- Home

- »

- Next Generation Technologies

- »

-

Flush Mount Photo Album Market Size, Industry Report 2030GVR Report cover

![Flush Mount Photo Album Market Size, Share & Trends Report]()

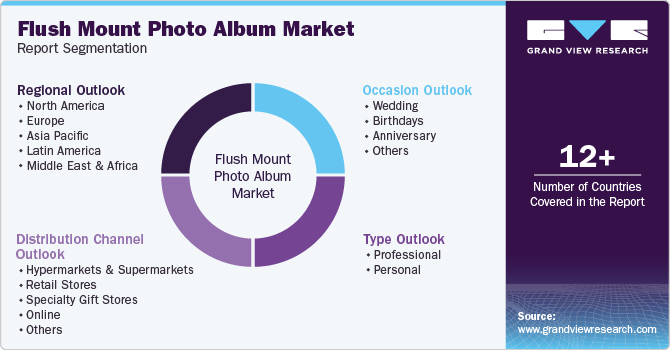

Flush Mount Photo Album Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Professional, Personal), By Distribution Channel (Retail Stores, Specialty Gift Stores, Online), By Occasion, By Region, And Segment Forecasts

- Report ID: 978-1-68038-689-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flush Mount Photo Album Market Trends

The global flush mount photo album market size was valued at USD 3.77 billion and is expected to grow at a CAGR of 3.6% from 2025 to 2030. This expansion can be attributed to the increasing popularity of personalized gifting, particularly for special occasions such as weddings, anniversaries, and graduations. Consumers are increasingly drawn to unique, high-quality products that capture personal experiences and memories. Flush mount photo albums meet this demand through customizable features and premium materials. Also, the emotional significance of preserving cherished moments in a tangible format further enhances their market appeal.

Another significant driver of growthis the rising preference for theme-based weddings. Couples are selecting distinctive themes that reflect their personalities and are more inclined to invest in high-quality flush mount photo albums that align with their wedding aesthetics. This preference enhances the overall wedding experience while driving demand for albums capable of showcasing professional photography with sophistication. The flush mount design, which enables seamless layouts and panoramic views, is particularly well-suited to capture the essence of themed celebrations, thereby fueling market expansion.

In addition, advancements in printing techniques and materials have played a pivotal role in the growth of the flush mount photo album industry. Innovations such as high-definition printing and durable substrates ensure vibrant, long-lasting images that are appealing to professional photographers and consumers. Furthermore, the emergence of online platforms offering customizable options has improved accessibility, allowing customers to choose from various designs, colors, and finishes that cater to their preferences. This shift toward digital customization has expanded the consumer base and intensified competition among manufacturers, spurring innovation in the market.

Moreover, the cultural importance of preserving memories through high-quality print media continues to drive demand for flush mount photo albums. Tangible keepsakes are increasingly valued over digital alternatives, making these albums a favored choice for documenting significant life events. Their ability to create visually compelling narratives resonates with consumers' desire for meaningful and enduring gifts. This cultural shift toward appreciating physical representations of memories further drives the market growth.

Type Insights

The professional segment dominated the market in 2024, accounting for 70.6% of the total revenue share. This dominance is due to the growing demand from professional photographers prioritizing high-quality albums to present their work effectively. The flush mount design, known for its sophisticated presentation, enhances the visual appeal of photographs, making it the preferred option for major events such as weddings and family portraits. Furthermore, the emphasis on customization and the use of premium materials within this segment caters to clients seeking distinctive and personalized products. These factors highlight the critical role of the professional segment in driving growth and fostering innovation within the flush mount photo album industry.

The personal segment is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to increasing consumer preference for personalized keepsakes that capture cherished memories. With individuals seeking to document significant life events such as birthdays, anniversaries, and vacations, the demand for high-quality photo albums rises. Moreover, advancements in online customization tools make it convenient for consumers to create unique albums tailored to their styles. These trends indicate a strong potential for growth in the personal segment.

Distribution Channel Insights

The online segment held the largest revenue share of the market in 2024. This growth is attributable to the convenience and accessibility that online platforms offer consumers for creating personalized albums. With advancements in e-commerce, customers can easily customize their photo albums from the comfort of their homes, selecting from various designs, materials, and layouts. In addition, competitive pricing and promotional discounts provided by online retailers enhance consumer appeal, further boosting sales in this segment. These factors contribute to the continued expansion of the flush mount photo album industry.

The hypermarkets and supermarkets segment is expected to exhibit a significant CAGR during the forecast period. This growth can be attributed to the increasing consumer preference for one-stop shopping experiences, where customers can find a wide range of products, including flush mount photo albums, under one roof. The convenience offered by these retail formats allows consumers to browse various options and make informed purchasing decisions. Moreover, promotional offers and discounts in hypermarkets and supermarkets further attract shoppers, enhancing sales in this segment.

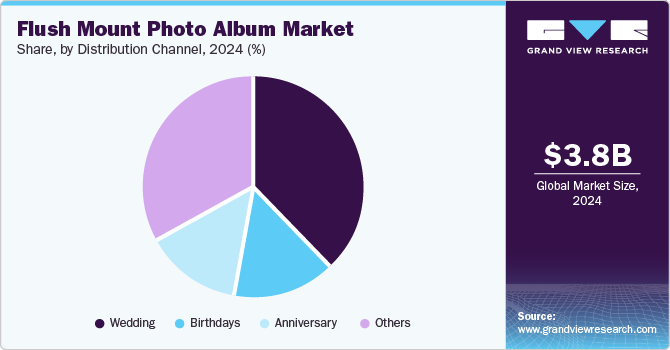

Occasion Insights

The wedding segment held the largest revenue share of the market in 2024. This dominance is due to the growing trend of personalized wedding experiences, where couples seek high-quality albums to capture and showcase their special moments. The flush mount design provides an elegant presentation that enhances the visual appeal of wedding photographs, making it a preferred choice among photographers and clients alike. In addition, with weddings becoming more luxurious, the demand for premium photo albums continues to rise, further strengthening the wedding segment's leading position in the market.

The anniversary segment is expected to witness a significant CAGR during the forecast period. This growth can be attributed to the rising trend of celebrating milestone anniversaries with personalized gifts that capture cherished memories. Flush mount photo albums provide a luxury way to celebrate these special occasions, allowing couples to display their journey together through high-quality photographs. Furthermore, the emotional value of preserving memories in a tangible format further enhances the appeal of these albums for anniversary celebrations. With consumers increasingly seeking meaningful and customized gifts, the anniversary segment is expected to drive market growth in the coming years.

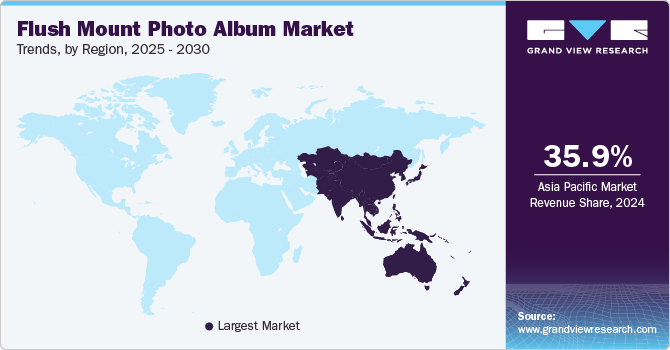

Regional Insights

The North America flush mount photo album market held a significant share of the global market in 2024. This growth is driven by high demand for premium, customizable albums, especially for special occasions such as weddings and anniversaries. The presence of numerous professional photographers in the region contributes to the demand, as they prefer high-quality albums to showcase their work. Moreover, the rise of online platforms offering easy customization options has expanded market reach. Personalized gifting trends also support the growth of this market in North America. As a result, the demand for flush mount photo albums is expected to remain strong, driven by the desire to preserve memories through tangible keepsakes.

U.S. Flush Mount Photo Album Market Trends

The U.S. flush mount photo album market held the largest revenue share of the regional market in 2024. This growth is due to the growing demand for premium, personalized albums for events such as weddings and anniversaries. Professional photographers in the U.S. also contribute to the market, relying on these albums for superior presentations. The rise of e-commerce platforms offering customization options has further expanded market access. Furthermore, the growing interest in luxury and customized products has boosted demand. These factors are expected to contribute to the expansion of the market and drive growth in the flush mount photo album industry.

Asia Pacific Flush Mount Photo Album Market Trends

The Asia Pacific flush mount photo album market dominated the global market with a revenue share of 35.9% in 2024. This growth is driven by rising disposable incomes and a growing appreciation for personalized products among consumers in the region. The increasing trend of documenting special occasions, such as weddings and anniversaries, has further boosted demand for high-quality photo albums. Moreover, advancements in printing technology have made it easy for consumers to create customized albums, enhancing their appeal. These factors are expected to continue driving market growth in the coming years.

The China flush mount photo album market held the largest revenue share of the regional market in 2024. This dominance is due to the country's booming wedding industry, where couples increasingly seek premium photo albums to capture their special day. The rise of e-commerce platforms has also facilitated access to a wide range of customizable album options for Chinese consumers. Furthermore, cultural practices emphasizing the importance of preserving family memories contribute to the strong demand for flush mount photo albums in China.

MEA Flush Mount Photo Album Market Trends

The MEA flush mount photo album market is anticipated to witness a significant CAGR during the forecast period. This growth can be attributed to the increasing popularity of social media, where consumers are motivated to share high-quality printed memories. With digital photography becoming more accessible, individuals seek ways to transform digital images into tangible keepsakes. In addition, cultural events and celebrations in the region often emphasize the importance of beautifully presented photo albums, driving demand for premium products.

The KSA flush mount photo album market held a significant revenue share of the regional market in 2024. This prominence is driven by a strong tradition of gifting high-quality albums during major life events and celebrations. The growing influence of Western wedding trends has also led to an increased interest in luxurious photo presentations among Saudi consumers. Furthermore, local manufacturers are expanding their offerings to include customized options that cater to regional tastes and preferences.

Key Flush Mount Photo Album Company Insights

Some key players in the flush mount photo album industry include Zno Inc., Shutterfly, Inc., Artifact Uprising, and MILK Books. These companies leverage advanced printing technologies and customization options to enhance their product offerings, catering to both professional photographers and consumers. They focus on delivering high-quality, personalized solutions for special occasions such as weddings, anniversaries, and birthdays. The growing trend of documenting personal milestones drives their market growth, as consumers increasingly seek elegant and unique ways to preserve their memories. Overall, these firms are committed to innovating within the flush mount photo album space to meet the diverse needs of their customers.

-

Zno Inc. offers customizable products for professional photographers and consumers. Their albums feature rigid pages and high-quality silver halide printing, ensuring durability and vibrant image presentation. It emphasizes personalization, allowing users to choose from various cover styles and paper types to create unique keepsakes. With a commitment to quality and innovation, it continues to attract customers seeking elegant photo solutions.

-

Shutterfly, Inc. provides an easy-to-use online platform for creating custom albums. The company utilizes advanced printing technologies to deliver vibrant colors and sharp details. Its focus on personalization makes it a popular choice for commemorating special occasions. By offering various design options, the company meets the diverse needs of consumers seeking to preserve their memories in style.

Key Flush Mount Photo Album Companies:

The following are the leading companies in the flush mount photo album market. These companies collectively hold the largest market share and dictate industry trends.

- Advance Photo Lab Inc.

- PikPerfect

- Zno Inc.

- nphoto.com

- Printique LLC

- Shutterfly, Inc.

- MILK Tailor Made Books Ltd

- Photobook Worldwide

- Artifact Uprising

- ASUKANET

- MILLER'S PROFESSIONAL IMAGING

- Midwest Photographic Resource Center

- Digital Pro Lab

- Bay Photo Lab

Recent Developments

-

In May 2024, PikPerfect launched a DIY service that made premium-quality photo albums more accessible to consumers. This new service lets users personalize their albums using various templates and AI technology. The initiative aims to meet the growing demand for customizable photo products. By enhancing accessibility, the company strengthened its position in the flush mount photo album market.

-

In July 2022, Shutterfly announced the launch of The Shutterfly Collective, marking its expansion beyond traditional photo personalization. This initiative featured collaborations with digital icons and independent artists from Spoonflower, aiming to offer unique and customizable products. The company focuses on enhancing creativity and providing customers with diverse options for personal expression, which reflects its commitment to innovation in the personalized product market.

Flush Mount Photo Album Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.92 billion

Revenue forecast in 2030

USD 4.68 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, occasion, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Advance Photo Lab Inc.; PikPerfect; Zno Inc.; nphoto.com; Printique LLC; Shutterfly, Inc.; MILK Tailor Made Books Ltd; Photobook Worldwide; Artifact Uprising; ASUKANET; MILLER'S PROFESSIONAL IMAGING; Midwest Photographic Resource Center; Digital Pro Lab; Bay Photo Lab

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flush Mount Photo Album Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flush mount photo album market report based on type, distribution channel, occasion, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Personal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Retail Stores

-

Specialty Gift Stores

-

Online

-

Others

-

-

Occasion Outlook (Revenue, USD Million, 2018 - 2030)

-

Wedding

-

Birthdays

-

Anniversary

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.