- Home

- »

- Animal Health

- »

-

Flea, Tick And Heartworm Products Market Size Report, 2033GVR Report cover

![Flea, Tick And Heartworm Products Market Size, Share & Trends Report]()

Flea, Tick And Heartworm Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Type, By Animal, By Mode Of Delivery, By Parasite (External Parasite, Internal Parasite), By Care, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-062-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flea, Tick And Heartworm Products Market Summary

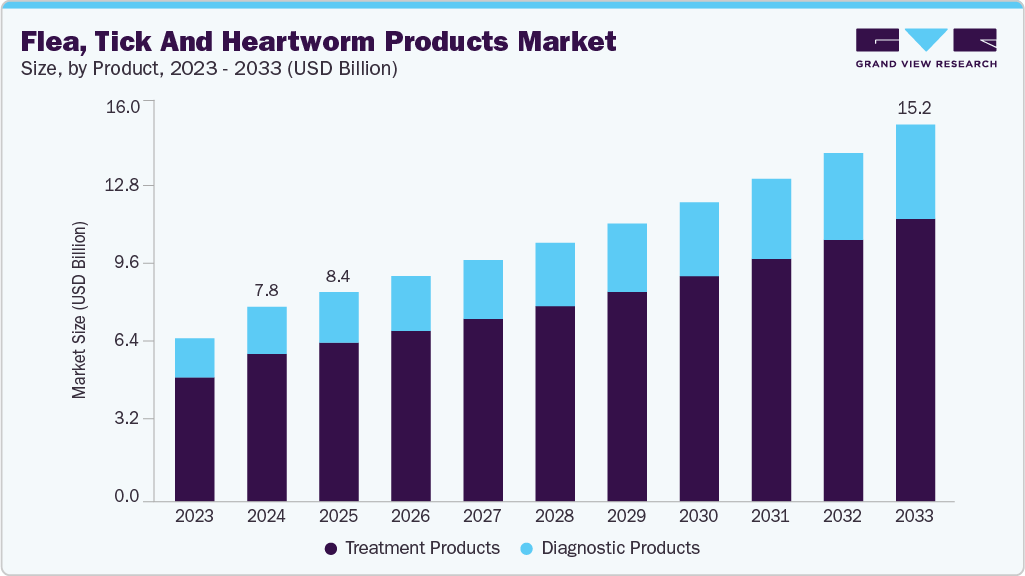

The global flea, tick and heartworm products market size was estimated at USD 7.85 billion in 2024 and is projected to reach USD 15.21 billion by 2033, growing at a CAGR of 7.62% from 2025 to 2033. The market is experiencing growth driven by the increasing prevalence of vector-borne diseases, the growing importance of preventive care, and the emergence of novel FTH products.

Key Market Trends & Insights

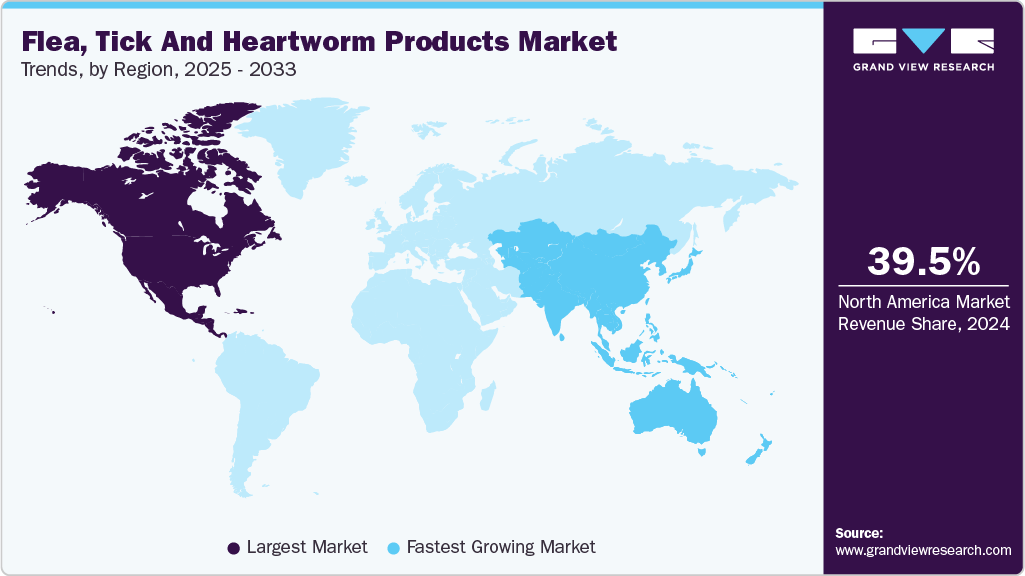

- The North America flea, tick and heartworm products market held the largest revenue share of 39.48% in 2024.

- The flea, tick and heartworm products industry in the U.S. accounted for the highest market share in the North America market.

- By product, the treatment segment held the largest market share of 75.90% in 2024.

- By type, the prescription segment held the largest market share in 2024.

- By animal, the canine segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.85 Billion

- 2033 Projected Market Size: USD 15.21 Billion

- CAGR (2025-2033): 7.62%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

A rise in the spread of heartworm disease and cases of parasitic infestations among animals is also expected to fuel the growth of the flea, tick and heartworm products industry. The expansion of flea-, tick-, and mosquito-borne diseases like Lyme disease, ehrlichiosis, and heartworm is creating greater awareness among pet owners and veterinarians about preventive care. In recent years, their spread has been on the rise globally. According to 2023 data published by the American Veterinary Medical Association (AVMA) and the American Heartworm Society (AHS), estimated that in 2022, many veterinary clinics in the U.S. handled over 100+ cases of heartworm disease in animals per clinic. Of the total veterinarians who responded to this survey, 29% reported that heartworm disease cases have steadily risen over the last year. The prevalence of heartworm diseases was reported to be about 20% for dogs and 33% for cats in the U.S., according to a March 2024 study published in the Parasites & Vectors journal.

In addition, a March 2024 release by the British Small Animal Veterinary Association (BSAVA) reported that even though the disease is not endemic in the UK, heartworm disease diagnosis has been steadily increasing, with most cases found in dogs. Additionally, a study was conducted in Australia to understand the prevalence of heartworm infection in dogs. This February 2023 study inferred that the prevalence was estimated to be as high as 32.1%, varying slightly in different areas of the country.

The market is set to experience high growth prospects in the forecast period. One of the crucial drivers in this market is the increasing emphasis put by veterinary professionals on the importance of preventive care in animals for managing parasitic infections like flea, tick, and heartworm. Preventive care focuses on administering FTH medication to animals like cats & dogs since their early years of development, irrespective of infestation. Product manufacturers are also actively innovating and seeking regulatory approvals to increase their product portfolio and assist in effectively managing these conditions.

Furthermore, a Merck Animal Health survey of August 2025 revealed a significant gap between pet owners’ intentions and their actual compliance with flea and tick prevention. Most owners recognize the importance of treatment, struggle with timely administration, seasonal misconceptions, and lack of awareness about vector-borne diseases like ehrlichiosis. This highlights an urgent need for education and long-duration solutions. These compliance challenges are driving demand for innovative, long-lasting, and veterinarian-prescribed flea and tick preventives. As awareness grows, companies offering annual or extended-duration treatments are likely to see strong adoption and revenue growth.

Recent Product Launches in the Flea, Tick and Heartworm Products Market

Company

Month & Year of Launch / Approval

Description

Elanco

Oct-24

Credelio Quattro approved by the U.S. FDA: a chewable tablet covering fleas, ticks, heartworm, and several intestinal worms. Reuters

Boehringer Ingelheim

Apr-24

Launched NexGard SPECTRA in India: a monthly chewable combining afoxolaner + milbemycin oxime for both internal & external parasite control. Devdiscourse

Merck Animal Health

Jul-25

Bravecto Quantum (fluralaner injectable) approved in the U.S.: single injection provides 8-12 months of flea & tick protection. Industry Intelligence Inc.

Virbac

Aug-22

Introduced Iverhart Max: a chewable tablet combining ivermectin, pyrantel pamoate, and praziquantel; broad internal parasite plus heartworm coverage

Market Concentration & Characteristics

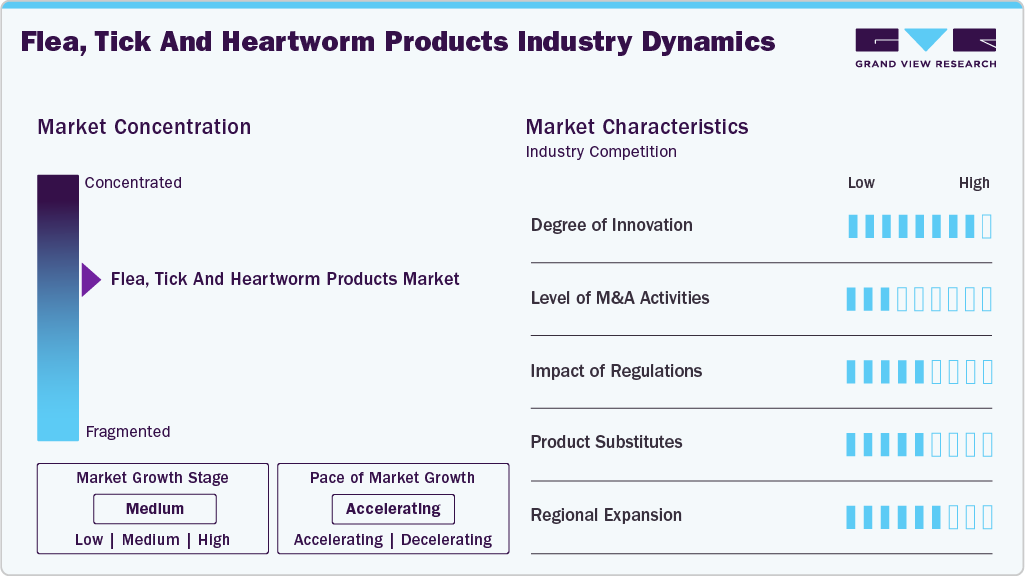

The flea, tick, and heartworm products market exhibits moderate concentration. The pace of its growth is accelerating, dominated by leading players such as Zoetis, Boehringer Ingelheim, Elanco, Merck Animal Health, and Ceva. These companies hold strong brand portfolios, global distribution networks, and invest heavily in R&D, creating competitive barriers for smaller players, transforming innovation and market expansion.

The degree of innovation in the flea, tick and heartworm products industry is estimated to be high. The industry manufacturers are actively launching innovative products using novel techniques to address market problems.For example, in September 2025, Elanco’s Credelio Quattro achieved blockbuster status for delivering broad-spectrum parasite protection covering fleas, ticks, heartworm disease, and positioning the company for global expansion beginning in 2026.

The market has a low level of mergers and acquisitions. Industry participants are trying to consolidate the distribution channels for FTH products by acquiring other platforms. For instance, in January 2023, PetMeds acquired PetCareRx. The acquisition was completed to capitalize on the latter's vast pet FTH, vitamins, treats, etc., portfolio to increase the former's product portfolio and market reach.

The regulations are estimated to impact the market greatly. On the one hand, the market is constantly experiencing an influx of FTH product approvals by the regulatory authorities. On the other hand, the market is also experiencing a turbulent phase amidst regulatory action about the safety issues of some of the major products.

A few leading players, including Boehringer Ingelheim, Zoetis, and Merck & Co. Inc., currently dominate the market with blockbuster products such as Simparica Trio, NexGard, Frontline, Heartgard, and Bravecto. These globally recognized brands generate significant revenue and maintain strong market control. As a result, despite the presence of substitutes, the market remains relatively concentrated due to their established brand strength.

The market is witnessing moderate regional expansion as industry leaders strengthen their presence through partnerships with animal shelters and welfare organizations. For instance, in January 2025, Zoetis expands its portfolio with FDA approvals, enhancing Simparica Trio and Revolution Plus coverage, addressing emerging ticks and tapeworms, strengthening market leadership, veterinarian confidence, and adoption in canine and feline preventives.

Product Insights

The treatment products segment held the largest revenue share of the flea, tick and heartworm products market in 2024, owing to strong demand for effective parasite management in pets. Pet owners increasingly seek solutions to treat existing infestations, rather than solely relying on preventive measures, boosting sales of prescription and over-the-counter treatments. Popular products such as Simparica Trio, NexGard, Frontline, and Heartgard dominate this segment due to their broad-spectrum efficacy against multiple parasites. High awareness of vector-borne diseases, rising pet ownership, and veterinary recommendations further fuel adoption.

The diagnostic products segment is expected to register the fastest CAGR during the forecast period. Comprising test kits and consumables for detecting parasites such as heartworms, its growth is driven by increasing demand for antigen testing in pets. The global rise in heartworm cases has amplified the need for accurate and timely diagnosis, prompting manufacturers to develop specialized test kits. These innovations enhance detection reliability and speed, meeting veterinary and pet-owner needs.

Type Insights

The prescription segment dominated the flea, tick, and heartworm products market in 2024. Veterinarians primarily prescribe oral chewables or topical treatments for effective parasite control, particularly as resistance to some over-the-counter preventives rises in certain regions. Prescription products often use different chemical classes to ensure safety and efficacy, requiring veterinary oversight. For instance, in July FDA approved Bravecto Quantum (fluralaner extended-release injectable), the first long-acting treatment providing 8-12 months of flea and tick protection. Its administration requires professional guidance, reinforcing the importance of prescription options in the market.

OTC is the fastest-growing market segment, with its growth fueled by the increasing pet ownership and consumer preference for convenient, accessible solutions. Pet owners are seeking easy-to-administer treatments without requiring veterinary visits, boosting demand for topical, oral, and spray products. Rising awareness of year-round parasite risks, combined with growing retail availability in pharmacies, pet stores, and online platforms, further accelerates adoption. Manufacturers are responding with innovative formulations, user-friendly packaging, and broad-spectrum efficacy.

Animal Insights

The canine segment held the largest revenue share of 48.81% in 2024, driven by the high prevalence of parasitic infestations in dogs and strong pet ownership rates. Dog owners increasingly invest in preventive treatments to protect their pets from fleas, ticks, and heartworm, supported by veterinary recommendations and growing awareness of animal health. Popular products such as oral chewables, spot-on treatments, and collars specifically designed for dogs reinforce the dominance of this segment in the market.

The other segment, including ferrets, horses, and similar species, is expected to be the fastest-growing over the forecast period. This market growth is expected due to rising awareness of parasite risks in non-canine and non-feline pets, along with increasing ownership of exotic and farm animals, which is driving demand for specialized preventive and treatment products. Veterinary recommendations and tailored formulations for these species ensure safe and effective parasite control, boosting adoption.

Mode of Delivery Insights

The topical segment led the flea, tick, and heartworm products market in 2024, owing to its advantages over oral medications. Many topical treatments are not systemically absorbed, meaning they do not enter the pet’s bloodstream or penetrate the skin barrier. This makes them particularly suitable for animals with a history of adverse drug reactions or those that have not responded well to oral treatments, offering a safer and effective alternative for parasite control.

The injectable segment is projected to register the fastest CAGR over the forecast period, driven by its higher bioavailability for treating internal infections like heartworm disease. With the rising incidence of heartworm among dogs, cats, and other animals, along with a growing number of new injectable product launches, demand for this delivery method is expected to increase significantly, positioning injectables as a rapidly expanding segment in the flea, tick, and heartworm products market.

Parasite Insights

The external parasite segment, targeting fleas, ticks, and other ectoparasites, held the largest share of the flea, tick and heartworm products industry in 2024. The growing recognition of the health hazards associated with external parasites, such as allergic reactions, skin infections, and the spread of vector-borne diseases, fuels the need for efficient control measures. Pet owners are progressively looking for preventive and therapeutic options like topical spot-on treatments, oral chewables, collars, and sprays to safeguard their pets throughout the year. Veterinary endorsements, along with novel formulations that provide extensive protection and convenient administration.

The internal parasite segment is projected to grow at the fastest CAGR over the forecast period, driven primarily by the prevalence of heartworm infections in dogs and cats. According to 2023 reports from AVMA, BSAVA, and AHS, heartworm has become one of the fastest-spreading parasitic infections in companion animals. Its potential to cause severe and sometimes fatal cardiac complications underscores the critical need for effective internal parasite prevention and treatment.

Care Insights

The preventive care segment led the flea, tick and heartworm products market in terms of revenue share in 2024, and is projected to register the fastest CAGR over the forecast period. This growth is driven by veterinarians and animal welfare organizations emphasizing proactive measures against flea, tick, and heartworm (FTH) complications. Pet owners are increasingly advised to administer preventive medications regularly, regardless of current infection status, to avoid parasitic infestations. In instances where infestations are detected, structured treatment protocols complement preventive care. The focus on early intervention and routine prophylaxis is fueling widespread adoption.

The therapeutic care segment is the second fastest growing, driven by the rising cases of parasitic infections and the need for targeted treatment. This segment includes medications and protocols designed to treat active infestations, including fleas, ticks, and heartworms, as well as related complications. Increased awareness among pet owners and veterinarians about the health risks associated with untreated infestations, such as allergic reactions, anemia, and cardiac issues, is fueling demand.

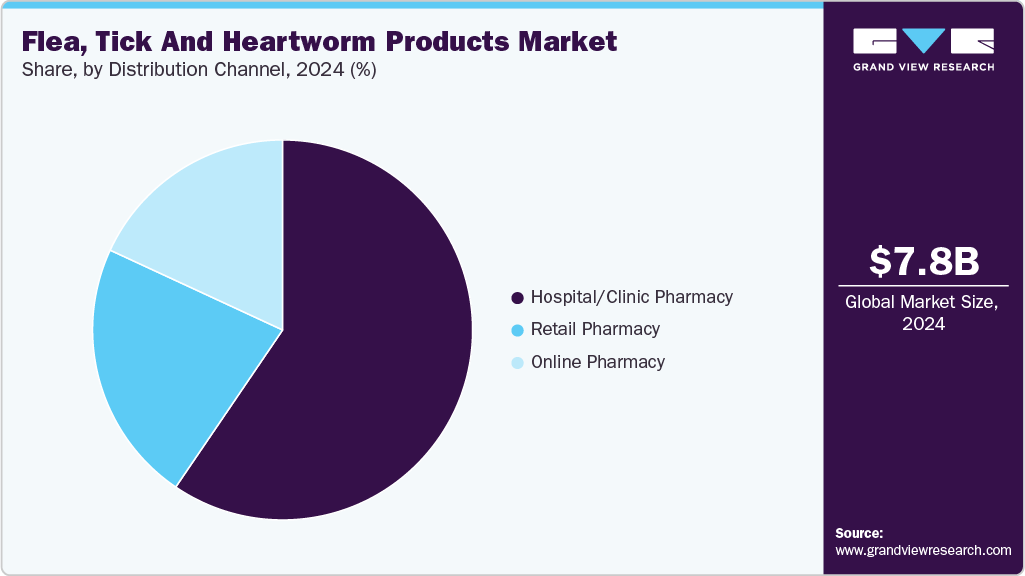

Distribution Channel Insights

The hospital and clinic pharmacy dominated the flea, tick and heartworm products industry with the largest revenue share in 2024. This dominance is driven by the prescription requirement for most FTH products, necessitating veterinary oversight before purchase. Growing pet owner willingness to invest in pet health, coupled with increasing FTH-related complications, further fuels demand. In addition, rising patient volumes at veterinary clinics, where drugs often require professional monitoring, support consistent product sales.

The online segment is projected to register the fastest growth over the forecast period, driven by increasing online pharmacy penetration in developing regions, a wider variety of OTC products, and the convenience of digital purchasing. Online platforms allow pet owners to access a broad range of veterinary products from non-medical supplies to OTC and prescription drugs directly from their devices, at any time. Competitive offerings, discounts, and promotions further enhance adoption. The ease of procurement, combined with expanding product availability and user-friendly interfaces, is accelerating market growth, positioning the online channel as a key driver in the flea, tick, and heartworm products market.

Regional Insights

North America dominated the global flea, tick and heartworm products market in 2024, holding the largest revenue share of 39.48%. The growing number of pet owners in North America is boosting demand for flea, tick, and heartworm (FTH) products. Rising incidences of FTH-related illnesses in pets further drive the need for preventive and treatment solutions. Supported by a well-established veterinary industry with widespread clinics and increasing pet healthcare expenditures, the region is witnessing significant market growth, fueled by pet owners’ willingness to invest in comprehensive animal care.

U.S. Flea, Tick and Heartworm Products Market Trends

The flea, tick and heartworm products industry in the U.S. accounted for the highest market share in the North America market, owing to significant product approvals by the U.S. FDA and strict regulatory screening of FTH products and their effects in practical applications in recent years.

The Canada flea, tick and heartworm products market is expected to grow at a significant CAGR during the forecast period. The market is developing due to growing awareness of preventive healthcare and demand for convenient treatment options. Recent advancements focus on broad-spectrum efficacy, improved safety profiles, and the development of natural or eco-friendly formulations, catering to consumer preferences for safer and environmentally conscious pet care solutions.

Europe Flea, Tick And Heartworm Products Market Trends

The Europe flea, tick and heartworm products industry is projected to experience growth driven by rising demand for flea, tick, and heartworm products, fueled by increasing risks of parasite transmission from pets to humans. According to 2024 data from Animal Health Europe, over 700 new parasitic infections emerged between 2009 and 2016 due to dog-to-human transmission. Additionally, approximately 128,888 Lyme disease cases were reported between 2005 and 2020, originating from tick infestations in pets, highlighting the critical need for effective preventive and treatment measures across the region.

The flea, tick and heartworm products market in Germany is expected to grow significantly over the forecast period. The market is expanding due to heightened awareness of preventive care and advancements in treatment options. For instance, in January 2025, Boehringer Ingelheim launched Frontpro, a chewable tablet for dogs that protects against fleas and ticks. Frontpro is the first over-the-counter FTH product available in Germany, offering a convenient solution for pet owners.

The UK flea, tick and heartworm products market is expected to grow significantly over the forecast period. An increasing prevalence of tick and flea infestations influences the country’s growth. According to Animal Health Europe 2024, approximately one in four cats and one in seven dogs in the UK are affected by fleas. This rising incidence is fueling demand for FTH products, including shampoos, spot-on treatments, and powders, as pet owners seek effective solutions to protect their animals from these parasites.

Asia Pacific Flea, Tick and Heartworm Products Market Trends

The Asia Pacific flea, tick and heartworm products industry is expected to grow at the fastest CAGR over the forecast period.The market is witnessing rapid growth, driven by urbanization and rising disposable incomes in countries like China and India, contributing to greater demand for pet healthcare products. In addition, advancements such as the introduction of combination treatments, such as Elanco's Credelio Quattro, a chewable tablet that protects dogs against multiple parasites, including fleas, ticks, and heartworms. These innovations, along with expanding veterinary infrastructure and rising disposable incomes, are propelling the market's expansion across the region.

The flea, tick and heartworm products market in China is witnessing new growth opportunities due to growing R&D infrastructure and increasing disposable incomes. Advancements such as combination treatments, including Elanco's Credelio Quattro chewable tablet that protects dogs against multiple parasites, are enhancing preventive care. Along with expanding veterinary infrastructure and growing consumer spending on pet health, these innovations are fueling the market’s expansion across the country.

The market for flea, tick and heartworm products in India is poised for strong growth, driven by rising pet adoption and increasing demand for preventive healthcare. According to 2024 data from Dogster, over 11% of Indian households own at least four pets. Recognizing this potential, global companies are expanding their presence through product launches and regional operations. For example, in April 2024, Boehringer Ingelheim introduced NexGard Spectra, a chewable tablet targeting internal and external parasites, following CDSCO approval.

Latin America Flea, Tick And Heartworm Products Market Trends

The growth of the flea, tick and heartworm products industry is fueled by the increasing pet ownership, which is driving higher demand for veterinary medications. Countries such as Brazil and Argentina rank among the highest globally in pet ownership per capita. For instance, 2024 data from Dogster estimates that approximately 80% of Argentina’s population has owned a pet at some point, highlighting strong market potential.

Brazil flea, tick and heartworm products market is gaining momentum, supported by increasing pet ownership, higher disposable incomes, and evolving consumer attitudes toward pet healthcare. Growing public awareness of the importance of preventing flea, tick, and heartworm infections, along with supportive government initiatives, is further expected to drive demand and expand the market in the country.

Middle East & Africa Flea, Tick and Heartworm Products Market Trends

The Middle East & Africa (MEA) flea, tick, and heartworm products market, comprising countries like South Africa, Saudi Arabia, Kuwait, and the UAE, is primarily driven by the surge in pet ownership across the region. For instance, approximately 45% of adults in South Africa own pets, reflecting the nation’s strong affinity for animals. Of these pet owners, 78% have dogs, whereas 36% keep cats. This increase is boosting pet owners’ spending on healthcare, particularly for preventive and therapeutic treatments against parasitic infections and infestations.

The South Africa flea, tick and heartworm products market held the largest revenue share of the MEA market, largely fueled by the country’s high dog ownership. According to a 2024 Dogster article, approximately 78% of pet owners in South Africa own dogs, which are the primary hosts for fleas, ticks, and heartworms. As most FTH products target these conditions in dogs, the strong dog adoption rate is expected to drive demand, creating significant market growth opportunities.

The flea, tick and heartworm products market in the UAE is experiencing growth with the rising awareness for pet health and advancements in veterinary care. Innovations such as combination treatments, including Elanco's Credelio Quattro chewable tablet, protecting dogs against multiple parasites, are enhancing preventive care. Expanding veterinary infrastructure and rising consumer spending on pet health are further fueling the regional market growth.

Key Flea, Tick and Heartworm Products Company Insights

The market is competitive due to the presence of domestic players in each country, fragmenting the market. Thus, creating an intense competition to maintain in the market. Moreover, companies and organizations are engaging heavily in activities such as research & development, product launch, and expansion of portfolio, as well as geographical presence. For instance, in April 2025, The FDA approved a label extension for Zoetis' Simparica Trio, making it the only canine combination parasiticide preventing flea tapeworms, ticks, heartworm, and intestinal worms, enhancing comprehensive parasite protection for dogs.

Key Flea, Tick and Heartworm Products Companies:

The following are the leading companies in the flea, tick, and heartworm products market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Virbac

- Elanco

- Ceva

- Promika, LLC

- Sergeant's Pet Care Products, Inc.

- ADAMS (Central Garden & Pet)

- BioNote Inc.

- Secure Diagnostics Ltd.

- iNtRON Biotechnology

- Biopanda Reagents Ltd.

Recent Developments

-

In September 2025, Elanco’s Credelio Quattro achieved blockbuster status, offering the broadest isoxazoline parasite protection against fleas, ticks, heartworm, and intestinal worms, marking a major advancement in comprehensive canine parasite control.

-

In July 2025, Intervet, Inc. received FDA approval for Bravecto Quantum, the first long-acting injectable for dogs, protecting against fleas and ticks for 8-12 months.

-

In January 2025, FDA expanded Zoetis’s Simparica Trio and Simparica Chewables’ labels to include Asian longhorned tick control, broadening their coverage and reinforcing their status as leading combination parasiticides for dogs. In addition, the FDA also approved a new label indication for Revolution Plus, used for the treatment of Dipylidium caninum (tapeworm) infections.

Flea, Tick and Heartworm Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.45 billion

Revenue forecast in 2033

USD 15.21 billion

Growth Rate

CAGR of 7.62% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, animal, mode of delivery, parasite, care, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Zoetis; Boehringer Ingelheim; Merck & Co. Inc.; Virbac; Elanco; Ceva; Promika, LLC; Sergeant's Pet Care Products, Inc.; ADAMS (Central Garden & Pet); BioNote Inc.; Secure Diagnostics Ltd.; iNtRON Biotechnology; Biopanda Reagents Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flea, Tick and Heartworm Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flea, tick and heartworm products market report based on product, type, animal, mode of delivery, parasite, care, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic Products

-

Test Kits

-

Consumables

-

-

Treatment Products

-

Spot on

-

Oral pills/Chewable

-

Spray

-

Liquid Solution

-

Shampoo

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescription

-

OTC

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Canine

-

Feline

-

Others

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2021 - 2033)

-

Topical

-

Oral

-

Injectable

-

-

Parasite Outlook (Revenue, USD Million, 2021 - 2033)

-

External Parasite

-

Internal Parasite

-

-

Care Outlook (Revenue, USD Million, 2021 - 2033)

-

Preventive Care

-

Therapeutic Care

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital/Clinic Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global flea tick and heartworm products market size was estimated at USD 7.85 billion in 2024 and is expected to reach USD 8.45 billion in 2025.

b. The global flea tick and heartworm products market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2033 to reach USD 15.21 billion by 2033.

b. North America held the highest revenue share of over 39.48% of the market in 2024. The number of Americans who own pets is increasing, which is driving up demand for FTH products. The region's need for FTH products is also anticipated to grow as the incidence of illnesses caused by flea, tick, and heartworm in pets rises.

b. Some key players operating in the flea tick and heartworm products market include Zoetis, Boehringer Ingelheim, Merck & Co. Inc, Virbac, Elanco, Ceva, Promika, LLC, Sergeant's Pet Care Products, Inc., Adams, BioNote Inc., Secure Diagnostics Ltd., iNtRON Biotechnology, and Biopanda Reagents Ltd.

b. Key factors that are driving the flea tick and heartworm products market growth the include growing importance of preventive care, emergence of novel FTH products, rise in spread of heartworm disease among animals, rise in awareness campaigns and increasing cases of parasitic infestations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.