- Home

- »

- Plastics, Polymers & Resins

- »

-

Fluid Dispensing Equipment Market, Industry Report, 2033GVR Report cover

![Fluid Dispensing Equipment Market Size, Share & Trends Report]()

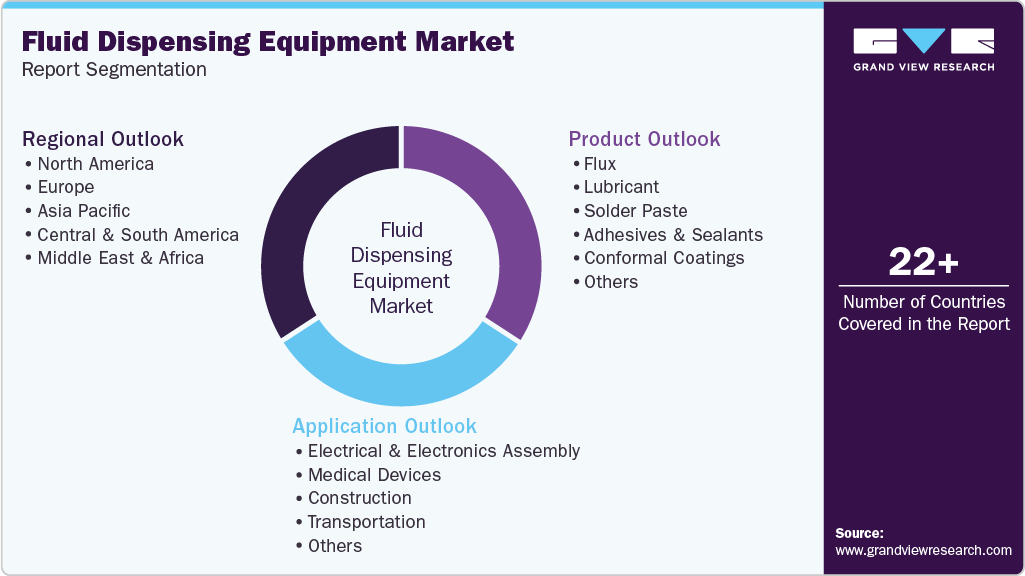

Fluid Dispensing Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Flux, Lubricant, Solder Paste, Adhesives & Sealants, Conformal Coatings), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-148-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluid Dispensing Equipment Market Summary

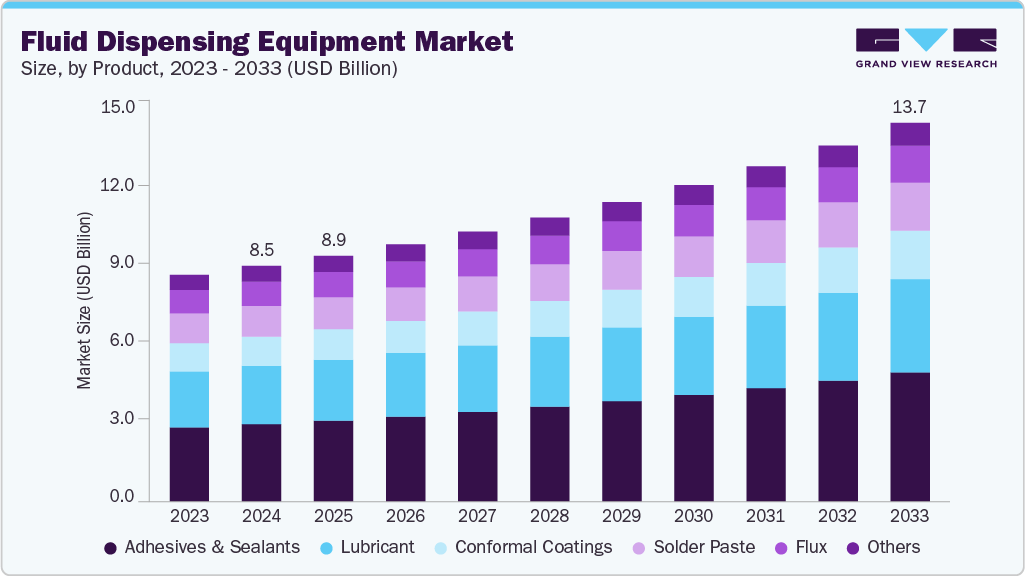

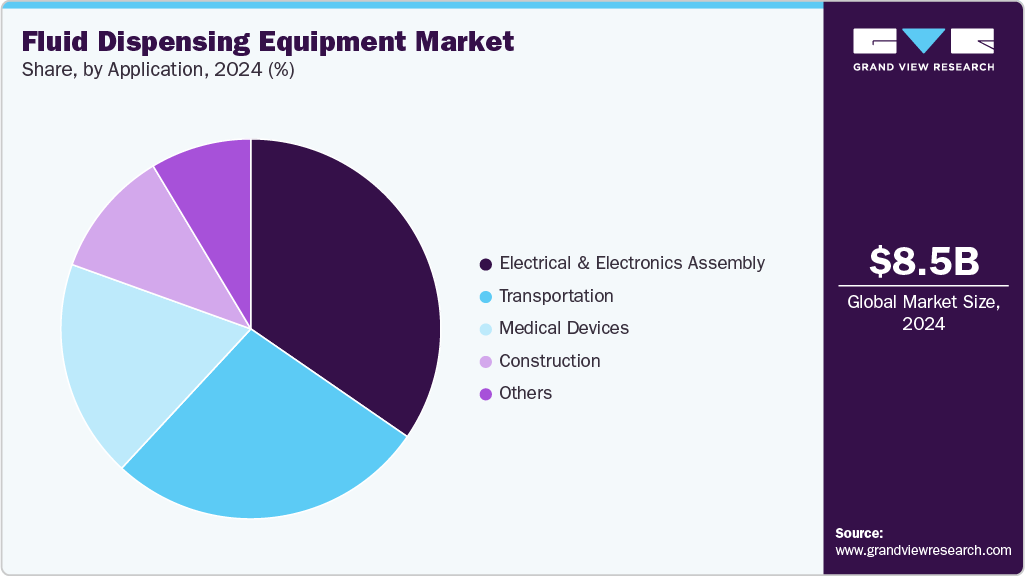

The global fluid dispensing equipment market size was estimated at USD 8,545.9 million in 2024 and is projected to reach USD 13,737.4 million by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The growing demand for miniaturized and high-precision components in electronics and medical devices is accelerating the adoption of advanced fluid dispensing systems.

Key Market Trends & Insights

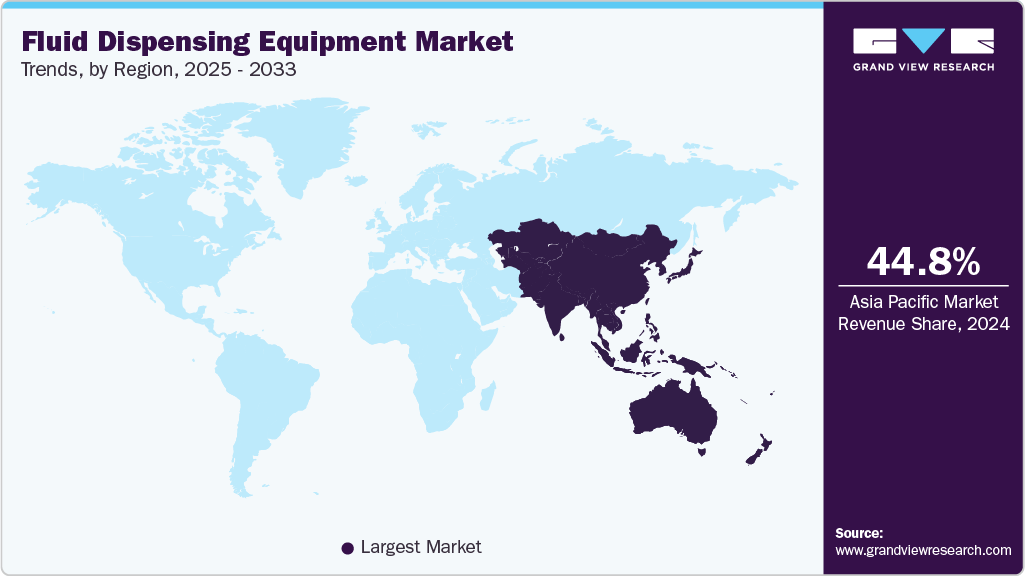

- Asia Pacific dominated the fluid dispensing equipment market with the largest revenue share of 44.8% in 2024.

- The fluid dispensing equipment market in the China is expected to grow at a substantial CAGR of 6.8% from 2025 to 2033.

- By product, the adhesives & sealants segment is expected to grow at the fastest CAGR of 6.0% from 2025 to 2033.

- By application, the transportation segment is expected to grow at the fastest CAGR of 5.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 8,545.9 Million

- 2033 Projected Market Size: USD 13,737.4 Million

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

Manufacturers seek non-contact and micro-dispensing technologies to handle complex assemblies with higher accuracy. Rising use of adhesives, sealants, and lubricants in transportation, aerospace, and renewable energy sectors is fueling demand for controlled dispensing solutions. High-viscosity fluid handling and two-component systems are increasingly critical in structural bonding and battery manufacturing. In addition, stringent quality and traceability standards are prompting the integration of smart dispensing systems. Emerging economies are also seeing growth due to expanding industrialization and infrastructure projects.

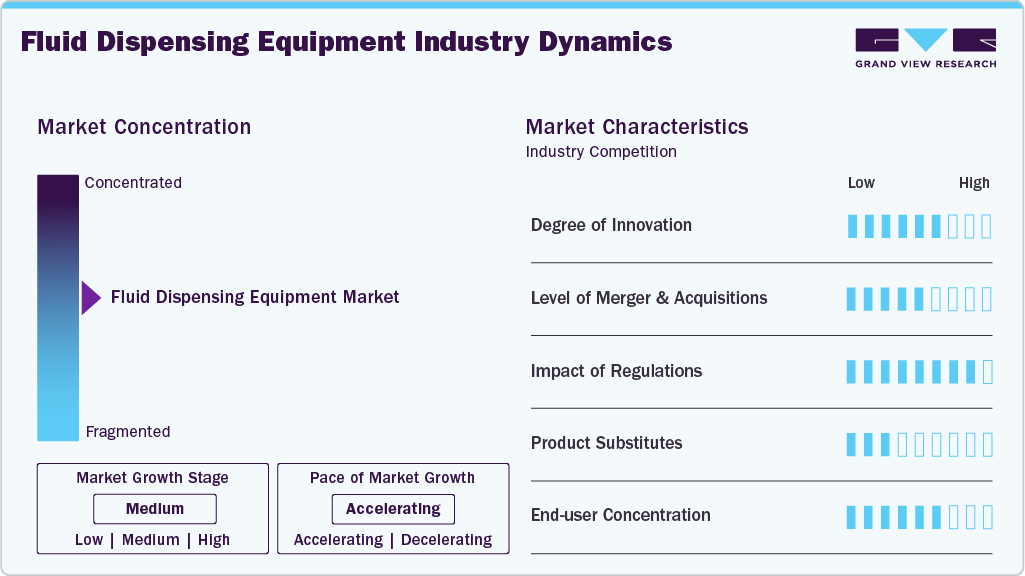

Market Concentration & Characteristics

The global fluid dispensing equipment industry is moderately concentrated, with a few key players holding significant market shares. Some companies dominate due to strong technological capabilities and broad global reach. However, the presence of several regional and niche manufacturers adds a degree of fragmentation. The balance between innovation-driven leaders and specialized local firms keeps competition active.

The fluid dispensing equipment industry is driven by continuous innovation, especially in micro-dispensing, non-contact systems, and automation. Companies are investing heavily in R&D to improve precision, speed, and compatibility with complex materials. Advancements in electronics, medical devices, and EV manufacturing are pushing technical boundaries. Innovation is a key differentiator in gaining market share and meeting evolving application needs.

Mergers and acquisitions are moderately active in this sector, mainly involving larger firms acquiring niche or regional players. These deals help companies expand technology portfolios, enter new markets, and strengthen distribution networks. Strategic acquisitions also enhance capabilities in specialized dispensing for electronics or medical industries. M&A activity reflects the industry's push for consolidation and product line expansion.

Regulations influence the industry mainly through quality, safety, and environmental standards across end-use sectors. In medical and electronics manufacturing, compliance with FDA, ISO, and RoHS is essential for equipment integration. Fluid handling systems must also meet cleanroom or hygienic design standards in sensitive applications. Regulatory compliance encourages manufacturers to adopt more advanced, controlled dispensing technologies.

Drivers, Opportunities & Restraints

The growing demand for precision manufacturing in electronics, transportation, and medical sectors is a key driver for fluid dispensing equipment. Industries are shifting toward automation to enhance efficiency and reduce human error in fluid application. Rising use of adhesives and sealants in product assembly further boosts equipment adoption. In addition, miniaturization trends demand advanced, micro-scale dispensing technologies.

Expanding industrialization in emerging markets presents strong growth potential for equipment manufacturers. Adoption of electric vehicles and renewable energy systems opens new application areas for high-viscosity and 2K dispensing systems. Integration of IoT and AI in dispensing solutions creates opportunities for smarter, more efficient operations. Customization and modular system designs are also gaining traction across end-use industries.

High initial investment costs for advanced dispensing systems can limit adoption, especially among small and mid-sized manufacturers. Variability in raw material properties and fluid behavior poses challenges for standardizing equipment performance. Limited technical expertise in handling automated systems may slow adoption in certain regions. In addition, fluctuating demand in key end-use sectors can impact market stability.

Product Insights

The adhesives and sealants segment led the market with the largest revenue share of 32.9% in 2024, due to their widespread use in electronics, transportation, and industrial assembly. These materials require precise application to ensure strong bonding, leak prevention, and product integrity. High-viscosity fluid handling systems are crucial for consistent performance. Their versatility and critical role in structural and functional applications drive consistent demand.

The conformal coatings segment is anticipated to witness at the fastest CAGR during the forecast period, as electronic components become more compact and sensitive. These coatings protect against moisture, dust, and chemical exposure, which is essential for durability and reliability. Increasing use of PCBs in transportation and consumer electronics is driving their adoption. Advanced dispensing systems enable uniform application across complex geometries, enhancing performance.

Application Insights

The electrical and electronics assembly segment led the market with the largest revenue share of 34.6% in 2024, due to high demand for precision in component placement and bonding. Fluid dispensing equipment ensures accurate application of adhesives, sealants, and coatings on densely packed PCBs. The need for miniaturization and reliability in smartphones, wearables, and consumer electronics drives usage. Automation in assembly lines further boosts equipment deployment in this sector.

The transportation segment is anticipated to grow at the fastest CAGR during the forecast period, fueled by advancements in electric vehicles, aerospace, and railway manufacturing. These industries require high-performance adhesives, sealants, and lubricants for bonding, sealing, and component protection. The shift toward lightweight materials and improved safety features increases the demand for precise dispensing technologies. Moreover, automation in production lines ensures efficiency and consistency, supporting rapid market expansion.

Regional Insights

The fluid dispensing equipment market in North America is anticipated to grow at a substantial CAGR of 4.8% during the forecast period, due to advanced manufacturing capabilities and strong demand from electronics and medical sectors. The U.S. is a key contributor, driven by automation adoption and R&D investments. Major players have established production and support centers across the region. The presence of high-tech industries sustains steady equipment demand.

U.S. Fluid Dispensing Equipment Market Trends

The fluid dispensing equipment market in the U.S. dominates the North American market in 2024, due to its strong base in electronics, transportation, and medical device manufacturing. High automation levels and early adoption of advanced dispensing technologies drive demand. The presence of leading manufacturers and R&D centers further strengthens its position. Regulatory standards in healthcare and electronics also support consistent market growth.

The Canada fluid dispensing equipment market is experiencing steady growth, driven by expanding manufacturing and technology sectors, coupled with increasing government initiatives for industrial innovation. The country’s investments in clean energy and EV infrastructure are boosting demand for precision fluid handling. Growth in medical equipment and electronics assembly also supports equipment adoption.

Europe Fluid Dispensing Equipment Market Trends

The fluid dispensing equipment market in Europe holds a significant share owing to its robust transportation, aerospace, and electronics manufacturing base. Countries like Germany and France lead in adopting high-precision dispensing technologies. Environmental regulations also push industries toward cleaner, efficient fluid handling systems. Innovation and compliance needs drive continuous upgrades in dispensing solutions.

The Germany fluid dispensing equipment market is a key market in Europe due to its leadership in transportation and industrial automation. High demand for precise adhesive and sealant application supports the use of advanced dispensing systems. The country's strong focus on innovation and Industry 4.0 initiatives drives equipment upgrades. Growing use of electronics in vehicles further fuels market expansion.

The fluid dispensing equipment market in UK is growing steadily, supported by investments in medical devices, electronics, and aerospace manufacturing. Increased demand for reliable and efficient fluid application tools drives equipment adoption. The push for sustainable and high-performance products encourages the use of advanced dispensing technologies.

Asia Pacific Fluid Dispensing Equipment Market Trends

Asia Pacific dominates the fluid dispensing equipment market with the largest revenue share of 44.8% in 2024, due to large-scale electronics and semiconductor production, especially in China, Japan, and South Korea. Rapid industrialization and the expansion of EV manufacturing further boost demand. Cost-effective production and growing automation in developing nations enhance regional growth. Government support for tech manufacturing strengthens market presence.

The fluid dispensing equipment market in China is experiencing rapid growth due to its dominance in electronics and semiconductor manufacturing. The expansion of EV production and consumer electronics drives demand for high-precision dispensing solutions. Government support for automation and smart factories accelerates the adoption of advanced systems. Domestic players and foreign investments continue to strengthen China’s market position.

The India fluid dispensing equipment market is growing steadily, fueled by increasing investments in electronics manufacturing and transportation assembly. Government initiatives like "Make in India" promote local production, boosting demand for fluid handling equipment. The rise in medical device manufacturing also supports the adoption of precision dispensing technologies. Growing awareness of automation benefits is gradually driving industrial upgrades.

Middle East & Africa Fluid Dispensing Equipment Market Trends

The fluid dispensing equipment market in the Middle East and Africa is emerging market for fluid dispensing equipment, led by manufacturing growth in the UAE, South Africa, and Saudi Arabia. Rising demand in the construction, electronics, and packaging industries contributes to market expansion. Government-led industrial diversification is encouraging technological upgrades. However, adoption is still in early stages compared to other regions.

The Saudi Arabia fluid dispensing equipment market is witnessing growth due to its push for industrial diversification under Vision 2030. Investments in manufacturing, electronics, and transportation sectors are increasing the demand for automated dispensing systems. The country's focus on localizing medical device production further supports market expansion. Emerging industrial zones and infrastructure projects are driving equipment adoption across various applications.

Central & South America Fluid Dispensing Equipment Market Trends

The fluid dispensing equipment market in Central & South America is witnessing steady growth, supported by expanding industrial sectors in Brazil and Argentina. Increasing investments in electronics and transportation assembly lines are creating new opportunities. The need for accurate adhesive application in consumer products drives adoption. However, limited infrastructure may slightly slow the pace of high-end system deployment.

The Brazil fluid dispensing equipment market is growing due to the expansion of its transportation, electronics, and packaging industries. Increasing adoption of automation in manufacturing is driving demand for precise fluid application systems. Investments in renewable energy and infrastructure projects are creating new opportunities for equipment use. Local production capabilities combined with imports ensure a steady supply to meet rising needs.

Key Fluid Dispensing Equipment Company Insights

Some of the key players operating in the market include Nordson Corporation., Graco Inc., Musashi Engineering, Inc.

-

Nordson Corporation specializes in precision dispensing and fluid management systems tailored for industrial and electronics manufacturing. It provides equipment for applying adhesives, sealants, coatings, and biomaterials with high accuracy. The company is known for supporting automation in micro-dispensing and surface treatment. Its operations span multiple industries, including packaging, medical devices, and semiconductor assembly. Nordson maintains a global presence through technical centers, service networks, and continuous investment in R&D.

-

Graco Inc. develops and manufactures equipment used to pump, mix, spray, and dispense a wide range of fluids. Its systems are widely applied in construction, transportation, food processing, and general manufacturing sectors. Graco structures its business into dedicated divisions that address contractor, industrial, and process needs. The company emphasizes durable design and technical performance in both portable and integrated systems. With a broad international distributor network, it maintains a strong global footprint.

Key Fluid Dispensing Equipmen Companies:

The following are the leading companies in the fluid dispensing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Nordson Corporation.

- Graco Inc.

- Musashi Engineering, Inc.

- GPD Global.

- Fisnar

- IVEK Corporation

- Henkel Slovenija d.o.o.

- OK International, Inc.

- DOPAG India Pvt Ltd.

- Valco Melton Inc.

- Dymax

- ViscoTec Pumpen- u. Dosiertechnik GmbH

- ITW Dynatec

- Anda Technologies USA, INC.

- INTERTRONICS.

Recent Developments

-

In July 2025, Nordson launched the VersaBlue II Melter, designed for hygiene product manufacturing like diapers and incontinence items. It offers improved adhesive dosing, energy efficiency, and smart connectivity features. The system supports modern protocols like EtherCAT and OPC UA. Its design aims to boost precision and reduce waste in nonwoven applications.

-

In July 2025, Graco Inc. has completed the acquisition of Color Service S.r.l., an Italian company known for automated powder and liquid dosing systems. The deal, valued at USD 71.1 million, strengthens Graco’s presence in precision material handling. Color Service adds specialized dosing technology and global reach. The move supports Graco’s growth strategy in advanced dispensing solutions.

-

In May 2025,Musashi Engineering introduced the HYPER SOLDERJET, a high-speed jet dispenser designed for precise, non-contact solder paste application. It reduces clogging issues and ensures stable performance even on uneven surfaces. The system supports various pastes, including silver and gold. Its design improves accuracy and efficiency in electronics manufacturing.

Fluid Dispensing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,913.4 million

Revenue forecast in 2033

USD 13,737.4 million

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE.

Key companies profiled

Nordson Corporation.; Graco Inc.; Musashi Engineering, Inc.; GPD Global.; Fisnar.; IVEK Corporation; Henkel Slovenija d.o.o.; OK International, Inc.; DOPAG India Pvt Ltd.; Valco Melton Inc.; Dymax; ViscoTec Pumpen- u. Dosiertechnik GmbH; ITW Dynatec; Anda Technologies USA, Inc.; INTERTRONICS.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluid Dispensing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fluid dispensing equipment market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Flux

-

Lubricant

-

Solder Paste

-

Adhesives & Sealants

-

Epoxy Adhesives

-

Epoxy Underfill

-

Others

-

-

Conformal Coatings

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Electrical & Electronics Assembly

-

Semiconductor Packaging

-

Printed Circuit Boards

-

Others

-

-

Medical Devices

-

Construction

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fluid dispensing equipment market size was estimated at USD 8,545.9 million in 2024 and is expected to be USD 8,913.4 million in 2025.

b. The global fluid dispensing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 13,737.4 million by 2033.

b. Electrical and electronics assembly is the leading application segment and accounted for 34.6% share in 2024, due to high demand for precision in component placement and bonding. Fluid dispensing equipment ensures accurate application of adhesives, sealants, and coatings on densely packed PCBs.

b. Some of the key players operating in the fluid dispensing equipment market include Nordson Corporation., Graco Inc., Musashi Engineering, Inc., GPD Global., Fisnar., IVEK Corporation, Henkel Slovenija d.o.o., OK International, Inc., DOPAG India Pvt Ltd., Valco Melton Inc., Dymax, ViscoTec Pumpen- u. Dosiertechnik GmbH, ITW Dynatec, Anda Technologies USA, INC., INTERTRONICS.

b. The fluid dispensing equipment market is driven by rising demand for precision in electronics, transportation, and medical device manufacturing. Growing automation and Industry 4.0 adoption enhance production efficiency and quality. Additionally, the need for accurate application of adhesives, sealants, and coatings supports market growth across diverse industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.