Flow Imaging Microscopy Market Size, Share & Trends Analysis Report By Technology (Dynamic Image Analysis, Static Image Analysis), By Sample (Large Molecule, Small Molecule, Liquid Sample), By End-use, By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-350-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Flow Imaging Microscopy Market Trends

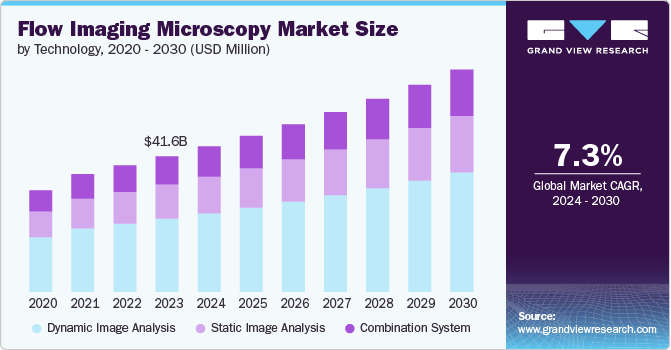

The global flow imaging microscopy market size was valued at USD 41.64 million in 2023 and is projected to grow at a CAGR of 7.31% from 2024 to 2030. Factors contributing to the growth include technological advancements, increasing applications across various industries, rising demand for automated imaging solutions, and the growing focus on research and development activities. For instance in April 2023, Nikon Corporation introduced the ECLIPSE Ui digital imaging microscope for medical use in Japan through its subsidiary, Nikon Solutions Co., Ltd. This innovative microscope lacks an eyepiece lens, enhancing pathologists’ comfort and enabling image sharing on displays, streamlining pathological observation processes.

Advancements in imaging technology, such as the integration of artificial intelligence and machine learning algorithms, significantly enhanced the capabilities of flow imaging microscopy systems. These technological advancements improved image quality, higher throughput, and enhanced data analysis capabilities. For instance, in October 2023, Olympus unveiled the FV4000MPE multiphoton and FLUOVIEW FV4000 confocal laser scanning microscopes, which comprise advancements in imaging technology. These microscopes bear reduced noise, higher precision, and improved sensitivity, setting a new standard for scientific imaging and enabling researchers to make novel discoveries.

The shift towards personalized medicine has led to growing demand for flow imaging microscopy among researchers. As customized medicine gains prominence in healthcare, there is a growing need for advanced imaging techniques that can provide detailed insights into individual patient characteristics at a cellular level. Flow imaging microscopy enables researchers and clinicians to rapidly analyse cell populations, supporting personalized treatment strategies based on specific patient profiles.

Technology Insights

Dynamic image analysis segment held the largest revenue share of 53.95% in 2023. This can be attributed to the growing demand for advanced imaging techniques that can provide real-time, high-resolution visualization and quantitative analysis of particles, cells, and other microscopic objects. For instance, Yokogawa Fluid Imaging Technologies, Inc developed the FlowCam system, which utilizes dynamic image analysis to rapidly acquire digital images of particles and analyse their size, shape, and other morphological features.

The static image analysis segment is expected to witness fastest market growth due to increasing demand for high-resolution imaging and analysis capabilities in various industries, such as pharmaceuticals, biotechnology, and research institutions. Advancements in software algorithms enhanced the accuracy and efficiency of static image analysis systems, further driving their adoption. For instance, Sysmex Corporation’s flow imaging microscope system enables precise particle measurement and morphology analysis in environmental monitoring and material science fields.

Sample Insights

The large molecule segment held the largest revenue share of 52.64 in 2023. Large molecules, such as proteins, antibodies, and polymers, are crucial in the pharmaceuticals, biotechnology, and food and beverage industries. The increasing demand for biopharmaceuticals and protein-based therapeutics significantly boosted the adoption of flow imaging microscopy for analysing these large molecules.

The liquid sample segment is experiencing the fastest-growing share of the market. This can be attributed to the increasing demand for analysing and characterizing particles, cells, and other microscopic objects suspended in liquid media across various applications. Flow imaging microscopy becomes increasingly important in environmental monitoring applications, such as analysing water samples to identify microplankton or other particulates. As the need for advanced analytical tools to study microscopic objects in liquid media continues to grow across various industries, the demand for flow imaging microscopy systems capable of handling liquid samples is expected to increase, driving the growth of this segment in the market.

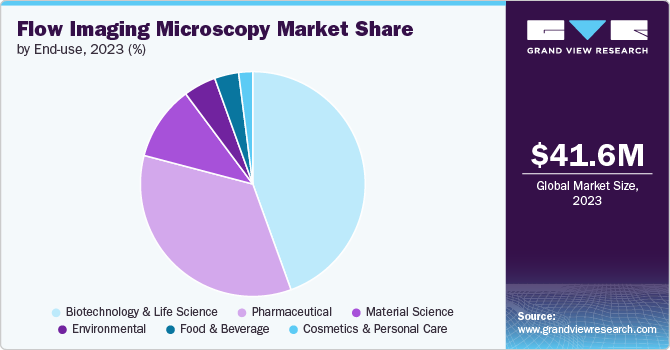

End-use Insights

The biotechnology and life science segment held the largest revenue share of 44.47% in 2023 due to the increasing demand for advanced imaging techniques in drug discovery and development processes. Flow imaging microscopy allows researchers to analyse particles, cells, and microorganisms in real-time, aiding in identifying potential drug candidates and understanding their behaviour at a microscopic level.

The environmental segment is project to grow with the fastest CAGR. This is attributed the increasing focus on environmental monitoring and analysis in various industries, such as pharmaceuticals, food and beverages, and water treatment.

Regional Insights

North America flow imaging microscopy market accounted for 45.79% share in 2023. The market is driven by the increasing adoption of these advanced imaging systems in pharmaceutical and biotechnology research and the growing prevalence of chronic diseases. For instance, in February 2024, a report published by the Centers for Disease Control and Prevention (CDC) found that over 60% of adults in the U.S. have at least one chronic condition, fuelling the demand for more accurate and efficient diagnostic tools such as flow imaging microscopy.

U.S. Flow Imaging Microscopy Market Trends

The flow imaging microscopy market of the U.S. is a critical player in the global industry, with a robust healthcare system and a strong emphasis on research and innovation. The country’s regulatory environment, led by the FDA, sets stringent standards for medical devices, including flow imaging microscopy systems. This regulatory framework influences market trends by ensuring product quality and safety for patients. Technological advancements such as automation, artificial intelligence integration, and enhanced data analytics capabilities are shaping the landscape of flow imaging microscopy in the US market.

Europe Flow Imaging Microscopy Market Trends

Europe flow imaging microscopy market is experiencing steady growth, driven by the region's strong focus on pharmaceutical and biopharmaceutical research and the increasing adoption of these technologies in clinical diagnostics. The European Union's regulatory framework, which emphasizes alternative methods to animal testing, has also contributed to the market's expansion, as flow imaging microscopy offers a more ethical and reliable approach to particle and cell analysis.

Asia Pacific Flow Imaging Microscopy Market Trends

The flow imaging microscopy market of Asia Pacific is poised for significant growth, fuelled by the rising prevalence of chronic diseases, the increasing investment in research and development, and the growing awareness of the benefits of these advanced imaging systems. Regulatory bodies in Asia Pacific countries focus on harmonizing standards with international regulations to ensure product quality and safety. The prevalence of infectious diseases such as dengue fever and malaria has created a demand for advanced imaging solutions for accurate diagnosis and monitoring of these conditions.

Key Flow Imaging Microscopy Company Insights

Several key players dominate the market, driving growth through the development of innovative products, strategic acquisitions, and partnerships. For instance, in November 2021, Predictive Health Diagnostics Company (PHDC) acquired MUSE Microscopy, a high-value intellectual property portfolio, to enhance its diagnostic capabilities and support better therapeutic outcomes through imaging-based diagnostics.

Key Flow Imaging Microscopy Companies:

The following are the leading companies in the flow imaging microscopy market. These companies collectively hold the largest market share and dictate industry trends.

- Bettersize Instruments

- Bio-Techne

- Anton Paar

- Yokogawa Electric Corporation

- Microtrac MRB

- Micromeritics Instrument Corporation

- Fritsch

- Haver & Boecker

- Spectris

- HORIBA

- Barco NV

Recent Developments

-

In October 2023, Lambert Instruments unveiled the LIFA vTAU, a camera-based Fluorescence Lifetime Imaging Microscope (FLIM) system. The LIFA vTAU is equipped with a Single Photon Avalanche Diode (SPAD) detector capable of capturing up to 100 lifetime images per second and offers support for various imaging modes, such as frequency domain FLIM and time-lapse recordings.

-

In July 2023, EMBL and ZEISS Group International formed a long-term partnership to bridge the gap between early-stage imaging technology development and its practical use in life science research. The partnership benefits both parties by providing access to advanced microscopy technologies and market insights.

Flow Imaging Microscopy Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 44.68 million |

|

Revenue forecast in 2030 |

USD 68.21 million |

|

Growth rate |

CAGR of 7.31% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, sample type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Bettersize Instruments; Bio-Techne; Anton Paar; Yokogawa Electric Corporation; Microtrac MRB; Micromeritics Instrument Corporation; Fritsch; Haver & Boecker; Spectris; HORIBA |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flow Imaging Microscopy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow imaging microscopy market report on the basis of technology, sample type, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Dynamic Image Analysis

-

Static Image Analysis

-

Combination System

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Molecule

-

Small Molecule

-

Liquid Sample

-

Other Samples

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Life Science

-

Pharmaceutical

-

Material Science

-

Environmental

-

Food and Beverage

-

Cosmetics and Personal Care

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global flow imaging microscopy market size was estimated at USD 41.64 million in 2023 and is expected to reach USD 44.68 million in 2024.

b. The global flow imaging microscopy market is expected to grow at a compound annual growth rate of 7.31% from 2024 to 2030 to reach USD 68.21 million by 2030.

b. North America dominated the flow imaging microscopy market with revenue share of 45.79% in 2023. This attributed to increasing adoption of advanced imaging systems in pharmaceutical and biotechnology research and the growing prevalence of chronic diseases.

b. Some key players operating in the flow imaging microscopy market include Bettersize Instruments, Bio-Techne, Anton Paar, Yokogawa Electric Corporation, Microtrac MRB, Micromeritics Instrument Corporation, Fritsch, Haver & Boecker, Spectris, HORIBA

b. Key factors that are driving the flow imaging microscopy market growth include technological advancements, increasing applications across various industries, rising demand for automated imaging solutions, and the growing focus on research and development activities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."