- Home

- »

- Consumer F&B

- »

-

Flavors Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Flavors Market Size, Share & Trends Report]()

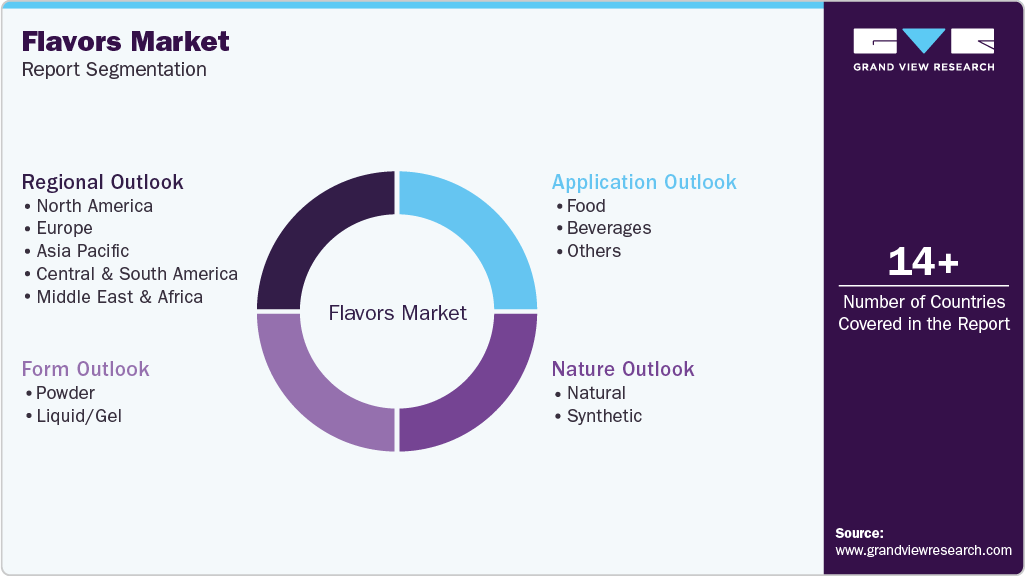

Flavors Market (2026 - 2033) Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By Form (Powder, Liquid/Gel), By Application (Food, Beverages), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-131-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavors Market Summary

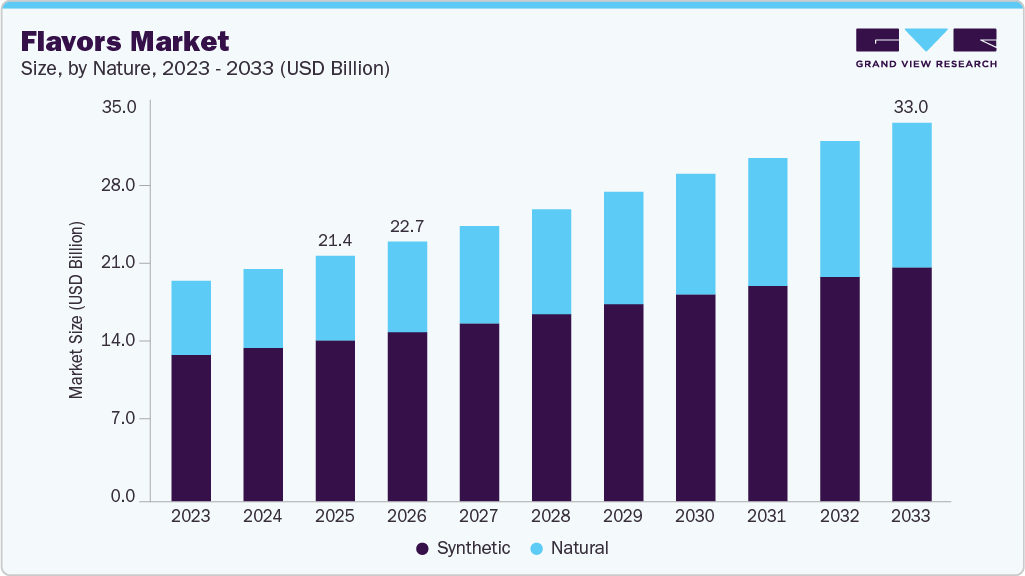

The global flavors market size was estimated at USD 21.42 billion in 2025 and is projected to reach USD 33.03 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. The market growth is attributed to the evolving consumer preferences for diverse and authentic culinary experiences.

Key Market Trends & Insights

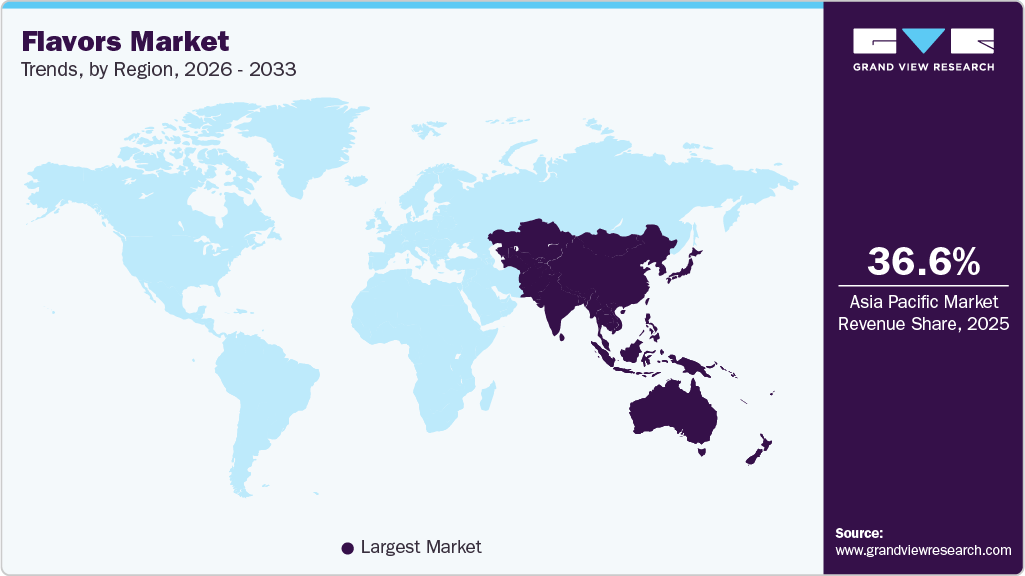

- Asia Pacific dominated the flavors market in 2025 with a share of 36.6% and was also experiencing significant growth, projecting a CAGR of 7.1%.

- The flavors market in Japan is set to grow at a CAGR of about 7.6% from 2026 to 2033.

- By nature, the synthetic flavors accounted for a revenue share of more than 65.6% in 2025.

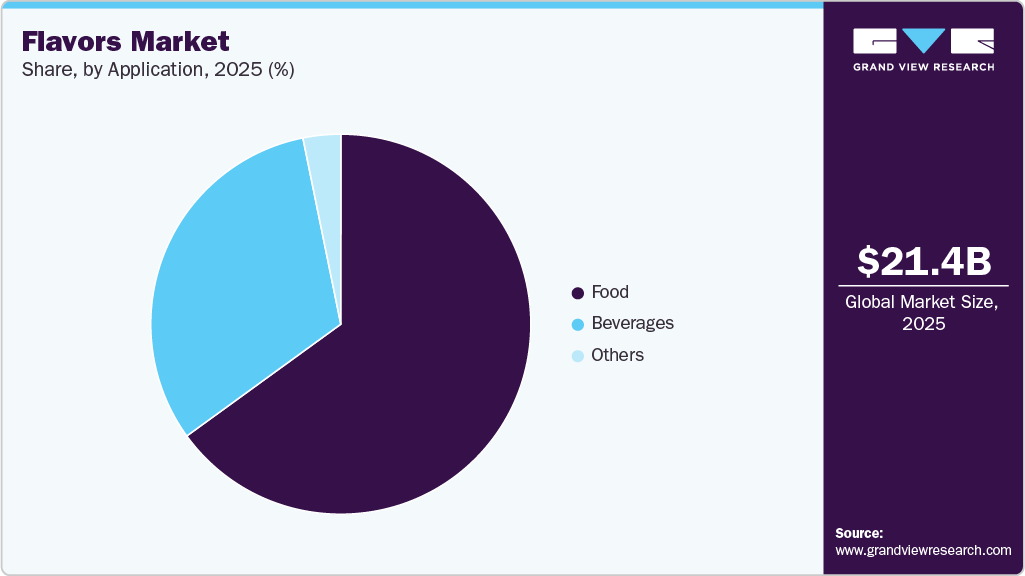

- By application, the food flavors accounted for a revenue share of 64.9% in 2025.

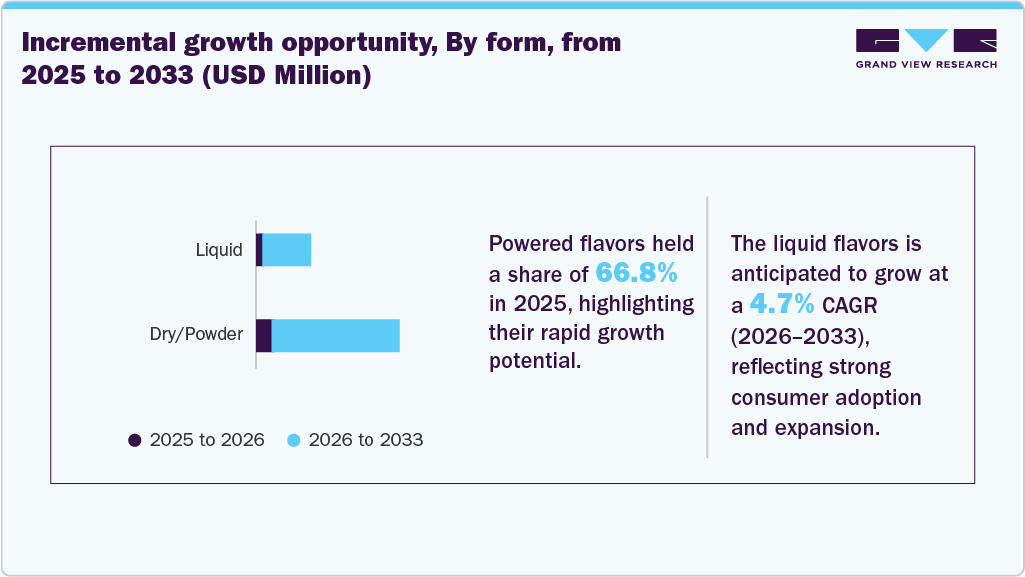

- By form, the powder flavors accounted for 66.8% of the market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 21.42 Billion

- 2033 Projected Market Size: USD 33.03 Billion

- CAGR (2026-2033): 5.5%

- Asia Pacific: Largest market in 2025

A key trend is the increasing demand for ethnic and regional flavors, driven by globalization, increased travel, and a willingness to explore new tastes. Consumers are no longer content with simply trying "Italian" or "Mexican" food; they are actively seeking out nuanced tastes and regional specialties like Sichuan peppercorn, Peruvian ceviche, or specific Indian curries. This trend is fueled by social media, cooking shows, and food blogs that expose individuals to a wider range of global cuisines, creating a desire to replicate these experiences at home.

Another significant driver is the rising demand for natural and clean-label ingredients, strongly supporting the natural and organic flavors industry. Consumers are increasingly conscious of the ingredients in their food and are actively seeking products with recognizable, minimally processed components. This translates to a surge in demand for natural flavors derived from fruits, vegetables, herbs, and spices, while artificial flavors face increasing scrutiny. At the same time, advancements in fermentation and precision processing are contributing to the biotech flavors industry, enabling sustainable and consistent flavor development. The emphasis on sustainability and ethical sourcing further reinforces the preference for naturally derived flavor profiles. Besides, the shift toward plant-based diets is also contributing to demand for innovative flavorings that enhance the taste and appeal of vegetarian and vegan products.

The globalization of food culture and increasing interconnectedness are also playing a vital role. International cuisines are becoming increasingly popular, driving demand for authentic aromas across regions. Restaurants and foodservice providers are incorporating global flavors to attract broader consumer bases, while busy lifestyles increase reliance on convenience foods. This trend is creating demand for flavors that deliver authentic taste quickly, with cross-industry innovations from the feed flavors and sweeteners market influencing flavor enhancement and palatability techniques.

Furthermore, the growth of the convenience food and beverage sector is contributing significantly to the market. As lifestyles become busier, consumers increasingly rely on ready-to-eat meals, snacks, and beverages that require aroma enhancement to deliver satisfying sensory experiences. Manufacturers are leveraging global flavors to differentiate offerings, particularly in emerging economies with urbanizing populations.

Besides, aging populations and growing health awareness are shaping demand for global flavors. Older consumers seek bolder taste experiences, while health-conscious consumers prefer flavorful alternatives to high-sodium or high-sugar products. Global flavors with perceived health benefits are being incorporated across food categories, creating opportunities for functional and wellness-driven flavor innovation.

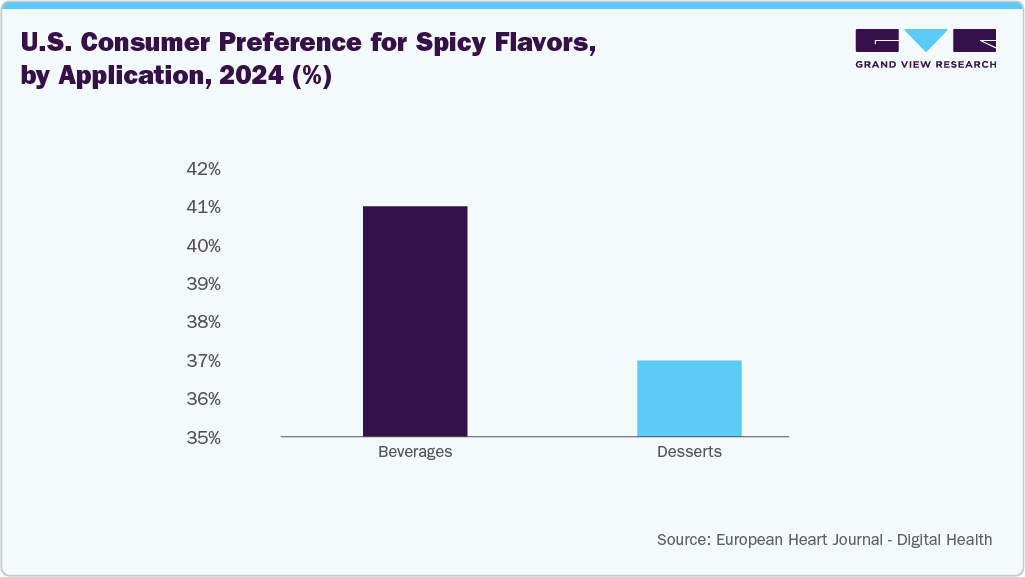

Consumer Surveys & Insights

Beck Flavors' 2024 "Flavors of the Year" initiative offers invaluable insights into evolving consumer preferences, empowering businesses across the restaurant, retail, and manufacturing sectors to strategically align their product development and offerings with emerging trends. Annual, in-depth consumer research conducted by Beck Flavors reveals a significant appetite for spicy flavor profiles, with 41% of U.S. consumers expressing a desire for spicy beverages and 37% favoring spicy desserts. This data underscores a shifting landscape where consumers are increasingly receptive to bold and nuanced taste experiences.

Moreover, the crowning flavor of 2024, Hot Pepper Jelly, encapsulates this trend. This innovative flavor delivers a sophisticated blend of sweet, spicy, and tangy notes, appealing to both adventurous palates and health-conscious consumers seeking a unique twist on familiar flavors. Backed by robust research data, Hot Pepper Jelly exemplifies the growing consumer demand for sensory culinary experiences and possesses the attributes necessary for sustained market appeal. By leveraging Beck Flavors' "Flavors of the Year" insights, businesses can effectively cater to evolving consumer preferences, fostering innovation and driving revenue growth.

Nature Insights

Synthetic flavors accounted for a revenue share of more than 65.6% in 2025, primarily due to their cost-effectiveness and stability. Synthetic/artificial flavors are generally much cheaper to produce than their natural counterparts, making them an attractive option for manufacturers seeking to minimize production costs, particularly in price-sensitive product categories. This cost advantage is further amplified by the fact that synthetic flavors can be manufactured in large quantities with consistent quality and without being subject to the seasonal variations or supply chain complexities that often plague natural flavor sources. Consequently, synthetic flavors remain prevalent in a wide range of processed foods and beverages, especially in developing countries where affordability is a key purchasing factor; thus, the artificial flavors industry held a significant share in 2025.

Natural flavors is anticipated to witness a growth rate of 6.9% from 2026 to 2033, driven by increasing consumer awareness and preference for clean-label products. This trend is fueled by a growing understanding of the potential health risks associated with artificial additives and a desire for more authentic and sustainable food experiences. Consumers are actively seeking organic and natural products with recognizable ingredient lists, perceived as healthier and more trustworthy. This surging demand is pushing manufacturers to invest in research and development to extract and preserve natural aromas from various botanical sources, fruits, vegetables, spices, and herbs. The trend is particularly strong in developed markets like North America and Europe. Furthermore, the growing popularity of ethnic cuisines and global culinary influences is driving demand for specific and authentic natural flavor profiles that can only be achieved through natural extraction and processing methods.

Form Insights

The powder flavors accounted for a revenue share of 66.8% in 2025. Convenience and extended shelf life are primary drivers, making powder formats ideal for processed foods, snacks, and ready-to-mix beverages. Furthermore, powdered flavors offer ease of handling and precise dosage, which appeals to manufacturers seeking consistent flavor profiles in large-scale production. The versatility of powders allows for diverse applications, including dry rubs, seasonings, and encapsulated flavor systems, contributing to their increasing adoption across various food and beverage categories. Growing consumer preference for clean-label products further fuels the demand for natural and organic powdered flavors extracted from fruits, vegetables, and spices, reflecting a shift towards healthier and more transparent ingredients.

The liquid/gel flavors are estimated to grow at a CAGR of 4.7% from 2026 to 2033, primarily due to their ability to deliver intense and authentic taste profiles. This is particularly important in applications like beverages, confectionery, and dairy products, where a strong and immediate flavor impact is desired. Liquid flavors blend seamlessly with other liquid ingredients, ensuring uniform distribution and a consistent sensory experience. Moreover, the ease with which liquid flavors can be incorporated into existing manufacturing processes, often requiring minimal equipment modifications, makes them a popular choice for both small-scale artisanal producers and large-scale food and beverage manufacturers. Besides, the demand for liquid and gel flavors is also fueled by the growing popularity of ready-to-drink beverages, alcoholic cocktails, and gourmet sauces and syrups. Consumers are increasingly seeking unique and exciting aroma experiences, driving manufacturers to incorporate innovative and premium liquid flavors to differentiate their products.

Application Insights

The food flavors accounted for a revenue share of 64.9% in 2025, driven by evolving consumer preferences and product innovation across multiple food categories. A major trend shaping demand is the rising popularity of ethnic and regional cuisines, which is increasing the use of specialized spice blends, sauces, and flavor systems, including citrus flavors widely used in beverages, bakery, confectionery, and savory applications. Thus, the citrus flavors are growing significantly. Moreover, growing emphasis on clean-label and sustainability is also strengthening the bio-based flavors and fragrance market, as food manufacturers prioritize flavors derived from natural, renewable sources such as real fruits, vegetables, herbs, and spices. In addition, the expansion of the dairy flavors, covering cheese, butter, cream, and yogurt profiles, supports demand from both traditional dairy and rapidly growing plant-based alternatives. The surge in convenience foods and ready-to-eat meals further fuels the need for robust flavor solutions capable of withstanding processing while masking off-notes from preservatives. Moreover, the booming plant-based food segment is creating strong demand for advanced flavor compounds that accurately replicate meat and dairy taste profiles, opening new avenues for innovation.

The beverage application is estimated to grow at a CAGR of 6.0% from 2026 to 2033, fueling demand for innovative and diverse aroma profiles for beverage production. A key trend is the growing popularity of functional beverages, including those with added vitamins, minerals, and botanical extracts, which is strengthening interest in the encapsulated flavors and fragrances market due to its ability to improve flavor stability, controlled release, and shelf-life performance. This necessitates flavors that not only taste appealing but also complement functional ingredients while masking any unpleasant notes. Consumers are also gravitating toward healthier beverage options with reduced sugar content, driving demand for flavor enhancers and sweetness modulators that maintain a desirable taste profile without excessive sugar. Beyond functional drinks, both alcoholic and non-alcoholic beverage segments are increasingly driven by experimentation and novelty. The rise of craft beverages, innovative cocktails, and unique flavor combinations is encouraging manufacturers to explore exotic fruits, spices, and herbs, further supporting advanced flavor delivery technologies.

Regional Insights

Asia Pacific dominated the flavors market in 2025 with a share of 36.6% and is set to grow at a CAGR of about 7.1% from 2026 to 2033, driven by diverse culinary traditions, rapidly changing consumer preferences, and strong economic growth. Demand for both traditional and innovative flavors is high across countries in the region. Moreover, the rise of food delivery services and online retail has expanded the reach of different cuisines and flavors, further accelerating innovation. Health is also becoming a growing concern in the region, owing to the increasing obesity and diabetes rates, driven by rising disposable income and more people moving to urban areas. Besides, consumers are increasingly seeking out flavors that enhance the healthfulness of food products, such as those emphasizing natural ingredients and lower sugar or sodium content.

China Flavors Market Trends

China flavors marketis driven by a rapidly expanding middle class with increasing purchasing power and a growing appetite for diverse culinary experiences. Traditional Chinese flavors remain dominant, but there has been a surge in demand for international flavors, particularly from Western cuisines and other Asian countries. E-commerce plays a significant role in driving innovation through its ability to introduce and expose consumers to new flavors and food products. Health and wellness trends are gaining traction as Chinese consumers become more health-conscious. Demand for natural and organic flavors is on the rise, particularly in the baby food and beverage sectors. Government regulations are also driving changes in the market, with stricter controls on food safety and ingredient labeling, thus influencing the demand for natural and clean-label flavorings.

The flavors market in Japan is set to grow at a CAGR of about 7.6% from 2026 to 2033. Traditional Japanese flavors, such as soy sauce, miso, and seaweed, maintain a strong presence. Yet, there is a growing interest in international and fusion cuisine and the unique flavors that they offer. A sophisticated understanding of sensory science and the use of advanced technologies also characterizes the market. Japan's aging population and shrinking labor force have led to a preference for convenient and ready-to-eat food products, which, in turn, boost the market. Health and wellness are also key concerns, with consumers increasingly looking for low-sugar, low-sodium, and fortified foods. This has led to significant growth in demand for flavors that can help food manufacturers improve the nutritional profile of their products while adding to the overall quality.

North America Flavors Market Trends

The flavors market in North America held over 24.2% of the global revenue in 2025, driven by a strong consumer focus on health and wellness, leading to demand for natural, organic, and clean-label flavors. Consumers are increasingly seeking products with recognizable and sustainable ingredients, pushing manufacturers to innovate with flavor profiles that align with these values. Familiar comfort flavors like vanilla, chocolate, and citrus remain popular, but there's also growing interest in global cuisines and ethnic flavors such as Mexican, Asian, and Mediterranean. The beverage industry is a key demand driver, with innovations in flavored waters, ready-to-drink teas, and plant-based milk alternatives incorporating unique and exotic flavor combinations. Another significant trend is the rise of savory and umami flavors, especially in snacks and prepared foods. Manufacturers are leveraging these complex flavor profiles to reduce sodium content while maintaining a satisfying taste experience.

The flavors market in the U.S. is expected to grow at a CAGR of 5.0% from 2026 to 2033, characterized by its fast-paced innovation and strong focus on convenience. Restaurant-inspired flavors are highly sought after, with consumers looking to recreate dining experiences at home. There’s a high demand for bold and adventurous flavors driven by a diverse population and growing culinary interest. Sweet and spicy combinations, such as mango habanero, are becoming increasingly popular. Moreover, the growing interest in plant-based diets fuels the demand for flavors that can improve the taste and texture of meat alternatives. Furthermore, advanced extraction techniques and encapsulation methods allow flavor houses to create more authentic and intense flavor experiences. The functional food and beverage market is also booming, with ingredients like adaptogens and probiotics being paired with flavors that mask their often-bitter taste.

Europe Flavors Market Trends

The flavors market in Europe is expected to grow at a CAGR of 3.7% from 2026 to 2033. Stringent regulations regarding flavorings drive innovation in natural flavor extraction and development. Consumers focus on healthy food options, driving the demand for flavors that enhance the nutritional profile of food and beverages and flavors that work well in reduced-sugar formulations. Regional culinary traditions heavily influence flavor preferences, leading to diverse flavor profiles across different countries. Moreover, the increasing awareness of allergens and sensitivities is driving demand for allergen-free and clean-label flavorings. The beverage industry in Europe faces a lot of pressure to reduce sugar content and is therefore actively investing in masking flavors. Fermented foods are also gaining popularity throughout Europe, and flavor suppliers are innovating with flavors that both enhance and complement the inherent taste of these products.

Germany flavors market is expected to grow at a CAGR of 6.3% from 2026 to 2033. Flavors used in healthy and functional foods are in high demand, with ingredients like herbs, spices, and fruit extracts being used to enhance nutritional profiles. Traditional German flavors, such as those found in cured meats, sausages, and baked goods, remain popular. Health and wellness are also a dominating factor, influencing flavor and ingredient choices. The popularity of organic and sustainable products is particularly strong, with consumers willing to pay a premium for ethically sourced and environmentally friendly options. Clean label is also a key trend, with consumers demanding recognizable and minimal ingredients in food & beverages across categories.

The flavors market in the UK is heavily influenced by trends in food service and retail, with consumers seeking restaurant-quality flavors in their home cooking. There is a growing demand for globally inspired flavors from regions like Asia, the Middle East, and Africa, reflecting the country’s diverse population. Savory flavors, especially those used in snacks and ready meals, are a key driver of demand, with options like smoked paprika and chili gaining popularity. Consumers are showing a growing interest in plant-based diets and demanding vegan options, driving the need for flavor masking and enhancing ingredients that appeal to plant-based palettes. There is also a lot of focus on locally sourced and natural ingredients, with flavors that celebrate British culinary heritage remaining popular.

Central & South America Flavors Market Trends

The flavors market in Central & South America is set to grow at a CAGR of about 5.3% from 2026 to 2033. The market is driven by a strong preference for bold, vibrant flavors, particularly spicy, sweet, and savory profiles. Regional cuisines vary considerably, leading to unique flavor profiles in each country. Flavors like chili, citrus, herbs, and tropical fruits play a key role in enhancing both traditional and modern dishes. Economic growth and urbanization are contributing to a greater demand for convenience foods and beverages. In addition, there is a growing interest in healthier food options, fueling demand for natural and organic essences, especially in the beverage and snack sectors. Consumers are also increasingly seeking out flavors that can enhance the functionality of food products or offer health benefits, leading to greater innovation in product development.

Middle East & Africa Flavors Market Trends

The flavors market in the Middle East & Africa is set to grow at a CAGR of about 4.4% from 2026 to 2033, driven by population increases, rising disposable incomes, and urbanization. Traditional Middle Eastern and African flavors, such as spices, herbs, dates, and citrus, remain popular. However, the market is also seeing increased demand for Western and Asian flavors, reflecting growing global cultural exposure. The market is split between traditional flavors and consumers wanting to try newer and more innovative flavor profiles influenced by globalization. Economic growth and urbanization are leading to changes in dietary habits, with higher demand for processed foods and beverages. This is driving the need for flavors that enhance taste and appeal. There is also a growing trend towards health-conscious food choices, with greater demand for natural and organic flavors, reflecting an increasing awareness of health and wellness.

Key Flavors Company Insights

Key companies, including Givaudan, Firmenich SA, Symrise AG, Sensient Technologies Corporation, International Flavors & Fragrances Inc., Takasago International Corporation, Kerry Group plc, MANE, Robertet Group, and Huabao Flavours & Fragrances Co., Ltd., are some of the dominant players operating in the market. These industry giants employ diverse strategies to maintain and expand their market dominance. A crucial aspect of their approach is consistent innovation through new product launches, constantly introducing novel flavor profiles and technologies that cater to evolving consumer preferences and industry trends. Moreover, these companies actively pursue strategic acquisitions and mergers to consolidate their market position, broadening their product offerings and access to new geographical regions or specialized flavor segments.

Beyond product innovation and M&A activity, these key players strategically leverage expansion and partnership strategies to further solidify their competitive positioning. They invest in expanding their manufacturing and R&D facilities in emerging markets to cater to local tastes and strengthen their supply chains. Furthermore, collaborations and partnerships with food and beverage manufacturers, research institutions, and even technology companies are instrumental in gaining access to new technologies, market insights, and distribution channels. These collaborative efforts enable them to tailor their flavor solutions to specific application areas and address emerging consumer demands for natural, sustainable, and health-focused flavorings. The competitive dynamics within the market, driven by these diverse strategies, ultimately contribute to a constantly evolving landscape and a wealth of innovative flavor solutions for the food and beverage industry.

Key Flavors Companies:

The following are the leading companies in the flavors market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- Firmenich SA

- Symrise AG

- Sensient Technologies Corporation

- International Flavors & Fragrances Inc.

- Takasago International Corporation

- Kerry Group plc

- MANE

- Robertet Group

- Huabao Flavours & Fragrances Co., Ltd.

Recent Developments

-

In January 2025, PepsiCo and Tata Consumer Products partnered to co-develop and market packaged snacks in India, aiming to tap into the rapidly growing snack market. This collaboration will feature fusion flavors, combining PepsiCo's popular Kurkure brand with Tata's recently acquired Ching's Secret. The partnership follows the dissolution of their previous joint venture and is designed to leverage Tata's brand portfolio and PepsiCo's snack innovation expertise.

-

In January 2025, RECOVER 180 introduced a new flavor, Strawberry Banana, as part of its premium hydration beverage lineup, just in time for the new year. This refreshing flavor combines the sweetness of strawberries with the creaminess of bananas, and like all RECOVER 180 drinks, it features organic coconut water, essential vitamins, and minerals for optimal hydration.

-

In November 2024, Narichan launched a new ready-to-drink (RTD) kimchi beverage called Kimchi Me, aimed at expanding beyond traditional kimchi products. This unique drink is made from squeezed kimchi juice and contains no sugar or gluten. It is designed to offer the health benefits of kimchi, such as aiding digestion and relieving hangovers, in a convenient format.

Flavors Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.67 billion

Revenue forecast in 2033

USD 33.03 billion

Growth rate (revenue)

CAGR of 5.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Givaudan, Firmenich SA, Symrise AG, Sensient Technologies Corporation, International Flavors & Fragrances Inc., Takasago International Corporation, Kerry Group plc, MANE, Robertet Group, Huabao Flavours & Fragrances Co., Ltd.

Customization scop

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavors Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flavors market report based on nature, form, application, and region:

-

Nature Outlook (Revenue, USD Billion, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Powder

-

Liquid/Gel

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others

-

-

Beverages

-

Juices & Juice Concentrates

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flavors market was estimated at USD 21.42 billion in 2025 and is expected to reach USD 22.67 billion in 2026.

b. The global flavors market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 to reach USD 33.03 billion by 2033.

b. Asia Pacific dominated the flavors market with a share of 36.6% in 2025, driven by diverse culinary traditions, rapidly changing consumer preferences, and strong economic growth. Demand for both traditional and innovative flavors is high across countries in the region. Moreover, the rise of food delivery services and online retail has expanded the reach of different cuisines and flavors, further accelerating innovation.

b. Some of the key market players in the flavors market are Givaudan, Firmenich SA, Symrise AG, Sensient Technologies Corporation, International Flavors & Fragrances Inc., Takasago International Corporation, Kerry Group plc, MANE, Robertet Group, and Huabao Flavours & Fragrances Co., Ltd.

b. The market growth is attributed by the evolving consumer preferences for diverse and authentic culinary experiences. A key trend is the increasing demand for ethnic and regional flavors, driven by globalization, increased travel, and a willingness to explore new tastes. Manufacturers are leveraging global flavors to differentiate their offerings and appeal to consumers seeking convenient but exciting culinary options. This trend is particularly prominent in emerging economies with rapidly urbanizing populations and evolving dietary habits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.