- Home

- »

- Automotive & Transportation

- »

-

Food Cold Chain Market Size & Share, Industry Report, 2033GVR Report cover

![Food Cold Chain Market Size, Share & Trends Report]()

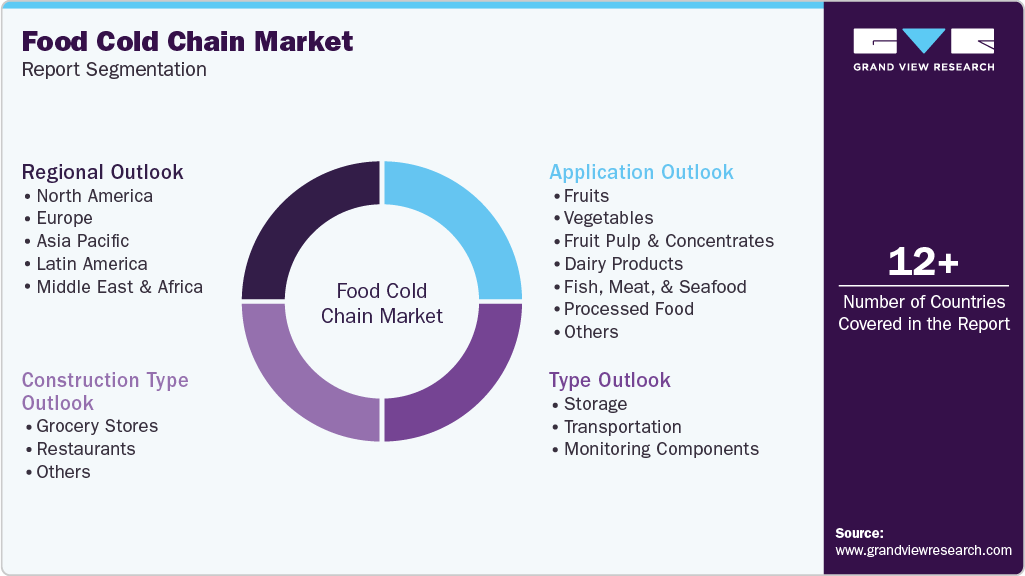

Food Cold Chain Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Storage, Transportation), By Construction Type (Grocery Stores, Restaurants), By Application (Fruits, Vegetables, Dairy Products), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-106-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Cold Chain Market Summary

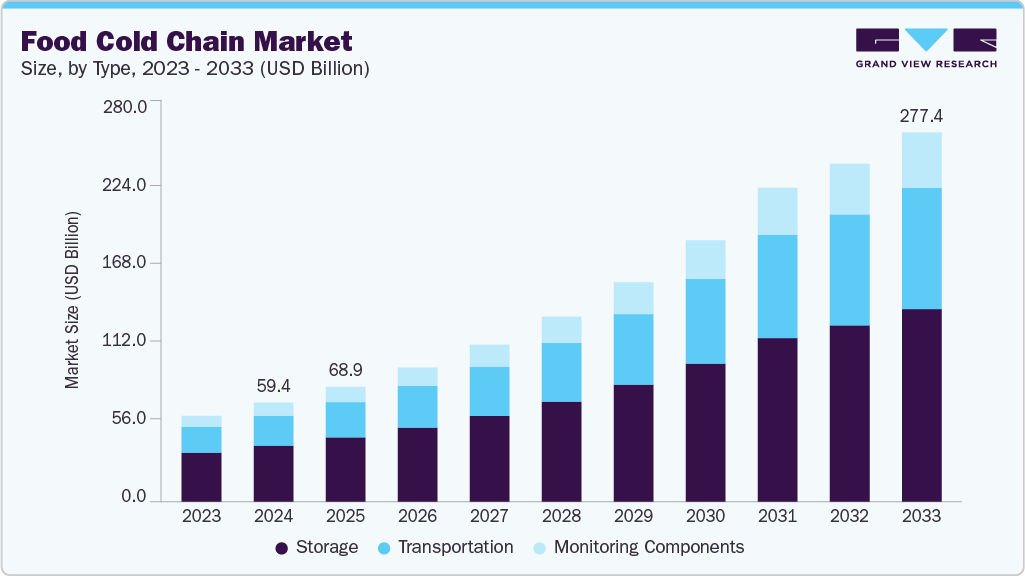

The global food cold chain market size was estimated at USD 59.37 billion in 2024 and is projected to reach USD 277.43 billion by 2033, growing at a CAGR of 19.0% from 2025 to 2033. The market is witnessing a remarkable surge in demand, primarily fueled by the growing consumer preference for quality foods.

Key Market Trends & Insights

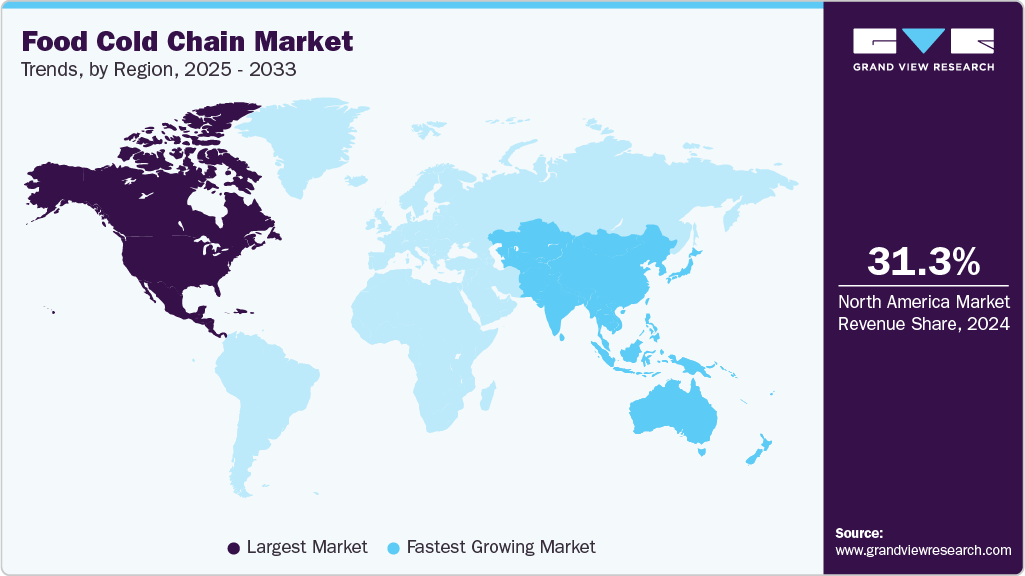

- The North America food cold chain market accounted for a global revenue share of 31.3% in 2024.

- The food cold chain industry in the U.S. held a dominant position in 2024.

- By type, the storage segment accounted for the largest revenue share of 56.5% in 2024.

- By construction types, the restaurants segment held the largest revenue share of 46.7% in 2024.

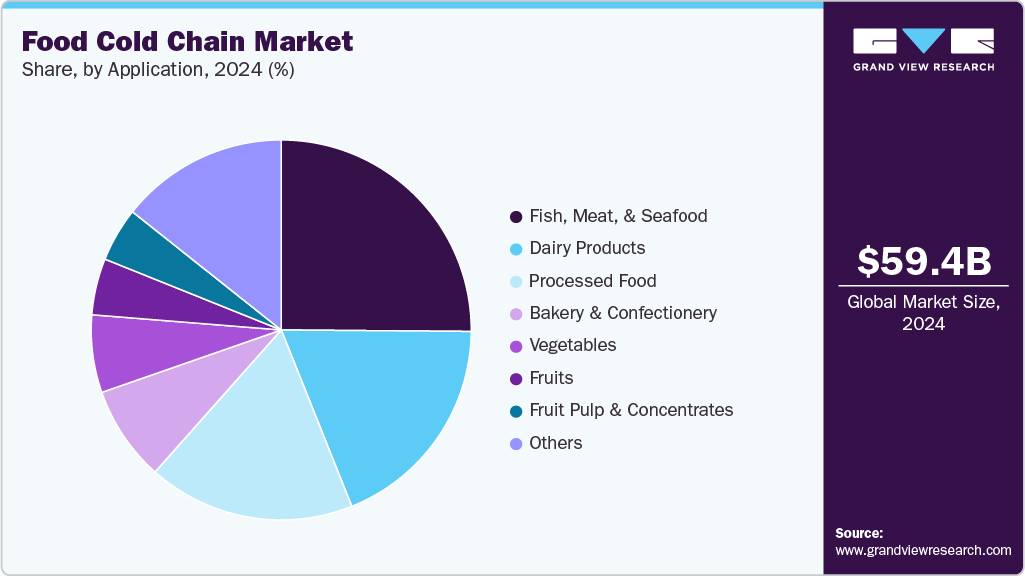

- By application, the fish, meat, and seafood segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 59.37 Billion

- 2033 Projected Market Size: USD 277.43 Billion

- CAGR (2025-2033): 19.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In recent times, there has been a substantial rise in awareness among customers regarding the criticality of food safety. As a result, there is an escalating desire for refrigerated food products that are fresh and safe to consume and meet high-quality standards. The food cold chain industry includes the systems that handle and transport perishable food products under controlled temperature conditions to ensure their freshness, quality, and safety from the point of production to the point of consumption. It is a crucial logistical process that involves maintaining a specific temperature range throughout the supply chain, including during transportation, storage, and distribution.The cold chain market plays a pivotal role in this industry, especially for products like fruits, vegetables, dairy, meat, seafood, and pharmaceuticals. By using refrigerated facilities, temperature-controlled vehicles, and advanced technologies like RFID, the cold chain ensures that perishable items remain in optimal condition, reducing the risk of spoilage, bacterial growth, and other quality issues.

Moreover, RFID technology has emerged as a pivotal driver in the cold chain market, enhancing visibility and efficiency in the entire process. Maintaining optimal product temperatures during transportation and storage is a critical concern among the challenges faced in the cold chain. Any deviation from the required temperature range poses a substantial risk, leading to bacterial growth, spoilage, and deterioration of food quality.

The food cold chain market is witnessing substantial growth, fueled by increased investments in its development. The rising demand for fresh and processed food products is a key driver spurred by population growth, urbanization, and evolving consumer preferences. Simultaneously, there is a heightened emphasis on tackling the critical issue of food waste on a global scale. This collective momentum is propelling businesses to channel resources into strengthening the cold chain infrastructure, ensuring efficient and seamless processes that preserve the quality and safety of food products while minimizing waste.

Type Insights

The storage segment accounted for the largest revenue share of 56.5% in 2024. The storage component plays a crucial role by providing specialized facilities and solutions to maintain food products at optimal low temperatures throughout their journey from production to consumption. The storage segment is further bifurcated into reefer containers and warehouses. Factors driving the increasing demand for perishable food include shifting consumer preferences, population growth, and urbanization. Moreover, technological advancements have played a significant role in enhancing the efficiency and reliability of cold storage solutions, further bolstering their importance in the industry.

The monitoring components segment is expected to grow at the fastest CAGR during the forecast period. Monitoring components are vital in temperature-controlled food logistics to ensure that perishable goods maintain the required temperature range throughout transportation, storage, and distribution processes. Several key factors drive the market for monitoring components in temperature-controlled food logistics. The growing focus on food safety and quality regulations by governments and regulatory bodies worldwide has prompted businesses to adopt advanced monitoring technologies.

Construction Type Insights

The restaurants segment held the largest market share of 46.7% in 2024. By construction type, the market is segmented into grocery stores, restaurants, and others. The construction segment is focused on creating facilities designed to store and transport fresh produce at low temperatures. These facilities are essential for maintaining the quality and freshness of perishables by effectively controlling and continuously monitoring temperature, humidity, and other environmental conditions. By using advanced designs and materials, these specialized constructions ensure that temperature-sensitive food items are preserved in optimal conditions throughout their journey from production to consumption.

The grocery stores segment is expected to grow at the fastest CAGR during the forecast period. Temperature-controlled storage and transportation systems are indispensable to uphold the quality and safety of perishable goods. As a result, grocery stores that offer perishable food items are purposefully designed with specific features to ensure precise temperature and optimal conditions throughout the supply chain. This meticulous process begins with storage at the distribution center, extends to transportation, and ultimately culminates at the store for the benefit of the end consumer.

Application Insights

The fish, meat, and seafood segment dominated the food cold chain industry in 2024. Based on application, the market is segmented into fruits; vegetables; fruit pulp & concentrates; dairy products; fish, meat, and seafood; processed food; bakery & confectionery; and others. The market growth is primarily driven by the growing global demand for fresh, high-quality, and safe protein sources significantly influences the need for efficient cold chain logistics.

The processed food segment is projected to grow at the fastest CAGR of 20.9% over the forecast period. The changing consumer lifestyle and preferences have increased demand for convenient and ready-to-eat food options. Processed food caters to these needs, offering a wide range of convenient and easy-to-prepare meals. Secondly, urbanization and busy schedules have resulted in a growing reliance on processed food products, as they provide a quick and accessible solution for consumers with limited time for cooking.

Regional Insights

The North America food cold chain market held a significant share of 31.3% in 2024. In North America, the food cold chain is a comprehensive and efficient system that ensures the timely and safe delivery of fresh produce from farm to customer. This well-organized cold chain encompasses cold storage facilities, refrigerated vehicles, and distribution centers, all working together to maintain ideal temperature and humidity levels for the perishable goods.

U.S. Food Cold Chain Market Trends

The U.S. food cold chain industry held a dominant position in 2024, due to the stringent food safety regulations, advanced infrastructure, and strong demand for perishable products such as dairy, meat, seafood, and frozen meals. The growing popularity of e-grocery and meal kit delivery services has further accelerated investments in temperature-controlled warehousing and last-mile delivery networks.

Europe Food Cold Chain Market Trends

The Europe food cold chain industry was identified as a lucrative region in 2024. Europe represents a mature and regulated market for food cold chain, with a strong focus on food quality, traceability, and carbon efficiency. Well-established logistics networks and a high penetration of advanced cold storage solutions characterize the region.

The UK food cold chain market is expected to grow rapidly in the coming years due to the post-Brexit trade adjustments, increasing consumer expectations for fresh and frozen goods, and regulatory pressure on food traceability. Retailers and third-party logistics providers are investing in cold chain upgrades to reduce spoilage and meet the surge in demand from online grocery channels.

The food cold chain market in Germany held a substantial market share in 2024. The country benefits from its central location, robust infrastructure, and export-oriented food industry. The market is supported by a strong network of refrigerated warehouses and transport services that cater to both domestic consumption and intra-European trade.

Asia Pacific Food Cold Chain Market Trends

The Asia Pacific food cold chain industry is anticipated to grow at a CAGR of 25.7% during the forecast period. The food cold chain sector is a significant contributor to the continent's economy, supporting local and regional agriculture and providing employment opportunities for thousands. However, it faces several challenges, including increasing demand for fresh produce, complex supply systems, and evolving consumer preferences. In response to these challenges, cold chain providers in the region are actively investing in cutting-edge innovations and new technologies to strengthen the cold chain and effectively address these issues.

The Japan food cold chain market is expected to grow rapidly in the coming years. Japan’s market is advanced and highly urbanized, catering to a sophisticated consumer base with high expectations for food freshness and quality. The country’s aging population and growing demand for ready-to-eat meals are driving expansion in refrigerated logistics and automated storage solutions.

The food cold chain market in China held a substantial market share in 2024, driven by urbanization, rising disposable incomes, and shifting consumer preferences toward frozen, imported, and high-protein foods. Government initiatives aimed at food safety and reducing post-harvest losses are accelerating the development of cold chain logistics, particularly in inland and Tier 2 and Tier 3 cities.

Key Food Cold Chain Company Insights

Some of the key companies in the food cold chain market include Americold Logistics LLC, Agro Merchant Group, Burris Logistics, Inc., Henningsen Cold Storage Company, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Americold Logistics LLC is a provider of temperature-controlled warehousing and logistics, with more than 240 facilities worldwide, offering approximately 1.5 billion cubic feet of refrigerated storage across North America, Europe, Asia-Pacific, and South America.The company plays a critical role in the global food cold chain by connecting food producers, processors, distributors, and retailers to consumers through its extensive network. Americold provides comprehensive cold storage solutions complemented by value-added services such as blast freezing, pick and pack, labeling, repacking, kitting, staging, and cross-docking.

-

AGRO Merchants Group is a cold storage operator specializing in temperature-controlled logistics for the global food industry. With a network of 66 facilities across 11 countries, including the U.S., Europe, Latin America, and Asia-Pacific, the company provides comprehensive cold chain solutions encompassing refrigerated warehousing, transportation, distribution, and value-added services such as blast freezing, tempering, automated repacking, and USDA inspection. AGRO Merchants serves a diverse customer base across fresh and frozen food commodities, leveraging local market expertise combined with a global infrastructure to ensure food safety, quality, and supply chain efficiency.

Key Food Cold Chain Companies:

The following are the leading companies in the food cold chain market. These companies collectively hold the largest market share and dictate industry trends.

- Americold Logistics LLC

- Agro Merchant Group

- Burris Logistics, Inc.

- Henningsen Cold Storage Company

- Lineage Logistics, LLC

- Nordic Logistics

- Preferred Freezer

- Wabash National

- Cold Chain Technologies, Inc.

- Cryopak Industries Inc.

Recent Developments

-

In May 2024, Candor Expedite launched a new cold chain division called Candor Food Chain. It combines its national shipping services with an innovative reusable cold packaging solution that maintains frozen and refrigerated shipments at controlled temperatures for up to nine days using regular transport. This technology, introduced through a partnership with European firm Cool Chain, allows consolidation of perishable and dry goods in a single truck supporting three temperature zones, frozen, refrigerated, and ambient, thereby reducing the need for multiple deliveries and cutting costs for food manufacturers, distributors, and retailers across the U.S.

-

In December 2023, Americold Realty Trust, in partnership with its joint venture, RSA Cold Chain in Dubai, announced plans to develop and operate an advanced cold storage facility valued at USD 35 million in the Jebel Ali Free Zone (Jafza) at the Port of Jebel Ali, Dubai. The facility will feature 40,000 pallet positions and offer multi-temperature storage solutions tailored to support the cold chain needs of temperature-sensitive food products. This initiative strengthens the strategic alliance between Americold and DP World, a global leader in supply chain logistics and port operations, with the objective of enhancing the resilience and operational efficiency of the food and beverage supply chain across the UAE and the wider Middle East region.

Food Cold Chain Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 68.90 billion

Revenue forecast in 2033

USD 277.43 billion

Growth rate

CAGR of 19.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report construction type

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, construction type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; MEA; KSA; UAE; South Africa

Key companies profiled

Americold Logistics LLC; Agro Merchant Group; Burris Logistics, Inc.; Henningsen Cold Storage Company; Lineage Logistics, LLC; Nordic Logistics; Preferred Freezer; Wabash National; Cold Chain Technologies, Inc.; Cryopak Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Cold Chain Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global food cold chain market report based on type, construction type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Storage

-

Warehouses

-

Reefer Containers

-

-

Transportation

-

Road

-

Sea

-

Rail

-

Air

-

-

Monitoring Components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

-

Software

-

On-premise

-

Cloud-based

-

-

-

-

Construction Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Grocery Stores

-

Restaurants

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruits

-

Apples

-

Banana

-

Berries

-

Nectarines, Plums, and Peaches

-

Melons

-

Others

-

-

Vegetables

-

Leafy Vegetables

-

Lettuce

-

Onions

-

Potato

-

Others

-

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food cold chain market size was estimated at USD 59.37 billion in 2024 and is expected to reach USD 68.90 billion in 2025.

b. The global food cold chain market is expected to grow at a compound annual growth rate of 19.0% from 2025 to 2033 to reach USD 277.43 billion by 2033.

b. North America led the overall market in 2024, with a market share of 31.3%. In North America, the food cold chain is a comprehensive and efficient system that ensures the timely and safe delivery of fresh produce from farm to customer. This well-organized cold chain encompasses cold storage facilities, refrigerated vehicles, and distribution centers, all working together to maintain ideal temperature and humidity levels for the perishable goods.

b. Some key players operating in the food cold chain market include Americold Logistics LLC; Agro Merchant Group; Burris Logistics, Inc.; Henningsen Cold Storage Company; Lineage Logistics, LLC; Nordic Logistics; Preferred Freezer; Wabash National; Cold Chain Technologies, Inc.; Cryopak Industries Inc.

b. The market is witnessing a remarkable surge in demand, primarily fueled by the growing consumer preference for quality foods. In recent times, there has been a substantial rise in awareness among customers regarding the criticality of food safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.