- Home

- »

- Consumer F&B

- »

-

Fish Oil Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Fish Oil Market Size, Share & Trends Report]()

Fish Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Human Consumption, Aquaculture, Pet Food), By Species (Tuna, Salmon, Pangasius, Tilapia), By Region, And Segment Forecasts

- Report ID: 978-1-68038-149-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fish Oil Market Summary

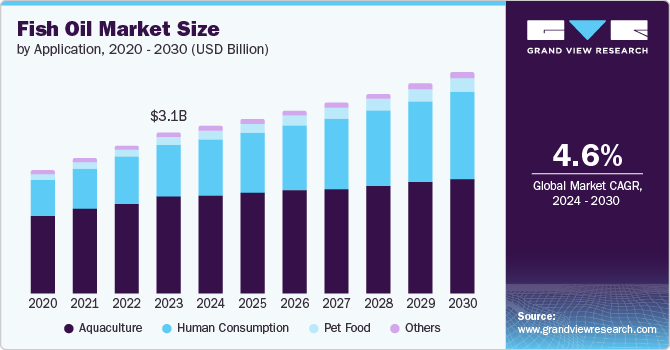

The global fish oil market size was estimated at USD 3.08 billion in 2023 and is projected to reach USD 4.20 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. Increasing awareness regarding the health benefits of omega-3 fatty acids on brain & heart health is expected to be a primary factor propelling market growth.

Key Market Trends & Insights

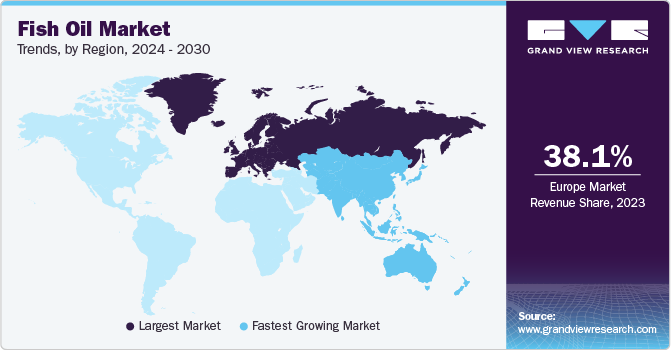

- Europe accounted for the highest revenue share of 38.1% in the global market in 2023.

- The UK has a well-developed retail network encompassing pharmacies, health food stores, and online platforms.

- By application , the aquaculture segment dominated the market for fish oil with a revenue share of 59.6% in 2023.

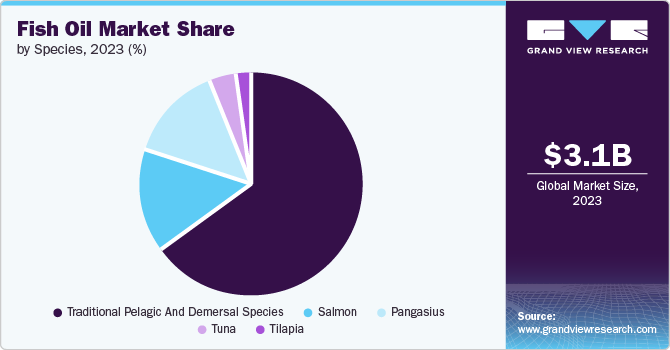

- By Species, traditional pelagic and demersal species held the highest market revenue share of 66.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.08 Billion

- 2030 Projected Market Size: USD 4.20 Billion

- CAGR (2024-2030): 4.6%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Fish oil, with its anti-inflammatory properties, helps fight chronic inflammatory conditions. Additionally, fish oil finds extensive applications in alleviating various skin conditions such as psoriasis and dermatitis. With advancements in research and increasing knowledge about its application in areas other than healthcare, fish oil is expected to witness a substantial demand in upcoming years.

Globally, there has been a significant surge in the number of people suffering from cardiovascular diseases in recent years due to a hectic work environment and adoption of sedentary lifestyle practices. Hypertension, accumulation of plaque in arteries, and increasing levels of cholesterol and triglycerides are common reasons for heart stroke. Omega-3 in fish oil helps reduce the level of these harmful substances in the arteries. Furthermore, fish oil helps patients with irregular heartbeats and depression. The increasing geriatric population worldwide and a surge in chronic disease incidences are expected to boost the demand for fish oil by 2030.

Apart from cardiovascular disorders, fish oil is finding widespread applications in addressing mental health conditions as well. An optimum level of omega-3 fatty acids helps substantially fight brain-related conditions. Pregnant women are advised to take fish oil supplements during the first trimester and beyond. It improves cognitive development and reduces the risk of various allergies. Fitness enthusiasts, athletes, and bodybuilders worldwide regularly incorporate fish oil supplements in their nutritional diet to boost muscle strength and increase range of motion. Such a wide range of applications is expected to fuel market expansion in the coming years.

Application Insights

The aquaculture segment dominated the market for fish oil with a revenue share of 59.6% in 2023. The global population is steadily increasing, and there is an increasing demand for protein sources such as fishmeal. Aquaculture offers a sustainable and controlled method to meet this growing demand. Fish oil and fishmeal offer excellent nutritional value, owing to the presence of over 40 essential nutrients and high levels of polyunsaturated fat content. As a result, it is a highly sought after feed by aquaculture farmers aiming to increase production yield. As aquaculture production expands, the requirement for fish oil to nourish these farmed fish populations is expected to increase accordingly.

The human consumption application segment accounted for a substantial market share in 2023 and is projected to witness the fastest growth rate during the forecast period. The growing worldwide population, rising demand for protein-rich foods, and health benefits offered by fishmeal and fish oil are all vital factors driving industry growth. Experts recommend an intake of omega-3 doses ranging from 500 mg to 3000 mg, depending on age, gender, health conditions, and other such parameters. Growing awareness among consumers about the health benefits of fish oil and the increasing prevalence of cardiovascular diseases is expected to propel market growth through this segment.

Species Insights

Traditional pelagic and demersal species held the highest market revenue share of 66.6% in 2023. Pelagic species (living and feeding near water surface) and demersal species (living and feeding near seabed) tend to be more abundant in oceans compared to other fish types. This readily available supply makes them a cost-effective source of raw material for fish oil production. Additionally, these species naturally possess a higher oil content in their tissues compared to other fish varieties. This translates to a more efficient extraction process and greater yield of fish oil per unit of fish processed.

Meanwhile, the tilapia species segment is expected to advance at the highest CAGR of 11.7% during the forecast period. Tilapia is an ideal fish species for aquaculture owing to its ease of farming, as they can be grown in small confined water bodies in large numbers. Moreover, they grow in lesser time and can be fed a cheap vegetarian diet. These qualities associated with ease of breeding translate to relatively lowered production costs, in comparison to other species. Worldwide, China is the largest producer of tilapia and exports fishes to the U.S. Tilapia is relatively affordable, making it a much preferred option among consumers for extracting fish oil, which is expected to propel market growth.

Regional Insights

Europe accounted for the highest revenue share of 38.1% in the global market in 2023. Fish oil production in this region is largely based on harvesting small pelagic species of fish such as sprat, herring, and sand-eels. Europeans tend to have a strong focus on preventive healthcare and are well-informed regarding health benefits of omega-3 fatty acids, which are abundant in fish oil.The European Food Safety Authority (EFSA) recommends consumption of 250mg of EPA and DHA daily to maintain good health and well-being. This awareness translates to a greater demand for fish oil supplements and functional foods containing these ingredients. Despite being a relatively small country, Norway accounts for a substantial share of fish oil imports, being the biggest importer in 2022. A well-developed aquaculture space and favorable government regulations are expected to fuel market growth.

The UKhas a well-developed retail network encompassing pharmacies, health food stores, and online platforms. This extensive distribution network facilitates easy access to fish oil products for a wide range of consumers. Additionally, the prevalence of cardiovascular diseases is high in the economy, which can be effectively addressed by taking preventive care. With increasing awareness about health benefits of omega-3 fatty acids and their uses in improving the overall well-being, fish oil demand is expected to amplify in the near future.

Asia Pacific Fish Oil Market Trends

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. This is owing to the population in regional economies consuming high levels of fish. With urbanization and busy lifestyles, dietary patterns are changing in this region. Fish oil supplements offer a convenient way to maintain healthy omega-3 intake, which is crucial for heart & brain health, and maintaining a healthy lifestyle. Moreover, economies such as Japan have a rapidly aging population. Fish oil is perceived to support cognitive function and joint health, which drives demand from this demographic. Additionally, commercial production of fish is rising steadily, offering an affordable source of protein and essential nutrients to a large consumer base.

China produces and consumes a substantial amount of fishmeal and fish oil. China is home to large commercial fish farms, exporting various species of fish worldwide. A majority of fishmeal in China is utilized for feeding aquaculture and pig farms. The aquaculture segment accounted for over 68% of the total fish oil consumption in the country in 2022, according to IFFO - The Marine Ingredients Organisation. Additionally, China is the largest producer of tilapia fish globally and exports this species to the U.S. Growing awareness about the health benefits of omega-3 in China has made the local population a prominent consumer of fish oil.

North America Fish Oil Market Trends

North America faces a growing obesity challenge, leading to an increased focus on preventive healthcare measures. Fish oil is positioned as a potential aid in managing conditions such as heart disease and hypertension, which are linked to obesity. Additionally, the U.S. population is seeking alternate ways of fulfilling their daily requirement of polyunsaturated fatty acids, and fish oil can effectively address this demand. The American Heart Association (AHA) recommends consumption of fish-based products to reduce the risk of congestive heart failure, coronary heart disease, and ischemic stroke.

Americans are at increasing risk of cardiovascular diseases due to unhealthy lifestyle practices and the U.S. Department of Agriculture (USDA) recommends consumption of least 227 grams of fish per week due to its fatty acid content. To manage high triglyceride levels, 4 grams per day consumption of omega-3s is recommended. Osteoporosis affects about 10 million Americans and leads to a reduction of bone density, thus becoming a major problem when combined with obesity. It leads to chronic inflammation and increased strain on bones due to excess weight. Omega-3 fatty acids in fish oil, which have anti-inflammatory properties, are useful in improving bone density and controlling obesity. A significant market growth is expected owing to a combination of these factors.

Key Fish Oil Company Insights

Some key companies involved in the fish oil market includeCroda International plc; Pelagia AS; and Sürsan.

-

Croda International is a British specialty chemicals company. Its life sciences segment offers nutritional supplements such as fish oil concentrates under the brand Incromega. The products are manufactured by Croda’s PureMax purification technology, which leverages multiple refining steps to ensure purity and a higher concentration of omega-3 for nutritional applications. The PureMax brand is used in a number of customer products, such as Pregna DHA and Doppel herz A-Z.

-

Pelagia is a prominent producer of pelagic fish supplements for human consumption and a supplier of essential ingredients in all numerous types of animal feed and fish products, including fishmeal, protein concentrate, and fish oil. The Epax brand under Pelagia offers omega-3 in a variety of concentrations in its nutritional supplements. The company also offers a range of feed products, such as marine protein and marine oil.

Key Fish Oil Companies:

The following are the leading companies in the fish oil market. These companies collectively hold the largest market share and dictate industry trends.

- Ocean Group Ltd.

- Croda International plc

- GC Rieber

- Pelagia AS

- BASF SE

- DSM

- Sürsan

- Omega Protein Corporation

- TripleNine

- OLVEA Group

Recent Developments

-

In June 2024, GC Rieber VivoMega opened a new omega-3 manufacturing facility in Norway. The plant, which will operate on 100% renewable energy, is expected to double the current output of triglyceride marine omega-3s and vegan algal oils, addressing the rising demand for omega-3 supplements.

-

In March 2024, Pelagia announced the acquisition of the UK-based seafood trading firm Ideal Foods Limited. With this, Pelagia plans to develop collaboration and synergy with Ideal Foods to enhance its global supply chain and strengthen its market presence while continuing to innovate and utilize seafood co-products.

Fish Oil Market Report Scope

Report Attribute

Details

Market Size Value in 2024

USD 3.20 billion

Revenue Forecast in 2030

USD 4.20 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Base Year For Estimation

2023

Historical Data

2018 - 2022

Forecast Period

2024 - 2030

Quantitative Units

Volume in tons, revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, species, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; China; Japan; Australia & New Zealand; South Korea; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Croda International plc; Pelagia A/S; Sürsan; Ocean Group Ltd.; GC Rieber; BASF SE; DSM; Omega Protein Corporation; TripleNine; OLVEA Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fish Oil Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fish oil market report based on application, species, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Human Consumption

-

Aquaculture

-

Pet Food

-

Others

-

-

Species Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Traditional Pelagic and Demersal Species

-

Tuna

-

Salmon

-

Pangasius

-

Tilapia

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cable conduit systems market was valued at USD 7.90 billion in the year 2023 and is expected to reach USD 8.39 billion in 2024.

b. The global cable conduit systems market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030, reaching USD 13.31 billion by 2030.

b. The rigid type segment registered the largest revenue market share of over 63.0% in 2023. Rigid cable conduit systems are made from materials such as steel, aluminum, or rigid plastic and are designed to provide a sturdy and durable pathway for electrical cables and wires.

b. Key players in the market include Hubbell Incorporated, Schneider Electric SE, ABB Group, Legrand, Aliaxis Group, Atkore International, Electri-Flex Company, Eaton Corporation PLC, Robroy Industries, Champion Fiberglass Inc., Dura-Line Holdings Inc., Prime Conduit; B.E.C. Conduits Pvt. Ltd., and Southwire Company, LLC.

b. The global cable conduit systems market is increasing, particularly in emerging economies, and countries are investing in building new roads, railways, buildings, and other public utilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.