Food Grade Lubricants Market Size, Share & Trends Analysis Report By Product Mineral, Synthetic, Bio-Based), By Application (Food, Beverages, Pharmaceuticals, Cosmetics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-521-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Food Grade Lubricants Market Size & Trends

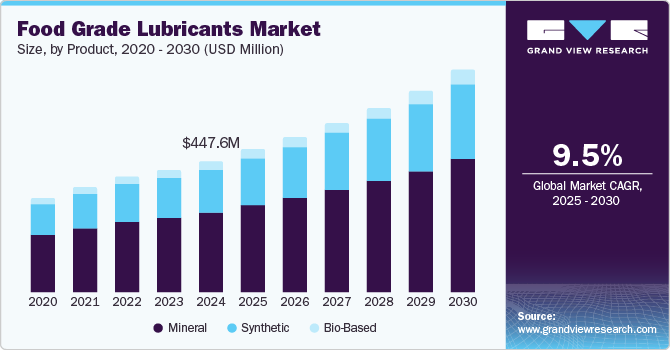

The global food grade lubricants market size was valued at USD 447.6 million in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. The global expansion of the food and beverage industry drives the market, which increases the need for lubricants that enhance equipment efficiency while adhering to safety standards. The rising consumption of processed foods further fuels demand. Technological advancements, including synthetic and biodegradable lubricants, support adoption in extreme conditions. In addition, industries such as dairy and meat processing prioritize high-quality lubricants to ensure safety and product quality.

The global growth of the food and beverage industry necessitates lubricants that enhance equipment efficiency while complying with strict safety regulations. Rising demand for processed and packaged foods further boosts adoption. Technological advancements, such as synthetic and biodegradable lubricants, cater to extreme operational conditions. In addition, industries such as dairy and meat processing prioritize high-quality lubricants to ensure product safety and quality. For instance, the UK food and beverage industry contributed USD 48.4 billion in GVA and a turnover of USD 182.0 billion in 2023, with domestic sales amounting to USD 159.1 billion.

The increasing consumption of processed foods drives demand for food-grade lubricants, essential for maintaining hygiene and safety in food processing machinery. These lubricants help prevent contamination and ensure compliance with food safety standards. This trend reflects the growing need for efficient and reliable machinery in the expanding food production sector. For instance, in June 2022, Northeastern University revealed that 73% of the U.S. food supply is ultra-processed.

Technological advancements, such as the development of synthetic and biodegradable lubricants, enhance the functionality of food-grade lubricants in extreme conditions. These innovations improve performance, safety, and compliance, supporting their growing adoption in the food processing industry. For instance, the CASSIDA product line from FUCHS offers high-performance lubricants tailored for the food and beverage industries. The range includes fully synthetic, semi-synthetic, and white-oil-based lubricants optimized for specific applications. Key products include CASSIDA Fluids and Greases (fully synthetic) and CASSIDA FM Lubricants (semi-synthetic and white-oil-based), designed for reliability and safety in food processing environments.

Product Insights

The mineral segment accounted for the largest share of 61.0% in 2024. The growing demand for high-purity, food-grade lubricants to meet stringent safety standards is a key driving factor for the mineral food-grade lubricants market. In addition, expanding production facilities in key regions, such as Asia, supports the increasing market need for reliable and high-quality lubricants in the food and beverage industry. For instance, in February 2024, CLG (Chevron Lummus Global) launched a new white oil processing facility in China designed to produce high-purity white oils. With a capacity of 200,000 metric tons per year, this facility was expected to cater to the food-grade lubricant market, providing products that meet stringent safety standards for the food and beverage industry.

The bio-based segment is expected to grow at the fastest CAGR of 10.4% over the forecast period, which can be attributed to the growing demand for sustainable, non-toxic, and eco-friendly lubricants that ensure food safety while offering high performance and biodegradability in food and beverage processing machinery. For instance, Bio-Food Grade Gear Oils are bio-based, odorless, and tasteless, making them safe for incidental food contact in food and beverage machinery. These oils are made from renewable agricultural resources and offer excellent performance, biodegradability, and sustainability.

Application Insights

The food segment held the largest market share of 62.4% in 2024. It comprises bakery, confectionery, dairy, meat, poultry & seafood, sauces & dressings, and others. The segment growth can be attributed to the growing demand for high-performance, food-safe lubricants that enhance equipment efficiency, reduce maintenance, and ensure compliance with food safety standards in food processing environments. For instance, in February 2024, Metalube launched its next-generation Metachain Food Grade chain oils, NSF registered for food-safe applications. The product range includes ester-based oils with varying viscosities (FG-30, FG-35, FG-40, FG-45) designed for equipment such as bakery ovens and conveyors. These oils enhance thermal stability, reduce deposits, and offer optimized performance. The oils are suitable for both food-contact and non-food-contact areas, meeting high standards for food safety in food processing environments.

The beverages segment is expected to register the fastest CAGR of 10.1% during the forecast period. The segment consists of carbonated soft drinks, fruit beverages, sports drinks, alcoholic beverages, and others. The driving factors for the segment include the need for efficient lubrication solutions that ensure the smooth operation of beverage processing equipment while maintaining strict food safety standards. The demand for high-performance lubricants that reduce wear extend equipment life, and minimize contamination risks in food and beverage production lines contributes to market growth.

Regional Insights

North America food grade lubricants market held a significant market share in 2024, which can be attributed to the increasing demand for high performance, extended fluid life, and regulatory compliance for safe use in food processing applications where incidental food contact may occur. For instance, in January 2022, Petro-Canada (Suncor Energy Inc.) expanded its food-grade lubricant line by introducing the PURITY FG Synthetic Compressor Fluid, designed for food processing applications. This synthetic PAO-based product offers superior performance with enhanced thermal stability, extended fluid life, and resistance to wear and oxidation. It is NSF H1 registered and compliant with FDA regulations, ensuring safe use in environments where incidental food contact may occur. The product suits various applications, including compressors and gearboxes in food processing plants.

Europe Food Grade Lubricants Market Trends

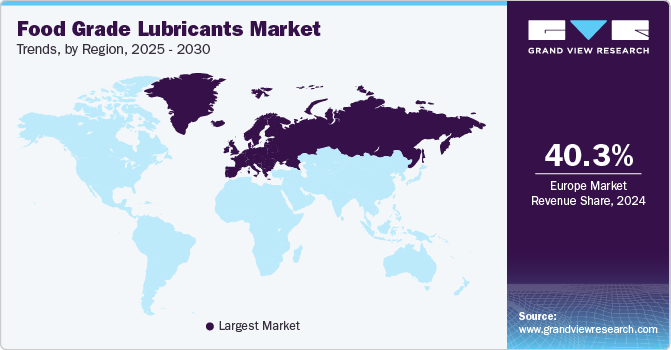

The Europe food grade lubricants market held the largest revenue share of 40.3% in 2024, which can be attributed to the significant size and growth of the food and drink industry. This industry employs millions and generates substantial turnover, leading to the increased demand for high-performance lubricants that ensure safety and efficiency in manufacturing processes. For instance, in 2022, the EU food and drink industry generated a turnover of USD 1.2 trillion and added USD 242.9 billion in value, establishing itself as one of the largest manufacturing sectors in the region.

The Germany food grade lubricants market held a substantial market share in 2024 and is expected to grow at the fastest CAGR over the forecast period owing to the increasing investment in manufacturing high-performance lubricants. In May 2024, Klüber Lubrication (Freudenberg SE) announced an investment of USD 16.8 million to expand its production facility in Mysore, India. The investment was expected to enhance the company's capacity to manufacture high-performance lubricants, including food-grade variants.

Asia Pacific Food Grade Lubricants Market Trends

The Asia Pacific food grade lubricants market is anticipated to grow at a CAGR of 11.1% over the forecast period, which can be attributed to the growing focus on sustainability and energy efficiency in manufacturing processes, which aligns with the increasing demand for environmentally conscious lubricants in the food industry. For instance, in May 2024, ENEOS Corporation, an energy and lubricants company, established a pilot plant to produce refined base oils in Japan. The company aims to produce a significant volume of refined oil that adheres to industry standards, contributing to energy efficiency and environmental conservation efforts within the lubricants market.

The Japan food grade lubricants market is expected to grow rapidly in the coming years due to strict regulatory standards, such as NSF H1 certification, ensuring high-quality lubricants for safe food processing. In addition, the growing focus on sustainability and energy-efficient manufacturing processes, exemplified by companies such as ENEOS, boosts demand for eco-friendly lubricants.

The China food grade lubricants market held a substantial market share in 2024 owing to the growth of the food processing industry, where increasing demand for safe and efficient lubricants is essential for improving productivity and meeting hygiene standards. Rising health and hygiene awareness among consumers has also prompted manufacturers to invest in high-quality, contamination-free lubricants.

Key Food Grade Lubricants Company Insights

Some of the key companies operating in the food grade lubricants market include Exxon Mobil Corporation, CITGO Petroleum Corporation, FUCHS, TotalEnergies, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Exxon Mobil Corporation is a major integrated oil and gas company that produces, explores, and discovers crude oil, natural gas, and liquids. It also refines crude oil, manufactures lubricants, and produces various petrochemicals, including plastics and specialty products. The company operates a vast network of manufacturing plants, transportation systems, and distribution centers globally.

-

FUCHS is an independent lubricant manufacturer that develops, produces, and markets a wide range of lubricants and specialty products globally. Its portfolio includes automotive and industrial lubricants, metalworking fluids, and solutions for niche applications, catering to automotive, aerospace, construction, food, and agriculture industries.

Key Food Grade Lubricants Companies:

The following are the leading companies in the food grade lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- CITGO Petroleum Corporation

- FUCHS

- TotalEnergies

- Petro-Canada (Suncor Energy Inc.)

- Klüber Lubrication (Freudenberg SE)

- SKF

- LANXESS

- JAX Incorporated

- Calumet, Inc.

- Shell plc

- Chevron Corporation

- Clearco Products Co, Inc.

- CONDAT

- Dow

- ELBA LUBRICAITON INC USA

- Engen Petroleum LTD

- Matrix Specialty Lubricants

- The Chemours Company

- The Lubrizol Corporation

Recent Developments

-

In September 2024, Petro-Canada's PURITY FG SEAMER-E Fluid was recognized by PneumaticScaleAngelus, an OEM for can seamer machines, for several high-speed lubrication seaming units. This food-grade lubricant complies with strict safety standards such as NSF H1 certification and FDA regulations and fits into HACCP and GMP plans, ensuring suitability for incidental food contact. The fluid offers benefits such as extended stability, excellent load capacity, and corrosion resistance, making it a reliable choice for food processing maintenance protocols.

-

In October 2023, The Lubrizol Corporation announced the launch of Carbopol Polymers for Nutraceuticals, which was approved for EU food-grade applications. These polymers allow manufacturers to innovate by producing smaller, easier-to-digest tablets while offering multifunctional benefits such as sustained release and stable suspension of active ingredients.

Food Grade Lubricants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 485.7 million |

|

Revenue forecast in 2030 |

USD 764.0 million |

|

Growth rate |

CAGR of 9.5% from 2024 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Colombia; Peru; Saudi Arabia; South Africa |

|

Key companies profiled |

Exxon Mobil Corporation; CITGO Petroleum Corporation; FUCHS; TotalEnergies; Petro-Canada (Suncor Energy Inc.); Klüber Lubrication (Freudenberg SE); SKF; LANXESS; JAX Incorporated; Calumet, Inc.; Shell plc; Chevron Corporation; Clearco Products Co, Inc.; CONDAT; Dow; ELBA LUBRICAITON INC USA; Engen Petroleum LTD; Matrix Specialty Lubricants; The Chemours Company; The Lubrizol Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Food Grade Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food grade lubricants market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mineral

-

Synthetic

-

Bio-Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Bakery

-

Confectionery

-

Dairy

-

Meat, Poultry, & Seafood

-

Sauces & Dressings

-

Others

-

-

Beverages

-

Carbonated Soft Drinks

-

Fruit Beverages

-

Sports Drinks

-

Alcoholic Beverages

-

Others

-

-

Pharmaceuticals

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."