Flow Sensors Market Size, Share & Trends Analysis Report By Type (Liquid, Gas), By Technology (Coriolis, Differential Flow, Vortex), By Application (Automotive, Consumer Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-376-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Flow Sensors Market Size & Trends

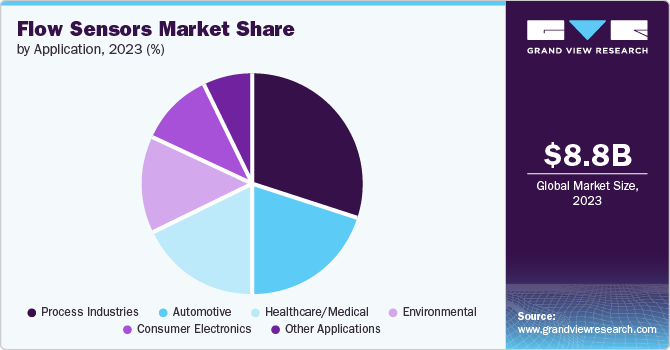

The global flow sensors market size was valued at USD 8.85 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The demand for flow sensors is on the rise in sectors such as oil & gas, water management, and chemical processing, driven by efficient resource allocation, cost savings, and enhanced process stability. The rise in applications and advancement of ultrasonic, electromagnetic, and Coriolis technologies has resulted in a higher utilization of flow sensors.

The adoption of flow sensors across various industries, including power generation, has been driven by their numerous advantages. Flow sensors are increasingly utilized in coal-fired, fuel oil, and natural gas power plants, as well as in geothermal, hydroelectric, and nuclear power facilities. The rise in regulations for controlling toxic gas emissions from power plants has been a key factor contributing to the increased usage of flow sensors. These sensors play a crucial role in monitoring and optimizing the flow of fuels, coolants, and other process fluids to ensure efficient and environment- friendly operations.

Emerging technologies such as Industrial Internet of Things (IIoT), asset management, and advanced diagnostics are facilitating new collaborations between flow sensor users and suppliers. Moreover, advancements in networking, cloud platforms, and service offerings such as data analytics are being leveraged in the strategies of both end-users and manufacturers. These technological innovations are expected to drive further growth and optimization of flow sensor applications across a wide range of industries.

Type Insights

Gas flow sensors accounted for the largest market revenue share of 53.9% in 2023. There has been a significant increase in the need for fossil fuel-derived energy sources to power vehicles due to extensive growth in the automotive sector. This element results in an increase in the market's need for oil & gas. Flow sensors are widely utilized in the oil & gas sector for monitoring flow, identifying leaks, detecting pipe bursts, and measuring the contamination levels of oil & gas. Thus, the rising demand for energy sources derived from fossil fuels contributes to the expansion of flow sensors within the market.

Liquid flow sensors are expected to grow significantly over the forecast period, as technologies such as ultrasonic, electromagnetic, and thermal dispersion are utilized in these sensors to precisely gauge the flow rate of liquids. They are crucial in guaranteeing accuracy in fluid management procedures, enabling automation, and maximizing resource usage. Various factors such as the rising need for process automation in different industries, strict regulations in healthcare and food processing for fluid management, and a focus on resource efficiency are fueling the market for liquid flow sensors.

Technology Insights

Differential flow accounted for the largest market revenue share of 34.6% in 2023 as these sensors offer high accuracy in measuring flow rates by comparing differential pressures across a flow section. This method provides precise measurements even in varying conditions and low flow rates, making them suitable for a wide range of applications where accuracy is critical. These sensors can be used across various industries such as automotive, aerospace, pharmaceuticals, and process industries.

Ultrasonic technology is expected to register the fastest CAGR of 8.1% over the forecast period. Improvements in signal processing technology have led to better noise reduction, ultimately enhancing the accuracy of flow metering measurements. This enhancement adds to the increasing use of ultrasonic flow meters and their broad implementation in different industries.

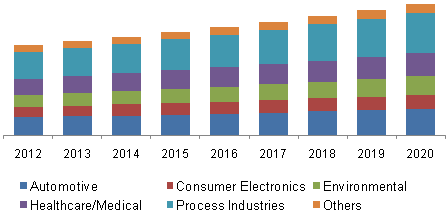

Application Insights

In 2023, process industries accounted the largest market share of 30.4%. Process industries include power generation, energy production, food processing, and mining operations. There is a growing utilization of flow sensors in various industries such as oil & gas, chemical plants, pulp & paper, and water treatment. Industries require durable sensors for tough conditions.

Environmental applications of flow sensors are expected to register the fastest CAGR of 7.0% from 2024 to 2030 due to factors including the extensive use of environmental sensors in industrial and manufacturing sectors, strict government regulations on pollution control, and the increasing demand for environmental sensors to enhance agricultural productivity.

Regional Insights

North America flow sensors market led the global flow sensors market with a total revenue share of 34.5% in 2023 due to well-established oil & gas, chemicals, and power generation sectors. North America has led the way in implementing advanced manufacturing infrastructure utilizing industrial internet of things methods. Companies set up and uphold an operational process spanning control methods, manufacturing, and business processes.

U.S. Flow Sensors Market Segment Trends

The U.S. flow sensors market dominated North America with a share of 85.6% in 2023 due to a growing economy with the country projected to maintain its strong role as a chemical exporter and a recovering manufacturing industry are also forecasted to boost the expansion of this market. The U.S. Department of Energy predicts that the hydropower industry is likely to increase from 101 GW to around 150 GW by 2050.

Europe Flow Sensors Market Trends

Europe flow sensors market has emerged in the flow meter market, having the biggest portion. The region hosts various long-standing sectors such as oil & gas, chemical processing, water management, and pharmaceuticals, all of which heavily rely on flow meters. The strong industrial infrastructure in Europe creates a need for flow meters. In addition, Europe enforces strict regulations and standards to ensure process optimization, safety, and environmental compliance.

Flow sensors market in the UK is expected to grow rapidly in the coming years due ongoing advancements in flow meter technologies. This allows producers in the country to provide cutting-edge and top-notch flow meter solutions, drawing in customers from both the region and worldwide.

Asia Pacific Flow Sensors Market Trends

Asia Pacific flow sensors market is anticipated to witness significant growth over the forecast period. Rapid urbanization and industrialization have raised pollution levels and may result in environmental issues. Asian Pacific governments have put in place strict regulations and policies to reduce pollution, including India's National Clean Air Program (NCAP), South Korea's Special Measures Act on decreasing fine dust, and Japan's Clean Air Act. In Addition, Japan is enhancing environmental awareness with the Act Promoting Measures to Address Global Warming.

The flow sensors market in Japan is poised to experience rapid growth, driven by the country’s industrial automation and manufacturing sectors. The automotive industry, a vital component of Japan's economy, is a major consumer of flow sensors, which are used to optimize processes, reduce costs, and enhance efficiency. Japan's efforts to develop smart cities, infrastructure, and reduce greenhouse gas emissions are contributing to the growing demand for flow sensors. Furthermore, advancements in sensor technology, such as IIoT and data analytics, are enhancing the accuracy, reliability, and affordability of flow sensors.

Key Flow Sensors Company Insights

The flow sensors market is shaped by a mix of established leaders and agile newcomers. Some key players in the market are Emerson Electric Co.; Flowserve Corporation; Schlumberger Limited (SLB); Crane Co.; Valmet; KITZ Corporation; and IMI PLC. Collaboration between users and suppliers is increasing, facilitated by IIoT and advanced diagnostics.

-

Emerson Electric Co. is a provider of industrial valves and flow sensors, offering a wide range of critical flow control solutions across oil & gas, power, chemicals, and water/wastewater industries. Its products include actuators, valves, and advanced flow measurement instruments, with a focus on innovation and digital transformation.

-

Flowserve is a provider of industrial valves and flow control equipment, serving oil & gas, power, chemical, and process industries. Its products include valves, pumps, seals, and automation technologies to optimize operations, reduce emissions, and enhance sustainability.

Key Flow Sensors Companies:

The following are the leading companies in the flow sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Rechner Sensors

- Proxitron GmbH

- Siemens AG

- Sika AG

- First SensorAG

- EmersonElectric Co.

- SICK AG

- OMEGA Engineering

- Christian Bürkert GmbH & Co. KG

- TSI

Recent Developments

-

In June 2024, Flowserve and Heide Refinery announced a partnership to implement Flowserve's Energy Advantage Program, aiming to reduce energy consumption and carbon emissions. The program's initial phase estimated a 2,000 MWh power reduction, leading to 1,300 metric tons of CO2 savings.

-

In February 2024, Panasonic released its ultrasonic flow and concentration meter for hydrogen in China. This product measures hydrogen flow, concentration, and temperature, pressure, and humidity simultaneously, with a broad measurement range and digital/analog output capabilities.

-

In August 2023, Emerson announced the acquisition of Flexim, a German company specializing in ultrasonic flow measurement technology. The deal expanded Emerson's intelligent devices portfolio and measurement capabilities, with Flexim's technology complementing Emerson's existing flow measurement positions. The transaction is expected to close by the end of 2023.

Flow Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.40 billion |

|

Revenue forecast in 2030 |

USD 13.68 billion |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Rechner Sensors; Proxitron GmbH; Siemens AG; Sika AG; First SensorAG; EmersonElectric Co.; SICK AG; OMEGA Engineering; Christian Bürkert GmbH & Co. KG; TSI |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flow Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow sensors market report based on type, technology, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Gas

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Coriolis

-

Differential Flow

-

Ultrasonic

-

Vortex

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Environmental

-

Healthcare/Medical

-

Process Industries

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."