Flow Meter Market Size, Share & Trends Analysis Report By Product, By Power Type (Electric, Solar, and Battery Powered), By Application, By Pipe Size (2 inches, 4 inches, 6 inches), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-150-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Flow Meter Market Size & Trends

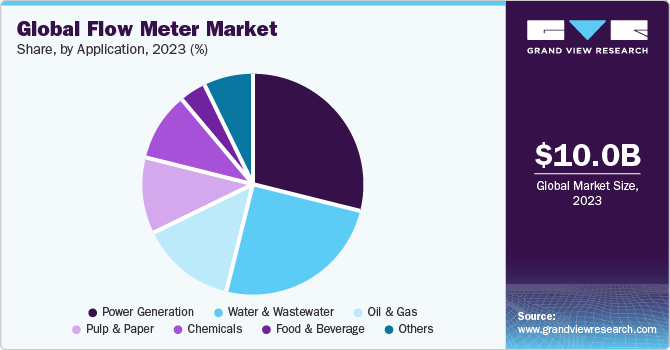

The global flow meter market size was valued at USD 10.02 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. The market shipment size was valued at 53,78,749 units in 2020. The increasing demand for flow rate measurement in O&G management applications across the globe is expected to drive the growth of the market over the forecast period. The adoption of measurement technologies and instruments would also gain traction in other sectors, such as water and wastewater, power generation, and pulp and paper over the forecast period. The adoption of products would be particularly significant in the O&G, and chemical and petroleum refinery sectors owing to the recent detection of shale gas reserves in North America, Europe, and the Asia Pacific.

The demand for intelligent systems is expected to increase over the foreseeable period as the integration of IoT has led to the introduction of smart measurement solutions. The demand for the Coriolis flowmeter is estimated to increase on account of its enhanced smart capabilities to measure the rate more accurately. The players in the market are mainly targeting the O&G sector and investing aggressively to offer innovative products and solutions to measure the flow rate of liquids, gases, and vapors. Additionally, custody transfer in the oil and gas sector is one of the key applications creating lucrative opportunities for ultrasonic and Coriolis flowmeters.

Advancements in technologies such as wireless monitoring and control, advanced sensors, and digital readouts are expected to drive the growth of the market over the forecast period. Manufacturers of the product are increasingly adopting the Internet of Things (IoT) sensors for smart metering solutions. The advanced approach of IoT enables automatic meter reading, which collects data automatically and remotely. Owing to such technological developments in products, the market is expected to grow at a significant rate from 2024 to 2030. However, the calibration of the product is a time-consuming process, which is expected to pose a challenge for market growth.

Rapid urbanization across developing countries in the Asia Pacific drives the need for adequate water and wastewater management and power generation. As a result, the demand for the product in water and wastewater applications is expected to be high in the region. However, labor skill issues regarding operational processes of smart systems along with high initial costs associated with these advanced products are a few factors that could hamper the growth of the flow meter market. Similarly, the lack of adequate calibration facilities in the MEA region and the political instability in the region are factors affecting the growth of the regional market.

In the wake of the recent COVID-19 outbreak, there has been a significant disturbance in most industries across the globe. Industries such as oil and gas, chemicals, metals and mining, pulp and paper, and food and beverages globally have been adversely impacted in the pandemic due to the disruption of the supply chain, closedown of plants, and a subsequent decline in demand for products offered by these industries. Similarly, the outbreak in its initial phase significantly impacted the overall market as these were less adopted by the abovementioned industries for the short term.

Market Concentration & Characteristics

The market growth stage in the flow meter market is high, and the pace of the market growth is accelerating. These key players typically include established companies with extensive product portfolios, strong brand recognition, and wide geographic presence. While numerous manufacturers and suppliers are operating in the flow meter market, a handful of major players tend to command a larger share of the market due to their competitive advantages, such as technological expertise, diversified product offerings, and established customer relationships.

The flow meter market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain high market share and the need to consolidate in a rapidly growing market.

While flow meters are widely used for measuring the flow rate of fluids in various industries, there are some alternatives or substitutes that can serve similar purposes in certain applications. One alternative to traditional flow meters is the use of ultrasonic sensors, which utilize sound waves to measure flow velocity. These sensors can be non-invasive and offer advantages in applications where contact with the fluid is undesirable or difficult.

Market concentration plays a pivotal role in the flow meter market. While there is a diverse range of flow meter companies operating globally, the market features a considerable number of smaller and regional players catering to niche segments or specific industries, contributing to competition and diversity within the market landscape. Overall, while market concentration may vary by region and industry segment, the flow meter market remains dynamic and competitive, driven by ongoing innovation, regulatory requirements, and evolving customer needs.

Product Insights

The magnetic flowmeters segment held the largest revenue share of approximately 26.17% of the total market share in 2023. The product has further been classified into wired and wireless magnetic flowmeters. Ultrasonic segments are anticipated to witness a high growth rate exceeding 7.3% from 2024 to 2030. These flowmeters feature the integration of IoT, leading to smart flow rate measurement solutions.

Differential pressure (DP) and positive displacement (PD) flowmeters are conventional products for measuring rates. On the other hand, a magnetic flowmeter is ideal for measurement applications in sectors such as pulp and paper, petrochemicals, food and beverage, and chemicals and petroleum refinement owing to the reliability, accuracy, and cost-effectiveness of these meters. As a result, the magnetic segment is expected to gain a significant market share through 2030. Product innovations such as two-wired and clamp-up products and wireless magnetic meters (also known as magmeters) have created additional opportunities for the adoption of magnetic flow meters. These systems are widely used in applications such as power generation, oil and gas, and water and wastewater management.

Power Type Insights

The battery-powered segment held the largest revenue share of approximately 45.6% of the total market share in 2023. The solar power type segment is anticipated to witness a high growth rate exceeding 7.4% from 2024 to 2030. Solar power systems are very effective in remote locations where regular power supply is unavailable; similarly, they are a clean source with fewer expenses. A solar power system primarily comprises the solar panel, battery, enclosure, and charge regulator.

Battery-powered systems are primarily used across the global market due to ease of use, portability, and rechargeable batteries. These rechargeable products are economical and are preferred for applications entailing high power. They have a low energy density, making them compatible with applications, such as handheld devices requiring compact battery size. These batteries are charged with high speed and less stress and provide a longer shelf life. They perform well under rigorous working conditions and are relatively low in cost.

Application Insights

The oil and gas segment is expected to emerge as the fastest-growing segment, registering a CAGR of 6.4% from 2024 to 2030 owing to the rapid growth of the industry. The development of shale gas reserves is also expected to boost the demand for the product in the oil and gas (O&G) and chemical and petroleum refinement sectors. Flow meters are an effective solution to measure the rate of upstream and downstream processes, custody transfer, and liquid hydrocarbons within the O&G and chemical industries.

Countries in the Asia Pacific region, such as China, India, and Southeast Asian countries, are witnessing rapid urbanization and industrial development. This has triggered the need for adequate power generation, water supply, and wastewater treatment. Moreover, with the increasing population, approximately 34.0 billion gallons of wastewater are processed per day in the U.S. alone, according to the Environmental Protection Agency (EPA). Government investments in wastewater treatment plants are significant in the North American and European regions. As a result, the water and wastewater segment accounted for a share of around 25.33% of the total market and is anticipated to register a CAGR exceeding 6.1% from 2024 to 2030.

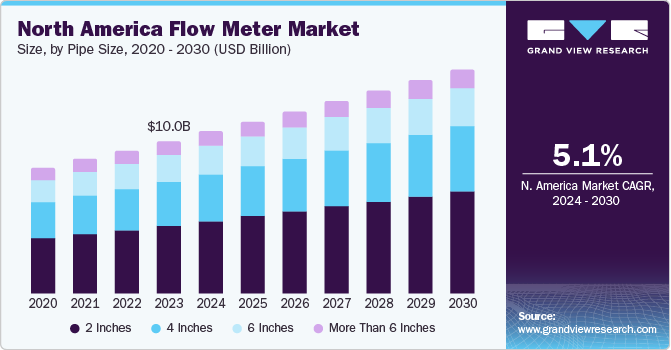

Pipe Size Insights

The 2-inch pipe size segment held the largest revenue share of approximately 44.73% of the total market share in 2023 and is anticipated to witness a high CAGR exceeding 5.9% from 2024 to 2030. The precise pipe size is most important for any product because a distorted fluid velocity profile (swirl) is one of the common reasons for product inaccuracy. Swirls or other distortions in the flow are caused by various connecting instruments such as elbows, tees, and valves.

To maintain accuracy and reduce flow distortions there are a few piping requirements regarding the profile of the fluids/materials passing through the system. If the length of the pipe is not precise, the materials (solid/liquid/gas) flowing through it may lose their characteristics (temperature, pressure, moisture, among others); and result in an inaccurate reading. Flowmeter manufacturers and experts suggest specific pipe size requirements that vary based on flow meter technology and material (solid/liquid/gas).

Regional Insights

Some of the prominent market players in North America include General Electric; Emerson Electric Corporation; and Honeywell International Inc.; therefore, the region holds a significant market share in terms of revenue.

U.S. Flow Meter Market

The flow meter market in the U.S. is expected to account for a significant revenue share in the North America flow meter market. The adoption of digitalization and IoT-enabled flow meters is on the rise, allowing for remote monitoring, predictive maintenance, and real-time data analytics, further driving market growth in the U.S.

Europe Flow Meter Market Trends

Europe dominated the market and accounted for over 35.37% of the global revenue share in 2023, followed by North America. In Europe, the adoption of systems is high in the power generation segment, contributing to the regional market growth. The demand for magnetic, ultrasonic, and Coriolis flow meters for O&G management is expected to increase in the region. Europe is home to numerous manufacturers and providers of flow rate measurement products and solutions, such as Endress+Hausar AG, Krohne Messtechnik GmbH, and ABB Ltd. Therefore, Europe accounted for the largest market share in 2020, and this trend is expected to continue through the forecast period.

The flow meter market in the U.K. is expected to account for a significant revenue share in the Europe flow meter market. The UK flow meter market is characterized by steady growth driven by several factors. Increased emphasis on water conservation and environmental protection has spurred demand for flow meters in industries such as water and wastewater management, where precise measurement is essential for efficient resource utilization.

Germany flow meter market is expected to account for a significant revenue share in the Europe flow meter market. The strong manufacturing sector, particularly in industries like oil and gas, chemicals, and pharmaceuticals, has contributed to the demand for flow meters for process monitoring and control applications.

The flow meter market in France is expected to account for a significant revenue share in the Europe flow meter market. Technological advancements, such as the integration of digital and wireless technologies into flow metering systems, have also played a significant role in shaping the France flow meter market landscape, offering enhanced accuracy, reliability, and remote monitoring capabilities.

APAC Flow Meter Market Trends

APAC is anticipated to witness a substantial CAGR exceeding 7.1% from 2024 to 2030. The market in India and China is expected to witness significant growth over the forecast period owing to continuous developments in the water and wastewater management sector.

The flow meter market in China is expected to account for a significant revenue share in the Asia Pacific flow meter market. The flow meter market in China is experiencing robust growth driven by various factors. China's rapid industrialization and urbanization have led to increased demand for flow meters across industries such as oil and gas, water and wastewater management, chemicals, and pharmaceuticals.

India flow meter market is expected to account for a significant revenue share in the Asia Pacific flow meter market. The country's focus on infrastructure development, particularly in sectors like energy, utilities, and construction, has further fueled the demand for flow meters for monitoring and controlling fluid flow in pipelines, plants, and facilities.

The flow meter market in Japan is expected to account for a significant revenue share in the Asia Pacific flow meter market. Stringent environmental regulations from the Japanese government aimed at curbing pollution and ensuring resource conservation have mandated the use of flow meters for accurate measurement and management of water, air, and other fluids.

Brazil Flow Meter Market Trends

The flow meter market in Brazil is expected to account for a significant revenue share in the Latin America flow meter market. Technological advancements, including the adoption of smart meters and digitalization of flow measurement systems, have also contributed to the market's growth by offering improved accuracy, efficiency, and data management capabilities.

Saudi Arabia (KSA) Flow Meter Market Trends

The flow meter market in Saudi Arabia (KSA) is expected to witness noticeable growth in the coming years. Expanding industrial base, growing infrastructure needs, and increasing emphasis on environmental sustainability, the flow meter market in Saudi Arabia (KSA) presents significant opportunities for manufacturers and suppliers.

Key Flow Meter Company Insights

The key market players engage in strategies such as partnerships, business expansions, new product developments, and contracts to expand their market share. Companies are focusing on strategic geographic expansions through partnerships & collaborations and mergers and acquisitions. Additionally, industry players are continually investing in R&D to develop differentiated products and stay ahead of the competition. The report also includes a competitive landscape for a holistic understanding of the rivalry among the industry players.

Some prominent players in the market include ABB Ltd., Emerson Electric Corporation, General Electric, Krohne Messtechnik Gmbh, HÖNTZSCH GMBH & CO. KG, Hitachi High-Tech Corporation, and Siemens.

-

ABB Ltd, is a global technology company specializing in robotics, automation, electrification, and digitalization solutions for industries such as utilities, transportation, infrastructure, and manufacturing.

-

KROHNE Messtechnik GmbH is a leading global manufacturer and supplier of industrial process instrumentation and measurement solutions. The company specializes in the development and production of flow meters, level meters, temperature meters, pressure meters, and analytical instruments for various industries such as oil and gas, water and wastewater, chemicals, food and beverage, pharmaceuticals, and more.

FloRight Solutions and FlowGenix. are some of the emerging market participants in the target market.

-

FloRight specializes in the design and production of cutting-edge flow meters for various industrial applications, including oil and gas, chemical processing, and water management.

-

FlowGenix is a U.S.-based company that specializes in the development and production of innovative flow measurement solutions for a wide range of industries, including oil and gas, water and wastewater management, and pharmaceuticals.

Key Flow Meter Companies:

The following are the leading companies in the flow meter market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these flow meter companies are analyzed to map the supply network.

- ABB Ltd.

- Emerson Electric Corporation

- em-tec GmbH

- Endress+Hausar AG

- General Electric

- Hitachi High-Tech Corporation

- Honeywell International Inc.

- HÖNTZSCH GMBH & CO. KG

- Krohne Messtechnik Gmbh

- Siemens

- Yokogawa Electric Corporation

Recent Developments

-

In January 2021, Badger Meter, Inc. announced the acquisition of Analytical Technology, Inc., a global provider of water quality monitoring systems. This acquisition is expected to help the company enhance its customer base in the U.S. market.

-

In September 2019, Krohne Messtechnik GmbH announced the strategic joint venture with Samson AG. Post joint venture Krohne Messtechnik GmbH announced its product innovation that unites valve and measuring technology with unique diagnostics and control functions in one device.

-

In December 2017, Hitachi High-Tech Corporation entered into a strategic partnership agreement with Flutura Business Solutions Pvt. Ltd. (U.S.), an Industrial IoT company. This collaboration helped the former provide cost-efficient solutions to customers. Additionally, industry players are continually investing in R&D to develop differentiated products and stay ahead of the competition.

Flow Meter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 10.02 billion |

|

Revenue forecast in 2030 |

USD 14.66 billion |

|

Growth Rate |

CAGR of 5.5% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, power type, pipe size, region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil |

|

Key companies profiled |

ABB Ltd.; Emerson Electric Corporation; em-tec GmbH; Endress+Hausar AG; General Electric; Hitachi High-Tech Corporation; Honeywell International Inc.; HÖNTZSCH GMBH & CO. KG; Krohne Messtechnik Gmbh; Siemens; Yokogawa Electric Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flow Meter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented global flow meter market report based on product, application, power type, pipe size, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Differential Pressure (DP)

-

Positive Displacement (PD)

-

Magnetic

-

Wired

-

Wireless

-

-

Ultrasonic

-

Coriolis

-

Turbine

-

Vortex

-

Others

-

-

Power Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Electric

-

Solar

-

Battery Powered

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Water & Wastewater

-

Oil & Gas

-

Chemicals

-

Power Generation

-

Pulp & Paper

-

Food & Beverage

-

Others

-

-

Pipe Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

2 inches

-

4 inches

-

6 inches

-

More than 6 inches

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global flow meter market size was estimated at USD 8.29 billion in 2020 and is expected to reach USD 8.82 billion in 2021. The global flow meter market shipment size was valued at 53,78,749 units in 2020.

b. The global flow meter market is expected to grow at a compound annual growth rate of 5.7% from 2021 to 2028 to reach USD 12.99 billion by 2028.

b. Europe dominated the flow meter market with a share of 36.29% in 2020. This is attributable to the presence of a large number of manufacturers and providers of flow rate measurement products and solutions in the region such as Endress+Hausar AG, Krohne Messtechnik GmbH, and ABB Ltd.

b. Some key players operating in the flow meter market include ABB Ltd, Emerson Electric Corporation, General Electric, Krohne Messtechnik GmbH, HÖNTZSCH GMBH & CO. KG, and Siemens.

b. Key factors that are driving the flow meter market growth include increasing demand for flow rate measurement in oil and gas management applications and the growing popularity of intelligent flow meters.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."