- Home

- »

- Healthcare IT

- »

-

Fitness Platforms For Disabled Market Size Report, 2030GVR Report cover

![Fitness Platforms For Disabled Market Size, Share & Trends Report]()

Fitness Platforms For Disabled Market Size, Share & Trends Analysis Report By Type (Exercise & Weight Loss, Activity Tracking), By Platform (iOS, Android), By Device (Smart Phones, Wearable Devices), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-915-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

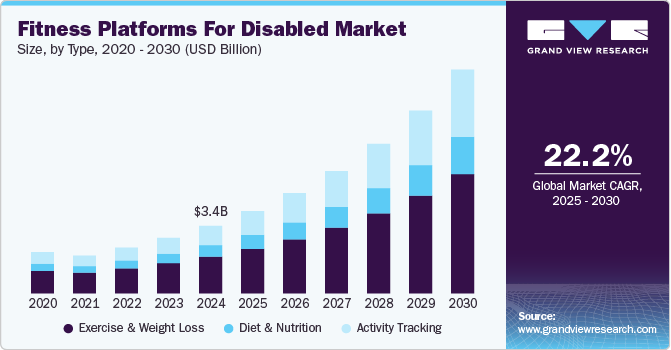

The global fitness platforms for disabled market size was estimated at USD 3.35 billion in 2024 and is projected to grow at a CAGR of 22.2% from 2025 to 2030. Smartphones have evolved from being devices of communication & entertainment to devices that can monitor health and fitness. Mobile applications for smartphones have made life easy by making it convenient for performing daily activities. With the increasing adoption of smartphones and easy availability of technologically advanced devices, innovators have started investing to capitalize on the growth opportunities by focusing on delivering quality healthcare and comfort to consumers through various mobile platforms, which would help them track their fitness regimes and give answers to fitness-related inquiries over the phone, WhatsApp, or any other mobile application.

As per the report from BankMyCell.com, the total number of smartphone users globally in 2024 is 4.88 billion, representing 60.42% of the world's population owning a smartphone. Regarding the total number of devices (considering that users might have multiple phones), there are 7.21 billion active smartphone subscriptions. When feature phones are included, this figure rises to 8.31 billion. An increase in the adoption of smartphones is expected to proportionately scale up the use of fitness platforms among different consumer groups, including people with disabilities.

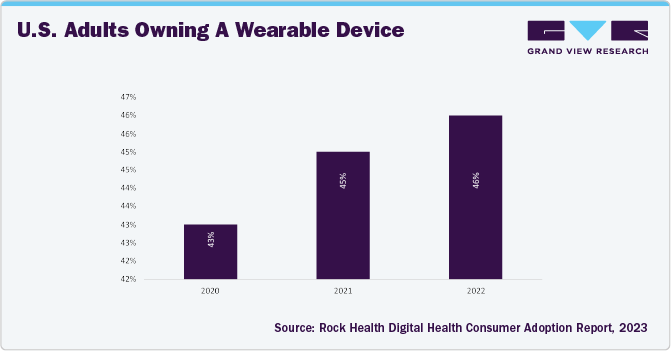

A wearable fitness device is used for measuring & compiling user activity data and synchronizing it with a suitable fitness application. According to the 2023 NIH report, nearly one in three Americans utilize a wearable device, such as smartwatch or band, to monitor their health and fitness. Moreover, the International Data Corporation (IDC) has reported that in the third quarter of 2023, worldwide shipments of wearable devices increased by 2.6% compared to the previous year, setting a new third-quarter record with a total of 148.4 million units.

The adoption of wearable devices, such as most digital technologies, varies based on socioeconomic factors such as income, education, and occupation. According to a study by Pew Research Center in June 2019, nearly 31% of individuals belonging to household income group of USD 75,000 or above per year use wearable fitness devices, a statistic which drops down to 12% for users with household income USD 30,000 or less per year. High adoption of wearable devices is expected to drive the market over the forecast period.

In addition, growing geriatric population is driving industry expansion. As per the United Nations report, it is anticipated that the global population of individuals aged 65 and older will more than double, increasing from 761 million in 2021 to 1.6 billion by 2050. Moreover, the surging disabled population across the globe is supplementing market growth. In 2021, the U.S. Census Bureau reported that approximately 42.5 million individuals in the civilian noninstitutionalized population in the U.S. have disabilities, constituting 13% of this demographic.

Market Concentration & Characteristics

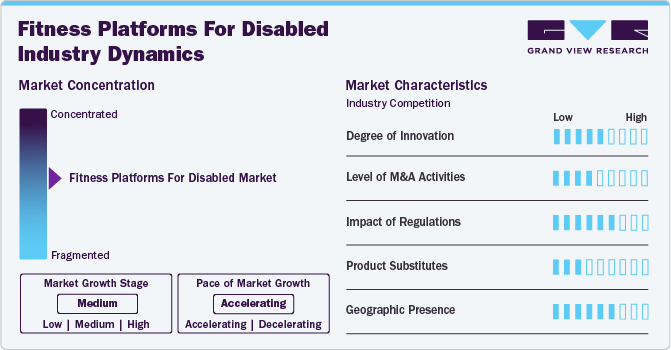

Fitness platforms for the disabled are increasingly incorporating advanced technologies such as adaptive AI to provide more customized fitness experiences to individuals. In addition, the integration of virtual reality (VR) and augmented reality (AR) is enhancing engagement by creating immersive environments that motivate users to participate in physical activities safely. Furthermore, community-driven features that connect users with similar experiences foster a sense of belonging and encouragement.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for fitness platforms for the disabled.

Compliance with accessibility standards, such as the Americans with Disabilities Act (ADA) in the U.S. or similar frameworks in other regions, ensures that these platforms are designed to accommodate a wide range of physical needs and limitations. Such regulations compel developers to incorporate features such as screen readers, adaptable interfaces, and customizable workout options.

Traditional fitness facilities often offer in-person classes and personal training tailored to individuals with disabilities, providing a social and interactive environment that some may prefer over digital solutions. Additionally, community-based programs, such as adaptive sports leagues or rehabilitation centers, serve as viable alternatives, fostering physical activity in a supportive group setting.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Type Insights

The exercise & weight loss segment dominated the market and accounted for the largest revenue share of 54.3% in 2024. This growth can be attributed to an increasing number of companies focusing on introducing innovative platforms for weight loss and sticking to the daily workout routine among people with disabilities. Most exercise and weight loss plans offered by these fitness platforms are personalized for users. These platforms supply customized recommendations on food consumption and physical activity, which aid in weight loss. The introduction of advanced technologies further aids market growth. For instance, workout platforms are usually equipped with audio cues, video demos, and fitness tracking tools, which can help in supporting an exercise routine.

The activity tracking segment is anticipated to witness the fastest CAGR from 2025 to 2030. This can be attributed to the high demand for wearable health & fitness tracking systems among people with disabilities and the launch of new activity tracking devices. Tracking health and fitness through apps & gadgets has become popular among people with disabilities in the past years, which is leading to an increase in the consumer pool. Users can access Do It Yourself (also termed as DIY) insights for diet, as well as gain information about the impact of physical exercise on their health. With an increasing consumers, major technology companies have started investing in fitness technology. Android and Apple are two main companies at the forefront of fitness platforms domain. Both companies have their individual health platforms known as Google Fit and Apple Health, majorly for people in wheelchair.

Devices Insights

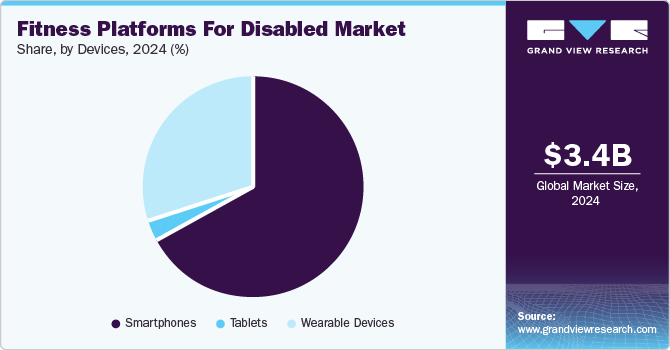

The smartphones segment dominated the market and accounted for the largest revenue share of 66.9% in 2024. The segmental growth can be attributed to the increasing penetration of smartphones globally. According to an article in The Hindu, over 2 billion 5G smartphones were shipped worldwide in the last quarter of 2023, with China, the U.S., and Western Europe accounting for almost 70% of all 5G shipments. In addition, the cost & availability of 5G smartphones increased as the price difference between 5G and 4G chipsets narrowed, contributing to segment growth.

The wearable devices segment is anticipated to witness significant growth from 2025 to 2030. Wearable devices enable people with disabilities to easily perform daily tasks, such as browsing the web, sending emails, and using social media & fitness platforms for daily physical activities through voice-activation & gesture controls. Smartwatches are capable of performing a variety of functions, helping people with vision difficulty, hearing loss, and other physical impairments.For instance, the Apple Watch provides VoiceOver, which enables users with vision difficulties to navigate the system. The Apple watch also offers zoom features in their gadgets, which enables the enlarging of the watch interface for people with limited vision.

Platform Insights

The iOS segment dominated the market and accounted for the largest revenue share of 52.2% in 2024. The high adoption of iOS devices is one of the major factors propelling market growth. For instance, according to the Demandsage report, as of 2023, there are 153 million iPhone users in the U.S. In addition, according to the Backlinko report, in 2023, Apple delivered 231.8 million iPhones across the globe.The fitness platforms designed for iOS devices are capable of providing fitness coaching, activity tracking, streaming workout classes, and inspiration & motivational videos for workouts, guided meditation, stretching, & others.

The android segment is anticipated to witness significant growth from 2025 to 2030. This growth can be attributed to the high usage rate of Android smartphones among people with disabilities. As per the Backlinko report, as of Q4 2023, android smartphones represented 56% of global quarterly smartphone sales. Furthermore, the Android operating system has undergone continuous improvements. These include enhanced health & fitness tracking features, Application Programming Interface (API) integrations, and machine learning capabilities. These enhancements strengthen the functionality and accuracy of fitness platforms for disabled.

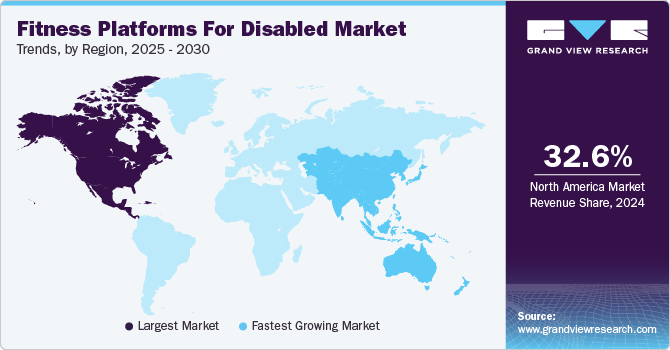

Regional Insights

North America fitness platforms for disabled market dominated the global market and accounted for the largest revenue share of 32.6% in 2024 owing to the readiness of IT infrastructure, increasing penetration of smartphones, growing internet connectivity, growing prevalence of chronic diseases & disabilities, and rising awareness about fitness & wellbeing.

U.S. Fitness Platforms For Disabled Market Trends

The fitness platforms for disabled market in the U.S. held the largest share of the North America market in 2024. Increasing awareness about fitness & workout and the benefits of exercise, such as reduction in depression, stress, & anxiety, increase in cardiovascular fitness, and improvement in overall health, has led to an increase in the adoption of fitness platforms by the disabled community in the U.S.

Canada fitness platforms for disabled market is anticipated to register the fastest growth during the forecast period. Increasing disabilities among the population is escalating market growth. Results from the Canadian Survey on Disability (CSD), 2022 indicated that 27% of Canadians aged 15 and above, totaling 8.0 million individuals, experienced one or more disabilities that restricted their daily activities.

Europe Fitness Platforms For Disabled Market Trends

The fitness platforms for disabled market in Europe is anticipated to register significant growth during the forecast period owing to the launch of numerous products, supportive government initiatives, recognition from private investors, technological collaborations, and emergence of startups.

Germanyfitness platforms for disabled market is anticipated to register a considerable growth rate during the forecast period. Significant advancements in healthcare IT with rising healthcare expenditure, growing smartphone penetration, increasing adoption of digital health solutions, and rising awareness among users about the benefits of fitness platforms in maintaining a healthy & active lifestyle are fostering regional growth.

The fitness platforms for disabled market in the UK is anticipated to register a considerable growth rate during the forecast period. Favorable government initiatives and support are promoting the adoption of fitness platforms across communities of all abilities. Furthermore, users are becoming more aware about the benefits and features of fitness platforms, such as workout videos, progress visualization, wearable device integration, nutrition management, calorie tracker, and workout calendars, which is boosting their adoption in the UK.

Asia Pacific Fitness Platforms For Disabled Market Trends

Asia Pacific fitness platforms for disabled market is anticipated to register the fastest growth rate during the forecast perio dowing to increasing penetration of smartphones & smart wearables, growing digital literacy, increasing healthcare IT expenditure, improving internet connectivity, growing awareness levels, and increasing adoption of fitness applications.

The fitness platforms for disabled market in China held the largest share in 2024. The growing patient population and increasing internet penetration in China can spur the country’s market. According to data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion Internet users, an increase of 35.49 million since December 2021.

Japan fitness platforms for disabled market is anticipated to register considerable growth during the forecast period. Rising geriatric population and rapid technological advancements are expected to drive market growth. An increase in R&D activities by Japanese mobile phone service providers & electronics manufacturers for the development of smart wearable healthcare devices and supporting services is expected to drive the market.

Latin America Fitness Platforms For Disabled Market Trends

The fitness platforms for disabled market in Latin America is anticipated to register lucrative growth during the forecast period. Increasing expenditure on electronic & mobile devices by buyers is contributing to market growth. In addition, the number of smartphone users in Brazil reached 155 million in 2023, up from 143.4 million in 2022, further boosting access and visibility of fitness platforms across the country’s population.

Brazil fitness platforms for disabled market is anticipated to register considerable growth during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are some of the key factors boosting the market growth in Brazil. As per the Kepios estimates, in January 2023, Brazil had 181.8 million internet users. This indicates a large pool of users including disabled people turning to fitness apps.

Middle East and Africa Fitness Platforms For Disabled Market Trends

The fitness platforms for disabled market in the Middle East and Africa is anticipated to register significant growth during the forecast period. Fitness apps are revolutionizing healthcare in the MEA, facilitated by improving internet connectivity and government initiatives. Wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes.

South Africa fitness platforms for disabled market is anticipated to register considerable growth during the forecast period. Wearable devices, mHealth apps, and AI are key trends shaping the fitness app landscape. For instance, according to Healthnews, in 2023, there were an estimated 16,069,888 health & fitness app downloads in South Africa, with an average of 0.354 downloads per Internet user.

Key Fitness Platforms For Disabled Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Fitness Platforms For Disabled Companies:

The following are the leading companies in the fitness platforms for disabled market. These companies collectively hold the largest market share and dictate industry trends.

- Apple, Inc.

- Kakana

- Champion’s Rx

- Adaptive Yoga Live

- Evolve21

- Kym Nonstop

- Exercise Buddy, LLC

- Special Olympics

- YouTube

- Hulu, LLC

View a comprehensive list of companies in the Fitness Platforms For Disabled Market

Recent Developments

-

In October 2023, Ali Jawad, a champion in Paralympic powerlifting from Britain, teamed up with his previous agent and fellow British athlete Sam Brearey to create Accessercise, a fitness app designed for individuals who wish to work out despite their disabilities.

-

In September 2021, Move United, a community-based adaptive sports organization, announced the launch of Move United on Demand, a digital fitness platform that offers exercise and fitness routines for disabled communities. These 35 different workout sessions range from HIIT to yoga to stretching.

-

In August 2021, iFIT, a fitness app, announced the integration of closed captioning to its video series of workout classes and live fitness sessions to serve the hearing impaired and deaf communities.

Fitness Platforms For Disabled Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.08 billion

Revenue forecast in 2030

USD 11.10 billion

Growthrate

CAGR of 22.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, devices, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden;, Japan;, China; India; Australia; Thailand;, South Korea; Brazil; Argentina;, South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apple, Inc.; Kakana; Kakana; Champion’s Rx; Evolve21; Kym Nonstop; Exercise Buddy, LLC; Special Olympics; YouTube; and Hulu, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fitness Platforms For Disabled Market Report Segmentation

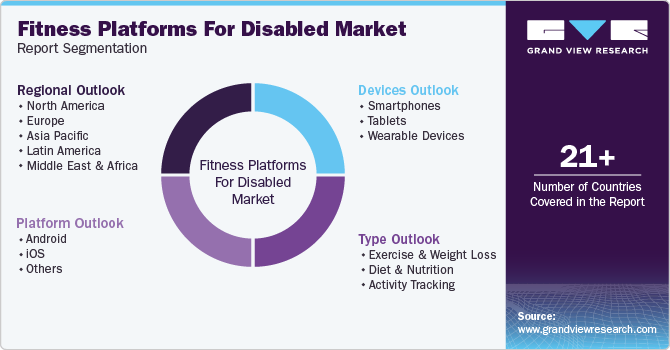

This report forecasts revenue and growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global fitness platforms for disabled market report based on the type, platform, devices, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Exercise & Weight Loss

-

Diet & Nutrition

-

Activity Tracking

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Devices Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fitness platforms for disabled market size was estimated at USD 3.35 billion in 2024 and is expected to reach USD 4.08 billion in 2025.

b. The global fitness platforms for disabled market is expected to grow at a compound annual growth rate of 22.2% from 2025 to 2030 to reach USD 11.1 billion by 2030.

b. Key factors that are driving the fitness platforms for disabled market growth include increasing geriatric population and increasing smartphone penetration across the globe.

b. North America dominated the fitness platforms for disabled market with a share of 32.6% in 2024. This is attributable to growing awareness about fitness and daily health monitoring among the disabled which led to an increase in adoption of fitness platforms in the region.

b. Some key players operating in the fitness platforms for disabled market include Apple, Inc.; Kakana; Kakana; Champion’s Rx; Evolve21; Kym Nonstop; Exercise Buddy, LLC; Special Olympics; YouTube; and Hulu, LLC.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."