products to sauces, further boosts their adoption in the food thickeners industry.

The protein segment is expected to grow at the highest CAGR over the forecast period due to the rising consumer demand for high-protein foods and health-conscious products. Manufacturers are increasingly incorporating protein-based thickeners, such as whey protein and gelatin, into various food products as more individuals adopt a protein-rich diet for fitness and wellness. For instance, protein thickeners are commonly used in ready-to-drink protein shakes and meal replacement bars, enhancing texture while providing nutritional benefits. In addition, the growing popularity of plant-based diets has spurred interest in alternative protein sources, such as pea protein, which can also serve as effective thickeners.

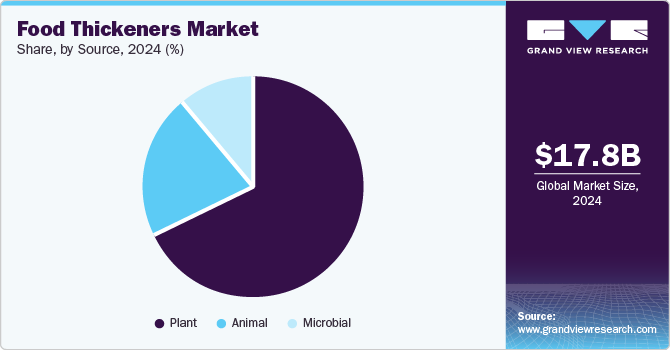

Source Insights

The plant segment dominated the food thickeners industry with the largest revenue share in 2024, driven by increasing consumer preference for natural and plant-based ingredients, which has led to a surge in demand for thickeners derived from sources such as tapioca, guar gum, and agar. These plant-based thickeners meet the growing trend toward healthier eating and align with the rising popularity of vegan and vegetarian diets. Furthermore, the versatility of plant-based thickeners in various applications, such as sauces, soups, and dairy products, enhances their appeal among manufacturers aiming for clean-label products that resonate with health-conscious consumers.

The animal segment is expected to grow at a significant CAGR over the forecast period due to the increasing demand for specific functional properties that only animal-based thickeners can provide. These thickeners, such as gelatin and collagen, are prized for their unique gelling and stabilizing abilities, which are essential in various applications, particularly in the confectionery and dairy sectors. Gelatin is widely utilized in gummy candies and desserts to achieve texture and mouthfeel desired by consumers. In addition, the rise in health and wellness trends has led to a greater focus on protein-rich diets, further increasing the demand for animal-based thickeners that contribute to texture and nutritional value.

Application Insights

The beverages segment dominated the food thickeners market with the largest revenue share in 2024 due to the increasing demand for textured and flavorful drink options. As health trends evolve, many consumers seek beverages that provide hydration and enhanced sensory experience, prompting manufacturers to incorporate thickeners that improve mouthfeel and viscosity. In addition, the growing popularity of functional beverages, such as those enriched with vitamins and minerals, further drives the demand for thickeners that stabilize these formulations while offering an enjoyable drinking experience.

The sauces & dips segment is expected to grow at a significant CAGR over the forecast period due to the increasing consumer preference for flavorful and convenient meal accompaniments. As dining habits evolve, more consumers are seeking ready-to-use sauces and dips that enhance the taste of their meals without the need for extensive preparation. In addition, the trend toward clean-label products is prompting companies to develop sauces that use natural thickeners, appealing to health-conscious consumers who prioritize ingredient transparency.

Regional Insights

The North America food thickeners market held the largest revenue share of 39.1% in 2024, driven by a large population base with a preference for convenience foods, leading to increased demand for processed products that use thickeners for improved texture and stability. In addition, the U.S. and Canada have stringent food safety regulations that encourage manufacturers to adopt high-quality thickeners. A rising trend toward health-conscious eating prompts consumers to seek clean-label products with natural ingredients. Furthermore, the behavioral shift toward home cooking in recent years has increased the demand for sauces and dressings that require thickeners, strengthening North America's position in the market.

U.S. Food Thickeners Market Trends

The U.S. food thickeners market dominated North America in 2024, driven by industry trends and an increasing number of health-conscious consumers seeking suitable, nutritious food options. This has led to a higher demand for processed foods that use thickeners to enhance texture and stability. In addition, the presence of a robust food & beverage industry enables easy access to diverse thickeners. The trend toward clean-label products is prompting manufacturers to use natural thickeners that appeal to consumers who prefer transparency in ingredients.

Asia Pacific Food Thickeners Market Trends

Asia Pacific food thickeners market is expected to grow at the highest CAGR over the forecast period due to rapid urbanization and rising disposable incomes in the region. In addition, significant lifestyle changes and growing demand for non-alcoholic beverages, such as fruit juices and energy drinks, are expected to drive the need for thickeners that enhance mouthfeel and viscosity. Furthermore, the rising awareness about health benefits associated with natural ingredients is prompting manufacturers to focus on plant-based thickeners, aligning with the increasing popularity of vegan diets.

The China food thickeners market dominated Asia Pacific in 2024 with the largest revenue share, driven by a growing middle-class population that increasingly demands processed and appropriate food options, reflecting a shift in dietary habits. The country boasts a robust food processing industry, which is essential for producing a wide variety of products that require thickeners for texture and stability. Furthermore, the increasing incidence of dysphagia among the aging population drives demand for thickening agents that enhance the safety and palatability of food.

Europe Food Thickeners Market Trends

Europe food thickeners market is expected to grow significantly over the forecast period due to the well-established food & beverage industry continuously innovating to meet consumer demands, driving the need for effective thickeners in various applications. Moreover, a strong trend toward clean-label products is prompting manufacturers to use natural thickeners that align with consumers' preferences for transparency in ingredients. The increasing consumption of ready-to-eat meals and convenience foods is further expected to fuel the demand for thickeners and position Europe as a key market in the food thickeners industry in the coming years.

Key Food Thickeners Company Insights

Some of the key players in the food thickeners market are Cargill, Incorporated; Archer Daniels Midland Company (ADM); DuPont De Nemours, Inc.; Tate & Lyle PLC; CP Kelco; Kerry Group plc.; Ingredion Incorporated; Ashland; FDL Limited; Naturex S.A.; Medline Industries, LP; and Darling Ingredients. These companies employ various strategies to maintain a competitive edge, including the development of innovative products that cater to diverse consumer needs across multiple food applications. They focus on sustainability by using natural and plant-based ingredients, which align with the growing demand for clean-label products.

-

Archer Daniels Midland Company (ADM) is known for its extensive ingredient portfolio, which enhances food texture and stability. The company focuses on innovation and sustainability, developing a range of plant-based thickeners that cater to the growing consumer demand for clean-label products. ADM leverages advanced processing technologies to create high-quality thickeners, such as modified starches and hydrocolloids, which are widely utilized in various applications, including sauces, dairy products, and baked goods.

-

Cargill offers a diverse range of thickening agents that enhance the quality and consistency of food products. The company emphasizes innovation by developing natural thickeners that align with consumer preferences for healthy and sustainable options. Cargill's portfolio includes starches, gums, and other essential functional ingredients in beverages, dressings, and frozen foods.

Key Food Thickeners Companies:

The following are the leading companies in the food thickeners market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- DuPont De Nemours, Inc.

- Tate & Lyle PLC

- CP Kelco

- Kerry Group plc.

- Ingredion Incorporated

- Ashland

- FDL Limited

- Naturex S.A.

- Medline Industries, LP

- Darling Ingredients

View a comprehensive list of companies in the Food Thickeners Market

Recent Developments

-

In January 2023, Nestlé India announced the launch of ThickenUp Clear, a food and beverage thickener specifically created to aid individuals with difficulties in swallowing, particularly those suffering from oropharyngeal dysphagia. This xanthan gum-based formulation is tasteless, colorless, and odorless and is known to improve swallowing safety and efficacy.

Food Thickeners Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 18.98 billion |

|

Revenue forecast in 2030 |

USD 25.85 billion |

|

Growth rate |

CAGR of 6.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, source, application, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, South Africa, UAE |

|

Key companies profiled |

Cargill, Incorporated, Archer Daniels Midland Company (ADM), DuPont De Nemours, Inc., Tate & Lyle PLC, CP Kelco, Kerry Group plc., Ingredion Incorporated, Ashland, FDL Limited, Naturex S.A., Medline Industries, LP, Darling Ingredients |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Thickeners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food thickeners market report based on type, source, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein

-

Starch

-

Hydrocolloids

-

Gelatin

-

Xanthan Gum

-

Agar

-

Pectin

-

Others

-

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal

-

Plant

-

Microbial

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery

-

Confectionery

-

Sauces & Dips

-

Beverages

-

Convenience & Processed Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."