- Home

- »

- Next Generation Technologies

- »

-

Focused Ion Beam Market Size, Share & Trends Report 2030GVR Report cover

![Focused Ion Beam Market Size, Share & Trends Report]()

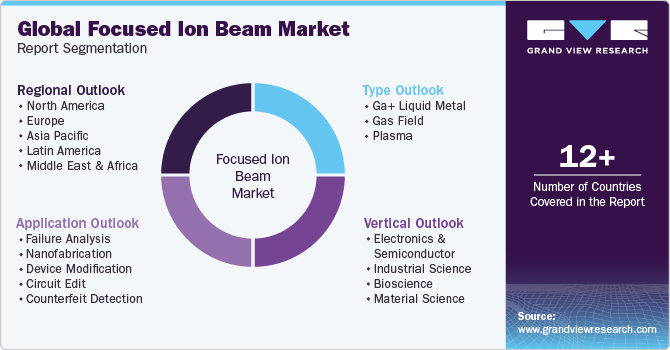

Focused Ion Beam Market Size, Share & Trends Analysis Report By Type (Ga+ Liquid Metal, Gas Field, Plasma), By Application, By Vertical (Electronics & Semiconductor, Bioscience), By Region, & Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Focused Ion Beam Market Size & Trends

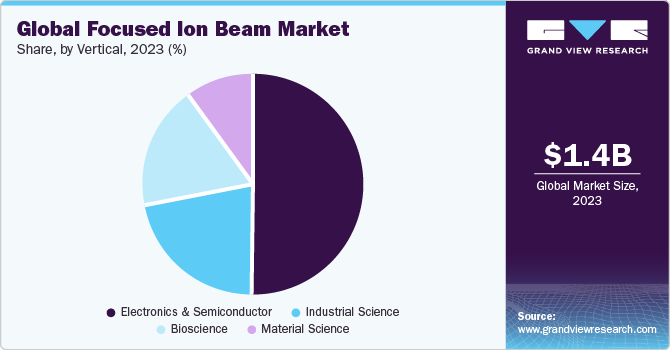

The global focused ion beam market size was estimated at USD 1.44 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The technological advancements drive the focused ion beam (FIB) market, the increasing demand for high-resolution microscopy, and the rising investment in research and development activities. Technological advancements in FIB technology have led to the development of more efficient and precise devices. For instance, the introduction of gas-assisted FIB systems has enabled the creation of high-quality and uniform nanostructures.

The use of high-resolution microscopy has become increasingly prevalent across a range of fields. FIB devices provide nanoscale imaging and analysis in materials science and life sciences research, leading to the development of novel solutions. For instance, in February 2023, JEOL Ltd. launched the JIB-PS500i, a combination of FIB and scanning electron microscope (SEM) system.

Moreover, the rising investment in research and development activities also contributes to the FIB market's growth. Many companies are actively investing in the development of advanced FIB systems that can cater to the evolving needs of various industries. It has led to the development of new FIB systems that offer enhanced capabilities, such as high-throughput processing and improved imaging quality.

Market Concentration & Characteristics

The global focused ion beam market is moderately concentrated, the growth stage is medium, and the pace of the industry growth is accelerating. The industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by the increasing demand for high-precision micro-machining and nano-machining applications.

The focused ion beam industry has witnessed the rise of several service substitutes, including laser-based ion beam technology, ion beam etching, and ion beam sputtering. Electron microscopy, a powerful tool that uses electron beams to produce images of minute objects, has proven significant value in materials science, biology, and physics research. It allows researchers to study materials at the atomic and molecular level, making it a viable alternative to focused ion beam technology and an essential service in the industry.

FIB technology is being used for circuit editing, failure analysis, and device prototyping in the electronics industry. In contrast, the healthcare industry uses it for imaging of biological samples, drug discovery, and tissue engineering. The aerospace and automotive industries also use focused ion beam technology for materials research and development. Overall, the focused ion beam industry end-user concentration is diverse and spans several industries.

Type Insights

The Ga+ liquid metal segment dominated the market with a share of 80.3% in 2023, owing to the widespread adoption in key industries. FIB systems have become widespread in various industries, such as electronics and semiconductors, for failure analysis, defect repair, and circuit editing. Furthermore, these systems have been employed in materials science research for microstructure analysis, composition analysis, and 3D imaging. The Ga+ liquid metal ion sources, characterized by high resolution and precision, play a crucial role in both fields.

The gas field segment is expected to grow at a significant rate over the forecast period owing to the growing concern for the environment and focus on sustainability. The gas field FIB uses nitrogen gas that is non-toxic and readily available, eliminating hazardous waste concerns linked to gallium-based FIBs and driving demand in the market.

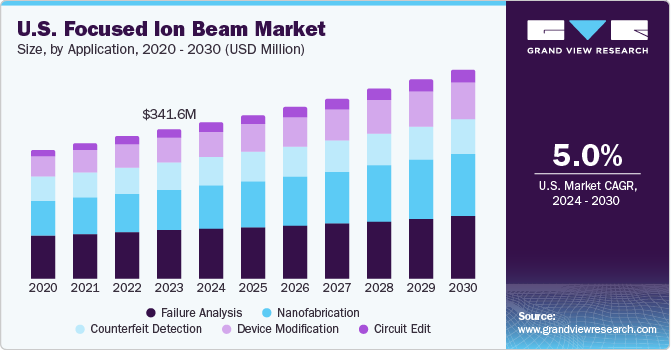

Application Insights

The failure analysis segment captured the largest market share in 2023, primarily due to the increasing complexity of semiconductor devices. As these devices become smaller and more complex, identifying and analyzing defects is becoming more challenging. FIB systems are uniquely suited to this task, as they provide high-resolution imaging and precise milling capabilities that allow for detailed analysis of defects. FIB systems are often used for circuit edit applications, where engineers need to make changes to semiconductor devices after fabrication. It may involve cutting traces, adding connections, or debugging circuits to correct design errors or optimize device performance.

The nanofabrication segment is expected to grow at a significant CAGR over the forecast period. It can be attributed to the development of specialized nanofabrication tools, such as nano-machining nozzles and focused electron beam-induced deposition (FEBID) sources. These tools offer enhanced capabilities for precise material deposition and removal at the nanoscale. FIB systems allow for precise material removal and deposition at the nanoscale level, making them valuable tools for modifying and repairing semiconductor devices. Engineers can use FIB technology to edit device structures, remove unwanted material, or add new features to semiconductor chips.

Vertical Insights

The electronics and semiconductor segment led the market in 2023 and is expected to witness the fastest growth over the forecast period, owing to the increasing demand for advanced microelectronics and nanotechnology applications. The market growth is being driven by the growing demand for 5G, AI, IoT, autonomous vehicles, and consumer electronics. Focused ion beam systems play a crucial role in developing and producing these advanced electronic devices.

The bioscience segment is expected to grow substantially during the forecast period. FIB technology is used for a variety of applications, including sample preparation for transmission electron microscopy (TEM) and scanning electron microscopy (SEM), allowing for the preparation of ultra-thin sections of biological samples, which can then be analyzed with high-resolution imaging techniques. The increasing demand for personalized medicine also drives the bioscience segment of the FIB market. FIB technology can be used to create customized implants, prosthetics, and other medical devices that are tailored to the individual patient's needs.

It has significant potential for improving patient outcomes and reducing healthcare costs, leading to various company partnerships. For instance, in October 2023, Thermo Fisher collaborated with Flagship Pioneering, a biotech company, to develop and provide innovative tools and equipment specializing in biotech and therapies ecosystems.

Regional Insights

North America region dominated the market and accounted for a 34.7% share in 2023. The semiconductor industry has been rapidly growing, with North America emerging as a hub for semiconductor manufacturing. To remain competitive, companies are investing extensively in research and development. FIB technology plays a crucial element in semiconductor fabrication processes, resulting in an increased demand for FIB systems.

U.S. Focused Ion Beam Market Trends

The U.S. focused ion beam market accounted for 23.6% of the global market in 2023. The U.S. has renowned research universities and institutions that invest heavily in nanotechnology and material science research. FIB technology plays a crucial role in enabling researchers to conduct high-resolution imaging, precise material manipulation, and advanced analytical techniques, driving innovation in semiconductor manufacturing, biomedical engineering, and quantum computing.

Asia Pacific Focused Ion Beam Market Trends

The Asia Pacific region is anticipated to witness the fastest growth in the market. The Asia Pacific has some of the world's largest semiconductor companies. As demand for smaller, more powerful electronic devices continues to rise, there is a growing need for advanced semiconductor fabrication technologies such as FIB systems.

The focused ion beam market in China is expected to grow over the forecast period. China is investing heavily in nanotechnology research and development to drive innovation and economic growth. FIB technology plays a crucial role in nanofabrication, nano-manipulation, and materials analysis, driving demand from academic and industrial research sectors.

The India focused ion beam market is expected to witness a significant growth in the region over the forecast period. India's semiconductor and electronics industry is experiencing rapid growth, driven by increasing domestic demand, government initiatives such as "Make in India," and rising investments in electronics manufacturing. FIB systems are essential for semiconductor research, development, and quality control, driving demand in India.

Middle East & Africa (MEA) Focused Ion Beam Market Trends

The Middle East & Africa (MEA) region is expected to grow substantially in the forecast period. The oil and gas industry in the MEA region is adopting advanced technologies to improve exploration, production, and refining processes. FIB systems are used for materials analysis, corrosion studies, and microstructural analysis in the oil and gas industry, presenting growth opportunities in the region.

Key Focused Ion Beam Company Insights

Some of the key players operating in the market include Zeiss, Thermo Fisher Scientific, Hitachi, and JEOL.

-

ZEISS is a global technology enterprise that delivers optical solutions for inspiring experiences. The company develops products that are shaping technological progress in various industries. ZEISS offers a wide range of solutions, including microscopy, eyeglass lenses, planetariums, and industrial metrology. It offers Crossbeam FIB-SEM, which combines field emission scanning electron microscope (FE-SEM) and FIB.

-

Hitachi High-Technologies Corporation is a Japanese company that offers a wide range of cutting-edge products and services in various sectors, including electronic devices, life sciences, and industrial equipment. The company is known for its advanced technological solutions and innovative products that cater to the needs of different industries worldwide. Its offerings include several FIB solutions such as FIB and FEB system Ethos NX5000, FIB-SEM NX9000, NX2000, and MI4050. Focus, A&D Company are some of the other market participants in the focused ion beam market.

-

Focus GmbH is a company that specializes in providing advanced solutions in the field of focused ion beam (FIB) technology. The company offers a range of products and services related to FIB systems, catering to various industries such as semiconductors, materials science, and life sciences.

-

A&D Company, Limited, also known as A&D, is a Japanese multinational corporation specializing in developing and manufacturing precision measuring instruments and equipment. Their offerings include digital-to-analog converters (DAC), electron beams (EB), and FIBs.

Key Focused Ion Beam Companies:

The following are the leading companies in the focused ion beam market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Zeiss

- Hitachi High-Technologies Corporation

- JEOL Ltd.

- TESCAN ORSAY HOLDING, a.s.

- Fibics Incorporated

- Raith GmbH

- Focus GmbH

- A&D Company

- Veeco Instruments, Inc.

- Eurofins Scientific

- Delong Instruments Co., Ltd.

Recent Developments

-

In September 2023, Thermo Fisher Scientific launched the Plasma-Focused Ion Beam (PFIB) Thermo Scientific Hydra Bio. It streamlines volume electron microscopy procedure for cell biologists working with resin or cryo-embedded samples. Integrated into the Helios Hydra DualBeam platform, it supports various microscopy techniques, including FIB-SEM serial sectioning, cryo-electron tomography, and array tomography. With cryogenic and room temperature operation options, researchers can study cellular architecture with excellent contrast and flexibility, switching between four ion species to optimize sample requirements.

-

In July 2023, The European Molecular Biology Laboratory (EMBL) and ZEISS formed a strategic partnership to advance imaging technology in life sciences. This collaboration grants EMBL Imaging Centre users access to ZEISS's latest microscopy technologies, while EMBL's research provides insights for ZEISS's development. The agreement addresses future imaging needs through early access to innovations and joint technology discussions. This partnership represents an exciting opportunity to enhance research capabilities in the life sciences field.

Focused Ion Beam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,548.5 million

Revenue forecast in 2030

USD 2.36 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Thermo Fisher Scientific; Zeiss; Hitachi High-Technologies Corporation; JEOL Ltd.; TESCAN ORSAY HOLDING, a.s.; Fibics Incorporated; Raith GmbH; Focus GmbH; A&D Company; Veeco Instruments, Inc.; Eurofins Scientific; Delong Instruments Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Focused Ion Beam Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global focused ion beam market report based on type, application, vertical, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ga+ Liquid Metal

-

Gas Field

-

Plasma

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Failure Analysis

-

Nanofabrication

-

Device Modification

-

Circuit Edit

-

Counterfeit Detection

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronics & Semiconductor

-

Industrial Science

-

Bioscience

-

Material Science

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global focused ion beam market size was estimated at USD 1.44 billion in 2023 and is expected to reach USD 1,548.5 million in 2024

b. The global focused ion beam market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030, reaching USD 2.36 billion by 2030

b. North America dominated the focused ion beam market with a revenue share of 34.7% in 2023. Regional growth is attributed to the rapidly growing semiconductor industry, with North America emerging as a hub for semiconductor manufacturing

b. Some key players operating in the focused ion beam market include Thermo Fisher Scientific; Zeiss; Hitachi High–Technologies Corporation; JEOL Ltd.; TESCAN ORSAY HOLDING, a.s.; Fibics Incorporated; Raith GmbH; Focus GmbH; A&D Company; Veeco Instruments, Inc.; Eurofins Scientific; Delong Instruments Co., Ltd.

b. Factors such as the increasing demand for high–resolution microscopy and the rising investment in research and development activities are driving the growth of the focused ion beam market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."