- Home

- »

- Advanced Interior Materials

- »

-

Flexible Pipes Market Size, Share & Growth Report, 2030GVR Report cover

![Flexible Pipes Market Size, Share & Trends Report]()

Flexible Pipes Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material, (High Density Polyethylene, Polyamides, Polyvinylidene Fluoride), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-439-9

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Pipes Market Summary

The global flexible pipes market size was estimated at USD 1.25 billion in 2023 and is projected to reach USD 1.65 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. This growth is attributed to the increasing exploration activities in offshore oil and gas locations.

Key Market Trends & Insights

- The flexible pipes market in Asia Pacific dominated the global industry in 2023 with a revenue share of 37.40%.

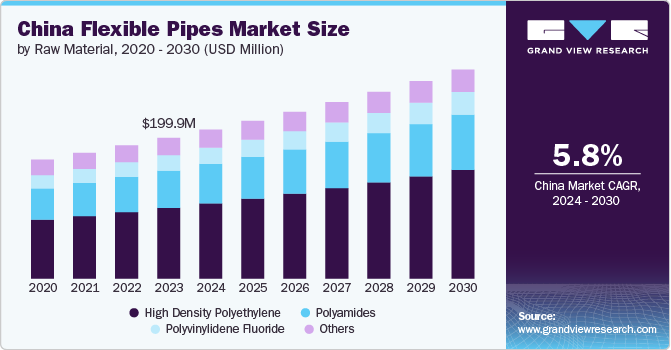

- China flexible pipes market is projected to grow steadily.

- Based on raw material, high-density polyethylene segment dominated the market with a revenue share of around 47% in 2023.

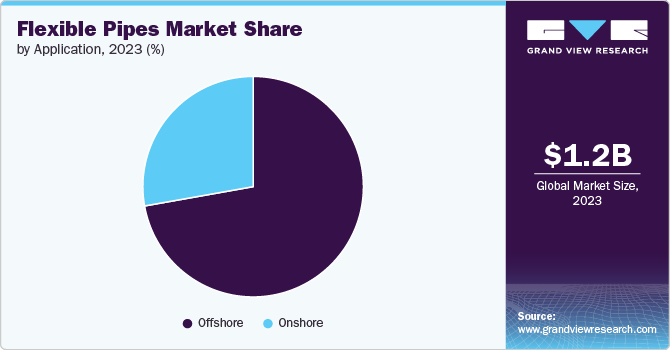

- Based on application, the offshore segment accounted for the largest revenue share of 72.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 1.65 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

These flexible pipes are essential for transporting fluids in challenging environments, particularly in deep-water operations where traditional piping systems may fail. The demand for flexible pipes is further bolstered by advancements in drilling technologies, which have enhanced the efficiency and safety of oil and gas extraction processes. As conventional reserves deplete, the industry is shifting focus toward deep-water and ultra-deep-water reserves, necessitating robust and adaptable piping solutions that can withstand high pressures and harsh conditions.

The market in China is witnessing robust growth, primarily fueled by the country's increasing energy demands and significant investments in offshore oil and gas exploration. As the world's most populous nation and a major economic player, China's appetite for energy resources, particularly from deep-sea areas, has led to a surge in the demand for flexible pipes. These pipes are essential for transporting fluids in challenging offshore environments, where traditional rigid pipes may not suffice. The Chinese government's commitment to expanding its offshore exploration capabilities has further accelerated this trend, positioning the country as a key player in the global flexible pipes market.

Moreover, China's cost-effective manufacturing capabilities and a strong domestic market provide it with a competitive edge in the flexible pipes sector. The country has become a hub for flexible pipe production, leveraging advanced materials and manufacturing processes to enhance the performance and durability of these products. This growth not only meets domestic needs but also contributes positively to the global market by supplying flexible pipes to other regions, thereby fostering international trade and collaboration in energy infrastructure development. As China continues to prioritize sustainable development and environmentally friendly solutions, its advancements in flexible pipe technology are likely to set benchmarks for global standards, further influencing the market dynamics worldwide.

Raw Material Insights

Based on raw material, high-density polyethylene dominated the market with a revenue share of around 47% in 2023 and is further expected to grow at a significant rate over the forecast period. HDPE is the most dominant material in the market due to its excellent strength-to-density ratio, resistance to corrosion, and cost-effectiveness. It is widely utilized in various applications, particularly in the oil and gas sector, where it can withstand high pressures and harsh environmental conditions. The versatility of HDPE makes it suitable for both onshore and offshore applications, contributing to its substantial market share. Its ability to be easily molded and extruded into various shapes further enhances its appeal in the market, allowing for innovative designs that meet specific operational requirements.

On the other hand, Polyamides are gaining traction due to their superior mechanical properties and resistance to wear and tear. They are particularly valued in applications that require flexibility and durability, making them suitable for dynamic environments where pipes are subject to movement and stress.

The PVDF segment is projected to experience the highest growth rate over the forecast period. This material is renowned for its exceptional chemical resistance and stability under extreme conditions, including high temperatures and aggressive chemicals. PVDF's unique properties make it ideal for specialized applications, such as in the chemical processing and nuclear industries, where reliability and safety are paramount. As industries increasingly prioritize performance and longevity in their materials, the demand for PVDF in the market is expected to rise, positively impacting the overall market dynamics and fostering innovation in pipe manufacturing technologies.

Application Insights

Based on application, the offshore segment accounted for the largest revenue share of 72.2% in 2023 and is further expected to grow at the fastest rate over the forecast period. The onshore segment is also experiencing significant growth, driven by the increasing demand for flexible pipes in extraction and processing activities involving various flammable gases and chemicals. The flexibility and adaptability of these pipes allow for easier installation and maintenance in complex terrains, making them a preferred choice for onshore applications. As conventional onshore reserves become more limited, the focus on enhancing extraction techniques and utilizing advanced materials in flexible pipes is becoming increasingly important. Overall, both onshore and offshore applications are vital to the flexible pipes market, contributing to its growth and evolution in response to global energy demands.

This growth is primarily driven by the increasing exploration and production activities in deep-water and ultra-deep-water environments, where flexible pipes are essential for transporting hydrocarbons from the seabed to surface facilities. The unique properties of flexible pipes, such as their ability to withstand harsh marine conditions and their corrosion resistance, make them ideal for offshore applications. Additionally, the rising trend toward renewable energy sources, including offshore wind and wave energy projects, is further bolstering the demand for flexible pipes in these settings.

Regional Insights

North America flexible pipes market is poised for substantial growth, primarily fueled by the rising demand for oil and gas, particularly from shale gas production in the U.S. and Canada. Additionally, ongoing investments in offshore drilling activities, especially in the Gulf of Mexico, are driving the adoption of flexible pipes due to their efficiency in hydrocarbon transportation.

Asia Pacific Flexible Pipes Market Trends

The flexible pipes market in Asia Pacific dominated the global industry in 2023 with a revenue share of 37.40% and is further expected to grow at a significant rate over forecast period. Asia Pacific’s growth is fueled by the rising demand for flexible pipes in various applications, particularly in the oil and gas sector, where the need for efficient and reliable transportation of hydrocarbons is paramount.

China flexible pipes market is projected to grow steadily, driven by significant investments in offshore oil and gas exploration and a strong emphasis on renewable energy projects, such as offshore wind farms. Additionally, the booming construction industry in China is increasing the demand for flexible pipes across various applications, including sewage systems and water supply.

Europe Flexible Pipes Market Trends

The flexible pipes market in Europe is experiencing robust growth, driven by increasing investments in offshore and onshore oil and gas projects, which are projected to enhance market value significantly.

Key Flexible Pipes Company Insights

Some of the key players operating in the market are National Oilwell Varco (NOV) and TechnipFMC PLC:

-

National Oilwell Varco, Inc. (NOV) is a leading American multinational corporation headquartered in Houston, Texas. The company specializes in providing equipment, technology, and services to the upstream oil and gas industry, operating through three main segments: Rig Technologies, Wellbore Technologies, and Completion and Production Solutions. NOV serves a diverse clientele, including drilling contractors, well-servicing companies, and independent oil and gas operators across more than 500 locations worldwide.

-

TechnipFMC PLC is a global leader in the oil and gas industry, providing a wide range of technologies, systems, and services. The company was formed through the merger of FMC Technologies and Technip in 2017, creating a significant player in the energy sector, particularly during a challenging period marked by fluctuating crude prices.

Shawcor Ltd and GE Oil & Gas Corporation are some of the emerging participants in the market.

-

Shawcor Ltd., now known as Mattr, is a Canadian materials technology company headquartered in Toronto, Ontario. It specializes in providing products and services primarily for the pipeline sector of the oil and gas industry, making it one of the largest pipe-coating providers globally. The company was originally founded in the mid-20th century by Francis Shaw and has evolved significantly over the decades, transitioning from a construction company to a leader in pipeline services and coatings.

-

GE Oil & Gas Corporation was a division of General Electric (GE) that specialized in providing advanced technology and services for the oil and gas industry. Established in the 1990s, the division grew significantly through strategic acquisitions, including the purchase of Italian company Nuovo Pignone in 1994, which marked GE's entry into the petroleum sector.

Key Flexible Pipes Companies:

The following are the leading companies in the flexible pipes market. These companies collectively hold the largest market share and dictate industry trends.

- National Oilwell Varco (NOV)

- TechnipFMC PLC

- The Prysmian Group

- GE Oil & Gas Corporation

- Shawcor Ltd

- SoulForce (Pipelife Nederland B.V.)

- Airborne Oil & Gas BV

- Magma Global Ltd

- ContiTech AG

- Chevron Phillips Chemical Company LLC

- Flexsteel Pipeline Technologies Inc.

Recent Developments

- In September 2023, TechnipFMC was awarded a substantial contract by Petrobras, the Brazilian state-owned oil company, to supply flexible pipes for the pre-salt fields located offshore Brazil. This contract follows the completion of a competitive tender process and is a significant development for TechnipFMC, reinforcing its position as a leading supplier in the region.

Flexible Pipes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.30 billion

Revenue forecast in 2030

USD 1.65 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, application region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina

Key companies profiled

National Oilwell Varco (NOV), TechnipFMC PLC, The Prysmian Group, GE Oil & Gas Corporation, Shawcor Ltd, SoulForce (Pipelife Nederland B.V.), Airborne Oil & Gas BV, Magma Global Ltd, ContiTech AG, Chevron Phillips Chemical Company LLC, Flexsteel Pipeline Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Pipes Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible pipes market report based on raw material, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

High Density Polyethylene

-

Polyamides

-

Polyvinylidene Fluoride

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

Deepwater

-

Ultra-deep water

-

Subsea

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global flexible pipes market size was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1.30 billion in 2024.

b. The global flexible pipes market is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030, reaching USD 1.65 billion by 2030.

b. High density polyethylene raw material accounted for the largest revenue share of 50.5% in 2023, increasing exploration activities in offshore oil and gas locations. These flexible pipes are essential for transporting fluids in challenging environments, particularly in deep-water operations where traditional piping systems may fail.

b. National Oilwell Varco (NOV), TechnipFMC PLC, The Prysmian Group, GE Oil & Gas Corporation, Shawcor Ltd, SoulForce (Pipelife Nederland B.V.), Airborne Oil & Gas BV, Magma Global Ltd, ContiTech AG, Chevron Phillips Chemical Company LLC, Pipeline Technologies Inc.

b. The key factors that are driving the flexible pipes market growth is the strength and resistance to weathering of composite doors and windows, which reduces the need for frequent maintenance compared to traditional materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.