- Home

- »

- Specialty Polymers

- »

-

Fluorotelomers Market Size, Share And Growth Report, 2030GVR Report cover

![Fluorotelomers Market Size, Share & Trends Report]()

Fluorotelomers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fluorotelomer Alcohol, Fluorotelomer Acrylate), By Application (Fire Fighting Foams, Textile), By Region, And Segment Forecasts

- Report ID: 978-1-68038-100-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluorotelomers Market Size & Trends

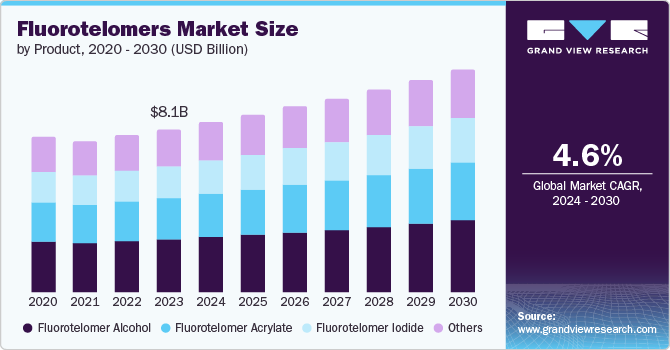

The global fluorotelomers market size was valued at USD 8.05 billion in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. The market demand is expected to grow as the key applications such as fire-fighting foams and, to a lesser extent, textiles are likely to increase. Moreover, the regulatory environment remains favorable to the substitution of toxic fluorocarbon. Fluorotelomer demand in niche markets such as semiconductor manufacturing, metal plating, and photography, mainly due to their environment-friendly usage, is expected to drive market growth further.

Innovations and technological advances are significant in the fluorotelomers market. These improve product efficiency, performance, and the experience of the customers hence leading to the making of improved and diverse fluorotelomer products. Moreover, the newest trends for small & specialized applications such as optics, pharmacology, electronic, repellent & surfactants are seen as global opportunities for fluorotelomers. The growth in the market will attract new start-ups and eventually drive the market growth.

With higher consumer knowledge and the need for proper fluorotelomer products, consumers become more sensitive to product quality, their impact on the environment, and performance, there is a demand for fluorotelomers in firefighting foams, the food industry, textiles, and stain resistance. The growing use of fluorotelomer in the textile industry is driving up demand for the fluorotelomer market worldwide. In addition, rising demand in the healthcare sector will drive the market growth.

The availability of a favorable legal environment and government policies are good for the fluorotelomers business. Legal requirements that compel individuals to shift from dangerous fluorocarbons to safer fluorotelomers form the foundation for market development since they outline the legal requirements required for the use of such products. Awareness by the government regarding fluorotelomer products and their positive implications drives market growth.

Product Insights

Fluorotelomer alcohol dominated the market with a revenue share of 32.6% in 2023. This dominance is attributed to their high efficiency in creating long-lasting and strong stain-free or water-proof layers for many products used by consumers. Due to the flexibility of their use in applications, fluorotelomer alcohol consumers and industries prefer it. In addition to this, fluorotelomer alcohols are chemically stable and non-degradable which ensured its use by various industries. Companies are investing in research and development so that fluorotelomer alcohol can deliver more enhanced performance without harming human health or the environment.

Fluorotelomer acrylate is expected to register the fastest CAGR of 5.0% during the forecast period. One of the drivers for segment growth in the market is the rising need for coatings and finishes with higher performances in sectors like textiles, electronics, automotive, and construction. Moreover, increased concerns about the environmental issues and measures put in place in terms of per- and poly-fluoroalkyl substances (PFAS) have formulated safer chemical inputs such as fluorotelomer acrylates. Such types of compounds have been found to perform similarly to PFAS-based products at the same time having a lower impact on the environment and being less toxic driving the market growth rapidly. In addition, an increase in the level of research has resulted in the development of a new formulation of fluorotelomer acrylates with improved properties and uses hence increasing demand across the globe.

Application Insights

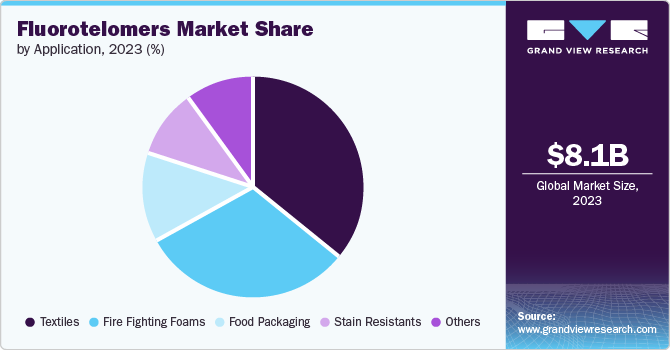

The textiles segment dominated the market with a revenue share of 35.3% in 2023. The growth of the textile industry is driven by factors such as increasing population, disposable income, and technological advancements. Government policies, consumer awareness, and the demand for sustainable products have also contributed to this growth. Moreover, industries are now producing eco-friendly products, and fluorotelomer-based finishes are preferred for their effectiveness and unique product offerings.

Fire fighting foams are expected to experience significant rise in demand over the forecast period. An increase in fire-related accidents, investment in fire protection facilities, and innovation in the current firefighting foam to mitigate the risks are some of the factors driving the market growth. Moreover, strict regulations towards the installation of fire protection systems by the government so that damage can be minimal. In addition, there is a high demand for firefighting foam in the oil and gas industry due to the high risk of fire accidents as firefighting foam is used to extinguish fire by suppressing the flame and cooling the fire, their high performance, and growing global trend for better firefighting equipment will drive the market growth in the forecast period.

Regional Insights

North America fluorotelomers market is expected to grow significantly over the forecast period, driven by rising demand for fluorotelomer products across various industries such as firefighting foam, food packaging, textiles, and surfactants and coatings. Ongoing research and development efforts in the market are expected to introduce improved fluorotelomer products that meet consumer needs.

U.S. Fluorotelomers Market Trends

The fluorotelomers market in the U.S. is expected to grow rapidly over the forecast period. Strict regulations, including product safety and environmental standards, play a crucial role in shaping the market, driving growth as companies comply with regulations to ensure safety and sustainability.

Europe Fluorotelomers Market Trends

Europe fluorotelomers market is expected to grow in the forecast period. The rising customer base of fluorotelomers in this region owing to several application areas which include textiles, packaging, and firefighting foam. These industries call for high-performance materials for some applications, and given the features that fluorotelomers have like water and oil repellency, they are well suited for use in these industries.

The fluorotelomers market in Germany has a significant market share in the global fluorotelomers market. There is a trend of companies to invest in new materials to improve the nature of the fluorotelomers so that they can be effectively used in various industries.

The UK fluorotelomers market is expected to grow in the forecast period due to competition and continuous innovation and development of products as well as marketing techniques in a bid to secure a bigger marketplace. This has been done by product differentiation and the ability to deliver customized products for particular customers’ requirements in turn driving the market.

Asia Pacific Fluorotelomers Market Trends

Asia Pacific fluorotelomers market dominated the global fluorotelomers market with a revenue share of 46.4% in 2023. Growth in the automotive and electronic sector, high demand for refrigeration and air conditioners, rapid industrialization and urbanization, and rise in disposable income are the major growth factors driving the market growth. As the rise in urbanization, their economy will also increase so there will be increased demand for high-performance materials and chemicals.

The fluorotelomers market in China is dominated the fluorotelomers market in Asia Pacific with a revenue share of 41.4% in 2023. According to reports, the Chinese government made an initiative “Made in China 2025,” aiming to focus on the development of high-tech industries including chemical sectors that will drive the growth of the fluorotelomers market

Indonesia fluorotelomers market is expected to have the fastest growth in the Asia Pacific region with a CAGR of 7.0%. With the increase in industrial plants and factories, the need for firefighting foams which include fluorotelomers is on the rise. The textile industry in Indonesia is growing at a steady rate with the help of factors like consumers’ disposable income, shift in customer trends toward textile products

Latin America Fluorotelomers Market Trends

The Latin America fluorotelomers market is expected to have the fastest growth in the global fluorotelomers market with a CAGR of 4.8%. The increased demand for stain-resistant coatings in several sectors including textile, furniture, automobile, and others are the major factors that have boosted the fluorotelomer market in Latin America. The expansion of the food packaging industry is expected to drive the need for fluorotelomers in the region as well.

Argentina fluorotelomers market has a significant market share in Latin America fluorotelomers market. Non-stick characteristics coupled with grease and oil resistance are widely used in the food packaging sector driving the growth of the market.

Fluorotelomers market in Brazil is expected to grow in the forecast period. The use of firefighting foams containing fluorotelomers in Brazil is expected to increase, especially in industries, commercial properties, and households, given the increased consciousness of people concerning fire emergencies.

Key Fluorotelomers Company Insights

Some key companies in the fluorotelomers market include The Chemours Company; Gujarat Fluorochemicals Limited; AGC Inc.; Saint-Gobain S.A.; and Asahi Glass Co., Ltd. The market is marked by technological advancements and vertical integration, with manufacturers controlling raw material supply and production. Key market participants are focusing on innovation, integration, and partnerships to stay competitive.

-

Chemours Company is a worldwide leader within the chemical industry that specializes in titanium technology, fluoroproducts, and chemical solution. The business enterprise is thought for its revolutionary products and solutions that cater to diverse industries inclusive of automobile, electronics, and strength. Fluorotelomers are a key product line for The Chemours Company.

-

Gujarat Fluorochemicals Limited (GFL) is a leading producer of fluorochemicals based in India. The organization has a numerous product portfolio that includes various fluoropolymer merchandise, areas of expertise chemical compounds, and fluorochemical intermediates. GFL is thought for its innovative solutions in the field of fluorochemicals and has a robust presence in both domestic and worldwide markets.

Key Fluorotelomers Companies:

The following are the leading companies in the fluorotelomers market. These companies collectively hold the largest market share and dictate industry trends.

- The Chemours Company

- Gujarat Fluorochemicals Limited

- AGC Inc.

- Saint-Gobain S.A.

- Asahi Glass Co., Ltd.

- Solvay SA

- 3M Company

- Arkema S.A.

- HaloPolymer OJSC

- Honeywell International Inc.

- Daikin Industries, Ltd.

- Dongyue Group Limited

- Kureha Corporation

- Quadrant AG

Recent Developments

-

In March 2024, Daikin Industries was selected for the “Innovation Momentum 2024: The Global Top 100” award, recognizing its innovative patent portfolio and technological advancements. This marked the first time Daikin has received this honor, citing its focus on sustainability and HVAC&R innovations.

-

In January 2024, Asahi India Glass Limited’s acquisition of AIS Adhesives Limited from Map Auto Ltd solidified its market presence by tapping into the company’s customer base and distribution networks.

-

In March 2023, AGC announced plans to expand its fluorochemical production capacity at its Chiba Plant to meet strong demand, particularly from the semiconductor industry. The investment of approximately 35 billion yen aimed to begin operations in the second quarter of 2025, targetting an increase in sales in the Performance Chemicals business to over 200 billion yen by 2024.

Fluorotelomers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.39 billion

Revenue forecast in 2030

USD 10.99 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

The Chemours Company; Gujarat Fluorochemicals Limited; AGC Inc.; Saint-Gobain S.A.; Asahi Glass Co., Ltd.; Solvay SA; 3M Company; Arkema S.A.; HaloPolymer OJSC; Honeywell International Inc.; Daikin Industries, Ltd.; Dongyue Group Limited; Kureha Corporation; Quadrant AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluorotelomers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluorotelomers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluorotelomer Alcohol

-

Fluorotelomer Acrylate

-

Fluorotelomer Iodide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fire Fighting Foams

-

Food Packaging

-

Stain Resistants

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.