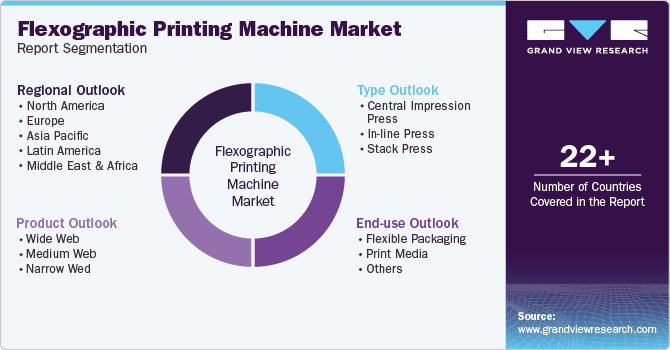

Flexographic Printing Machine Market Size, Share & Trends Analysis Report By Type (Central Impression Press, In-line Press, Stack Press) By Product (Wide Web, Medium Web, Narrow Web), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-420-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Flexographic Printing Machine Market Trends

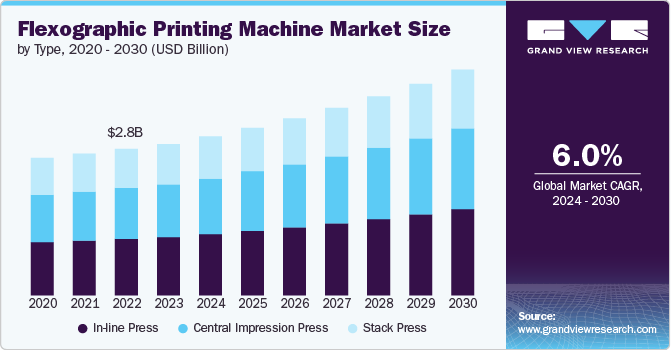

The global flexographic printing machine market size was estimated at USD 2,828.5 million in 2023 and is anticipated to grow at a CAGR of 6.0% from 2024 to 2030. The global flexographic printing machine market is primarily driven by the growing demand for high-quality, cost-effective packaging solutions. Flexographic printing, known for its efficiency and versatility, is becoming a preferred choice for producing a wide range of materials, including flexible packaging, labels, and cartons.

The rise of e-commerce has increased the need for customized and aesthetically appealing packaging, which flexographic printing can efficiently provide. The flexibility of the process in printing on various substrates, from plastic to paper, also supports its expansion in diverse industries. The continual improvements in ink formulations and press technology are helping to reduce operational costs and improve environmental sustainability, making flexographic printing an attractive option for manufacturers worldwide.

Drivers, Opportunities & Restraints

Advances in technology, such as the development of high-definition flexographic printing plates and automated presses, have significantly enhanced print quality and production speed, further fueling market growth.

The need for regular updates to technology and the substantial cost of high-quality flexo plates and inks can be prohibitive for smaller businesses. In addition, competition from other printing technologies, such as digital and offset printing, which offer high-quality output and lower setup costs, can limit market expansion.

Innovations in eco-friendly inks and substrates align with the increasing demand for environmentally responsible packaging solutions. The expansion of the e-commerce sector also offers opportunities for flexographic printing, as companies seek customized packaging solutions to enhance brand visibility and customer experience.

Type Insights

“The central impression press segment is expected to grow at a significant CAGR of 6.4% from 2024 to 2030 in terms of revenue”

The central impression press segment is witnessing an increase in demand due to its ability to deliver high-quality, consistent prints over large web widths, making it ideal for flexible packaging and other high-volume applications. Its centralized design reduces the risk of print defects and ensures uniformity, driving its adoption among manufacturers seeking precision and efficiency.

The in-line press segment held a 38.6% market share in 2023. The in-line press segment thrives due to its versatility and space efficiency. This type of press integrates various printing and finishing processes in a single line, which streamlines production and reduces operational costs. Its suitability for producing a wide range of packaging types and its ability to handle quick job changes support its growth, particularly in markets demanding flexibility and fast turnaround times.

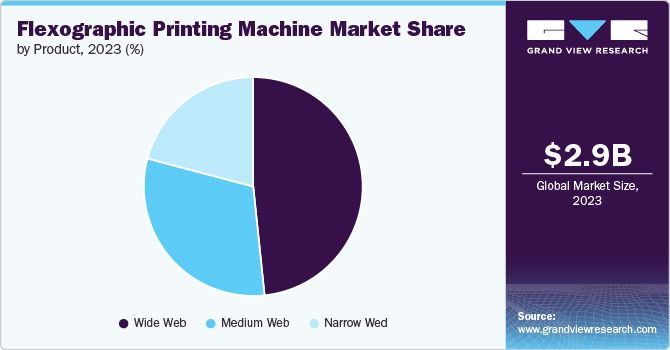

Product Insights

"The demand for the medium web segment is expected to grow at a rapid CAGR of 6.3% from 2024 to 2030 in terms of revenue”

The medium web segment is growing due to its cost-effectiveness and versatility, balancing high-quality output with manageable production scales. Medium web presses are ideal for flexible packaging and labels, offering a practical solution for moderate volumes at a lower cost than wide web presses. Their adaptability to various substrates and advancements in automation enhance efficiency, making them well-suited for customized and rapid-response packaging needs.

The wide web segment accounted for 48.4% of the market share in 2023. The growth of the wide web segment is driven by its capacity to handle large volumes of printing, which is essential for producing bulk quantities of flexible packaging and industrial applications. The efficiency of wide web presses in delivering high-speed, high-quality prints across large substrates makes them valuable for manufacturers aiming to scale production and meet high demand. In addition, advancements in wide web press technology, such as improved ink systems and automation features, enhance operational efficiency and reduce waste, further fueling the segment’s growth.

End Use Insights

"The growth of the flexible packaging segment is expected to grow at a significant CAGR of 6.3% from 2024 to 2030 in terms of revenue”

The growth of the flexible packaging segment is driven by increasing consumer demand for convenience and sustainability. Flexible packaging provides lightweight, versatile, and eco-friendly options that are ideal for a wide range of products. Innovations in materials and printing technologies enhance its appeal by improving durability and customization capabilities.

The print media segment accounted for 33.0% of the market share in 2023. The print media segment’s growth is fueled by the ongoing need for high-quality, visually appealing print materials in advertising, promotions, and publications. Advances in flexographic printing technology enable precise and vibrant color reproduction, meeting the demands of a competitive market that requires eye-catching and effective print media solutions.

Regional Insights

“India to witness fastest market growth at 6.2% CAGR”

In Asia Pacific, the flexographic printing market is experiencing significant growth due to rapid industrialization and urbanization, which are increasing the demand for packaged goods across various sectors. The burgeoning middle class and rising disposable incomes are driving consumption and, consequently, the need for diverse and customized packaging solutions. In addition, the expansion of e-commerce platforms in the region is creating a heightened need for innovative and flexible packaging options to enhance product presentation and functionality.

The flexographic printing machine market in China is estimated to grow at 7.6% over the forecast period. Rapid industrialization and urbanization are creating a significant demand for packaging solutions across various sectors, including food and beverages, consumer goods, and pharmaceuticals. China's expanding middle class and rising disposable incomes are fuelling increased consumption and, consequently, the demand for diverse and attractive packaging options. The government's focus on modernizing manufacturing processes and promoting environmental sustainability is further accelerating market growth.

North America Flexographic Printing Machine Market Trends

The growth of the flexographic printing market in North America is bolstered by technological advancements and a strong emphasis on sustainability. The adoption of cutting-edge flexographic printing technologies helps companies meet the high standards of environmental regulations and consumer preferences for eco-friendly and recyclable packaging materials. This focus on sustainability is coupled with continuous innovation in printing processes, which improves efficiency and reduces waste, further fueling market expansion.

Europe Flexographic Printing Machine Market Trends

The flexographic printing market in Europe, benefits from a robust regulatory framework that promotes sustainability and recycling. The region's commitment to high-quality print products and packaging innovation drives demand for advanced flexographic printing solutions. European businesses are increasingly investing in technologies offering superior print quality and functionality, in response to consumer expectations and stringent environmental standards, supporting the market’s growth.

Key Flexographic Printing Machine Company Insights

Some of the key players operating in the market include John Cockerill and Thermax Limited among others.

-

BFM Srl is a prominent Italian company specializing in the design and manufacturing of machinery for the packaging industry, particularly focusing on flexographic printing machines and winders. The company has been in the market for 49 years and company exports to over 80 countries.

-

Edale Ltd is a company specializing in the design, manufacture, and marketing of industrial printing and converting solutions for the packaging industry. The company has been serving the print and packaging market for over 75 years. It offers worldwide support and spares, including installation by experienced engineers, comprehensive operator manuals, optional training packages, and a global network of partners providing spare parts, consumables, and maintenance services.

Key Flexographic Printing Machine Companies:

The following are the leading companies in the flexographic printing machine market. These companies collectively hold the largest market share and dictate industry trends.

- Barry-Wehmiller Companies

- BFM srl

- TAIYO KIKAI Ltd.

- Comexi

- Edale.

- Heidelberger Druckmaschinen AG

- Koenig & Bauer Coding GmbH

- LohiaGroup

- Mark Andy Inc.

- Uteco

- Nilpeter

- OMET

- OMSO SpA

- ORIENT SOGYO Co. Ltd.

- Windmöller & Hölscher

Recent Developments

-

In August 2024, Edale. strengthened its position in the Chinese market by installing an in-line carton press at Rainbow Paper Products. This move marks a significant expansion for Edale in China, enhancing their ability to meet the growing demand for high-quality carton printing solutions.

-

In July 2024, Uteco announced a new partnership with Fotedar, as part of its expansion strategy. This collaboration aims to enhance Uteco's market presence and provide advanced packaging solutions to a broader customer base. The partnership will leverage Fotedar's expertise and distribution network to strengthen Uteco’s offerings in the industry.

Flexographic Printing Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2,975.0 million |

|

Revenue forecast in 2030 |

USD 4,221.9 million |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, end use and region |

|

Regional scope |

North America, Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Barry-Wehmiller Companies; BFM srl; TAIYO KIKAI Ltd.; Comexi; Edale.; Heidelberger Druckmaschinen AG; Koenig & Bauer Coding GmbH; LohiaGroup; Mark Andy Inc.; Uteco; Nilpeter; OMET; OMSO SpA; ORIENT SOGYO Co. Ltd.; Windmöller & Hölscher |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flexographic Printing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flexographic printing machine market on the type, product, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Impression Press

-

In-line Press

-

Stack Press

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wide Web

-

Medium Web

-

Narrow Wed

-

-

End Use (Revenue, USD Million, 2018 - 2030)

-

Flexible Packaging

-

Print Media

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global flexographic printing machine market size was estimated at USD 2,828.5 million in 2023 and is expected to reach USD 4,221.9 million in 2024.

b. The global flexographic printing machinmarket, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 4,221.9 million by 2030.

b. Asia Pacific dominated the flexographic printing machine market with a revenue share of 31.0% in 2023. In Asia Pacific, the flexographic printing market is driven by rapid industrialization, rising disposable incomes, and growing consumer demand for packaged goods.

b. Some of the key players operating in the flexographic printing machine market include Danfoss Group, Ramboll, Dall Energy, Veolia, Helen, ALFA LAVAL, General Electric Company, Uniper SE, ENGIE, FVB Energy Inc., Vattenfall AB, and Fortum.

b. The flexographic printing market is driven by the increasing demand for high-quality, cost-effective packaging solutions, fueled by consumer preferences for sustainable and eco-friendly materials. Technological advancements, such as high-definition flexographic plates and automated presses, enhance print quality and production efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."