- Home

- »

- Organic Chemicals

- »

-

Food Grade Magnesium Derivatives Market Size Report 2030GVR Report cover

![Food Grade Magnesium Derivatives Market Size, Share, & Trends Report]()

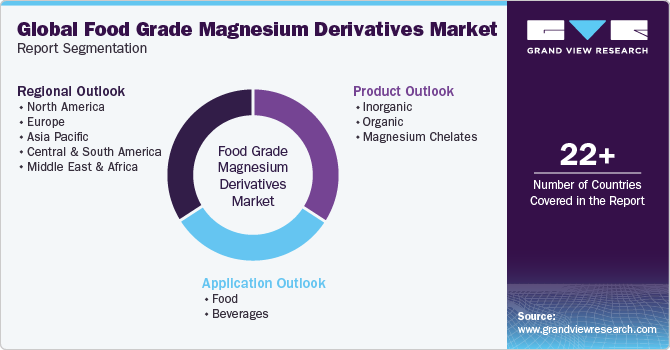

Food Grade Magnesium Derivatives Market Size, Share, & Trends Analysis Report By Product (Inorganic, Organic, Magnesium Chelates), By Application (Food, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-005-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

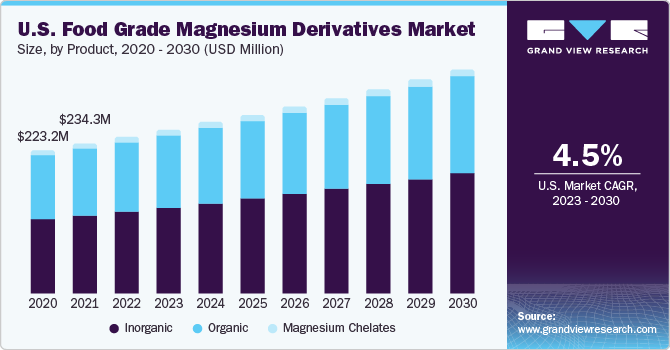

The global food grade magnesium derivatives market size was valued at USD 874.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. The magnesium derivatives are witnessing high demand from the food & beverages sector, in the form of anti-caking agents, flavoring agents, firming agents, color retention agents, and brewing agents. Magnesium derivative0s like magnesium chloride, oxide, lactate, gluconate, hydroxide, stearate, and citrate are among the most popular derivatives to be used in the food and beverages industry, due to their non-toxic and non-flammable properties. Among these, magnesium oxide is the most widely used. The prices of organic derivatives are growing in tandem with the hike in raw material prices coupled with the rising demand from the food & beverage industry, especially in developed economies.

The prices of organic derivatives are comparatively higher due to limited production for these products and growing demand from other end-use industries. Organic product prices are increasing significantly due to the rising demand for confectionery and beverage applications. Magnesium derivatives, such as magnesium chloride, lactate, citrate, and stearate, are witnessing high demand from the F&B sector.

This is due to their easy applications and availability. However, several health hazards are associated with the overconsumption of magnesium derivatives, which may drastically affect market growth in the coming years. Some of these derivatives can cause irritation to the nose and eyes. According to a safety data sheet of Santa Cruz Biotechnology, Inc., the overdose of these products may lead to diarrhea, nausea, diabetes, and heart disease. People with intestinal disease, heart or kidney disease, and diabetes are advised not to consume magnesium without medical consultation.

The recent European geopolitical conflict led to a surge in oil prices, which affected the production cost of the chemicals. From the manufacturer’s standpoint, the impact of rising energy prices led to increased chemical prices and eroded profits to a certain extent. Due to supply disruptions, the export and import of raw materials were affected across regions, especially in the European region, thus impacting several end-use markets. However, food-grade magnesium derivatives witnessed the minimal impact of the European conflict as the annual trade for food additives was not hampered.

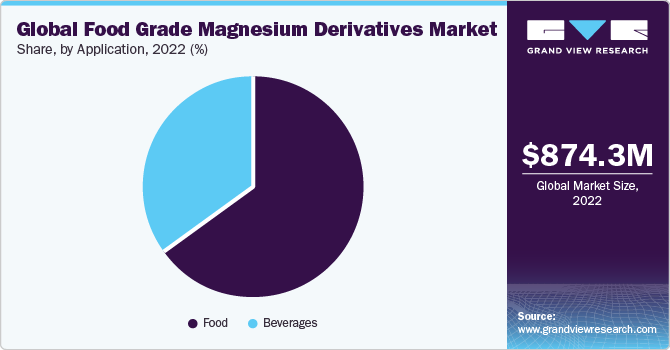

Application Insights

The food segment held the largest revenue share of 65.3% in 2022. Its high share is attributed to the increasing demand for various nutritional and organic food items like fruits, cheese, soy, and yogurt. During the COVID-19 pandemic, food items were categorized as essential products, as a result, the food industry saw stable growth over the past years and is anticipated to grow substantially in the near future. Moreover, the rising demand for various bakery, dairy, and confectionery items, is expected to have a positive impact on the global market.

The product demand in the beverages industry is expected to grow at the fastest CAGR of 5.0% over the forecast period. Non-alcoholic drinks among various other beverages emerged as a prominent application due to a clear change in consumer preference regarding the consumption of various beverage products, according to Future Drinks Expo. Non-alcoholic beverages include sports drinks, baby formula, juices, energy drinks, and coffee, among others. Magnesium derivatives are widely used as an ingredient in baby formula milk as they support muscle growth. They also help in the short-term treatment of constipation in children as well as adults.

Among various food products, confectionery products emerged as a key application for several magnesium derivatives, such as magnesium oxide, hydroxide, carbonate, stearate, and sulfate, which are extensively used in confectionery products, including candies, gums, jelly, biscuits, and chocolates, among others, as demolding agents, and as anti-sticking agents in the production of confectionery goods. Furthermore, they are also used as a binding agent in sugar for use in candies, such as mints. This is expected to drive product demand in the confectionery industry in the coming years.

Product Insights

The inorganic segment accounted for the largest revenue share of 55.5% in 2022. This is attributed to their growing inclusion in food & beverage formulation, due to physical and chemical properties like solubility in water and other alcoholic beverages, and high absorption rate in some derivatives. Out of the inorganic derivatives, magnesium oxide also known as magnesia or maglite is the most commonly used. It occurs naturally as a mineral periclase and is available in the market as a white powder. However, it can be sold in liquid form with the addition of water to it. Magnesium oxide is used as an anti-caking agent and as a flow enhancer in food products. It is also used in the manufacturing process of cream powder, milk powder, cocoa products, and chocolates.

The organic segment is expected to grow at a CAGR of 4.3% during the forecast period. Magnesium gluconate is one of the most popular organic derivatives used in food and beverage applications around the world. It is derived from organic and inorganic sources, such as wine, honey, and plants. Magnesium gluconate is bitter and has no odor. It is available in white crystalline powdered form. It is used as an organic additive in the food industry owing to its solubility in water to enhance the magnesium content in food products. Growing utilization of the product to increase the shelf life, quality, and freshness of end products is estimated to fuel the product demand in the near future.

Regional Insights

North America dominated the food grade magnesium derivatives market and accounted for the largest revenue share of 33.8% in 2022. This is attributed to the rising food & beverage spending, along with rising production, and the presence of key manufacturers operating in the North American region. In addition, steady household incomes, growing consumer expenditure, and changes in consumer lifestyles have led to changes in the dietary patterns of the population. This has positively influenced the demand for functional food & beverage products. The manufacturers of food & beverages are rapidly expanding their product portfolios by launching new flavors and categories to cater to the growing demand.

Europe is expected to grow at a CAGR of 4.0% during the forecast period. Europe is one of the biggest exporters of food and beverages products in the world with major manufacturing companies engaged in the production of confectionery and bakery products. There is a shift in the trend toward functional foods & beverages among consumers in the region, which is being tapped by regional players. The growing interest among consumers and rising awareness about the health benefits of functional food & beverage are boosting the functional foods & beverages market in the region, which is anticipated to further contribute to the product demand in Europe.

China, in the Asia Pacific region, is one of the prominent markets for magnesium derivatives. The rising spending power of consumers, owing to the country's economic development, has increased the demand for high-quality processed meals. Furthermore, the growing consumption of convenience meals and the utilization of magnesium derivatives in the food processing industry is expected to trigger market growth in the region.

Key Companies & Market Share Insights

The industry is highly competitive and dependent on the product mix, the number of sellers, and their geographical locations. The industry is dominated by a few leading manufacturing companies. Some of the manufacturers have a prominent regional as well as international dominance. The leading manufacturers are focusing on improving their product portfolios by means of launching new products, along with other initiatives like production capacity & geographical expansions, and partnerships & acquisitions. For instance, in August 2021, NikoMag increased its production capacity for magnesium hydroxide from 25,000 tons/year to 40,000 tons/year, while ensuring a high standard of quality and consistency for its products.

Key Food Grade Magnesium Derivatives Companies:

- Grecian Magnesite

- Sinwon Beverages Co., Ltd.

- Compass Minerals

- OLE Chemical Co., Ltd.

- Martin Marietta Magnesia Specialties

- Ibar Northeast

- NikoMag

- K + S Aktiengesellschaft

- Oksihim, Ltd.

- Hawkins

- ICL

- RX Chemicals

- Rahul Magnesia Pvt. Ltd.

- Vizag Chemicals

- Novotech Nutraceuticals, Inc.

- James M. Brown Ltd.

- Jungbunzlauer Suisse AG

- Corbion

- Dr. Paul Lohmann GmbH & Co. KGaA

- Gadot Biochemical Industries Ltd.

Recent Developments

-

In June 2022, Jungbunzlauer Suisse AG introduced two mineral salts, namely monomagnesium citrate and zinc gluconate. Zinc gluconate is derived from the neutralization process of gluconic acid with a high-purity zinc source, while monomagnesium citrate is a partially neutralized magnesium salt of citric acid. The newly launched products belong to the company’s special salts product group and are available through their sales offices and representatives.

-

In July 2019, K+S Aktiengesellschaft expanded its capacity for producing magnesium sulphate anhydrous, a highly sought-after specialty product, by commissioning a new facility at the Wintershall site of the Werra plant. This move allows K+S to meet the growing demand for magnesium sulphate anhydrous and solidifies its prominent market position in Europe for this particular product.

Food Grade Magnesium Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 912.8 million

Revenue forecast in 2030

USD 1.24 billion

Growth Rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Grecian Magnesite; Sinwon Beverages Co., Ltd.; Compass Minerals; OLE Chemical Co., Ltd.; Martin Marietta Magnesia Specialties; Ibar Northeast; NikoMag; K + S Aktiengesellschaft; Oksihim, Ltd.; Hawkins; ICL; RX Chemicals; Rahul Magnesia Pvt. Ltd.; Vizag Chemicals; Novotech Nutraceuticals, Inc.; James M. Brown Ltd.; Jungbunzlauer Suisse AG; Corbion; Dr. Paul Lohmann GmbH & Co. KGaA; Gadot Biochemical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Grade Magnesium Derivatives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food grade magnesium derivatives market based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Kilotons, Volume, 2018 - 2030)

-

Inorganic

-

Magnesium Oxide

-

Magnesium Carbonate

-

Magnesium Chloride

-

Magnesium Hydroxide

-

Magnesium Sulfate

-

Others

-

-

Organic

-

Magnesium Stearate

-

Magnesium Citrate

-

Magnesium Lactate

-

Magnesium Gluconate

-

Others

-

-

Magnesium Chelates

-

-

Application Outlook (Revenue, USD Million; Kilotons, Volume, 2018 - 2030)

-

Food

-

Bakery

-

Confectionery

-

Dairy

-

Others

-

-

Beverages

-

Alcoholic

-

Non-Alcoholic

-

-

-

Regional Outlook (Revenue, USD Million; Kilotons, Volume, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the food grade magnesium derivatives market with a share of 33.8% in 2022. This is attributed to the rising food & beverage production and spending, as well as a broad presence of key manufacturers operating in the North America region.

b. Some key players operating in the food grade magnesium derivatives market include Grecian Magnesite, SINWON INDUSTRIAL CO., LTD., Compass Minerals, OLE Chemical Co., Ltd., Martin Marietta Magnesia Specialties, Ibar Northeast, NikoMag, K + S Aktiengesellschaft, Oksihim, Ltd., Hawkins, ICL, RX Chemicals, Rahul Magnesia Pvt. Ltd., Vizag Chemicals, Novotech Nutraceuticals, Inc., James M. Brown Ltd., Jungbunzlauer Suisse AG, Corbion, Dr. Paul Lohmann GmbH & Co. KGaA, Gadot Biochemical Industries Ltd.

b. Key factors that are driving the market growth include rising demand from the food & beverage industry, rapid expansion of product portfolio of key manufacturers by launching new flavors and categories to cater to the growing demand.

b. The global food grade magnesium derivatives market size was estimated at USD 874.3 million in 2022 and is expected to reach USD 912.8 million in 2023.

b. The global food grade magnesium derivatives market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 1.24 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."