Fixed Wireless Access Market Size, Share & Trend Analysis Report By Offering, By Operating Frequency, By Demography, By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-421-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Fixed Wireless Access Market Size & Trends

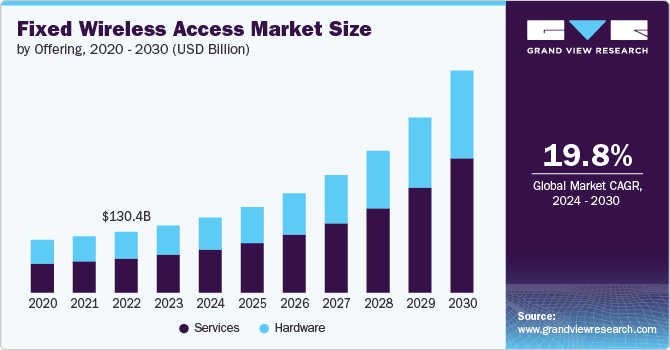

The global fixed wireless access market size was estimated at USD 143.61 billion in 2023 and is projected to grow CAGR of 19.8% from 2024 to 2030. The rapid advancement and deployment of 5G technology drives the market's growth; unlike traditional broadband, which relies on fixed-line connections such as fiber or DSL, fixed wireless access (FWA) leverages cellular networks to deliver high-speed internet. The rollout of 5G networks, which offer lower latency, higher bandwidth, and faster data speeds than 4G, has made FWA a viable alternative to wired broadband, particularly in areas where laying fiber-optic cables is cost-prohibitive or geographically challenging.

There is a growing demand for high-speed internet access in rural and underserved regions where traditional broadband infrastructure is inadequate or non-existent. FWA presents an attractive solution in these areas as it can be deployed more quickly and with lower capital expenditure compared to laying physical cables. The increasing need for reliable internet access for remote work, online education, streaming services, and other digital activities drives this demand.

Moreover, from an economic standpoint, FWA offers a more cost-effective solution than traditional broadband, especially in low-density or hard-to-reach areas. The reduced need for extensive physical infrastructure, such as cables and trenches, translates into lower deployment and maintenance costs. Furthermore, FWA is highly scalable, allowing service providers to expand their coverage and capacity in response to growing demand without substantial additional investment. This scalability makes FWA an attractive option for telecom operators looking to maximize their return on investment.

The evolving needs of consumers and businesses contribute to the growth of FWA. The rise of remote work, online education, and the increased reliance on digital services have highlighted the importance of reliable, high-speed internet connectivity. FWA offers a flexible and scalable solution that can quickly adapt to changing demands in urban, suburban, or rural settings. FWA provides a dependable internet connection for businesses that can support a range of operations, from small offices to large enterprises, without extensive infrastructure. This adaptability to diverse needs is a key factor in adopting FWA in the global market.

However, a lack of awareness about fixed wireless access and consumer perceptions could hinder market growth. Many consumers may be unfamiliar with FWA as a broadband option or may have concerns about its reliability, speed, and overall performance compared to traditional wired solutions. Misconceptions about the technology, such as the belief that it is only suitable for rural areas or offers inferior service, can deter potential customers from considering FWA.

Offering Insights

Services segment led the market and accounted for 56.8% of the global revenue in 2023. The shift towards subscription-based models is driving the growth of the segment. Many service providers are adopting subscription-based pricing for their FWA offerings, which includes ongoing access to connectivity and related services such as network security, customer support, and equipment leasing. This model provides customers with a predictable and manageable cost structure while ensuring continuous service updates and enhancements. For providers, subscription models offer a steady and recurring revenue stream, enhancing profitability and financial stability.

The hardware segment is expected to register significant growth from 2024 to 2030. The evolution of CPE, with improvements in design, functionality, and performance, significantly drives the market's growth. Modern CPE devices are now equipped with advanced features such as dual-band Wi-Fi, mesh networking capabilities, and enhanced security protocols, which improve user experience and connectivity reliability. The increasing adoption of these sophisticated CPE devices by both residential and business customers is contributing to the expansion of the hardware segment.

Operating Frequency Insights

The Sub-6 GHz segment accounted for the largest market revenue share in 2023. The Sub-6 GHz frequency bands, which include the spectrum below 6 GHz, are widely available and have been extensively used in various wireless communication technologies, including 4G LTE and early 5G deployments. This availability has made the Sub-6 GHz segment highly attractive for FWA applications. Many telecom operators already possess licenses for these frequency bands, allowing them to deploy FWA services quickly and cost-effectively.

The above 39 GHz segment is expected to grow significantly from 2024 to 2030. The increasing demand for high-capacity broadband services is driving the segment's growth. Consumers and businesses seek faster and more reliable internet connections to support bandwidth-intensive applications, such as cloud computing, online gaming, video conferencing, and streaming services. FWA solutions operating in the above 39 GHz range are well-suited to meet this demand, as they can deliver high speed with low latency, comparable to or even exceeding traditional fiber-optic connections.

Demography Insights

The urban segment accounted for the largest market revenue share in 2023. Urban areas are dynamic environments where the demand for connectivity can change rapidly due to population growth, new business developments, and increased reliance on digital services. Fixed wireless access offers the flexibility to quickly deploy and scale internet services to meet these changing demands. Unlike wired solutions requiring extensive planning and construction, FWA can be deployed rapidly using cellular infrastructure. This agility is particularly beneficial in urban settings, where there may be a need to quickly address gaps in coverage or respond to spikes in demand.

The semi-urban segment is expected to register significant growth from 2024 to 2030. Semi-urban areas often have a mix of residential, commercial, and small industrial zones, each with varying connectivity needs. FWA is adaptable to these diverse requirements, offering tailored solutions that can cater to homes, small businesses, and community institutions like schools and healthcare centers. The versatility of FWA in addressing different use cases within semi-urban environments further drives its adoption. As businesses in semi-urban areas increasingly rely on digital tools and services, the demand for reliable broadband supporting these activities has grown, making FWA an attractive option for service providers and consumers.

Technology Insights

The 4G segment accounted for the largest market revenue share in 2023. The extensive network coverage drives the market's growth. Over the past decade, telecom operators have invested heavily in expanding 4G infrastructure, resulting in widespread availability across urban, suburban, and rural areas. This extensive coverage makes 4G a highly accessible and practical solution for providing broadband internet through FWA. As a result, FWA services leveraging 4G technology can reach a broad customer base, driving its adoption in various markets.

The 5G segment is expected to grow significantly from 2024 to 2030. The superior performance and capabilities offered by the 5G network drive the segment's growth. 5G provides significantly higher data speeds, lower latency, and greater network capacity, which is crucial for delivering high-quality broadband services through FWA. The enhanced performance of 5G makes it possible to offer internet speeds that exceed those of traditional wired connections, such as fiber-optic and DSL, making FWA a competitive alternative for residential and business users. The ability of 5G to support high-bandwidth applications, including ultra-high-definition video streaming, online gaming, and large-scale IoT deployments, further drives its adoption in the fixed wireless access market.

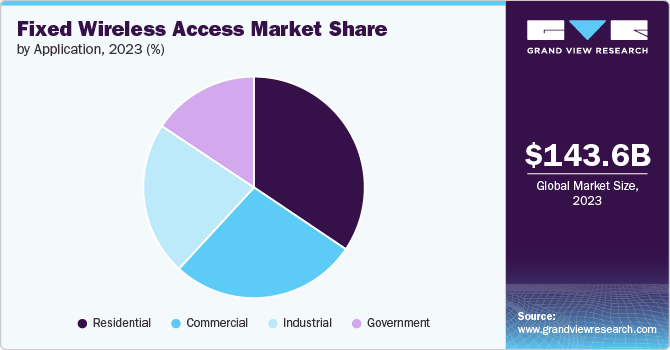

Application Insights

The residential segment accounted for a significant market revenue share in 2023. The growing adoption of smart home technologies is contributing to the increasing popularity of FWA in residential applications. Smart home devices such as security cameras, smart thermostats, voice assistants, and connected appliances require stable and high-speed internet connectivity to function effectively. As more households integrate these devices into their daily lives, the demand for reliable broadband, such as fixed wireless access, that can support multiple connected devices simultaneously is increasing.

The commercial segment is expected to register significant growth from 2024 to 2030. Fixed wireless access is well-suited for temporary or pop-up business operations, such as construction sites, event venues, or seasonal businesses. These operations often require quick and temporary internet solutions that can be set up and dismantled with minimal hassle. FWA offers the perfect solution, providing high-speed internet without needing permanent infrastructure. Businesses can deploy FWA to support short-term projects, mobile offices, or temporary retail locations, ensuring they have the connectivity they need to operate efficiently. This ease of deployment and flexibility of FWA makes it an attractive option for businesses with temporary or mobile operations, thus driving its growth in commercial applications.

Regional Insights

North America fixed wireless access market is poised for significant growth from 2024 to 2030. The growing adoption of Internet of Things (IoT) devices and smart technologies in residential and commercial settings drives the growth of the FWA market in North America. Smart homes, connected businesses, and industrial IoT applications require reliable and high-capacity internet connections to function effectively. FWA offers a robust solution for these needs, providing the bandwidth and low latency to support a wide range of connected devices, from smart thermostats and security systems to industrial sensors and machinery.

U.S. Fixed Wireless Access Market Trends

The U.S. fixed wireless access market is anticipated to register significant growth from 2024 to 2030. The shift towards remote work and the increasing reliance on digital services, accelerated by the COVID-19 pandemic, contributes to the growth of FWA in the U.S.

Europe Fixed Wireless Access Market Trends

Fixed wireless access market in Europe is poised for significant growth from 2024 to 2030. Government efforts to improve network infrastructure in the region drive the market's growth. For instance, the European Commission, through the Horizon 2020 program, committed public funding of more than EUR 700 million (USD 770 million) to support 5G opportunities in the region. Such initiatives are expected to drive the market's growth over the forecast period.

Asia Pacific Fixed Wireless Access Market Trends

Fixed wireless access market in Asia Pacific accounted for the largest share of 37.2% of the global revenue share in 2023. The large and rapidly growing population, rising adoption of 5G technology, and increasing digitalization drive the market growth in the region.

Key Fixed Wireless Access Company Insights

The fixed wireless access market is highly competitive, with companies constantly seeking to gain an edge through advanced technological innovations and unique service offerings.

For instance, in June 2023, Nokia Corporation launched a purpose-built FWA receiver tailored for the North American market. The Nokia FastMile 5G receiver has a high-gain antenna to provide high speeds across extended distances, making it ideal for serving rural and suburban communities with limited access. The receiver supports 5G and 4G bands, including Citizens Broadband Radio Service (CBRS) in either 5G or 4G and C-band.

Key Fixed Wireless Access Companies:

The following are the leading companies in the fixed wireless access market. These companies collectively hold the largest market share and dictate industry trends.

- Nokia Corporation

- AT&T Inc.

- T Mobile USA, Inc.

- CommScope Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- Huawei Technologies Co., Ltd.

- Inseego Corp

- Telstra

- FS.com

Fixed Wireless Access Market Report Scope

|

Attribute |

Details |

|

Market size value in 2024 |

USD 161.27 billion |

|

Revenue forecast in 2030 |

USD 476.34 billion |

|

Growth rate |

CAGR of 19.8% from 2024 to 2030 |

|

Historical data |

2019 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in Thousand Units, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, operating frequency, demography, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Philippines; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Nokia Corporation; AT&T Inc.; T Mobile USA, Inc.; CommScope Inc.; Verizon Communications Inc.; Vodafone Group Plc; Huawei Technologies Co., Ltd.; Inseego Corp; Telstra; FS.com |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fixed Wireless Access Market Report Segmentation

The report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the fixed wireless access market based on offering, operating frequency, demography, technology, and region.

-

Offering Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Customer Premises Equipment (CPE)

-

Indoor CPE

-

Outdoor CPE

-

-

Access Units

-

Femto Cells

-

Pico Cells

-

-

-

Services

-

-

Operating Frequency Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

24-39 GHz

-

Above 39 GHz

-

-

Demography Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

Urban

-

Semi-urban

-

Rural

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

4G

-

5G

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Oil & Gas

-

Mining

-

Utility

-

Others

-

-

Government

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Philippines

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fixed wireless access market size was estimated at USD 143.61 billion in 2023 and is expected to reach USD 161.27 billion in 2024.

b. The global fixed wireless access market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 476.34 billion by 2030.

b. Asia Pacific dominated the fixed wireless access market with a share of 37.15% in 2023. The large and rapidly growing population, rising adoption of 5G technology, and increasing digitalization drive the market growth in the Asia Pacific.

b. Some key players operating in the fixed wireless access market include Nokia Corporation; AT&T Inc.; T Mobile USA, Inc.; CommScope Inc.; Verizon Communications Inc.; Vodafone Group Plc; Huawei Technologies Co., Ltd.; Inseego Corp; Telstra; and FS.com.

b. Key factors that are driving the market growth include the rapid advancement and deployment of 5G technology and the growing demand for high-speed internet access in rural and underserved regions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."