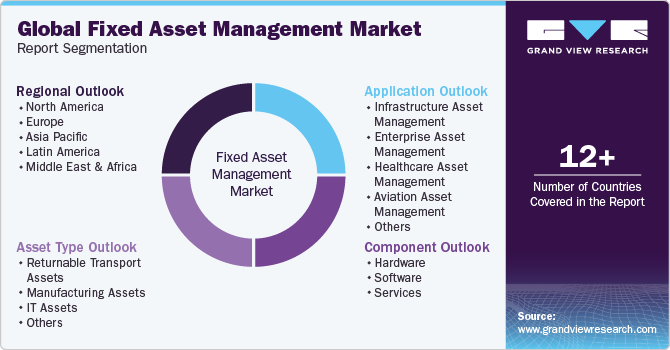

Fixed Asset Management Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Asset Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-287-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Fixed Asset Management Market Trends

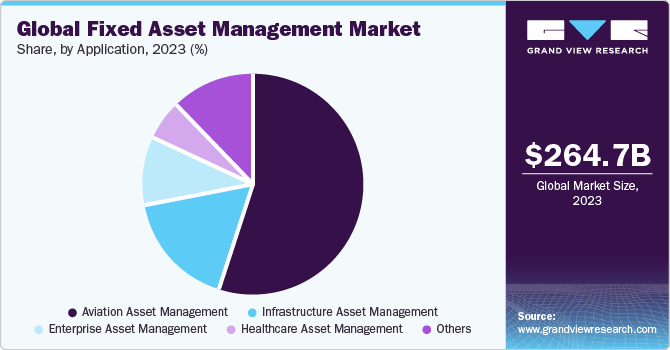

The global fixed asset management market size was estimated at USD 264.68 billion in 2023 and is projected to grow at a CAGR of 28.3% from 2024 to 2030. The market growth driven by several key factors. For instance, the increasing adoption of automation and digitization across industries has increased the need for efficient tracking and management of fixed assets. Tightening regulatory compliance requirements are also prompting organizations to invest in solutions that ensure accurate asset management and reporting. Government mandates regarding asset tracking, depreciation, and reporting standards create a strong demand for advanced fixed asset management systems.

The rise of cloud-based solutions has enhanced the scalability and accessibility of reliable asset management solutions, appealing to businesses seeking flexible solutions to manage their assets. The proliferation of IoT devices and RFID technology is enabling the real-time tracking and monitoring of assets, further driving market growth. For instance, in October 2023, PervasID, a UK-based provider of passive RFID reader systems for asset tracking and inventory automation, launched TrackMaster, a near-real-time tracking system worldwide. TrackMaster allows retailers to precisely track the location of their goods in retail stores or warehouses by using existing tags and eliminating the need for time-consuming and labor-intensive manual handheld scanning. Moreover, the growing awareness of cost-saving benefits and the potential for maximizing asset utilization are encouraging businesses to invest in comprehensive fixed asset management solutions, contributing to market expansion.

The growing focus of organizations across industries on predictive maintenance is another key trend driving the market. Buyers seek fixed asset management solutions equipped with predictive analytics and IoT sensors to anticipate equipment failures and optimize maintenance schedules. Suppliers are incorporating advanced analytics capabilities into their offerings to provide buyers with actionable insights that support proactive maintenance strategies, helping them minimize downtime, reduce maintenance costs, and maximize asset reliability.

The increasing need for efficient resource utilization is also driving the demand for fixed asset management solutions. Businesses are recognizing the importance of effectively managing fixed assets to optimize resource allocation and drive productivity. Moreover, organizations across various industries are adopting advanced asset management solutions to streamline operations, minimize downtime, and maximize the lifespan of their assets. This trend is particularly prominent in sectors such as manufacturing, energy, and infrastructure, where the efficient utilization of fixed assets directly impacts operational efficiency and profitability.

The increase in cyberattacks has highlighted the need for solutions that can protect organizational assets. For instance, according to IBM's Cost of a Data Breach Report 2023, the average cost of a data breach in 2023 was USD 4.45 million, an increase of 15% globally over the last three years. The sharp increase in cyberattacks has compelled organizations to reassess their security posture. According to the report, more than half of the companies and organizations covered in the report have planned to increase their security investments in areas such as employee training, incident response planning and testing, and threat detection and response tools.

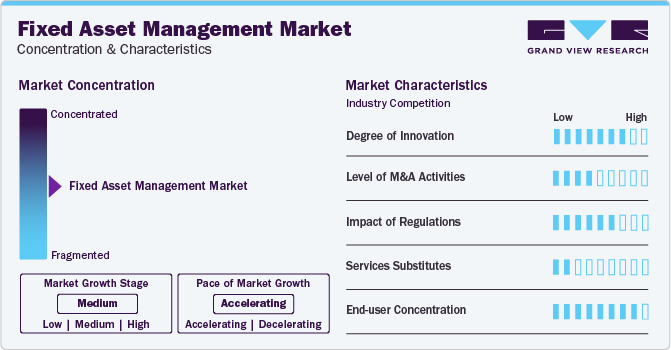

Market Concentration & Characteristic

One of the key opportunities of the market growth lies in the vast amount of data generated by connected assets. IoT-enabled sensors collect data regarding asset performance, usage patterns, and maintenance needs. By harnessing this data through analytics and AI-driven predictive maintenance algorithms, businesses can proactively identify potential issues, schedule maintenance activities more efficiently, and extend the lifespan of their assets. This predictive approach minimizes downtime, reduces the risk of unexpected breakdowns, and enhances overall asset reliability, translating into tangible bottom-line benefits for organizations.

A few key players in the market adopted the mergers & acquisition strategy to expand their product & service offerings. For instance, in November 2023, Rockwell Automation, Inc., Inc. completed the acquisition of Verve Industrial Protection, a cybersecurity software and services company specializing in industrial environments. The strategic acquisition was aimed at enhancing the company’s portfolio by integrating Verve Industrial Protection's leading asset inventory system and vulnerability management solution.

The threat of substitutes in the market is relatively low. While some companies may choose to manage their assets manually, the increasing complexity and scale of asset management tasks make specialized software solutions highly desirable. However, in some cases, companies opt for in-house solutions or alternative asset management methods, reducing reliance on external providers.

Customization and scalability have become critical considerations for buyers of fixed asset management solutions. Organizations are demanding asset management solutions that can be customized to their specific workflows and requirements. In addition, the high demand for scalable solutions can be attributed to the growing focus of organizations on proactive approaches to accommodate future growth and changing business needs without disruption. Suppliers are addressing these demands by offering flexible and scalable solutions that can adapt to the evolving needs of their customers, ensuring long-term satisfaction and value delivery.

Component Insights

Based on the component, the market has been segmented into hardware, software, and services. The services segment led the market with the largest revenue share of 45.77% in 2023. Services play a highly important role in the global market, owing to customers' higher dependency on support and maintenance services, parts replacement services, quality assurance, training and development, upgrade, repair & extend, sustaining & decarbonizing, replacing, and decommissioning of existing tools and systems. As organizations are increasingly adopting advanced software, technologies, and devices for managing infrastructure and assets by utilizing technologies like AI and IoT to optimize asset tracking, maintenance, and utilization, the need for ongoing services is also increasing.

The software segment is expected to register at the fastest CAGR of around 29.0% from 2024 to 2030. The global fixed asset management software segment is witnessing rapid growth, propelled by factors such as the widespread digitization of industries, stringent regulatory compliance requirements, and a growing emphasis on asset optimization and cost reduction. Moreover, the integration of Internet of Things (IoT) technology and advanced artificial intelligence and machine learning capabilities into asset management solutions is revolutionizing how organizations track, maintain, and utilize their assets. These software platforms offer real-time visibility, predictive maintenance capabilities, and streamlined processes, empowering businesses to make informed decisions, minimize downtime, and maximize the lifespan of their assets. As a result, the fixed asset management software market is poised for significant expansion in the foreseeable future.

Asset Type Insights

Based on asset type, the manufacturing assets segment led the market with the significant revenue share of 24.34% in 2023. The rapid pace of technological innovation in manufacturing, including the adoption of additive manufacturing (3D printing), robotics, and automation, presents both opportunities and challenges for asset management. Manufacturers investing in cutting-edge technologies require flexible and scalable asset management solutions capable of accommodating diverse asset types and evolving technology ecosystems. Solutions that offer compatibility with emerging technologies, interoperability with equipment from different vendors, and support for open standards facilitate seamless integration and future-proofing of manufacturing asset management systems, enabling manufacturers to stay agile and competitive in dynamic market environments.

The returnable transport assets segment is expected to register at the fastest CAGR of around 28.0% from 2024 to 2030. Technological advancements are playing a crucial role in driving the growth of the segment. The integration of IoT technology into Returnable Transport Assets (RTAs) enables real-time tracking, monitoring, and management of assets throughout their journey in the supply chain. IoT-enabled RTAs equipped with sensors and connectivity capabilities provide valuable data insights into asset location, condition, and utilization, empowering organizations to optimize route planning, minimize asset loss or theft, and improve the overall supply chain visibility and efficiency.

Application Insights

Based on the application, the market has been segmented into infrastructure asset management, enterprise asset management, healthcare asset management, aviation asset management, and others. The aviation asset management segment led the market with the largest revenue share of 54.87% in 2023. Aviation asset management involves the strategic monitoring of aircraft and related equipment throughout their lifecycle, from acquisition to disposal. This segment is witnessing growth primarily due to the increasing demand for air travel, driven by rising passenger numbers and cargo transportation needs. As airlines expand their fleets to meet this demand, the requirement for efficient asset management solutions becomes paramount. In addition, regulatory compliance and safety standards play a crucial role in driving growth in aviation asset management.

The enterprise asset management segment is expected to register at the fastest CAGR of 33.4% from 2024 to 2030. Industries such as oil and gas, mining, telecommunications, and healthcare rely heavily on physical assets to support their operations. As these asset-intensive sectors continue to grow and evolve, the demand for Enterprise Asset Management (EAM) solutions that can manage complex asset portfolios, ensure regulatory compliance, and optimize resource allocation is on the rise.

Regional Insights

North America dominated the fixed asset management market with the revenue share of 33.04% in 2023 and is also growing at a significant CAGR of 23.0% from 2024 to 2030. One of the primary drivers of the market growth in North America is the increasing adoption of advanced technology solutions by businesses across various industries. By leveraging IoT devices, data analytics, and cloud computing, companies can improve the performance of their assets, maximize the efficiency of their asset utilization, and streamline their operations. Moreover, stringent regulatory compliance requirements are compelling organizations to invest in robust fixed asset management solutions.

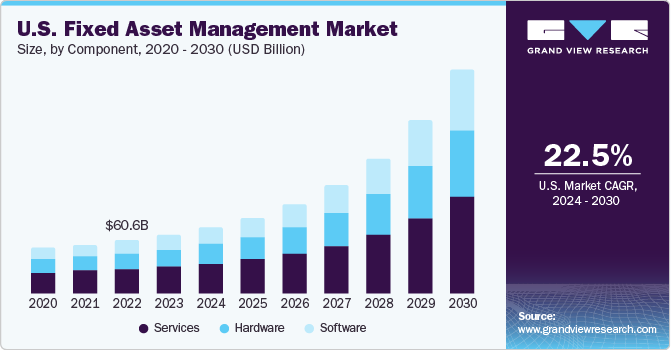

U.S. Fixed Asset Management Trends

The fixed asset management market in U.S. is anticipated to grow at a significant CAGR of 22.5% from 2024 to 2030. The rise of technology, particularly the integration of Internet of Things (IoT) devices and sensor technologies, has transformed fixed asset management practices in the U.S. IoT-enabled asset tracking systems provide real-time visibility into asset location, conditions, and performance, enabling proactive maintenance and minimizing downtime. Moreover, the adoption of cloud-based asset management platforms has facilitated centralized data storage, seamless collaboration, and accessibility from anywhere, enhancing operational efficiency and decision-making.

Asia Pacific Fixed Asset Management Trends

The fixed asset management market in Asia Pacific is expected to grow at the fastest CAGR of 31.9% from 2024 to 2030. The Asia Pacific region is witnessing unprecedented levels of infrastructure investment across various sectors, including transportation, energy, utilities, and telecommunications. Governments in countries such as China, India, and Southeast Asian nations are spearheading ambitious infrastructure projects to support economic growth and address urbanization challenges. As these projects come to fruition, the need for efficient fixed asset management becomes paramount to optimize the utilization, maintenance, and lifecycle of infrastructure assets.

The China fixed asset management market is anticipated to grow at a significant CAGR of 29.7% during the forecast period. China's sustained investment in infrastructure development serves as a fundamental driver for the market growth. The country's infrastructure projects encompass transportation systems, energy networks, telecommunications, and urban development. These large-scale investments create significant demand for asset management solutions to effectively plan, monitor, and maintain the vast array of assets across the nation.

The fixed asset management market in India is expected to grow at a significant CAGR of 35.5% from 2024 to 2030. Growing investments in cloud infrastructure are a key drivers for the market growth in India. As India continues to embrace digital transformation across industries, the adoption of cloud-based asset management solutions is expected to accelerate. Organizations recognize the need to optimize asset utilization, minimize downtime, and mitigate risks to remain competitive in today's dynamic business environment.

The Japan fixed asset management market is expected to grow at a substantial CAGR of 33.6% from 2024 to 2030. Japan's infrastructure, particularly in sectors such as transportation, energy, and utilities, is aging and requires notable renewal and modernization. This presents a compelling need for effective asset management solutions to optimize the lifecycle of existing infrastructure, extend its operational lifespan, and ensure safety and reliability.

Europe Fixed Asset Management Trends

The fixed asset management market in Europe is anticipated to grow at a significant CAGR of 29.8% from 2024 to 2030. The rising trend of digital transformation initiatives among European enterprises is driving the adoption of integrated asset management platforms. These platforms offer centralized control and visibility over diverse asset portfolios, facilitating better decision-making and resource allocation. Organizations are increasingly recognizing the importance of optimizing asset lifecycle management to enhance productivity, minimize downtime, and support long-term sustainability goals.

The UK fixed asset management market is expected to grow at the rapid CAGR of 31.1% from 2024 to 2030. The healthcare sector in the UK has been undergoing digital transformation aimed at enhancing patient care, increasing operational efficiency, and improving clinical outcomes. The growing adoption of digital technologies such as Electronic Health Records (EHRs), telemedicine, and wearable health devices presents the need for efficient asset management systems to effectively track and maintain these digital assets.

The fixed asset management market in Germany is anticipated to grow at a significant CAGR of 29.9% from 2024 to 2030. German automotive companies are investing heavily in digital platforms that enable real-time monitoring of assets throughout their lifecycle, from production to distribution and more. These platforms provide actionable insights that drive operational efficiency, reduce downtime, and enhance overall productivity.

The France fixed asset management market is expected to grow at the fastest CAGR of 33.1% from 2024 to 2030. One of the major drivers of the market growth in France is the ongoing digital transformation of infrastructure, particularly in the energy sector. The country's commitment to modernizing its electrical grid has heightened the focus on leveraging digital technologies to enhance efficiency, reliability, and sustainability of operations in the energy sector. As part of these digitization efforts, utilities and energy companies are investing in advanced asset management solutions to optimize the lifecycle of their infrastructure assets.

Middle East & Africa Fixed Asset Management Trends

The fixed asset management market in the Middle East & Africa is anticipated to grow at a significant CAGR of 25.6% from 2024 to 2030. The Middle East and Africa market for fixed asset management is driven by the growing use of advanced technologies such as Artificial Intelligence (AI) in asset management practices. As businesses in this region increasingly recognize the importance of efficient asset management, they are turning to advanced technologies to streamline processes, optimize resource allocation, and enhance overall productivity.

The Saudi Arabia fixed asset management market is expected to grow at substantial CAGR of 24.4% from 2024 to 2030. Smart manufacturing technologies, such as Industrial IoT (IIoT), big data analytics, and automation are transforming fixed asset management in Saudi Arabia. As the country continues to diversify its economy and invest in industrialization, there is a growing emphasis on leveraging advanced technologies to enhance operational efficiency, productivity, and competitiveness across various sectors.

Key Fixed Asset Management Company Insights

Some of the key players operating in the market include International Business Machines Corporation; Hitachi, Ltd.; and Honeywell International Inc. among others.

-

Hitachi, Ltd. is one of the leading providers of information and telecommunications systems, electronic systems and equipment, social infrastructure and industrial systems, construction machinery, automotive systems, railway systems materials and components, and smart life and eco-friendly systems. Hitachi Ltd.’s subsidiary Hitachi Energy offers a range of software solutions related to asset & work management, energy portfolio management, inspection insights, and SCADA & control systems. The company offers solutions pertaining to cybersecurity, digitalization, grid edge solutions, and power quality

-

Honeywell International Inc. is a diversified global technology and manufacturing company. The company’s product portfolio includes products related to building automation, aerospace technologies, automation & productivity, safety, and sensing & safety technologies, among others

Hexagon AB and Bentley Systems, Incorporated are some of the emerging market participants in the global market.

-

Hexagon AB is a global player in digital reality solutions, integrating software with sensing and autonomous technologies. The company’s solutions help customers utilize the growing volumes of data to enhance efficiency, productivity, quality, and safety across industrial, manufacturing, infrastructure, mobility, and public sector applications. The company has categorized its products by division under asset lifecycle intelligence; autonomous solutions; geosystems; manufacturing intelligence; and safety, infrastructure & geospatial

-

Bentley Systems, Incorporated provides infrastructure engineering software. The company’s portfolio encompasses various software solutions tailored to different applications spanning architecture, engineering, construction, and operations. The company’s software offerings empower users to design, build, and operate infrastructure assets efficiently and sustainably. The company’s software products are related to asset performance, bridge design, construction management, digital twin, geotechnical engineering, hydraulics, and mobility simulation, among other application areas

Key Fixed Asset Management Companies:

The following are the leading companies in the fixed asset management market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- ABB

- Hitachi, Ltd.

- Honeywell International Inc.

- General Electric Company

- International Business Machines Corporation

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- Oracle

- SAP SE

- Siemens AG

- Rockwell Automation

- WSP

- Zebra Technologies Corporation

Recent Developments

-

In April 2024, Rockwell Automation, Inc. announced plans to showcase its collaboration with Ericsson through a demonstration of Plex Asset Performance Management (APM) at the Hannover Messe 2024 trade fair. The system, powered by industrial private 5G connectivity, facilitates real-time decision-making and the management of emerging assets, such as Autonomous Mobile Robots (AMRs). The adoption of private 5G technology enables manufacturers to enhance their flexibility, agility, and sustainability while expanding the scope of devices and intelligence within their networks

-

In November 2023, ABB unveiled ABB Ability SmartMaster, an extensive APM platform tailored for the verification and condition monitoring of instrumentation and field devices across various industries, including wastewater, water, oil & gas, and chemical, among others, in India. SmartMaster systematically collects, analyzes, and validates diagnostic data from instruments remotely without disrupting ongoing measurement activities

-

In February 2024, ABB announced an agreement to acquire Seam Group, an energized asset management and advisory services company based in Ohio, U.S., from Align Capital Partners. The strategic acquisition was aimed at expanding the company’s electrification services portfolio in the U.S., enhancing its capabilities in preventive, predictive, and corrective maintenance; renewables; electrical safety; and asset management advisory services

-

In August 2023, SAP SE agreed with Software AG to incorporate its Intelligent Asset Management Suite, which includes Asset Performance Management (APM), with Software AG's Industrial IoT Platform, Cumulocity IoT. The collaboration was aimed at helping customers derive advantages from seamless product integration and a closed-loop approach to asset performance management

Fixed Asset Management Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 309.37 billion |

|

Market Value forecast in 2030 |

USD 1,379.13 billion |

|

Growth rate |

CAGR of 28.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, asset type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

Adobe; ABB; Hitachi, Ltd.; Honeywell International Inc.; General Electric Company; International Business Machines Corporation; Bentley Systems, Incorporated; Hexagon AB; AssetWorks, Inc.; Oracle; SAP SE; Siemens AG; Rockwell Automation; WSP; Zebra Technologies Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fixed Asset Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the fixed asset management market report based on component, asset type, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Real-Time Location System (RTLS)

-

Barcode

-

Mobile Computer

-

Labels

-

Global Positioning System (GPS)

-

Others

-

-

Software

-

Location & Movement Tracking

-

Check In/Check Out

-

Repair & Maintenance

-

Others

-

-

Services

-

Strategic Asset Management

-

Operational Asset Management

-

Tactical Asset Management

-

-

-

Asset Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Returnable Transport Assets

-

Manufacturing Assets

-

IT Assets

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure Asset Management

-

Transportation

-

Energy Infrastructure

-

Water & Waste Infrastructure

-

Critical Infrastructure

-

Telecommunication

-

Others

-

-

Enterprise Asset Management

-

Healthcare Asset Management

-

Aviation Asset Management

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fixed asset management market size was estimated at USD 264.68 billion in 2023 and is expected to reach USD 309.37 billion in 2024.

b. The global fixed asset management market is expected to grow at a compound annual growth rate of 28.3% from 2024 to 2030 to reach USD 1,379.13 billion by 2030.

b. North America dominated the fixed asset management market with a market share of 33.0% in 2023. One of the primary drivers of the fixed asset management market in North America is the increasing adoption of advanced technology solutions by businesses across various industries. By leveraging IoT devices, data analytics, and cloud computing, companies can improve the performance of their assets, maximize the efficiency of their asset utilization, and streamline their operations.

b. Some key players operating in the fixed asset management market include Adobe; ABB; Hitachi, Ltd.; Honeywell International Inc.; General Electric Company; International Business Machines Corporation; Bentley Systems, Incorporated; Hexagon AB; AssetWorks, Inc.; Oracle; SAP SE; Siemens AG; Rockwell Automation; WSP; Zebra Technologies Corporation.

b. The global fixed asset management market is witnessing growth driven by several key factors. For instance, the increasing adoption of automation and digitization across industries has increased the need for efficient tracking and management of fixed assets. Tightening regulatory compliance requirements are also prompting organizations to invest in solutions that ensure accurate asset management and reporting. Government mandates regarding asset tracking, depreciation, and reporting standards create a strong demand for advanced fixed asset management systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."