- Home

- »

- Disinfectants & Preservatives

- »

-

Food Grade Alcohol Market Size And Share Report, 2030GVR Report cover

![Food Grade Alcohol Market Size, Share & Trends Report]()

Food Grade Alcohol Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Ethanol, Polyols), By Source (Molasses & Sugarcane), By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-879-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

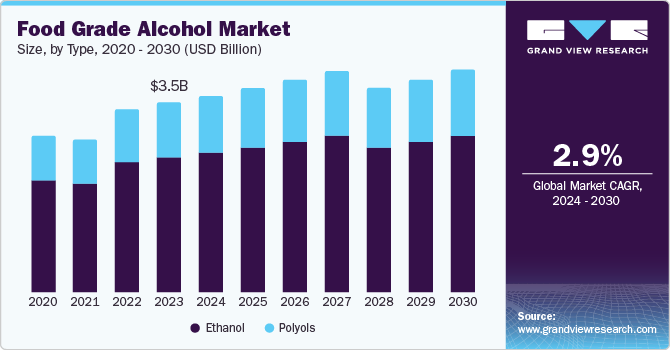

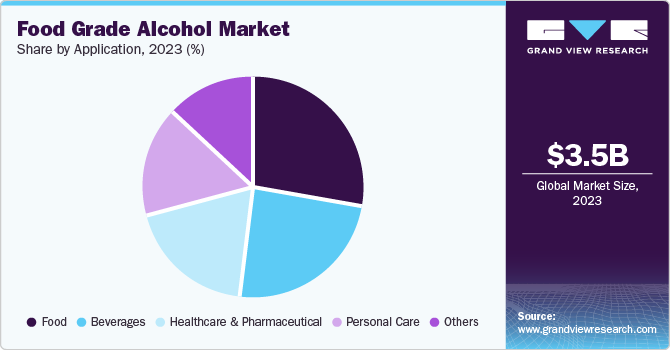

The global food grade alcohol market size was valued at USD 3.50 billion in 2023 and is projected to grow at a CAGR of 2.9% from 2024 to 2030. The market is anticipated to be driven by the increasing demand and consumption of spirits and beers in various economies. The growth in the food processing industry coupled with increasing ethanol consumption is projected to drive the market growth.

The market growth for the product is further expected to be propelled by its growing application in food and beverage, healthcare and pharmaceuticals, and personal care industries. For instance, the market has witnessed an increasing demand for naturally sourced food products. Consumers have become more health-conscious and sought products that offer enhanced purity and are free from synthetic additives. Food-grade alcohol, known for its high purity and natural source, fits well into this trend. It is widely used in culinary applications such as extracts, flavorings, and tinctures. Additionally, the rising consumption and trade of beverages including alcohol -an important ingredient for manufacturing extracts, flavors, yeast, and vinegar, has further propelled the market growth.

In addition, the ongoing popularity of craft spirits, specialty and artisanal drinks has accelerated the growth in the use of high-quality food grade alcohol. These beverages often use food grade alcohol in their production processes to ensure high quality and purity, thereby driving the market demand. Furthermore, the food and beverage industry has witnessed innovations in meal and drink compositions, further fueling the market demand.

Moreover, advancements in distillation and purification technologies have enhanced the efficiency and cost-effectiveness of food grade alcohol production. These technological advancements enabled manufacturers to produce high-purity alcohol more efficiently, meeting the growing demand. Additionally, the implementation of stringent regulations and quality standards by governing agencies regarding the use of safe and pure ingredients in various sectors has supported the market growth.

Product Insights

The ethanol segment dominated the market with 72.7% market share in 2023 attributed to the increase in alcohol production globally. Ethanol also called grain alcohol can be derived from various sugar, fruit, and starch sources such as sugar cane, sweet sorghum, corn, wheat, potatoes, etc. Among these, corn starch is used on a large scale for sourcing ethanol due to the large availability of raw materials. Ethanol’s versatility and effectiveness as a solvent, preservative, and flavoring agent has led to its widespread adoption in various industries including food and beverage, pharmaceuticals, and personal care products.

Polyols is expected to register the fastest CAGR of 3.4% over the forecast period. The anticipated growth is owing to an increased consumption of sugar alternatives in food products such as candies, cakes, and other baked items. Polyols have functional properties that extend beyond sweetness, including moisture retention and texture enhancement, which make them valuable in a wide range of food products. They improve the overall quality of food by adding texture, color, and flavor. Polyols are commercially generated from carbohydrates such as glucose, starch, and sucrose. Sorbitol, mannitol, maltitol, lactitol, isomalt, xylitol, and erythritol are some of the most often utilized polyols.

Source Insights

Molasses & sugarcane accounted for the largest market revenue share in 2023 as it is a prominent source of food grade alcohol production. Key countries sourcing alcohol from sugarcane and molasses include Brazil, India, China, and Thailand owing to abundant raw material availability. Molasses, a by-product of sugar production, is rich in fermentable sugars, which makes it an ideal raw material for ethanol production. It is a versatile feedstock that can be used to produce various types of food grade alcohol, including ethanol and rum. Moreover, health-conscious consumers have increasingly preferred alcohol derived from molasses and sugarcane for its high purity and quality. These characteristics make them suitable for a wide range of applications in the food and beverage industry, including the production of spirits, vinegar, and flavor extracts.

Grains are expected to emerge as the fastest-growing segment at a CAGR of 2.3% over the forecast period. The market surge can be attributed to its wide consumption of alcohol production. Different types of grains used in alcohol production are wheat, corn, maize, and rice. Corn and rye are widely used in the manufacturing of whiskey around the world. The primary purpose of rye grain is to provide flavor to the finished product. These grains are widely utilized in countries including the U.S. and Canada. Rice, a widely produced crop around the world, is used in the manufacturing of distilled spirits in India and Japan in small but significant amounts. Barley grain is also used in great numbers for the production of beer and whiskey all over the world. Wheat is only utilized when maize is in limited supply due to the expensive expense of production. Additionally, the advancements in fermentation and distillation technologies have improved the efficiency and quality of grain-based alcohol production.

Function Insights

Coloring & flavoring agents dominated the market with a 42.2% share in 2023 attributed to the consumption of alcohol as a food additive which aids the distribution of colors and helps enhance the flavor of food extracts. For instance, vanilla extract, the most widely used flavoring, is prepared by soaking vanilla beans in a solution of water and ethanol. Polyols including sorbitol and isomalt are also utilized in a variety of culinary products as flavoring and coloring additives. Additionally, the ongoing trend towards clean-label products has boosted the use of natural flavors and colors.Moreover, the expanding ready-to-eat and convenience food sectors have increased the need for stable and effective coloring and flavoring solutions, thereby fueling the market growth.

The coatings segment is expected to witness steady growth during the forecast period. This growth can be credited to its extensive utilization as a plasticizer in edible film coatings in food applications. The edible film is a thin layer functioning for packaging or coating food ingredients. Coatings operate as an oxygen barrier, reduce water evaporation, and improve the appearance of packaged products. For instance, sorbitol lowers internal hydrogen bonding in intramolecular bonds when employed as a plasticizer, resulting in increased mechanical strength. Ethanol is utilized as a coating agent in a variety of food products. For instance, in confectionery items, shellac soaked in ethanol solvents is commonly used to polish chocolates and sugar syrups.

Application Insights

The food segment dominated the market with a 28.2% share in 2023 owing to the increasing demand for natural and clean-label products where food grade alcohol is used as a natural preservative alternative. Bakery and confectionery industries have been major contributors, utilizing food grade alcohol in products such as cakes, chocolates, and candies for flavor enhancement and shelf-life extension. In addition, the rising popularity of processed and convenience foods, coupled with the demand for premium and artisanal products, has boosted the use of natural coloring and flavoring agents. These agents enhance the sensory appeal of food products, which makes them more palatable to consumers. Moreover, the use of food grade alcohol in fruit and vegetable processing, dairy products, and meat preservation has further increased its demand.

Beverages are projected to grow at a CAGR of 3.4% over the forecast period. The growth is anticipated to increase in consumption of beverages including alcohol, particularly among the young population which has driven the market. The rising demand for exotic flavors and unique beverages has also contributed to the development of microbreweries that provide innovative craft beers to alcohol enthusiasts. Imported beers have witnessed huge demand in the Asia Pacific (APAC) region despite high prices owing to an improved standard of living and rising indulgence in social activities.

Regional Insights

The Europe food grade alcoholmarket dominated with 34.0% of the global revenue share in 2023. The market growth is attributable to the well-established food and beverages sector that caters to the rising demand for craft beers, spirits, and specialty wines. Additionally, the region’s stringent regulations and increasing consumer demand for clean-label products and product safety have considerably driven the market growth.

North America Food Grade Alcohol Market Trends

North America food grade alcohol market held a significant market share in 2023 owing to an increased consumption of food products manufactured by using food-grade alcohol. Consumers and food and beverage makers have increasingly favored food grade alcohol owing to its versatility in producing a wide range of culinary flavors.

U.S. Food Grade Alcohol Market Trends

The U.S. food grade alcohol market was propelled by the increased demand for craft cocktails and new micro-distilleries. Consumers have increasingly sought premium and unique beverage experiences, which require pure and high-grade alcohol for production. Additionally, the market was also driven by the product’s usage as a solvent and disinfectant in the healthcare and pharmaceutical sectors.

Asia Pacific Food Grade Alcohol Market Trends

Asia Pacific food grade alcohol market is expected to witness a significant growth rate over the forecast period owing to the continuous industrial growth and improvements in production technologies enhancing the quality and availability of food grade alcohol. The growth can be attributed to the growing consumption food grade alcohol from emerging economies such as India, China, and Japan. In addition, the rising per capita incomes and growing population in these countries, coupled with plentiful accessibility of raw materials are anticipated to fuel the product market growth.

Key North America Long-term Care Software Company Insights

Some of the key companies in the food grade alcohol market include MGP, Cargill, Incorporated, Grain Processing Corporation, and others. These organizations have increasingly focused on increasing customer base to gain a competitive edge in the industry. Therefore, key players have undertaken several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

MGP Ingredients, Inc. is a producer of branded and distilled spirits and food ingredient solutions. Their product portfolio includes bourbon and rye whiskeys, gins, vodkas, and grain neutral spirits. In addition to spirits, MGP produces specialty wheat starches and proteins used in a wide range of food applications. The company has expanded its presence in the branded spirits market with acquisitions such as Luxco in 2021 and added popular brands including EzraBrooks and Yellowstone.

-

Cargill, Incorporated is a global agricultural and food corporation private company. The company operates in various sectors such as food ingredients, animal nutrition, protein, and salt production. The company specializes in the production of high quality ethanol to use in beverages, food products, and personal care items.

Key Food Grade Alcohol Companies:

The following are the leading companies in the food grade alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- MGP Ingredients, Inc.

- Cargill, Incorporated

- ADM

- Cristalco

- Grain Processing Corporation

- Wilmar International Ltd

- Extractohol

- Pure Alcohol Solutions

Food Grade Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.59 billion

Revenue forecast in 2030

USD 4.25 billion

Growth Rate

CAGR of 2.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, function, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico Germany, UK, France, Italy, Spain, Hungary, China, Japan, India, South Korea, Indonesia, Argentina, Brazil, UAE, Saudi Arabia

Key companies profiled

MGP; Cargill, Incorporated; ADM; Cristalco; Grain Processing Corporation; Wilmar International Ltd; Extractohol; Pure Alcohol Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Grade Alcohol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food grade alcohol market report based on type, source, function, application and region.

-

Type Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Ethanol

-

Polyols

-

-

Source Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Molasses & Sugarcane

-

Fruits

-

Grains

-

Others

-

-

Function Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Coatings

-

Preservatives

-

Coloring & Flavoring Agent

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Healthcare & Pharmaceutical

-

Food

-

Beverages

-

Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.