Fondaparinux Market Size, Share & Trends Analysis Report By Type (Deep Vein Thrombosis), By Product (Branded, Generic), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-960-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Fondaparinux Market Size & Trends

The global fondaparinux market size was valued at USD 688.0 million in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. A steadily aging population globally is anticipated to heighten the prevalence of health disorders and highlight the need for surgical procedures, which is anticipated to act as a major growth factor. Furthermore, increasing incidences of lifestyle conditions such as obesity and cardiovascular diseases are expected to drive the occurrence of disorders such as Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE), thus boosting the demand for fondaparinux.

Fondaparinux is a synthetic anticoagulant that is used to prevent the formation of blood clots. The steadily growing healthcare expenditure worldwide and growing health-related awareness among consumers are expected to drive further market expansion.

Fondaparinux offers a targeted prophylactic solution for the prevention of Venous Thromboembolic Events (VTEs), specifically Deep Vein Thrombosis (DVT), in post-surgical patients. DVT can potentially migrate and develop into Pulmonary Embolism (PE), a serious complication that forms a blood clot in the lungs. This medication is particularly effective during the initial post-operative period following major surgeries such as hip fracture repair, hip/knee replacements, and selected abdominal procedures when patients experience limited mobility that presents a potential risk factor for blood clot formation. The drug can be used in combination with warfarin to address acute DVT and pulmonary embolism.

In addition, the increasing prevalence of thromboembolic conditions, such as pulmonary embolism and deep vein thrombosis, particularly among older and sedentary individuals, drives the demand for anticoagulants like fondaparinux. This trend is amplified by the global aging population, which faces heightened risks of such illnesses, necessitating effective therapeutic interventions. Furthermore, enhanced awareness and diagnostic advancements have led to higher detection rates, boosting fondaparinux adoption. Its unique advantages, such as reduced risk of heparin-induced thrombocytopenia and no need for frequent blood monitoring, make it a preferred choice in various clinical scenarios.

Moreover, government healthcare policies and reimbursement programs support the prevention and management of thromboembolic diseases, fostering the market for fondaparinux. Ongoing research enhances its safety and efficacy. The rise in surgical procedures, especially orthopedics, increases the need for prophylactic anticoagulants to prevent postoperative complications. The economic burden of thromboembolic disorders drives the adoption of cost-effective treatments like fondaparinux. Expanding therapeutic indications and technological advancements in drug formulation also contribute to its growing significance in managing these conditions effectively.

Type Insights

The deep vein thrombosis (DVT) segment dominated the global fondaparinux market and accounted for the largest revenue share of 59.5% in 2024. This share can be attributed to a substantial increase in the number of patients suffering from DVT. For instance, according to the National Blood Clot Alliance, up to 600,000 people in the U.S. are diagnosed with DVT/PE each year, with 17% of such cases proving to be fatal. In addition, several cases of healthcare-associated VTE, which involves formation of blood clots in veins, can be treated using anticoagulant medications, resulting in an increased use of fondaparinux. Furthermore, the need for this medication to address DVT is expected to rise during the forecast period, as 20% of the cases of VTE are related to cancer and its treatment. Moreover, the occurrence of VTE is relatively high in expecting mothers, childbirth, or post-delivery, which presents another avenue for the use of fondaparinux.

Pulmonary embolism (PE) is expected to grow at a CAGR of 6.6% from 2024 to 2030. In this condition, a blood clot develops in a blood vessel, travels to an artery in the lung, and forms a blockage. Globally, one out of 1000 people suffer from PE, and around 20% of them with acute PE die within 90 days, making anti-clotting medicines essential for the treatment of such patients. Conditions such as obesity, prolonged sitting, or immobility (e.g., after surgery or during long flights), smoking, and certain medical conditions can increase the risk of blood clots. As the population ages, the risk of PE also rises. Wider availability of imaging tests such as CT scans has led to identification of more PE cases, which has driven the use of fondaparinux in such patients.

Product Insights

The generic segment led the market and accounted for the largest revenue share of 52.1% in 2024, primarily driven by much higher affordability of generics when compared to branded drugs, which leads to increased sales among a wider population base. Generic pharmaceutical manufacturers incur lesser development costs associated with the introduction of a new drug to the market. This cost difference is a major factor for patients and healthcare providers, especially for medications such as fondaparinux, which are in consistently high demand.

The branded segment is expected to grow at a lucrative CAGR of 6.0% over the forecast period, owing to a moderate increase in demand for such medications. A higher level of consumer trust in branded medications is expected to act as a major factor in driving demand. In addition, these drugs are manufactured after conducting extensive clinical trials, leading to increased confidence among patients regarding their efficacy. Furthermore, their rigorous assessment ensures that they meet established standards in terms of dosage, safety profile, performance characteristics, potency, stability, and administration method.

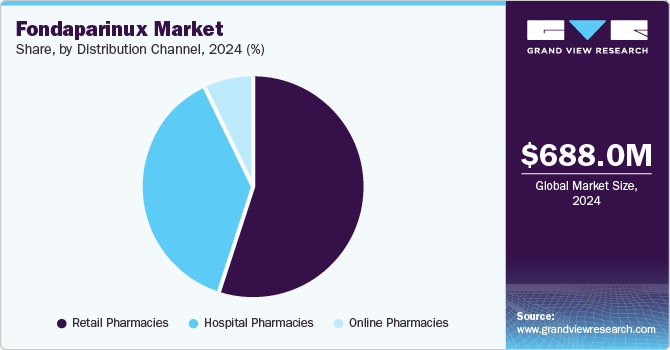

Distribution Channel Insights

The retail pharmacies held the dominant position market and accounted for the largest revenue share of 55.4% in 2024, driven by factors such as the increasing prevalence of cardiovascular diseases, which boosts demand for anticoagulants like fondaparinux. In addition, the expanding geriatric population and rising healthcare expenditure contribute to market growth. Furthermore, retail pharmacies benefit from advancements in technology and e-commerce, enhancing accessibility and convenience for customers seeking prescription medications, including fondaparinux.

The online pharmacies are expected to grow at the CAGR of 11.2% over the forecast period. This growth is attributed to the increased use of online platforms to purchase medications worldwide, as they offer increased convenience and acceptability, price transparency, and result in potential cost savings. The rise of telemedicine consulting has further helped in new avenues for online pharmacies. Patients can have virtual appointments with doctors, receive prescriptions electronically, and refill them seamlessly through these channels.

Regional Insights

North America fondaparinux market dominated the global market and accounted for the largest revenue share of 37.6% in 2024. This growth is attributed to the increasing geriatric population in the region, along with a wider scope for the use of fondaparinux in DVT, PE, cancer, and various orthopedic conditions that lead to blood clots. Furthermore, the presence of well-established healthcare infrastructure in regional economies and increased awareness among people regarding conditions such as DVT and PE, as well as how to address them, are major growth drivers for this market.

U.S. Fondaparinux Market Trends

The fondaparinux market in the U.S. dominated the North American market and held a dominant share in 2024, driven by the presence of a significant population with cardiovascular diseases, DVT, and PE. According to the American Heart Association, cardiovascular diseases have remained a leading cause of death in U.S. in recent years. Furthermore, the U.S. healthcare system often demonstrates a faster pace of regulatory approval for new medications compared to other regions, leading to early adoption and larger consumer base for this medicine.

Asia Pacific Fondaparinux Market Trends

The Asia Pacific fondaparinux market is expected to grow at the fastest CAGR of 7.3% over the forecast period, owing to the significantly increasing geriatric population in this region. For instance, according to the WHO, by 2030, nearly one-sixth of the global population will be 60 years old or older. This demographic shift will see the number of people in this age group rise from 1 billion in 2020 to 1.4 billion. Looking ahead to 2050, the population of individuals aged 60 and above is projected to double, reaching 2.1 billion. Meanwhile, the number of people aged 80 or older is expected to triple during this period, reaching 426 million by 2050. Furthermore, increasing incidences of CVDs and related diseases are fueling the growth and demand for fondaparinux, which is driving this industry.

The fondaparinux market in Japan is expected to remain a major market in the Asia Pacific region in coming years. The high proportion of aging population in the country, coupled with a well-developed healthcare infrastructure, has created significant awareness regarding the occurrence of conditions such as DVT and PE, along with measures to address them. A study published in the National Library of Medicine in November 2022 found that this drug was effective in treating VTE in patients with and without cancer, based on 260 patients from the Toho University Omori Medical Center. Such results are expected to highlight the importance of fondaparinux across a range of medical conditions, boosting its demand.

Europe Fondaparinux Market Trends

Europe fondaparinux market is expected grow significantly over the forecast period, driven by the increasing demand for this drug in Europe is on account of the presence of a robust healthcare ecosystem and economic affluence. In addition, European consumers have a high net disposable income, leading to their increased spending on healthcare. DVT affects 900,000 Europeans each year. According to the WHO, CVDs are a major cause of disability and premature death in this region, contributing to 42.5% of the total annual mortalities. These factors are responsible for the increased use of fondaparinux.

The fondaparinux market in the UK is a major market for Europe on account of the increasing cases of disorders such as obesity and CVD in the economy. According to Patient.info, an estimated one out of 1000 people in the UK suffer from Deep Vein Thrombosis annually, while there are around 25,000 deaths per year on account of blood clots that develop during hospital stays. As a result, it has become an urgent requirement to treat such conditions as soon as possible, aiding the demand for fondaparinux across healthcare settings in the region.

Key Fondaparinux Company Insights

Some of the key companies in the fondaparinux industry include GlaxoSmithKline (GSK); Abbott Laboratories, Inc.; and Dr Reddy's Laboratories Ltd. These players adopt strategies focused on enhancing research and development to improve drug formulations and expand therapeutic applications. In addition, they emphasize building robust distribution networks and fostering collaborations with healthcare providers to increase accessibility. Furthermore, efforts are directed toward addressing regulatory challenges, optimizing production efficiency, and leveraging technological advancements to maintain competitiveness and drive market growth.

-

GlaxoSmithKline is involved in the development of general and specialty medicines, as well as vaccines. The company invests extensively in research and development activities for its products, with R&D facilities located in Germany, India, China, Japan, Singapore, the U.S., and the UK, among other nations. It markets fondaparinux under the brand name Arixtra in injectable form of 1.5mg and 2.5 mg/0.5ml. The European Commission has granted GSK marketing authorization for the same.

-

Dr Reddy's Laboratories Ltd. specializes in the development of generics, branded generics, active pharmaceutical ingredients, biologics, and over-the-counter (OTC) drugs. The company has purchased exclusive intellectual property rights worldwide for fondaparinux sodium from Alchemia Ltd. They have received USFDA approval and offer single-dose, prefilled injections containing various doses in the range of 2.5 mg, 5 mg, 7.5 mg, and 10 mg of fondaparinux sodium.

Key Fondaparinux Companies:

The following are the leading companies in the fondaparinux market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories Inc.

- Alchemia Limited

- Apotex Inc.

- GSK plc

- Lupin Pharmaceuticals, Inc

- ScinoPharm Taiwan Ltd

- Dr. Reddy’s Laboratories Ltd.

- Bayer Healthcare AG

- GlaxoSmithKline

- Boehringer Ingelheim

- Sanofi

- WisMed

- Kaifeng

- Mylan

Recent Developments

-

In December 2024, The FDA approved Mylan's Arixtra (fondaparinux) for treating) pediatric patients aged one year and older, weighing at least 10 kg with venous thromboembolism (VTE). This approval develops fondaparinux's existing indications, as it is already authorized for adult use in preventing deep vein thrombosis (DVT) and treating acute DVT and pulmonary embolism. The decision was based on a study involving 366 pediatric patients, demonstrating significant clot resolution with fondaparinux. The recommended pediatric dose is 0.1 mg/kg subcutaneously once daily. Arixtra carries a boxed warning for spinal/epidural hematomas, and healthcare professionals are advised to consult the drug label for comprehensive dosing information.

Fondaparinux Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 731.1 million |

|

Revenue forecast in 2030 |

USD 990.9 million |

|

Growth rate |

CAGR of 6.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

March 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, product, distribution channel, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Abbott Laboratories Inc.; Alchemia Limited; Apotex Inc.; GSK plc; Lupin Pharmaceuticals, Inc; ScinoPharm Taiwan Ltd; Dr. Reddy’s Laboratories Ltd.; Bayer Healthcare AG; GlaxoSmithKline; Boehringer Ingelheim; Sanofi; WisMed; Kaifeng; Mylan. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fondaparinux Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fondaparinux market report based on type, product, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Vein Thrombosis

-

Pulmonary Embolism

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded

-

Generic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."