- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Food Fortifying Agents Market Size & Share Report, 2030GVR Report cover

![Food Fortifying Agents Market Size, Share & Trends Report]()

Food Fortifying Agents Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Vitamins, Minerals, Proteins & Amino Acids, Carbohydrates, Prebiotics & Probiotics, Lipids), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Fortifying Agents Market Size & Trends

The global food fortifying agents market size was valued at USD 92.86 billion in 2023 and is expected to grow at a CAGR of 9.1% from 2024 to 2030. The market is primarily driven by the increasing demand for nutrient-rich diets to address widespread deficiencies, especially in developing regions. Public health initiatives and government regulations mandating fortification to combat malnutrition and prevent diseases play a significant role. The rising health consciousness among consumers, coupled with the growing popularity of functional foods and dietary supplements, further fuels market growth. Additionally, advancements in food fortification technologies and the expansion of the food and beverage industry are contributing factors, making it easier for manufacturers to incorporate these agents into a variety of products.

Consumers are increasingly demanding transparency in food labeling, seeking products with minimal processing and ingredients derived from natural sources. This shift is driving manufacturers to source bio-based vitamins and minerals, such as plant-derived vitamin C or algae-based omega-3 fatty acids, to meet the demand for cleaner, more sustainable food fortification solutions.

The rise of personalized nutrition is another key trend influencing the market. As consumers become more health-conscious, they are looking for products tailored to their specific nutritional needs and health goals. This has led to the development of fortified foods and supplements that cater to individual dietary requirements, such as gluten-free, vegan, or allergen-free options. Personalized nutrition is supported by advancements in nutritional science and technology, enabling more precise and effective fortification strategies that align with consumers' unique health profiles.

The demand for fortified functional beverages is on the rise, aligning with the broader health and fitness trend. Consumers are seeking convenient and tasty ways to enhance their nutrient intake, leading to increased popularity of fortified sports drinks, energy drinks, and vitamin-infused waters. These beverages offer an easy way to consume essential nutrients on the go, appealing to busy lifestyles and active individuals. The growth in functional beverages underscores the market's responsiveness to consumer preferences for health-enhancing, convenient product options.

The increasing adoption of fortification in staple foods, such as rice, flour, and salt, is another trend aimed at addressing public health concerns on a larger scale. In regions with high malnutrition rates, governments and health organizations are implementing mandatory fortification programs to combat nutrient deficiencies. Fortifying widely consumed staples ensures that essential nutrients reach a broader population, contributing to improved public health outcomes. This trend highlights the importance of fortification as a strategic intervention to address global nutrition challenges.

For instance, in April 2023, Royal DSM, a global leader in health and nutrition, inaugurated a pioneering fortified rice kernel manufacturing facility near Hyderabad, designed to address nutritional deficiencies in India and the surrounding region. This state-of-the-art plant, compliant with ISO 22000: 2018, aims to produce 3,600 tonnes of nutritionally enriched rice kernels annually. Traditional milling of white rice removes nutrient-rich bran layers, leading to widespread micronutrient deficiencies in India, as highlighted by a 2022 report in The Lancet. DSM's innovative process blends vitamins and minerals with broken rice using a hot extrusion method, creating fortified kernels that match the appearance, cooking properties, and taste of regular rice. This fully automated process ensures precise nutrient dosage, microbial decontamination, and superior purity, offering a practical solution for those seeking health benefits without altering their dietary habits.

Type Insights

Based on type, vitamins led the market and accounted for a revenue share of 28% in 2023 due to their widespread deficiencies in populations worldwide and the well-documented health benefits they provide. Government initiatives and public health programs have extensively focused on fortifying staple foods with essential vitamins like A, D, B12, and folic acid to combat malnutrition and prevent related health issues such as rickets, anemia, and neural tube defects. These efforts are supported by regulatory bodies that mandate or encourage vitamin fortification to improve public health outcomes. Additionally, consumers are highly aware of the importance of vitamins for maintaining overall health, making them more receptive to vitamin-fortified foods, thus driving market demand.

Probiotics and prebiotics as food fortifying agents are expected to grow at the highest CAGR of 10.4% from 2024 to 2030 owing to the increasing awareness of gut health and its impact on overall well-being. Advances in microbiome research have underscored the benefits of these agents in supporting digestive health, immunity, and even mental health, leading to their rising incorporation into functional foods and beverages. Innovations in delivery methods have enhanced the stability and efficacy of probiotics and prebiotics, aligning with consumer trends towards functional and personalized nutrition. Furthermore, regulatory approvals and endorsements for the health claims associated with these ingredients, along with their expanding market presence in regions like Asia-Pacific and North America, are significantly boosting their market growth.

Application Insights

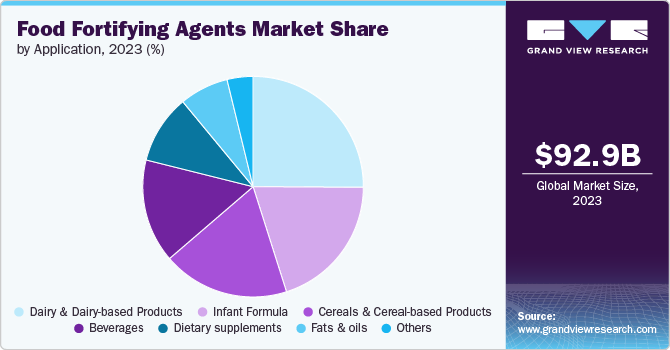

Based on application, dairy and dairy-based products led the market with the largest revenue share in 2023 due to their widespread consumption and compatibility with various fortifying agents. These products, such as milk, yogurt, and cheese, are staples in many diets worldwide, making them ideal carriers for essential nutrients like calcium, vitamin D, and probiotics. The inherent nutritional profile of dairy products is easily enhanced with additional fortification, which is crucial in addressing deficiencies, particularly in children and the elderly. Furthermore, the well-established dairy industry infrastructure facilitates efficient fortification processes and broad distribution, ensuring that fortified dairy products reach a large consumer base. Consumer perception of dairy products as healthy and nutritious also drives their preference for fortified versions.

Fortified beverages are expected to grow with a CAGR of 9.8% from 2024 to 2030 due to their versatility, convenience, and rising demand for functional drinks. The trend towards health and wellness has led consumers to seek out beverages that offer additional health benefits beyond hydration. Fortified beverages, such as sports drinks, fortified water, and functional juices, cater to this demand by incorporating vitamins, minerals, and other functional ingredients like probiotics and omega-3 fatty acids. Innovations in beverage formulation and packaging have also improved the stability and bioavailability of these fortifying agents, making them more effective and appealing to health-conscious consumers. Additionally, the beverage industry's ability to quickly adapt to new health trends and consumer preferences, combined with effective marketing strategies, has significantly contributed to the rapid growth of fortified beverages.

Regional Insights

North America food fortifying agents market accounted for a revenue share of 30.4% in 2023 due to its advanced food and beverage industry, high consumer awareness, and supportive regulatory environment. The region has well-established guidelines and policies for food fortification, ensuring the widespread use of fortifying agents in various food products. Additionally, the high prevalence of lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases has driven the demand for fortified foods that offer additional health benefits. The presence of major market players and continuous innovations in food technology further bolster North America's leading position in the market.

U.S. Food Fortifying Agents Market Trends

The food fortifying agents market in the U.S. is expected to grow at a CAGR of 9.1% from 2024 to 2030. The U.S. food fortifying age006Ets market is a significant contributor to the overall North American market, driven by high consumer awareness, extensive product offerings, and robust regulatory support. The country has a long history of food fortification programs, such as the fortification of cereals with folic acid to prevent neural tube defects. The U.S. market is characterized by a high demand for fortified foods and beverages, particularly among health-conscious consumers and those seeking to address specific nutritional deficiencies. The presence of leading food and beverage companies, along with continuous innovation and marketing efforts, ensures a steady supply of fortified products.

Europe Food Fortifying Agents Market Trends

The food fortifying agents market in Europe is expected to grow at a CAGR of 8.4% from 2024 to 2030, owing to the stringent food safety regulations, high consumer demand for nutritious foods, and a strong focus on preventive healthcare. The region's regulatory bodies, such as the European Food Safety Authority (EFSA), play a crucial role in ensuring the quality and safety of fortified foods. European consumers are increasingly seeking products with added health benefits, driving the market for fortified foods and beverages. The region's aging population and rising health consciousness also contribute to the demand for food fortifying agents. Moreover, the presence of key industry players and ongoing research and development activities support the market's growth in Europe.

Asia Pacific Food Fortifying Agents Market Trends

The food fortifying agents market in Asia Pacific is expected to grow with a CAGR of 9.7% from 2024 to 2030. The market is driven by rapid urbanization, rising disposable incomes, and increasing health awareness among consumers. The region faces significant nutritional deficiencies, prompting governments to implement fortification programs to address public health concerns. Countries like India and China are witnessing a surge in demand for fortified foods as part of efforts to combat malnutrition and improve overall health. The expanding middle-class population, coupled with a growing preference for functional and fortified foods, fuels the market's growth. Additionally, the region's dynamic food and beverage industry, supported by advancements in manufacturing technologies, is contributing to the accelerated adoption of food fortifying agents.

Key Food Fortifying Agents Company Insights:

The market is characterized by the presence of numerous well-established players such Cargill Incorporated; ADM; BASF SE; DuPont, and DSM, among others. The market players face intense competition from each other as some of them are among the top food fortifying agents manufacturers with diverse product portfolios for food fortifying agents. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Food Fortifying Agents Companies:

The following are the leading companies in the food fortifying agents market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill Incorporated

- ADM

- BASF SE

- DuPont

- Advanced Organic Materials, S.A.

- Eastman Chemical Company

- Kalsec Inc.

- DSM

- International Flavors & Fragrances Inc. IFF

- Kemin Industries, Inc.

Recent Developments

-

In April 2024, PLANTSTRONG, a plant-based food brand, expanded into the plant-based milk market, offering four shelf-stable varieties fortified with essential nutrients like calcium, vitamin D, and vitamin B12. The company has addressed consumer concerns about additives and lack of nutrients in many plant-based products by carefully formulating its milk.

-

In March, 2023, Dairy Farmers of America (DFA) launched a probiotics-fortified, lactose-free UHT milk in collaboration with Good Culture. This product is the first of its kind in the U.S. market, combining the nutritional benefits of dairy with microbiome-boosting probiotics, providing an affordable alternative to kefir and kombucha.

-

In November 2022, Glanbia Nutritionals introduced FerriUp, a whey protein concentrate tailored for active women. FerriUp addresses the iron and energy needs of this group with high levels of lactoferrin and vitamin B12, offering an 80% protein concentration. Although only 0.6% of sports nutrition products cater to women, 62% of active women find products that support iron and energy levels very appealing. FerriUp, created using a selective transfer membrane system, is ideal for ready-to-mix powders, aiding in iron modulation, energy levels, and immune health.

Food Fortifying Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.43 billion

Revenue forecast in 2030

USD 169.47 billion

Growth Rate (Revenue)

CAGR of 9.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Saudi Arabia

Key companies profiled

Cargill Incorporated; ADM; BASF SE; DuPont; Advanced Organic Materials, S.A.; Eastman Chemical Company; Kalsec Inc.; DSM; International Flavors & Fragrances Inc. IFF; Kemin Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Fortifying Agents Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food fortifying agents market report on the basis of type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vitamins

-

Minerals

-

Proteins & Amino Acids

-

Carbohydrates

-

Prebiotics & Probiotics

-

Lipids

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dairy & Dairy-based Products

-

Infant Formula

-

Cereals & Cereal-based Products

-

Beverages

-

Dietary supplements

-

Fats & oils

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food fortifying agents market size was estimated at USD 92.86 billion in 2023 and is expected to reach USD 100.43 billion in 2024.

b. The global food fortifying agents market is expected to grow at a compounded growth rate of 9.1% from 2024 to 2030 to reach USD 169.47 billion by 2030.

b. Some key players operating in food fortifying agents market include Cargill Incorporated; ADM; BASF SE; DuPont; Advanced Organic Materials, S.A.; Eastman Chemical Company; Kalsec Inc.; DSM; International Flavors & Fragrances Inc. IFF; Kemin Industries, Inc.

b. Key factors that are driving the market growth include increasing awareness of and demand for nutrient-rich diets to address widespread deficiencies, especially in developing regions. Public health initiatives and government regulations mandating fortification to combat malnutrition and prevent diseases play a significant role. The rising health consciousness among consumers, coupled with the growing popularity of functional foods and dietary supplements, further fuels market growth. Additionally, advancements in food fortification technologies and the expansion of the food and beverage industry are contributing factors, making it easier for manufacturers to incorporate these agents into a variety of products

b. Vitamins food fortifying agent accounted for a largest revenue share of 27.9% in 2023 due to their widespread deficiencies in populations worldwide and the well-documented health benefits they provide. Government initiatives and public health programs have extensively focused on fortifying staple foods with essential vitamins like A, D, B12, and folic acid to combat malnutrition and prevent related health issues such as rickets, anemia, and neural tube defects. These efforts are supported by regulatory bodies that mandate or encourage vitamin fortification to improve public health outcomes. Additionally, consumers are highly aware of the importance of vitamins for maintaining overall health, making them more receptive to vitamin-fortified foods, thus driving market demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.