Food Service Equipment Market Size, Share & Trends Analysis Report By Product (Kitchen Purpose Equipment, Refrigeration Equipment), By End Use, By Sales Channel (Online, Offline), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-841-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Food Service Equipment Market Trends

The global food service equipment market size was estimated at USD 39.1 billion in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2030. Furthermore, factors such as increasing digitalization, the need for sustainable & eco-friendly equipment, and stringent consumer safety norms are expected to create promising growth opportunities for the market in the near future. The market has rapidly evolved following clients' changing needs for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector.

The growing food service and hospitality sectors, including restaurants, cafes, and catering, are key drivers of market expansion. Increasing demand for takeout and the rise of quick-service and fast-casual chains highlight the need for efficient kitchen equipment to manage high-volume operations. Consumer preferences for dining out and ordering takeout and a shift towards gourmet and healthy food options further fuel the demand for advanced cooking and preparation technologies to enhance food quality and efficiency. The adoption of smart technology and IoT-enabled appliances is transforming the food service industry, enhancing monitoring, automation, and efficiency in commercial kitchens.

Labor shortages are pushing operators to embrace multi-functional equipment reducing human involvement while ensuring service quality is increasingly in demand. Stricter health and safety regulations are also driving the need for advanced equipment, such as ware-washing and storage solutions, to ensure hygiene and prevent contamination. Over time, there has been significant progress in the development of equipment designed for food preparation and storage, including cooking stoves, ranges, and electric refrigerators. Additionally, the emergence of specialized appliances tailored to prepare various cuisines has further expanded the market.

The growth of offices and increased food availability are boosting the food service equipment market. With more businesses offering in-house dining options for employees, there’s a rising demand for efficient kitchen tools like refrigerators, food warmers, and coffee machines. As diverse food options become more accessible, specialized equipment is needed to meet the variety of meals and snacks being served. Furthermore, the rise of social media, with food vlogging and influencers, fuels interest in innovative kitchen technologies and presentation styles. Additionally, the trend of "clout kitchens," driven by social media visibility, further accelerates the need for high-performance culinary equipment.

Product Insights

The kitchen purpose equipment segment dominated the market and accounted for a revenue share of 40.6% in 2024. The rise of commercial kitchens, cloud kitchens, and the expanding food service sector drives the growing demand for efficient kitchen equipment. Innovations like sensors in appliances for real-time monitoring and the focus on advanced technology solutions have become essential. The tourism industry's growth also boosts the demand for heavy-duty kitchen equipment, as hotels and restaurants strive to meet the culinary needs of travelers. Cloud kitchens, offering delivery-only services, further emphasize the need for high-volume, cost-effective kitchen solutions.

The food holding and storage equipment segment is expected to grow significantly at a CAGR of 7.9% over the forecast period. The increasing demand for takeout, delivery, and pre-packaged meals has amplified the need for efficient food storage solutions to preserve freshness and quality. As fast-food chains and delivery-only kitchens grow, the need for advanced holding and storage equipment to safely manage large volumes of food becomes more critical. Additionally, stricter food safety regulations are driving businesses to invest in reliable storage systems like refrigerators, freezers, and heated holding units to ensure compliance and prevent contamination.

End Use Insights

FSR (Full Service Restaurant) led the market and accounted for a revenue share of 43.4% in 2024 due to the emergence of digital dining trends. These trends have driven food service operators to adopt advanced equipment in order to accelerate preparation times and minimize delivery delays. Full service restaurants require specialized equipment to handle their diverse menus, ensuring smooth operations and high-quality food preparation. Furthermore, as shopping centers in business hubs grow globally, these restaurants are becoming more prevalent. With rising disposable incomes in both developed and developing countries, customers increasingly rely on these restaurants, driving the demand for advanced kitchen equipment to support their complex operations and diverse offerings.

The QSR (quick service restaurant) sector is expected to grow at the fastest CAGR of 27.2% over the forecast period, fueled by improvement in their food delivery services to meet the growing demand for ready-to-eat meals, particularly as a significant portion of the global population consists of busy working professionals. Furthermore, the globalization of prominent restaurant chains by establishing franchisee joints is a significant factor in the growing demand for food service equipment. QSRs emphasize menu innovation, convenience, and competitive pricing. The continual product innovations in the food service equipment industry have enabled time-constrained consumers to have quicker access to good-quality cooked items.

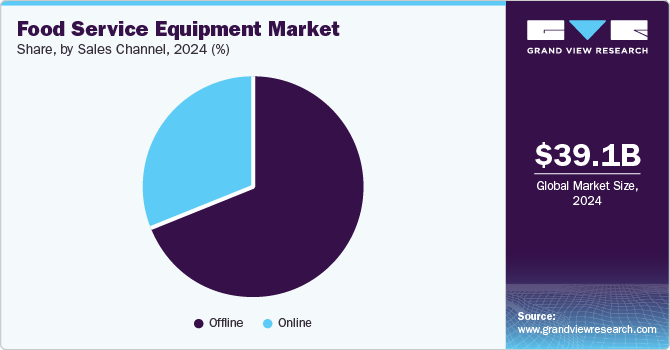

Sales Channel Insights

The offline sector dominated the market and accounted for a revenue share of 68.8% in 2024, driven by the strong market capture of brick & mortar retailers across the global food service equipment industry. The offline segment includes brick & mortar, specialty food retailers, shopping malls, and shopping centers. Restaurant owners and chefs prefer purchasing food service equipment offline to assess quality, functionality, and fit. In-person buying allows for price negotiation, immediate availability, and faster delivery, helping businesses meet operational needs and avoid downtime.

The online sector is expected to grow at the fastest CAGR of 7.4% over the forecast period, aided by the major key players' increasing introduction of online retailing to customers. Additionally, online retail sites allow customers to compare prices and specifications for different brands simultaneously, likely positively impacting customer shopping behavior. Furthermore, improved logistics enable faster delivery for online purchases, appealing to businesses and minimizing downtime. Online platforms provide customer reviews for insights, and their 24/7 availability allows businesses to shop anytime.

Regional Insights

Asia Pacific food service equipment market dominated the global market and accounted for the largest revenue share of 36.9% in 2024. The growing westernization of dining habits and tourism expansion in Singapore, Malaysia, Indonesia, and Australia are driving demand for food service equipment. Additionally, the rising popularity of diverse cuisines and processed foods further boosts the need for such appliances in the region. Furthermore, in developing countries of the region, higher disposable incomes are encouraging dining out, driving demand for food service equipment. Urbanization has led to more restaurants and cafes, increasing the need for advanced appliances.

China Food Service Equipment Market Trends

The food service equipment market in China dominated Asia Pacific market with the largest revenue share in 2024. The rising popularity of Western fast foods and the development of food service franchises in China impact the market's growth. As China’s middle-class population grows and urbanization increases, demand for restaurants, fast food chains, and cafes rises. Furthermore, the shift toward eating out and online delivery platforms fuels this trend. To meet demand, food service businesses are investing in advanced cooking and storage equipment for efficiency and safety.

Latin America Food Service Equipment Trends

The food service equipment market in Latin America is expected to grow at a CAGR of 8.0% over the forecast period. As economies grow, people have more disposable income to spend on dining out, with urbanization and busy lifestyles reducing time for home cooking. The rise of food delivery apps and demand for convenient, packaged foods, including frozen products, is fueling this trend. Consumers are also seeking simpler, more natural ingredients, driving the growth of food chains and boosting the food service equipment market. In Latin America, dining is a social activity, with restaurants and food stalls serving as community hubs. This cultural focus drives the growth of the food service equipment market.

The food service equipment market in Brazil dominated the Latin America food service equipment market with a high revenue share in 2024. Several factors drive the growing food service equipment market in Brazil, such as dining out, which is a social event where people gather to enjoy each other's company, making it a central part of Brazilian culture. With busy urban lifestyles, eating out offers convenience over home cooking. Additionally, Brazil’s diverse food culture, with a wide range of local and international dishes offered at restaurants and cafes, fuels the demand for specialized food service equipment.

North America Food Service Equipment Market Trends

North America food service equipment market held a substantial market share in 2024, owing to the surge in consumer sales, delivery, and takeout services. These services require specialized equipment to maintain food quality during transport, therefore, investments in high-quality packaging equipment, warming units, and advanced delivery logistics systems become essential. Restaurants need to ensure that food reaches customers in optimal condition, which drives the demand for equipment that can maintain temperature and preserve freshness. This trend supports the growth of the market, particularly in segments that cater to delivery and takeout operations.

The food service equipment market in the U.S. dominated the North America food service equipment market with a revenue share of 84.6% in 2024. The rising demand for quick service restaurants (QSR) and the growth of fast-food chains in the U.S. are significantly driving the market growth. QSRs require advanced, efficient kitchen tools to meet the fast-paced, high-volume demands of their operations while adapting to technological advancements and the changing dietary preferences of consumers. Furthermore, the incorporation of digital, prompt service delivery measures by the QSRs is helping them further develop and expand their presence in the U.S.

Key Food Service Equipment Company Insights

Key companies in the global food service equipment market are Electrolux, Welbilt, Duke Manufacturing, and MEIKO Maschinenbau GmbH & Co. KG, among others. Major players are leveraging technological advancements and responding to changing consumer preferences to strengthen their market positions within the sector.

-

Electrolux, headquartered in Stockholm, Sweden, focuses on food service equipment, providing solutions to restaurants, hotels, and other commercial establishments. Their food service equipment line includes products like cooking, refrigeration, dishwashing, and food preparation equipment.

-

Duke Manufacturing, based in St. Louis, Missouri, offers a variety of products, such as cooking equipment, food holding and warming equipment, refrigeration equipment, prep and cooking stations, and dishwashing and cleaning. They focus on improving energy efficiency, durability, and overall performance. Their products are designed to help foodservice operators enhance their workflow while reducing operational costs.

Key Food Service Equipment Companies:

The following are the leading companies in the food service equipment Market. These companies collectively hold the largest market share and dictate industry trends:

- Electrolux

- Welbilt

- Duke Manufacturing

- MEIKO Maschinenbau GmbH & C0. KG

- The Middleby Corporation

- HOSHIZAKI CORPORATION

- Hobart

- RATIONAL

- BUNN

- Cambro

Recent Developments

-

In April 2024, the Ali Group revived the Welbilt brand in North America, merging two iconic names in commercial food service equipment. This rebranding signaled a return to Welbilt’s roots, emphasizing quality and innovation. The redesigned logo reflected a blend of both companies' cultures, reaffirming Ali Group’s commitment to excellence. This change applied only to North America, with no impact on Ali Group companies outside the region.

-

In March 2024, Parts Town, a leader in OEM food service equipment parts distribution, launched PartPredictor, an AI-powered digital tool designed to streamline repairs. Analyzing data from millions of technician repairs helps service companies quickly identify the correct parts for specific equipment issues, predicting the most commonly used parts. PartPredictor is the first solution of its kind for the commercial foodservice sector.

Food Service Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 41.5 billion |

|

Revenue forecast in 2030 |

USD 58.2 billion |

|

Growth Rate |

CAGR of 7.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, sales channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, South Africa |

|

Key companies profiled |

Electrolux,Welbilt,Duke Manufacturing,MEIKO Maschinenbau GmbH & C0. KG,The Middleby Corporation,HOSHIZAKI CORPORATION,Hobart,Welbilt,RATIONAL,BUNN, Cambro |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Service Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global food service equipment market report based on product, end use, sales channel, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Kitchen Purpose Equipment

-

Cooking Equipment

-

Grills

-

Fryers

-

Ovens

-

Toasters

-

Others

-

-

Food & Beverage Preparation Equipment

-

Slicers & Peelers

-

Mixers & Grinders

-

Blenders

-

Juicers

-

Ice Crushers

-

Others

-

-

-

Refrigeration Equipment

-

Ware Washing Equipment

-

Food Holding & Storing Equipment

-

Others

-

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."