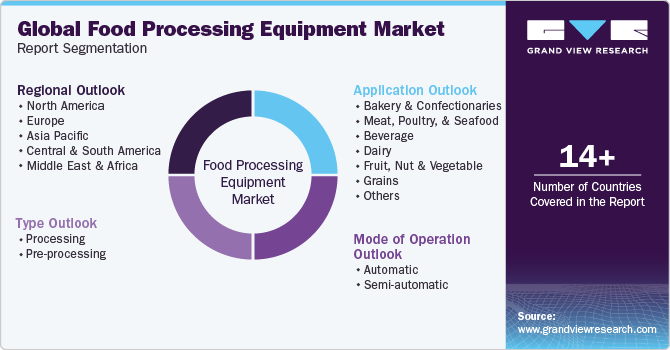

Food Processing Equipment Market Size, Share & Trends Analysis Report By Mode of Operation (Automatic), By Type (Processing), By Application (Beverage), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-491-8

- Number of Report Pages: 214

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Food Processing Equipment Market Trends

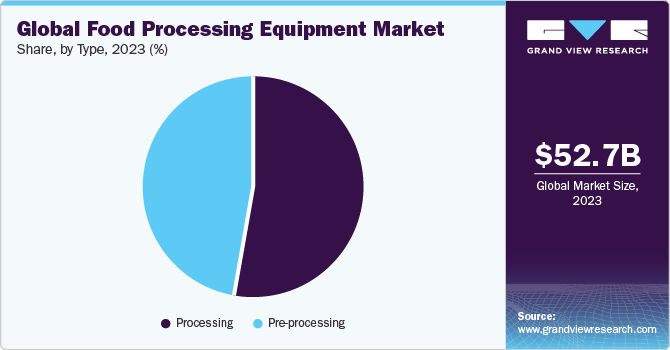

The global food processing equipment market size was valued at USD 52.69 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030. Population expansion, coupled with the rising per capita disposable income, is expected to result in an increased demand for meat and poultry and greater consumption of processed products, thus boosting the market growth over the forecast period. These systems are widely utilized across numerous applications, such as bakery and confectionery, meat, seafood and poultry, dairy, and grains, owing to their inherent advantageous characteristics, such as quality control, durability, hygiene, and preservation. The product is increasingly being utilized in the end-use industries, specifically in Asia Pacific, where rising domestic manufacturing and consumer income levels are driving innovation in this sector.

The food and beverage market in developing regions, such as Asia Pacific, is expected to dominate over the coming years owing to a rise in population, increasing foreign direct investments, rising disposable income, and changing preferences. In addition, increasing demand for leisure food in China, India, Indonesia, Malaysia, Japan, and various other countries is anticipated to boost the growth of the industry, thereby stimulating the product demand over the coming years.

Population growth and rising disposable income, along with increasing urbanization, are expected to augment the product demand in Middle Eastern countries. Moreover, the governments of Middle Eastern countries are focusing on reducing their reliance on the petroleum sector and promoting investments in industries, such as construction, automotive, and food and beverage.

Farmed fish solutions for the marine industry had provided a convenient solution for the demand-supply imbalance. However, the industry witnessed a price hike for fresh and processed fish. The positive economic condition of the market and potential customers are some of the prominent factors that assure the prominent growth of the market over the forecast period.

Though the number of malnourished people in the world has decreased by a considerable percent, the global condition of undernourished people is still critical. Rising population, dietary shifts, and a rise in spending power influence the market growth, which exerts pressure on the industry to fulfill the ever-increasing demand of the world.

In order to improve the food security of the world, one must increase pollution control measures and reduce food losses. These solutions can be easily achieved by standard and advanced processing equipment. This, in turn, is expected to create opportunities for equipment manufacturers over the forecast period.

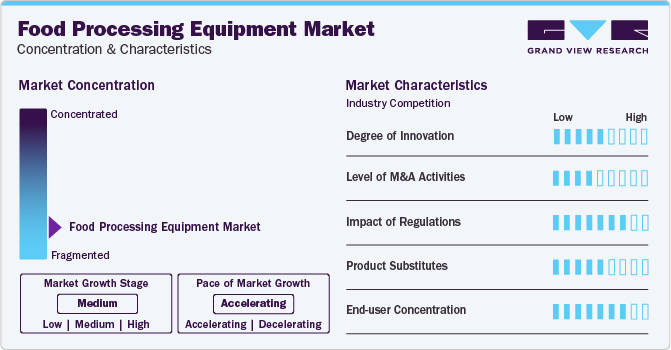

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Several key characteristics shape the dynamics of the food processing equipment market. The increasing spending on the processed food and beverage across the world is one key primary driver of the food processing equipment market growth. Consumers are continuously seeking for new innovative food and beverage products with enhanced nutrition, which is contributing to the market growth.

Food processing equipment manufacturers need to adhere to strict regulation and comply with the standard set by the global and local authorities. Food Safety Modernization Act (FSMA) of U.S. have designed the rules and regulation for food equipment manufacturers. The equipment must have sanitary designs, properly labelled, and must ensure the safety of the food material. The impact of the regulation on the food processing equipment market is significant owing to the involvement of the food products.

The rise of the hospitality industry driven by the increasing tourism, the number of café and restaurant are rapidly increasing. This increase in the end-user numbers are likely to have significant influence on the market growth. Moreover, the expansion of the food grocery retailers, convenience stores, and specialty food retailers across the world, the demand for food processing equipment is propelling.

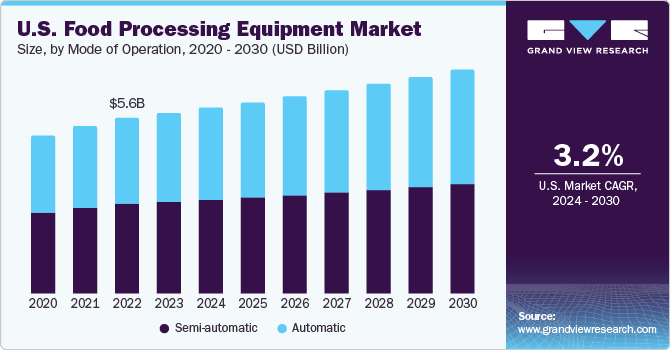

Mode of Operation Insights

The automatic segment held the largest revenue share of 50.4% in 2023, owing to the high demand for technological development, growing use of automation, and strong research and development capabilities of market players.

Previously, manufacturers used to opt for semi-automated equipment owing to the availability of labor, low cost of the semi-automated product, and financial budget. As the demand for processed food had increased, the manufacturers preferred to have automated systems in the market.

On account of the need to offer precise, standard, and quality products and gain a competitive advantage over other players, the manufacturers provide automated operational systems for the manufacturing of food processing equipment. With the latest industrial trend, the market for automated food processing equipment is expected to witness considerable growth over the forecast period.

The rise in demand for fast and packaged food is expected to compel manufacturers to expand their production capabilities, which is likely to trigger product demand over the forecast period. Consumers owing to various economic and environmental factors tend to opt for processed products, which, in turn, is expected to boost the product demand over the coming years.

Application Insights

Bakery and confectionaries held the largest revenue share of over 20% in 2023. Meat, poultry, and seafood products are expected to witness the fastest growth over the forecast period. The changing lifestyle of people, increasing inclination toward nutritious food, and awareness about the health benefits of marine products have triggered the demand for meat, poultry, and seafood products. In addition, the rising demand for equipment in which a single unit can operate multiple operations, such as cleaning, skinning, and weighing, is expected to create opportunities for product manufacturers over the coming years.

The moderate growth of the grains application segment is the result of dynamic regulatory changes and taxes imposed. In recent times, the imposed tariffs of China on the shipments from the U.S. depict lower imports of grain in China. Moreover, adverse weather conditions in Canada affect grain production, which eventually affects the product demand in the region.

Rising demand for nutritional enrichment, along with the EU’s support to regulate the application of food additives at the domestic level, is expected to augment market growth in the region. The presence of functional food manufacturers, along with the increasing R&D expenditure to develop innovatively formulated additives in Europe, is anticipated to boost the product demand over the coming years.

Type Insights

The processing equipment segment held the largest share of over 52% in 2023. The segment is expected to witness the fastest growth over the forecast period owing to the high demand for processed products and the increasing popularity of healthy and packaged food.

Pre-processing equipment deals with mixing, killing, and filleting, which are used in a wide range of application industries. The demand for these systems is expected to emerge from the Middle Eastern and Central and South American nations owing to the growing urbanization, industrialization, and changing consumer eating patterns.

Currently, over 80% of the people live in urban areas where consumers tend to opt for processed foods, such as frozen, bakery and confectionery, flavored dairy, and other allied products. In addition, advancements in processing and packaging technologies are anticipated to surge the product demand over the coming years.

The shelf arrangement in the supermarkets or hypermarkets or online sales altogether affects the buying behavior of the customers, which triggers the product sales. The constant rise in the demand for processed products is expected to create opportunities for food processing equipment manufacturers over the forecast period.

Regional Insights

Asia Pacific held the largest revenue share of over 35.0% in 2023 and is expected to witness the fastest growth over the forecast period. The Chinese market has a significant number of players, and thus product innovation and strategic alliance are the success factors for the Chinese players. New product innovations, developments, and the introduction of advanced technologies offer favorable opportunities for food manufacturers, thereby surging the market growth in recent years.

U.S. food processing equipment market

The U.S. is one of the most urbanized countries with around 80% of its population living in urban areas. This has influenced food preferences, which, in turn, has favored the growth of the food processing industry. However, being a mature market, the product demand is expected to witness sluggish growth over the forecast period.

Europe is one of the prominent regions in the food and drink industry. The industry accounts for a majority of the share in Europe’s economy as countries like Germany, Italy, and the U.K. play a vital role in shaping the economy. The increasing demand and supply of these systems in these areas, along with a strong and distributed network, is expected to create opportunities for product manufacturers over the coming years.

Brazil food processing equipment market

In Brazil, processed products are expected to witness a positive performance over the forecast period. Macroeconomic factors such as GDP growth and steady economic conditions have favored the growth of the food industry, and thus the processing equipment market. The market in Brazil is expected to expand at a CAGR of 4.3% from 2024 to 2030 owing to the untapped opportunities and customer base.

Key Companies & Market Share Insights

Mergers & acquisitions, new product launches, and licensing agreements are a few of the strategies adopted by the market players to strengthen their positions. Various government regulatory frameworks, taxes, and standards affect the trading of equipment. Various companies thus tend to opt for innovative and competitive strategies in the market in order to withstand the competition and maintain the position in the market.

Key Food Processing Equipment Companies:

- BAADER Group

- Marel

- Bühler AG

- GEA Group Aktiengesellschaft

- The Middleby Corporation

- Tetra Laval International S.A.

- Alfa Laval

- Krones AG

- JBT Corporation

- SPX Flow Inc.

- LEHUI

- Equipamientos Cárnicos, S.L. (MAINCA)

- FENCO Food Machinery s.r.l.

- Bigtem Makine A.S.

- TNA Australia Pty Limited

Recent Developments

-

In February 2023, Middleby Corporation disclosed its acquisition of Flavor Burst, enhancing its portfolio in the beverage group. The addition of Flavor Burst's cutting-edge beverage flavoring technology reaffirms Middleby's prominent standing in the food processing and food service sector as a leading innovator and major player.

-

In February 2023, Middleby Corporation announced the strategic acquisition of Escher Mixers, a renowned provider of automated and robotic solutions for dough handling and mixing processes in the bakery industry. This further strengthens Middleby's position in the market, allowing the company to offer comprehensive and efficient integrated solutions, leading to improved production capabilities, cost savings, and enhanced quality for bakery products.

-

In April 2023, Krones signed a definitive agreement to purchase 90% ownership of Ampco Pumps Company LLC. This strategic acquisition represents a significant milestone in the expansion of Krones Processing's components business, as it complements their existing portfolio, which now includes Ampco Pumps and Evoguard Valve Technology, covering all essential components for the processing technology market.

-

In April 2023, Marel unveiled its acquisition of the operating assets of E+V Technology, a prominent player in food processing equipment. This strategic move reinforces Marel's market position, particularly in the meat and poultry sectors, as it incorporates cutting-edge vision technology into its existing portfolio of solutions, enhancing its offerings in the food processing equipment industry.

Food Processing Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 54.68 billion |

|

Revenue forecast in 2030 |

USD 69.30 billion |

|

Growth Rate |

CAGR of 4.0% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Mode of operation, application, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; Russia; U.K.; Italy; Japan; China; India; South Korea; Australia; Brazil; South Africa |

|

Key companies profiled |

BAADER Group; Marel; Bühler AG; GEA Group Aktiengesellschaft; The Middleby Corporation; Tetra Laval International S.A.; Alfa Laval; Krones AG; JBT Corporation; SPX Flow Inc.; LEHUI; Equipamientos Cárnicos, S.L. (MAINCA); FENCO Food Machinery s.r.l.; Bigtem Makine A.S.; TNA Australia Pty Limited. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food processing equipment market report based on mode of operation, application, type, and region:

-

Mode of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bakery & Confectionaries

-

Meat, Poultry, & Seafood

-

Beverage

-

Dairy

-

Fruit, Nut, & Vegetable

-

Grains

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Processing

-

Extruders and Forming Machines

-

Ovens and Dryers

-

Refrigeration and Freezing Equipment

-

Coating Equipment

-

Others

-

-

Pre-processing

-

Sorting & Grading

-

Cutting and Peeling Equipment

-

Washing Equipment

-

Mixing and Blending Equipment

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food processing equipment market size was estimated at USD 50.80 Billion in 2022 and is expected to reach USD 52.69 Billion in 2023.

b. The food processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 69.30 Billion by 2030.

b. Asia Pacific dominated the food processing equipment market with a revenue share of 34.9% in 2021, on account of several factors including a surge in domestic food production and growing beverage contract manufacturing in India.

b. Some of the key players operating in the food processing equipment market include Krones AG, KHS Group, OPTIMA packaging group GmbH, ProMach, Sacmi Imola S.C., Coesia S.p.A., Syntegon Technology GmbH, Hiemens Bottling Machines.

b. The key factors that are driving the food processing equipment market include the rising food & beverage industry, stringent regulations pertaining to food processing & safety, and increasing demand for packaged and processed foods.

Table of Contents

Chapter 1. Food Processing Equipment Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Food Processing Equipment Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Food Processing Equipment Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Concentration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.4. Technology Overview

3.5. Regulatory Framework

3.6. Market Dynamics

3.6.1. Market Drivers Analysis

3.6.2. Market Restraints Analysis

3.6.3. Market Opportunity Analysis

3.6.4. Market Challenge Analysis

3.7. Food Processing Equipment Market Analysis Tools

3.7.1. Porter’s Analysis

3.7.1.1. Bargaining power of the suppliers

3.7.1.2. Bargaining power of the buyers

3.7.1.3. Threats of substitution

3.7.1.4. Threats from new entrants

3.7.1.5. Competitive rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political landscape

3.7.2.2. Economic and Social landscape

3.7.2.3. Technological landscape

3.7.2.4. Environmental landscape

3.7.2.5. Legal landscape

3.8. Economic Mega Trend Analysis

Chapter 4. Food Processing Equipment Market: Mode of Operation Estimates & Trend Analysis

4.1. Food Processing Equipment Market: Mode of Operation Movement Analysis, 2023 & 2030

4.2. Automatic

4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.3. Semi-automatic

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Food Processing Equipment Market: Application Estimates & Trend Analysis

5.1. Food Processing Equipment Market: Application Movement Analysis, 2023 & 2030

5.2. Bakery & Confectionaries

5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3. Meat, Poultry, & Seafood

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4. Beverage

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.5. Dairy

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.6. Fruit, Nut, & Vegetable

5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.7. Grains

5.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.8. Others

5.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Food Processing Equipment Market: Type Estimates & Trend Analysis

6.1. Food Processing Equipment Market: Type Movement Analysis, 2023 & 2030

6.2. Processing

6.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.2.2. Extruders and Forming Machines

6.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.2.3. Oven and Dryers

6.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.2.4. Refrigeration and Freezing Equipment

6.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.2.5. Coating Equipment

6.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.2.6. Others

6.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.3. Pre-processing

6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.3.2. Sorting & Grading

6.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.3.3. Cutting and Peeling Equipment

6.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.3.4. Washing Equipment

6.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

6.3.5. Mixing and Blending Equipment

6.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Food Processing Equipment Market: Region Estimates & Trend Analysis

7.1. Food Processing Equipment Market Share, By Region, 2023 & 2030, USD Billion

7.2. North America

7.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.2.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.2.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.2.5. U.S.

7.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.2.5.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.2.5.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion

7.2.6. Canada

7.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.2.6.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.2.6.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion

7.2.7. Mexico

7.2.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.2.7.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.2.7.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion

7.3. Europe

7.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.3.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.3.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.3.5. Germany

7.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.3.5.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.3.5.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.3.6. UK

7.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.3.6.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.3.6.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.3.7. Italy

7.3.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.3.7.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.3.7.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.3.8. Russia

7.3.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.3.8.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.3.8.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4. Asia Pacific

7.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4.5. China

7.4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.5.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.5.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4.6. India

7.4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.6.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.6.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4.7. Japan

7.4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.7.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.7.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4.8. Australia

7.4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.8.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.8.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.8.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.4.9. South Korea

7.4.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.4.9.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.4.9.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.5. Central & South America

7.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.5.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.5.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.5.5. Brazil

7.5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.5.5.3. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.5.5.4. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.6. Middle East & Africa

7.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.6.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.6.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

7.6.5. South Africa

7.6.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2. Market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

7.6.5.3. Market estimates and forecasts by application, 2018 - 2030 (USD Billion)

7.6.5.4. Market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Company Heat Map Analysis

8.6. Strategy Mapping

8.7. Company Profiles

8.7.1. BAADER Group

8.7.1.1. Participant’s Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Recent Developments

8.7.2. Marel

8.7.2.1. Participant’s Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Recent Developments

8.7.3. Bühler AG

8.7.3.1. Participant’s Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Recent Developments

8.7.4. GEA Group Aktiengesellschaft

8.7.4.1. Participant’s Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Recent Developments

8.7.5. The Middleby Corporation

8.7.5.1. Participant’s Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Recent Developments

8.7.6. Tetra Laval International S.A.

8.7.6.1. Participant’s Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Recent Developments

8.7.7. Alfa Laval

8.7.7.1. Participant’s Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Recent Developments

8.7.8. Krones AG

8.7.8.1. Participant’s Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Recent Developments

8.7.9. JBT Corporation

8.7.9.1. Participant’s Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Recent Developments

8.7.10. SPX Flow Inc.

8.7.10.1. Participant’s Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Recent Developments

8.7.11. LEHUI

8.7.11.1. Participant’s Overview

8.7.11.2. Financial Performance

8.7.11.3. Product Benchmarking

8.7.11.4. Recent Developments

8.7.12. Equipamientos Cárnicos, S.L. (MAINCA)

8.7.12.1. Participant’s Overview

8.7.12.2. Financial Performance

8.7.12.3. Product Benchmarking

8.7.12.4. Recent Developments

8.7.13. FENCO Food Machinery s.r.l.

8.7.13.1. Participant’s Overview

8.7.13.2. Financial Performance

8.7.13.3. Product Benchmarking

8.7.13.4. Recent Developments

8.7.14. Bigtem Makine A.S.

8.7.14.1. Participant’s Overview

8.7.14.2. Financial Performance

8.7.14.3. Product Benchmarking

8.7.14.4. Recent Developments

8.7.15. TNA Australia Pty Limited

8.7.15.1. Participant’s Overview

8.7.15.2. Financial Performance

8.7.15.3. Product Benchmarking

8.7.15.4. Recent Developments

List of Tables

Table 1 Global food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 2 Global food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 3 Global food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 4 Global food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 5 Global food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 6 North America food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 7 North America food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 8 North America food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 9 North America food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 10 North America food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 11 U.S. food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 12 U.S. food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 13 U.S. food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 14 U.S. food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 15 U.S. food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 16 Canada food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 17 Canada food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 18 Canada food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 19 Canada food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 20 Canada food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 21 Mexico food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 22 Mexico food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 23 Mexico food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 24 Mexico food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 25 Mexico food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 26 Europe food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 27 Europe food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 28 Europe food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 29 Europe food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 30 Europe food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 31 Germany food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 32 Germany food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 33 Germany food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 34 Germany food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 35 Germany food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 36 UK food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 37 UK food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 38 UK food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 39 UK food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 40 UK food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 41 Russia food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 42 Russia food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 43 Russia food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 44 Russia food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 45 Russia food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 46 Italy food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 47 Italy food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 48 Italy food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 49 Italy food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 50 Italy food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 51 Asia Pacific food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 52 Asia Pacific food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 53 Asia Pacific food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 54 Asia Pacific food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 55 Asia Pacific food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 56 China food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 57 China food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 58 China food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 59 China food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 60 China food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 61 Japan food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 62 Japan food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 63 Japan food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 64 Japan food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 65 Japan food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 66 India food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 67 India food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 68 India food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 69 India food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 70 India food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 71 South Korea food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 72 South Korea food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 73 South Korea food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 74 South Korea food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 75 South Korea food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 76 Australia food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 77 Australia food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 78 Australia food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 79 Australia food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 80 Australia food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 81 Central & South America food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 82 Central & South America food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 83 Central & South America food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 84 Central & South America food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 85 Central & South America food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 86 Brazil food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 87 Brazil food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 88 Brazil food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 89 Brazil food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 90 Brazil food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 91 Middle East & Africa food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 92 Middle East & Africa food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 93 Middle East & Africa food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 94 Middle East & Africa food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 95 Middle East & Africa food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 96 South Africa food processing equipment market estimates and forecasts by mode of operation, 2018 - 2030 (USD Billion)

Table 97 South Africa food processing equipment market estimates and forecasts by application, 2018 - 2030 (USD Billion)

Table 98 South Africa food processing equipment market estimates and forecasts by type, 2018 - 2030 (USD Billion)

Table 99 South Africa food processing equipment market estimates and forecasts by processing type, 2018 - 2030 (USD Billion)

Table 100 South Africa food processing equipment market estimates and forecasts by pre-processing type, 2018 - 2030 (USD Billion)

Table 101 Recent Developments & Impact Analysis, By Key Market Participants

Table 102 Company Heat Map Analysis, 2023

Table 103 Key Companies: Mergers & Acquisitions

Table 104 Key Companies: Product Launches

Table 105 Key Companies: Expansions

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Market Segmentation & Scope

Fig. 8 Segment Snapshot

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Food Processing Equipment Market - Value Chain Analysis

Fig. 11 Food Processing Equipment Market - Market Dynamics

Fig. 12 Food Processing Equipment Market - PORTER’s Analysis

Fig. 13 Food Processing Equipment Market - PESTEL Analysis

Fig. 14 Food Processing Equipment Market Estimates & Forecasts, By Mode of Operation: Key Takeaways

Fig. 15 Food Processing Equipment Market Share, By Mode of Operation, 2023 & 2030

Fig. 16 Automatic Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 17 Semi-automatic Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 18 Food Processing Equipment Market Estimates & Forecasts, By Application: Key Takeaways

Fig. 19 Food Processing Equipment Market Share, By Application, 2023 & 2030

Fig. 20 Bakery & Confectionaries Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 21 Meat, Poultry, & Seafood Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 22 Beverage Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Dairy Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 24 Fruit, Nut, & Vegetable Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 25 Grains Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 26 Other Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Food Processing Equipment Market Estimates & Forecasts, By Type: Key Takeaways

Fig. 28 Food Processing Equipment Market Share, By Type, 2023 & 2030

Fig. 29 Processing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Processing Market Estimates & Forecasts, by Type, 2018 - 2030 (USD Billion)

Fig. 31 Pre-processing Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 32 Pre-processing Market Estimates & Forecasts, by Type, 2018 - 2030 (USD Billion)

Fig. 33 U.S. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 34 Canada Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 35 Mexico Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 36 Germany Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 37 UK Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 38 Italy Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 39 Russia Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 40 China Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 41 India Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 42 Japan Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 43 Australia Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 44 South Korea Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 Brazil Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 South Africa Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Key Company Categorization

Fig. 48 Company Market Positioning

Fig. 49 Key Company Market Share Analysis, 2023

Fig. 50 Strategy Mapping

Market Segmentation

- Food Processing Equipment Mode of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

- Automatic

- Semi-automatic

- Food Processing Equipment Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Food Processing Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Food Processing Equipment Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- North America Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- North America Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- U.S.

- U.S. Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- U.S. Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- U.S. Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- U.S. Food Processing Equipment Market, By Mode of Operation

- Canada

- Canada Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Canada Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Canada Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Canada Food Processing Equipment Market, By Mode of Operation

- Mexico

- Mexico Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Mexico Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Mexico Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Mexico Food Processing Equipment Market, By Mode of Operation

- North America Food Processing Equipment Market, By Mode of Operation

- Europe

- Europe Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Europe Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Europe Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Germany

- Germany Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Germany Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Germany Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Germany Food Processing Equipment Market, By Mode of Operation

- U.K.

- U.K. Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- U.K. Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- U.K. Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- U.K. Food Processing Equipment Market, By Mode of Operation

- Italy

- Italy Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Italy Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Italy Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Italy Food Processing Equipment Market, By Mode of Operation

- Russia

- Russia Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Russia Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Russia Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Russia Food Processing Equipment Market, By Mode of Operation

- Europe Food Processing Equipment Market, By Mode of Operation

- Asia Pacific

- Asia Pacific Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Asia Pacific Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Asia Pacific Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- China

- China Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- China Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- China Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- China Food Processing Equipment Market, By Mode of Operation

- Japan

- Japan Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Japan Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Japan Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Japan Food Processing Equipment Market, By Mode of Operation

- Australia

- Australia Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- AustraliaFood Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Australia Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Australia Food Processing Equipment Market, By Mode of Operation

- India

- India Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- India Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- India Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- India Food Processing Equipment Market, By Mode of Operation

- South Korea

- South Korea Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- South Korea Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- South Korea Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- South Korea Food Processing Equipment Market, By Mode of Operation

- Asia Pacific Food Processing Equipment Market, By Mode of Operation

- Central & South America

- Central & South America Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Central & South America Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Central & South America Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Brazil

- Brazil Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Brazil Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Brazil Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- Brazil Food Processing Equipment Market, By Mode of Operation

- Central & South America Food Processing Equipment Market, By Mode of Operation

- Middle East & Africa

- Middle East & Africa Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- Middle East & Africa Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- Middle East & Africa Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- South Africa

- South Africa Food Processing Equipment Market, By Mode of Operation

- Automatics

- Semi-automatic

- South Africa Food Processing Equipment Market, By Application

- Bakery & Confectionaries

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

- South Africa Food Processing Equipment Market, By Type

- Processing

- Extruders and Forming Machines

- Ovens and Dryers

- Refrigeration and Freezing Equipment

- Coating Equipment

- Others

- Pre-processing

- Sorting & Grading

- Cutting and Peeling Equipment

- Washing Equipment

- Mixing and Blending Equipment

- Processing

- South Africa Food Processing Equipment Market, By Mode of Operation

- Middle East & Africa Food Processing Equipment Market, By Mode of Operation

- North America

Food Processing Equipment Market Dynamics

Driver: Food & beverage industry growth

The rapid growth in the food & beverage industry, particularly in the Asia Pacific, BRICS, CSA and the Middle East regions, is expected to act as a market driver over the forecast period. Growing domestic consumption of food & beverages in the light of the expansion of the retail network, new product launches, and population growth is expected to promote industry growth in BRICS. In addition, regulatory support aimed at facilitating foreign direct investments at domestic level in BRICS because of political change, particularly in India and China, aimed to increase country’s manufacturing output is expected to amplify food & beverage growth. The positive food and beverage industry trend ultimately favors the food processing equipment market.

Driver: Increasing demand for meat, poultry, and seafood

In recent years, the demand for meat, poultry, and seafood had witnessed substantial growth as compared to previous years. The increase in consumption of protein is owing to the surging awareness generated in terms of eating high nutritional food. The aggregate demand for meat, poultry, and seafood is expected to gain traction in the forecast period owing to improvement in the economic scenario of both developing and developed regions. Rise in the income status and per spending power of consumers proved boon to the spending on animal protein, which includes meat, poultry, and seafood. The Asia Pacific is one of the leaders in the global food processing equipment market and prominently in China.

Rise in the disposable income of China is one of the factors that strengthens the processing equipment market in China. China has witnessed double-digit growth in disposable income and it is expected to maintain the same trend over the next six years. This increase in disposable income acts as a major driver for food processing equipment market in China. The increasing living standard in people of China stimulates people to shift eating meat, poultry, seafood, and allied products. High disposable income allows the customer to choose their best value option available in the market. High disposable income provides an option for people in eating food apart from their houses and enhances their food habits.

Restraint: Environmental imbalance

The demand-supply scenario in the food and beverage industry is critical as the global population is rising with an alarming rate and thus is a critical factor to be considered while monitoring the industry growth. The customer’s preferences towards meat, poultry and seafood had blooms the market growth in the specified application. The changes in the natural habitat are a major contributor for environmental imbalance and is a prominent threat for declining ecological balance. Declining marine population in the recent past is one of such impact caused owing to overfishing and overexploitation of natural resources. Overexploitation is differentiated in two ways- direct overexploitation, which refers to hunting, harvesting etc., and indirect overexploitation, which deals with hunting and killing of non-target species such as Whales, Sharks etc. Bycatch that is hunting non-targeted species is one of the examples for indirect overexploitation. Ecological imbalance can be clearly visible with climatic change, temperature change, declining marine population, pollution etc. Changes in temperature affect the migration, reproduction and other related phenomena in the marine habitat. Further, illegal fishing and illegal practices, habitat degradation and ghost fishing altogether affect the ecology at the long-term basis. All the above-discussed factors ultimately affect the seafood industry, which in turn hampers the processing equipment market, and thus are co-related.

What Does This Report Include?

This section will provide insights into the contents included in this food processing equipment market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Food processing equipment market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Food processing equipment market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the food processing equipment market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for food processing equipment market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of food processing equipment market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Food Processing Equipment Market Categorization:

The food processing equipment market was categorized into four segments, namely mode (Automatic, Semi-automatic), application (Bakery & Confectionaries, Meat, Poultry, & Seafood, Beverage, Dairy , Fruit, Nut, & Vegetable, Grains), type (Processing, Pre-processing), and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The food processing equipment market was segmented into mode, type, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The food processing equipment market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into fourteen countries, namely, the U.S.; Canada; Mexico; Germany; Russia; the UK.; Italy; Japan; China; India; South Korea; Australia; Brazil; and South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Food processing equipment market companies & financials:

Thefood processing equipment market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

BAADER Group -BAADER Group manufactures and supplies advanced food processing equipment. This equipment includes, fish processing, poultry processing, separator processing, and business solutions. In its fish processing segment, the company designs and setups whole processing lines and fish processing capabilities for both on board and ashore applications. BAADER also offers value-added services including maintenance, spare parts, and remote services and training programs to its customers.

-

GEA Group -GEA Group is one of the process technology suppliers for food and other major industries. The product portfolio of the company comprises brewing systems, centrifuges & separation equipment, automation & control systems, compressors, chillers & heat pumps, dryers & particle processing plants, cleaners & sterilizers, distillation & fermentation systems, evaporators & crystallizers, farm equipment, emission control systems, filling & packaging systems, freezers & ice machines, granulators, and homogenizers. The company operates through two-business segments - Business Area Equipment and Business Area Solutions. In the segment Business Area Equipment, the company offers products, which includes a separator, refrigeration equipment, and other such equipment used in food processing and other industrial applications. In the segment Business Area Solutions, the company designs and develops various process solutions for food and beverage, chemicals, pharmaceutical, and other industries in standardized and customized format.

-

Marel - Marel is prominently engaged in the development, manufacturing, sells, and distribution for meat, poultry, and fish processing systems. The company majorly operates with brands including Marel Poultry, which offers a wide range of in-line poultry processing solutions including broilers, turkeys, and ducks. The segment Marel Meat offers stand-alone processing equipment and integrated systems for the meat industry. It offers de-boning, trimming, slaughtering, bacon processing, and others. The segment Marel Fish includes farmed and wild salmon and whitefish processing. The Marel operates 12 manufacturing sites and 4 distribution centers for service parts along with offices and subsidiaries in more than 30 countries.

-

Buhler AG - Buhler AG is a renowned manufacturer of industrial process technology for mobility, food, and communication market. Buhler AG operates through two-business segment - Advanced Materials and Grains & Food. The company offers food-processing equipment through its Grain & Food segment for grains, rice, oilseeds, malt, brewery, pulses, fruits, vegetables, pet food, animal feed, pasta, bakery products, and other products. The company is engaged in food processing processes technologies such as grading, pelleting, extrusion, dough preparation, mixing, drying, etc. Through its Advanced Materials segment, the company offers engineering and solutions for grinding, die-casting, etc. The Buhler AG operates in North America, South America, MEA, Europe and Asia, and operates as a subsidiary of Buhler Holding AG.

-