- Home

- »

- Advanced Interior Materials

- »

-

Foam Tape Market Size, Share And Growth Report, 2030GVR Report cover

![Foam Tape Market Size, Share & Trends Report]()

Foam Tape Market (2024 - 2030) Size, Share & Trends Analysis Report By Adhesive Type (Acrylic, Rubber, Silicone), By Technology (Hot Melt Based, Water Based, Solvent Based) By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-335-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foam Tape Market Size & Trends

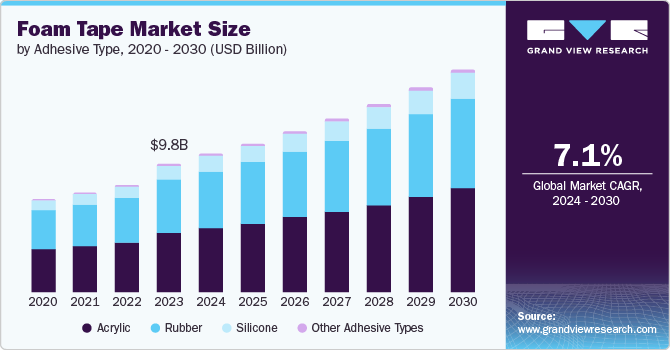

The global foam tape market size was estimated at USD 9.83 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The market growth is attributed to the rising use of bonding, insulation, and noise reduction applications in the automotive sector. Growing automotive production, particularly in emerging economies such as India, China, Brazil, and Mexico, fuels the product demand.

In addition, the growing construction industry, driven by urbanization and infrastructure development, increases the demand for foam tapes for sealing, bonding, and insulating applications in building projects. Similarly, the electronics industry utilizes the product for mounting and bonding components due to its insulating properties and ability to provide cushioning and protection. Such factors are expected to further boost the market demand.

The growing airline travel is anticipated to drive the demand for materials used in an airplane. Rising demand for transport is expected to increase the production capability of aircraft manufacturers, which may result in an extension of contracts between material suppliers and manufacturers. This is anticipated to propel the demand for materials, including foam tapes, which are primarily used in producing aircraft interiors and avionics.

Product distribution is carried out through multiple channels, including online platforms, direct distribution, and third-party distribution. Direct distribution channels offer the advantage of better product customization, which benefits the consumers. In addition, the absence of middlemen in the supply chain in case of direct distribution also results in a higher profit margin for the tape manufacturers.

However, the foam tapes market is expected to be restrained by the presence of a number of substitutes, such as sealants, fasteners, and adhesives. Extensive utilization of the aforementioned products for bonding across various end-use industries, including automotive, building and construction, and aerospace, is expected to drive the market growth over the forecast period.

Adhesive Type Insights

The acrylic segment led the industry in adhesive tapes with the largest revenue share of 46.16% in 2023. Acrylic adhesives are durable and offer superior color stability. They can also bond well to polar surfaces such as glass, metal, polycarbonates, and polyesters. As a result, tapes with acrylic adhesives witness a high demand for outdoor applications, where critical long-term bonding is essential.

Silicone adhesive is forecasted to grow at the highest CAGR of 7.7% from 2024 to 2030. Silicone adhesives offer excellent shear, UV, and solvent resistance, making them a better choice for several industrial applications. However, their high cost and very low initial tack compared to their counterparts are projected to hamper their market growth, especially in indoor applications.

Rubber adhesive is expected to witness significant demand over the projected period due to its ability to adhere to several low-energy, non-polar surfaces. However, rubber adhesives are often susceptible to oxidation, which results in the darkening of tapes. In addition, they tend to lose their tack or become brittle when exposed to infeasible external conditions.On account of the aforementioned factors, the demand for rubber adhesive-based pressure sensitive tapes is expected to be limited primarily to indoor applications.

Other types of chemistries used for manufacturing adhesives include ethylene-vinyl acetate (EVA), polyolefin, polyurethane, and styrene block copolymers (SBCs). The majority of the aforementioned adhesives are used with hot melt technology. EVA is the most commonly used material owing to its high adhesion characteristic, which aids its use in packaging, paper, and industrial applications.

Technology Insights

Solvent-based technology accounted for the largest revenue share of 47.48% in 2023 and is expected to grow significantly over the forecast period. These tapes are widely used across various specialized applications, such as flexographic printing. The use of synthetic rubber adhesive-based tapes for flying splices in the paper industry also contributes to their high demand.

The use of hot melt technology for double-sided tapes, primarily for mounting in the building construction and automotive industries, is expected to drive the market growth over the forecast period. Hot melt technology-based adhesive tapes are widely available across the globe on account of high production volumes by companies such as 3M, Tesa Tapes, and Nitto Denko.

Water-based technology is expected to grow at the fastest CAGE of 7.6% over the forecast period owing to its quick tack phase or drying time when used with foam rubber as an adhesive. Moreover, water-based adhesive tapes are extensively utilized in the building and construction industry for temporary mounting and joining applications, which is expected to drive this segment over the forecast period.

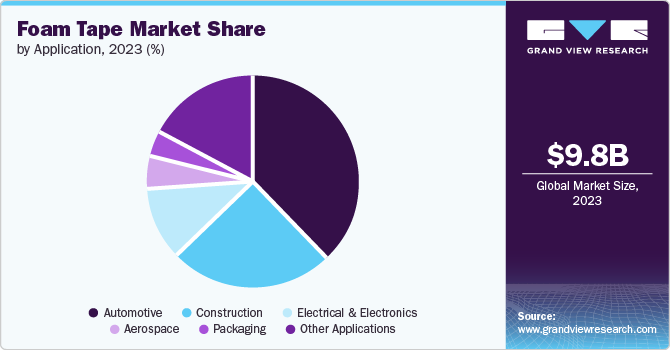

Application Insights

Based on Application, automotive segmentation dominated the market in 2023 with a revenue share of 38.0%. The demand for specialty tapes in the automotive industry is expected to ascend due to the major car manufacturers' increasing emphasis on vehicle light-weighting. These tapes are witnessing increased utilization in the mounting of panels, carpets, lighting, and trims in medium-and high-end cars.

In the electronics industry, specialty tapes are employed in mounting camera lenses, antennae, logos, printed circuit boards, and meshes for speakers and backlights, thereby accounting for a notable consumption volume. Growth in the manufacturing of electronic gadgets, primarily in the Asia Pacific region, is anticipated to drive the market for foam tapes over the forecast period.

Regional Insights

The North America foam tape market is expected to grow at the fastest CAGR during the forecast period. Major factors driving the market include the stable economy, increasing consumer and investor confidence given the country's economic growth, and the rising value of the U.S. dollar in international markets. The growth of the electronics, automotive, electrical, and medical sectors in Mexico, which are the key drivers, is anticipated to fuel product demand over the forecast period.

U.S. Foam Tape Market Trends

The foam tape market in the U.S. dominated the market with the largest revenue market share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Trends such as marking paint lines and humidity barriers in buildings, masking wall surfaces, and house wrapping are driving the growth of the foam tapes market in the U.S. This is because foam tapes offer home energy efficiency, manage air and moisture, and are recyclable.

Europe Foam Tape Market Trends

The foam tape market in Europe dominated the global market with the largest revenue share in 2023. Ascending demand for products in the packaging industry is expected to drive the market in the region in the coming years. Although the demand for adhesives and sealants is high in Europe, increasing the utilization of tapes to substitute adhesives in industrial applications is likely to propel the demand for foam tapes in Europe.

Asia Pacific Foam Tape Market Trends

The foam tape market in the Asia Pacific is expected to grow significantly over the forecast period. Asia Pacific is the fastest-growing economy, spearheaded by China and India. The increasing production in the region due to rising investments by the major manufacturers is expected to have a positive impact on the demand for foam tapes over the forecast period. The major economies contributing to the high product penetration in the region include China, India, Japan, and South Korea.

Key Foam Tape Company Insights

Some of the key players operating in the market include 3M,Nitto Denko Corporation, tesa SE, and Avery Dennison Corporation:

-

Avery Dennison Corporation offers its products to customers globally through direct and third-party distribution. The company's products serve multiple clients, including tape converters, original equipment manufacturers, original design manufacturers, personal care manufacturers, and construction firms. The company's core capabilities include high-speed coating, roll-to-roll processing, functional coating, microreplication, printing, and imaging, among others.

-

tesa SE operates as a wholly-owned affiliate of Beiersdorf AG in over 100 countries, with production facilities in Germany, Italy, the U.S., and China. In addition, the company manages 52 direct or indirect affiliates. It divided its business into two reportable segments: direct industries and trade market division.

HALCO Europe Ltd, LINTEC Corporation, Intertape Polymer Group, and LAMTEK Inc. are some of the emerging market participants.

-

LINTEC Corporation offers various products, including adhesive papers and films, window films, LCD-related products, automobile-related products, semiconductor-related equipment, and color papers. It operates through three business segments: paper and converted products, electronic and optical products, and printing and industrial material products. The company manufactures industrial-use adhesive tapes, such as double-sided foam tapes, as a commercial and industrial product.

Key Foam Tape Companies:

The following are the leading companies in the foam tape market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Nitto Denko Corporation

- HALCO Europe Ltd

- tesa SE

- Scapa

- LINTEC Corporation

- AVERY DENNISON CORPORATION

- Intertape Polymer Group

- LAMTEK Inc.

- Wuxi Canaan Adhesive Technology Co. Ltd.

Recent Developments

-

In November 2023, CCL Design announced the launch of our new 5400 LSE series of acrylic foam tapes. This product was developed by the research and development team located in Venray, Netherlands. The 5400 LSE series foam tapes feature primerless adhesion to plastics, ultra-strong bond to polypropylene, and superb bonding to automotive paints.

Foam Tape Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.56 billion

Revenue forecast in 2030

USD 17.02 billion

Growth Rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Adhesive Type, Technology. Application, and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan. India, South Korea, Brazil, Saudi Arabia

Key companies profiled

3M, Nitto Denko Corporation, HALCO Europe Ltd, tesa SE, Scapa, LINTEC Corporation, AVERY DENNISON CORPORATION, Intertape Polymer Group, LAMTEK Inc., Wuxi Canaan Adhesive Technology Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foam Tape Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global foam tapes market report based on adhesive type, technology, application, and region.

-

Adhesive Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Rubber

-

Silicone

-

Other Adhesive Types

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Solvent Based

-

Water Based

-

Hot Melt Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Electrical & Electronics

-

Aerospace

-

Packaging

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global foam tape market size was estimated at USD 9.83 billion in 2023 and is expected to reach USD 10.56 billion in 2024.

b. The global foam tape market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 17.02 billion by 2030.

b. The acrylic segment led the industry in adhesive tapes, with a revenue share of 46.2% in 2023, owing to its durability and superior color stability.

b. Some of the key players operating in the foam tapes market include 3M, Nitto Denko Corporation, HALCO Europe Ltd, tesa SE, Scapa, and LINTEC Corporation.

b. The key factor driving the foam tape market is the rising demand for lightweight automotive parts in North America and Europe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.