- Home

- »

- Advanced Interior Materials

- »

-

Food Service Disposable Market Size Report, 2021-2028GVR Report cover

![Food Service Disposable Market Size, Share & Trends Report]()

Food Service Disposable Market Size, Share & Trends Analysis Report By Packaging Type (Flexible, Rigid), By Material (Plastic, Polylactic Acid), By Application (Online, Food Service), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-2-68038-917-3

- Number of Report Pages: 218

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

The global food service disposable market size was valued at USD 53.9 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2021 to 2028. The global market is anticipated to be driven by the growing penetration of online food delivery services. Moreover, the increasing popularity of Quick-Service Restaurants (QSRs), especially in the developing regions, such as Asia Pacific, owing to busy lifestyles and hectic work schedules is expected to favor the market growth over the forecast period. The high demand for online food delivery services amid the COVID-19 pandemic is also expected to boost the market growth. The surge in demand is aided by the lockdowns imposed across major cities that restrict hotels, restaurants, and cafes from providing dine-in services.

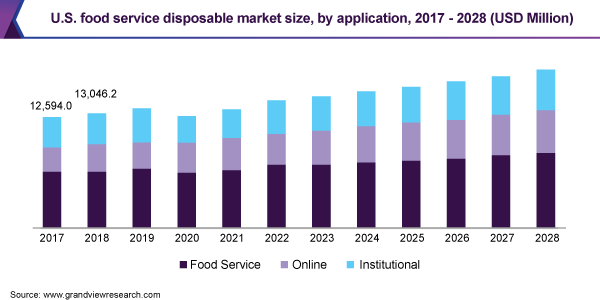

The U.S. emerged as the largest country for food service disposables in 2020 due to the extensive penetration of QSRs, which are the main consumers of food service disposables. Although the market witnessed a decline in growth in 2020 owing to the pandemic, imposed restrictions to curb the disease spread resulted in exponential growth of online food delivery services, which benefitted the food service disposables market. Disposable food packaging products, such as plates, cups, bowls, and containers, are highly economical as compared to their alternatives, such as non-disposable containers.

Moreover, these products provide convenience to customers and delivery personnel in the overall delivery process. The growth of online food delivery services is aided by platforms, such as Uber Eats, Glovo, Grubhub, Delivery Club, Postmates, Just Eat, and Deliveroo. According to a survey by Uber Eats, in 2019, the share of restaurants on its platform that reported an overall increase in sales after joining was 69% in London, 74% in Paris, and 67% in Warsaw. Thus, growing online food delivery service is expected to lead to a rise in product usage, thereby supporting the market growth.

Packaging Type Insights

The rigid packaging type segment led the largest revenue share of more than 77% in 2020. Rigid packaging is mainly used to protect food from spillage and for the convenience of consumers. A variety of rigid packaging is used by foodservice providers depending on the temperature, quantity, and material state of the food. The rigid packaging type includes plates & containers, bowls & tubs, mugs & saucers, lids, and other disposables. Plastic-made rigid products are anticipated to witness substantial growth.

The mugs, saucers, and containers used for beverages, such as hot & cold drinks and soups, are made from materials like metal and glass. These packaging products are mainly used when an insulated food packaging is required to decrease the chances of food spoilage due to inadequate temperature. These types of packaging products are also easy to recycle and reuse; due to these factors, they are proven to be more convenient and sustainable than their counterparts. The glass rigid packaging is deemed to be more premium than packaging made of other materials, such as plastic, which contributes to the high demand for glass products.

However, the flexible packaging type segment is estimated to record the fastest CAGR from 2021 to 2028. The high growth is attributed to the rising demand for flexible paper packaging as a result of government restrictions on single-use plastic products in many regions, such as Europe. The food service providers are now able to pack almost all kinds of foods in flexible packaging materials, such as pouches, wraps, and films, as they are unbreakable, lightweight, and more convenient than rigid products. These factors are expected to aid the segment over the forecast period.

Material Insights

The plastic material segment led the market accounting for more than 53% share of the global revenue in 2020. The segment will retain the dominant position throughout the forecast period as plastic is the most preferred choice of material in the packaging industry due to its low cost, ease of use, lightness, temperature resistance, etc. Plastics are used for the manufacturing of various products, such as plates, bowls, cups, trays, cutlery, and food containers.

Plastic containers can be single-use or multi-use. Single-use plastic accounts for the high share of global plastic waste and is harmful to the environment. As a result, the consumption of single-use plastic is expected to decline at a significant rate in the coming years. However, the outbreak of COVID-19 has propelled its consumption and delayed its decline as consumers find it to be a safer option than reusable products.

Paper and paperboard packaging has been witnessing high growth over the past few years, especially replacing popular disposables, such as plastic cups. Paper & paperboard is used to make various other products including plates, trays, bowls, straws, egg cartons, and tray liners. Paper-based takeaway containers are an affordable and eco-friendly option in the market. Increasing consumption of takeaway foods & beverages, such as pizza and coffee, is expected to spur the demand for disposable products driving the market growth.

Application Insights

The food service application segment led the market with a revenue share of more than 51% in 2020. The dynamics of the food service industry are changing rapidly, which is expected to aid in the growth of the food service disposables market. Moreover, increasing demand for takeaways and online food delivery services will boost the market growth. The COVID-19 pandemic had an adverse impact on the industry as all the food service businesses were closed due to strict lockdowns imposed across several countries.

The post-lockdown era has changed the aspects of the industry and forced it to increase the use of disposables for both dine-in and online food delivery applications. This has resulted in the increasing demand for food service disposables from all kinds of food service providers and the trend is expected to continue in the years to come.

Institutions, such as schools, colleges, universities, hospitals, correctional facilities, public & private cafeterias, nursing homes, and day-care centers, such products on a daily basis. Unlike restaurants & hotels, where there is dedicated staff for serving food and cleaning tables & utensils, institutions often prefer third parties, such as catering services and non-governmental organizations, for meals. Therefore, the consumption of the institutional application segment is less prone to fluctuations and tends to stay consistent.

Although many institutions, such as colleges, universities, and schools, have shifted to online platforms, the product demand is high in hospitals and other newly established institutions due to the pandemic, such as COVID care centers.

Regional Insights

Asia Pacific dominated the market in 2020 accounting for the largest revenue share of more than 36%. The regional market is anticipated to expand further at the fastest CAGR from 2021 to 2028 owing to the presence of the fastest-growing economies and flourishing food service industry. China is the largest contributor and is anticipated to retain its leading position in the regional market over the forecast period owing to the high density of fast-food restaurants and increasing adaptation to online food delivery systems.

India is also expected to register a significant growth rate in the regional market due to changing economy coupled with the high penetration of the food service industry. The other large markets in the region include Japan, South Korea, and Indonesia. These countries are heavily dependent on online delivery services and this trend is likely to stay in the market for the long term, thereby, benefiting the regional market. North America emerged as the second-largest regional market in 2020. Extensive penetration of hotels & restaurants in the U.S. and Canada and strong per capita spending on hoteling.

Europe is anticipated to witness a sluggish CAGR from 2021 to 2028. The stringent regulations, pertaining to the use of single-use plastic and plastic tableware, is expected to add to the sluggish growth of the market over a forecast period. Starting July 2021, it will be illegal to offer disposable plastic cutlery in the Europe regional market. Such stringent regulations are likely to hinder market growth in the years to come. Although, amid such developments, the demand for paper-based alternatives is anticipated to witness significant growth in Europe.

Key Companies & Market Share Insights

The market players are adopting several business strategies to gain a competitive edge over others. For instance, Berry Global Inc. introduced pivot clear cups. As the consumption of niche beverages, such as frozen, blended, and mixed, is increasing so is the requirement for cost-effective, high-quality, single-use clear cups. These cups are made from an exclusive polypropylene blend that offers advantages over clear cups in the market.

The COVID-19 pandemic adversely affected the market and companies faced a decline in product demand due to restrictions on import & export and transportation in the first quarter of 2020. However, with ease in lockdown restrictions, the product demand witnessed a swift rise. In addition, the product application scope has increased as consumers are preferring disposables over re-usable food containers due to safety concerns. Some of the prominent players in the global food service disposable market include:

-

Huhtamaki Food Service

-

Graphic Packaging International LLC

-

Sonoco Products Company

-

Sabert Corp.

-

Genpak LLC

-

Pactiv LLC

-

Contital Srl

-

Go Pak Group

-

R+R Packaging Ltd.

-

Interplast Group

Food Service Disposable Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 56.9 billion

Revenue forecast in 2028

USD 79.2 billion

Growth Rate

CAGR of 4.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging type, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Russia; Poland; The Netherlands; Portugal; China; India; Japan; Brazil; South Africa

Key companies profiled

Huhtamaki Food Service; Graphic Packaging International LLC; Sonoco Products Company; Sabert Corporation; Genpak LLC; Pactiv LLC; Contital Srl; Go Pak Group; R+R Packaging Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global food service disposable market report on the basis of packaging type, material, application, and region:

-

Packaging Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Rigid

-

Plates

-

Cups & Glasses

-

Trays & Containers

-

Bowls & Tubs

-

Mugs & Saucers

-

Lids

-

Others

-

-

Flexible

-

Wraps & Films

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2017 - 2028)

-

Plastic

-

PP

-

PE

-

PS

-

PVC

-

Others

-

-

Paper & Paperboard

-

Bagasse

-

Polylactic Acid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Food Service

-

Full Service

-

Quick Service

-

Others

-

-

Online Delivery

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Russia

-

Poland

-

The Netherlands

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food service disposable market size was estimated at USD 53.9 billion in 2020 and is expected to reach USD 56.9 billion in 2021.

b. The food service disposable market is expected to grow at a compound annual growth rate of 4.9% from 2021 to 2028 to reach USD 79.2 billion by 2028.

b. The rigid packaging type segment led the largest revenue share of more than 77% in 2020 in the food service disposable market.

b. Some of the key players operating in the food service disposable Market include Berry Global Inc., Anchor Packaging LLC, Westrock Company, Dart Container Corporation, Georgia-Pacific, and Huhtamaki.

b. The key factors that are driving the food service disposable market include increasing penetration of online food delivery services and increasing popularity for food trucks in developed countries that largely use food service disposable products to serve their customers.

b. The plastic material segment led the food service disposable market accounting for more than 53% share of the global revenue in 2020.

b. The food service application segment led the food service disposable market with a revenue share of more than 51% in 2020.

b. Asia Pacific dominated the food service disposable market in 2020 accounting for the largest revenue share of more than 36%.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."