Flow Computers Market Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Product (Wired Flow Computers, Wireless Flow Computers), By End Use (Oil & Gas, Water & Waste Management), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-649-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Flow Computers Market Size & Trends

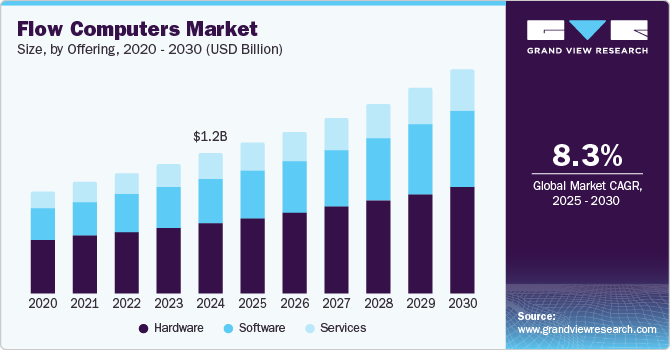

The global flow computers market size was valued at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. The market growth can be credited to the increasing demand for accurate and efficient flow measurement solutions across various industries, including oil and gas, chemicals, water and wastewater management, and food and beverage. The need for precise hydrocarbons and natural gas measurement in the oil and gas sector is critical for operational efficiency, regulatory compliance, and fiscal metering. Flow computers play a vital role in ensuring accurate data collection and analysis, which is essential for optimizing production processes and reducing operational costs.

In addition, technological advancements in flow computing systems have significantly propelled the market growth. For instance, developing more sophisticated and reliable flow computers capable of handling complex calculations and providing high accuracy has attracted significant industry investments. Introducing wireless and solar-powered flow computers has expanded the market, offering more flexible and sustainable solutions for flow measurement. Such advancements have made flow computers more accessible and appealing to a broader range of industries, further driving market expansion.

Moreover, the increasing need for process optimization and operational efficiency across various industries has driven the flow computers market. For instance, chemicals and food and beverage industries require precise flow measurements to maintain product quality and consistency. Flow computers provide accurate and reliable data, enabling better control over production processes and helping to identify and rectify any issues promptly. This leads to improved product quality, reduced downtime, and enhanced overall efficiency.

Offering Insights

The hardware segment dominated the market with a 51.0% share in 2024, owing to the growing demand for precise and reliable flow measurement solutions in oil and gas, chemicals, and other industries. Hardware components, including flow meters and sensors, are essential for accurate data collection and analysis to optimize production processes and ensure regulatory compliance. The oil and gas industry relies on these hardware components for fiscal metering and custody transfer applications.

The software segment is expected to boost over the forecast period owing to the rising need for advanced data analytics and real-time monitoring capabilities. Flow computer software provides sophisticated algorithms and analytics tools that enable industries to process and interpret vast amounts of flow data accurately and efficiently. In addition, the market has witnessed industries increasingly shift towards more automated and interconnected systems surging the demand for software solutions that can integrate seamlessly with existing infrastructure and provide real-time insights. Flow computer software enhances operational efficiency by enabling remote monitoring, predictive maintenance, and automated reporting.

Product Insights

Wired flow computers accounted for the dominant market share in 2024. These computers are essential for calculating, recording, and controlling the flow rate of liquids and gases, ensuring precise measurement and data integrity. In addition, technological innovations in sensor technology, data analytics, and connectivity have enhanced the performance and reliability of flow computers. Integrating Internet of Things (IoT) devices and advanced communication protocols like Modbus and Ethernet has improved real-time data acquisition and remote monitoring capabilities.

Wireless flow computers are projected to grow at a CAGR of 9.5% over the forecast period, reflecting the ongoing trend toward industrial automation. As industries strive to enhance operational efficiency and reduce human intervention, the adoption of automated flow measurement systems has considerably surged. With their robust and reliable performance, wireless flow computers have been rapidly integrated into automated systems for process control and monitoring.

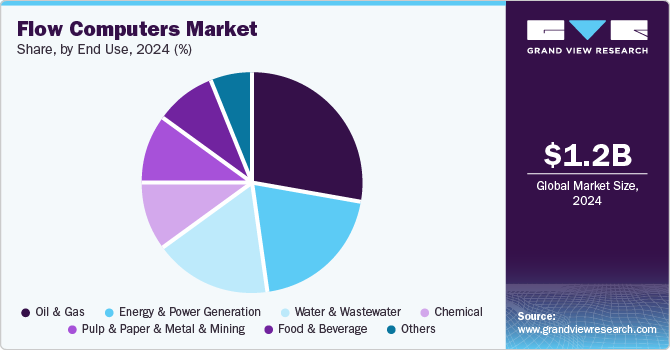

End Use Insights

The oil and gas sector dominated the market with a 27.8% share in 2024. This dominance is attributable to the growing demand for accurate and reliable flow measurement and control systems. Flow computers are essential for ensuring precise measurement of hydrocarbons and natural gas, which is critical for custody transfer, production optimization, and compliance with stringent industry standards. The accuracy provided by flow computers helps minimize discrepancies and financial losses, making them indispensable in the oil and gas industry.

Water & wastewater is expected to emerge as the fastest-growing segment over the forecast period. With growing concerns over water scarcity and the need for sustainable water usage, accurate flow measurement and monitoring have become crucial. Flow computers provide precise data on water flow, helping utilities and industries optimize water usage, detect leaks, and reduce wastage. This is particularly important in regions facing severe water shortages, where efficient water management is essential for environmental and economic reasons.

Regional Insights

The North American flow computers market dominated with a 33.7% share in 2024. It is an important oil and gas production region with extensive upstream, midstream, and downstream activities. Accurate and reliable flow measurement and control systems are critical in these operations, making flow computers essential for ensuring precise data collection, fiscal metering, and regulatory compliance.

U.S. Flow Computer Market Trends

The flow computer market in the U.S. is expected to be driven over the forecast period owing to the increased investments in infrastructure development and modernization projects. Expanding pipeline networks, water and wastewater management systems, and other critical infrastructure require advanced flow measurement and control solutions. Flow computers are essential for monitoring and managing these systems efficiently, ensuring optimal performance and reliability.

Europe Flow Computers Market Trends

The flow computers market in Europe held a 32.5% share in 2024 owing to the region’s stringent regulatory environment, particularly in industries such as oil and gas, water and wastewater management, and chemicals. European regulations mandate precise measurement and monitoring of fluid flows to ensure environmental compliance and operational safety. Flow computers are crucial in meeting these regulatory requirements by providing accurate and reliable flow rate and volume data.

Asia Pacific Flow Computer Market Trends

The Asia Pacific (APAC) flow computer market secured 21.0% of the global revenue share in 2023 owing to rapid industrialization. Countries such as China, India, and Southeast Asian nations have witnessed substantial industrial growth, which increases the demand for accurate and efficient flow measurement solutions. Moreover, the region is home to some of the world’s largest oil and gas reserves, leading to a continuous push for exploration and production activities. Flow computers play a crucial role in these operations by accurately measuring and controlling fluid flows. Additionally, the increasing investments in pipeline infrastructure and the development of new oil and gas projects have further boosted the demand for flow computers in the region.

Key Flow Computers Company Insights

Key market participants include ABB, Emerson Electric Co., SLB, Flowmetrics, and others. These companies have increasingly focused on research and development activities to launch new comprehensive products and retain their market dominance.

-

SLB is a global technology company that provides a wide range of services and products to the energy industry. The company operates through four main divisions: Production Systems, Well Construction, Digital & Integration, and Reservoir Performance. SLB’s offerings include advanced solutions for hydrocarbon production, carbon management, and the integration of adjacent energy systems.

-

Flowmetrics is a prominent manufacturer of flow computers known for its high-quality and reliable flow measurement products. The company offers a comprehensive range of flow meters, including insertion and in-line turbine meters, rotameters, and positive displacement meters.

Key Flow Computers Companies:

The following are the leading companies in the flow computers market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Emerson Electric Co.

- SLB

- Yokogawa Corporation of America

- OMNI Flow Computers, Inc.

- Schneider Electric

- Thermo Fisher Scientific Inc.

- Dynamic Flow Computers, Inc.

- KROHNE Group

- Kessler-Ellis Products (KEP)

- Contrec Ltd.

- TechnipFMC plc

- Flow Systems

- Fluidwell

- FLOWMETRICS

Recent Developments

-

In August 2023, ABB launched I/O series while broadening its XIO series of remote controllers, offering customers more choices to address the digital connectivity challenges in the modern oil and gas industry. The enhanced XIO series features a new Ethernet-to-Serial application, enabling real-time monitoring, improving data accessibility, and enhancing data integrity.

-

In January 2023, Emerson Electric Co. launched the latest generation of flow computers for gas, the FB1000 and FB2000 series.

Flow Computers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.33 billion |

|

Revenue forecast in 2030 |

USD 2.00 billion |

|

Growth Rate |

CAGR of 8.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Netherlands, China, Japan, India, Australia, South Korea, Brazil, Africa, Saudi Arabia, UAE |

|

Key companies profiled |

ABB; Emerson Electric Co.; SLB; Yokogawa Corporation of America; OMNI Flow Computers, Inc.; Schneider Electric; Thermo Fisher Scientific Inc.; Dynamic Flow Computers, Inc.; KROHNE Group; Kessler-Ellis Products (KEP); Contrec Ltd.; TechnipFMC plc; Flow Systems; Fluidwell; FLOWMETRICS |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flow Computers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow computers market report based on offering, product, end use, and region.

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired Flow Computers

-

Wireless Flow Computers

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil & Gas

-

Water & Wastewater

-

Energy & Power Generation

-

Food & Beverage

-

Chemical

-

Pulp & Paper & Metal & Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."