Fitness Equipment Market Size, Share & Trends Analysis Report By Distribution Channel (Offline, Online), By End-user (Fitness Centers/Gyms, Home Consumers), By Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-661-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global fitness equipment market size was estimated at USD 16.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The global market has experienced significant growth in recent years due to the rising health consciousness among individuals, growing awareness about the importance of regular exercise for overall well-being, and rising disposable incomes. Fitness equipment is used for performing exercises related to physical well-being, weight management, and improving a person's muscular strength and body stamina. The high number of obese population, increasing youth population, and increasing health concerns are the major factors that drive the global industry growth. This market includes a wide range of products designed for both residential and commercial applications, catering to individuals, fitness centers, gyms, and sports clubs.

The growth of e-commerce platforms has made fitness equipment more accessible, allowing customers to compare products, read reviews, and make purchases. Another significant driver contributing to the market growth is the increased focus on corporate wellness programs. Many enterprises acknowledge the importance of encouraging employee health and well-being, leading to the implementation of corporate wellness initiatives. To support corporate wellness programs, businesses are investing in on-site fitness establishments within their office premises. These facilities often include exercise equipment, such as exercise bikes, treadmills, yoga mats, and weight machines. The demand for fitness equipment in these workplaces drives market growth.

To support corporate wellness initiatives, manufacturers often collaborate with businesses to offer customized fitness solutions. These collaborations involve creating wellness programs and discounted or specialized equipment for corporate fitness facilities. Such partnerships between businesses and manufacturers drive the growth of the market. The shift toward remote work, particularly during the COVID-19 pandemic, has increased the demand for home gym equipment. Enterprises have acknowledged this trend and offer allowances for employees to set up home gyms or buy fitness equipment. This emphasis on corporate wellness expands beyond office spaces, driving sales in the home fitness equipment market.

Type Insights

The cardiovascular training equipment segment led the market in 2022 accounting for over 53% share of the global revenue. The scope of cardiovascular training equipment encompasses a range of machines, including treadmills, stationary cycles, and elliptical trainers & others. These machines, along with innovative features and technological advancements, are driving market growth. In addition, the increasing usage of wearable devices and fitness apps has created a demand for cardiovascular training fitness equipment seamlessly integrated with technologies, such as Internet of Things (IoT) devices, cloud computing, and mobile applications. The strength training equipment segment is estimated to grow significantly over the forecast period.

Strength training is a crucial part of a daily fitness routine to build muscle mass and increase overall strength. This type of training focuses on working the muscles through weights or weight machines. Market players are integrating smart strength technology into strength training equipment to track progress and performance, provide feedback on form, personalize workouts, and make the overall experience more engaging. For instance, PRIME Fitness USA offers SmartStrength technology, an innovative way to improve strength training to train a muscle in shortened, medial, or lengthened positions. It is a valuable tool for athletes, fitness enthusiasts, and individuals seeking optimal results from their workout routines.

End-user Insights

The home consumers segment led the market in 2022 accounting for over 51% share of the global revenue. Home gym equipment consumers are experiencing rapid growth, driven by several key trends, such as the rise of connected home devices, and increasing focus on health and wellness. Moreover, online fitness platforms have become popular, offering various workouts and fostering connections among fitness enthusiasts. IoT-enabled fitness equipment is in demand as it enables tracking and motivation. Functional fitness, focusing on exercises for everyday tasks, is gaining traction for overall health improvement.

In addition, the market sees a rise in demand for space-saving equipment, catering to individuals in small spaces seeking compact and easy-to-store fitness options. The fitness centers/gyms segment is estimated to grow significantly over the forecast period. The others segment includes corporate wellness programs, hotels & resorts, rehabilitation centers, educational institutions, military/law enforcement, and senior living communities, all aimed at promoting health and well-being. From corporate wellness programs and hotels to rehabilitation centers and educational institutions, fitness equipment is instrumental in maintaining overall health and fostering a culture of wellness.

It caters to the diverse needs of individuals and contributes to their physical fitness, improving their quality of life and overall well-being. For instance, in January 2022, NordicTrack, the Icon Health & Fitness Inc. brand, launched the NordicTrack iSelect Adjustable Dumbbells. These voice-controlled dumbbells are designed to work with Alexa, enabling users to electronically adjust the weight from 5 to 50 pounds using voice commands through a compatible Alexa-enabled device. This innovative feature ensures a smooth and convenient workout experience.

Distribution Channel Insights

The offline segment held the largest revenue share of over 56% in 2022. Offline fitness stores are gaining popularity as consumers seek personalized shopping experiences, offering a wide range of products and expert advice. Omnichannel retail is increasing, allowing customers to shop online, in-store, or both for convenience and wider reach. Moreover, in-person fitness experiences and traditional fitness distribution channels continued to play a vital role. Many people prefer attending gyms and fitness centers for various reasons, such as access to specialized equipment, social interaction, and personalized coaching. The online segment is estimated to register a significant growth rate during the forecast period.

The online distribution channel segment is witnessing significant growth due to various factors. The accessibility of high-speed internet enables people to stream live and on-demand fitness classes conveniently from home. In addition, the rising costs of traditional gym memberships make online fitness a more affordable option for many individuals. The popularity of wearable technology aids in tracking fitness progress and maintaining motivation. Moreover, the increasing awareness about the importance of physical fitness for overall health and well-being further boosts the demand for online fitness solutions. As a result, the online fitness market is predicted to continue expanding in the coming years.

Regional Insights

North America dominated the market in 2022 and accounted for over 33% share of the global revenue owing to the consumers’ growing health awareness and increased adoption of a healthy lifestyle that promotes weight management, physical well-being, improved body stamina, and muscular strength. The high obese or overweight population base in North America drives the demand in this region. In addition, increasing government regulations to promote health consciousness among its citizens has led North America to dominate the industry. The growth of the cardiovascular training equipment sector in the U.S. for home fitness is fueling the overall market expansion. The significant claim of the U.S. population for cardiovascular training equipment, such as stationary bikes, rowers, and treadmills, to maintain their cardio health is expected to propel fitness equipment demand in the country.

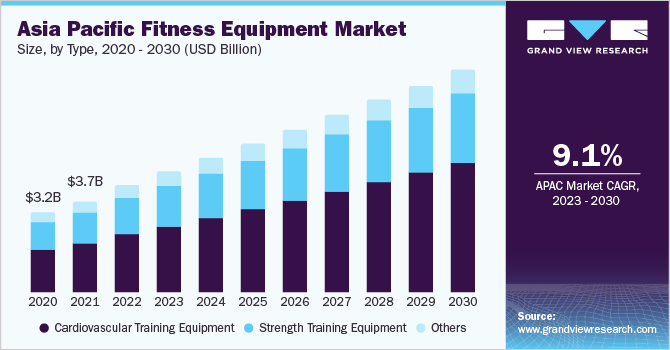

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Developed countries, such as Japan and South Korea, significantly drive market growth in the Asia Pacific region. Markets in countries, such as China and India, are witnessing rapid growth. The rising youth population across these countries drives the adoption of training equipment. In this region, there has been an increase in gym membership due to the adoption of Western culture and the growing desire to improve the overall appearance. The region's overall disposable income increased significantly. Product adoption in the region is anticipated to be accelerated by rapid urbanization in developing economies, a rise in the youth population, and rising per capita disposable income.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategies to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2023, Core Health & Fitness partnered with CRANK, a boutique fitness studio in the UAE, to expand CRANK's operations throughout the Gulf Cooperation Council (GCC) region and beyond. As part of this expansion, Core Health & Fitness will serve as the primary supplier of indoor bikes for CRANK's signature RIDE offering, further enhancing the studio's fitness experience. Some of the prominent players in the global fitness equipment market include:

-

Precor Incorporated

-

Life Fitness (KPS Capital)

-

Shandong EM Health Industry Group Co., Ltd.

-

Icon Health & Fitness

-

Johnson Health Tech

-

Nautilus, Inc.

-

TRUE

-

Technogym

-

Torque Fitness

-

Core Health & Fitness

-

Impulse Health Technology Co., Ltd.

Fitness Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 17.39 billion |

|

Revenue Forecast in 2030 |

USD 24.93 billion |

|

Growth rate |

CAGR of 5.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

August 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

type, end-user, distribution channel, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

PrecorIncorporated.; Life Fitness (KPS Capital); Shandong EM Health Industry Group Co., Ltd.; Icon Health & Fitness; Johnson Health Tech; Nautilus, Inc.; TRUE; Technogym; Torque Fitness.; Core Health & Fitness; Impulse Health Technology Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fitness Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fitness equipment market report based on type, end-user, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cardiovascular Training Equipment

-

Treadmills

-

Stationary Cycles

-

Elliptical Trainers & Others

-

-

Strength Training Equipment

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Home Consumers

-

Fitness Centers/Gyms

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fitness equipment market size was estimated at USD 16.04 billion in 2022 and is expected to reach USD 17.39 billion in 2023.

b. The global fitness equipment market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 24.93 billion by 2030.

b. North America dominated the fitness equipment market with a share of 34.5% in 2022. This is attributable to the consumers' growing health awareness and increased adoption of a healthy lifestyle that promotes weight management, physical well-being, improved body stamina, and muscular strength.

b. Some key players operating in the fitness equipment market include Precor Incorporated, Life Fitness (KPS Capital); Shandong EM Health; Industry Group Co., Ltd.; Icon Health & Fitness; Johnson Health Tech; Nautilus, Inc.; TRUE; Technogym; Torque Fitness.; Core Health & Fitness; and Impulse Health Technology Co., Ltd.

b. Key factors that are driving the fitness equipment market growth include increased awareness for health and fitness and increase in number of gyms and fitness clubs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."