- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Fireproof Ceramics Market Size And Share Report, 2030GVR Report cover

![Fireproof Ceramics Market Size, Share & Trends Report]()

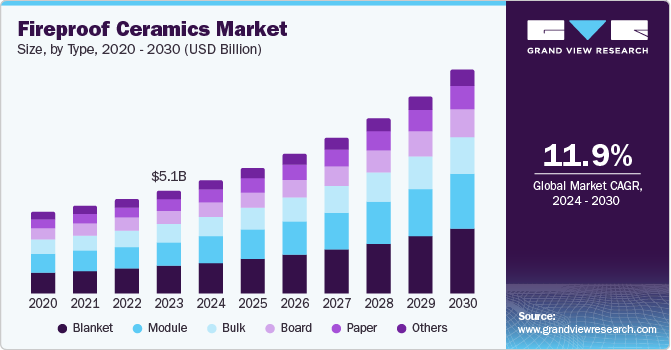

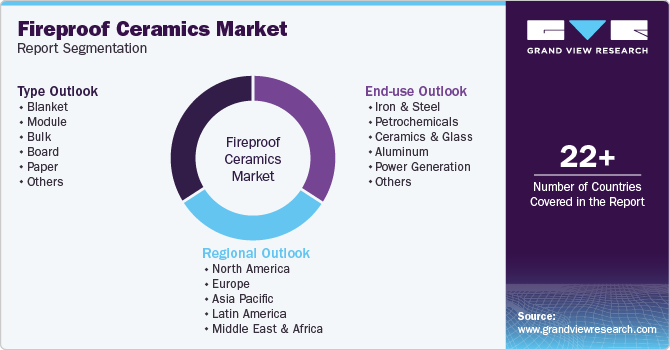

Fireproof Ceramics Market Size, Share & Trends Analysis Report By Type (Blanket, Module, Bulk, Board), By End Use (Iron & Steel, Petrochemicals, Aluminum), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-793-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Fireproof Ceramics Market Size & Trends

The global fireproof ceramics market size was valued at USD 5.09 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.9% from 2024 to 2030. The ability to withstand high temperatures and resist thermal shock has triggered the need for fireproof ceramics in various industries. In addition, rules and regulations of fire safety standards and the increase in energy awareness in industrial processes are anticipated to drive market growth. Furthermore, advancements in manufacturing technologies and innovations in material science enhance the properties of fireproof ceramics, making them more versatile and appealing to a broader range of applications.

The growing demand for fireproof ceramics is fueled by their critical applications in industries that require materials capable of withstanding high temperatures and resisting fire. The need for enhanced safety and durability in the aerospace, construction, and manufacturing sectors drives this surge. According to the European Commission, between 2019 and 2021, the European Union saw increases in the output and sales of ceramic products. Wall and floor tile production rose from 970 to 1,307 million m², with sales increasing from USD 10.80 billion to USD 12.45 billion. Despite reducing tableware and ornamentalware output from 330,000 to 300,000 tons, sales slightly increased from USD 1.69 billion to USD 1.57 billion.

Furthermore, a growing focus on sustainability and energy efficiency within various industries is expected to drive market growth. As organizations seek to reduce energy consumption and lower operational costs, fireproof ceramics are increasingly valued for their insulating properties, which enhance energy efficiency and reduce heat loss. In addition, the push towards greener technologies and sustainable industrial practices has led to innovations in fireproof ceramic materials. These developments align with environmental goals and cater to industries' evolving needs, aiming for economic and environmental benefits.

Type Insights

Blanket segment dominated the market and accounted for a share of 27.0% in 2023 and is expected to grow at the fastest CAGR of 13.3% over the forecast period. The driving factors for fireproof ceramic blankets include superior thermal insulation, fire resistance, and energy efficiency in industries such as metallurgy, petrochemicals, and power generation, where high-temperature processes are common. In addition, stringent safety regulations and the push for sustainability propel their adoption. For instance, the FB01-15 Fireproof Blanket is a high-performance, flexible wrap made of a ceramic fiber blanket with scrim-reinforced foil. It is designed for duct and cable tray applications, providing excellent thermal insulation and fire resistance. It is easy to trim and install. Asbestos-free with low flame spread and smoke development ensures superior fire protection.

Module segment is expected to grow significantly over the forecast period owing to its versatility and ease of installation, making it ideal for various high-temperature applications. In addition, the increasing demand for customizable and modular fire protection solutions in the industrial and construction sectors is anticipated to drive their growth. Furthermore, rising safety regulations and the need for efficient, scalable fireproofing systems are expected to drive their market growth.

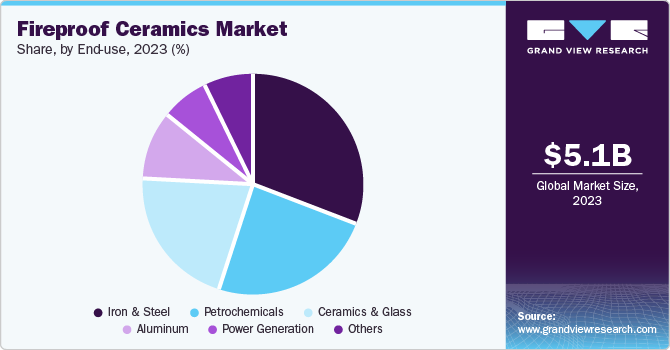

End Use Insights

The iron & steel segment dominated the market and accounted for a share of 31.4% in 2023. The driving factor for the segment is the need for advanced flame-retardant coatings that form protective ceramic layers under extreme heat. These coatings create a nonflammable barrier that prevents flames from reaching the metal and resists heat conduction, enhancing the fire resistance of steel structures and components. For instance, in January 2022, researchers developed a flame retardant inspired by lava that forms a ceramic layer when exposed to extreme heat, effectively preventing fires from spreading. This innovative coating, which combines metal oxides and boron nitride in a fire-retardant polymer, melts into a protective glassy sheet under intense heat. The coating can be sprayed on wood, steel, and foam insulation, enhancing fire resistance.

The petrochemicals segment is projected to grow at the fastest CAGR of 12.8% over the forecast period due to increasing demands for high-temperature and corrosion-resistant materials in petrochemical processing facilities. In addition, fireproof ceramics play an important role in safeguarding equipment and maintaining operational efficiency in harsh environments. Furthermore, expanding the petrochemical industry and stricter safety regulations are anticipated to drive the need for advanced fireproof ceramics to ensure reliable performance and compliance with safety standards.

Regional Insights

North America fireproof ceramics market is expected to grow significantly over the forecast period due to the need for high-performance materials that endure extreme temperatures and thermal shocks. Industries such as aerospace, automotive, and manufacturing require these ceramics for their durability and resistance to heat. This growing demand reflects the need for reliable materials that maintain integrity under harsh conditions. For instance, ZIRCAR Refractory Composites, Inc. launched RSLE-57, a high-strength silica composite designed for high-temperature applications up to 1650°C (3002°F). This material has low thermal expansion and excellent thermal shock resistance, making it ideal for induction hot presses and casting processes. In addition, RSLE-57 is non-wetting with molten metals and free of refractory ceramic fibers, ensuring durability and safety in various industrial applications.

Europe Fireproof Ceramics Market Trends

Europe fireproof ceramics market is anticipated to grow at the fastest CAGR over the forecast period. European government initiatives drive the market through regulations and funding to improve building safety and sustainability. Policies focus on enhancing fire resistance standards and promoting the adoption of advanced materials in construction. These efforts support innovation and encourage the development of more effective fireproof ceramic solutions. For instance, in November 2021, the "Ceramic Roadmap to 2050" was launched, the initiative outlines a strategic plan for advancing the ceramic industry's sustainability and innovation. It focuses on enhancing environmental performance, developing new materials, and integrating digital technologies to meet future demands. The roadmap aims to guide the industry towards a more sustainable and technologically advanced future by 2050.

Asia Pacific Fireproof Ceramics Market Trends

Asia Pacific fireproof ceramics dominated the market in 2023 due to the region’s rapid industrialization and significant growth in the construction and manufacturing sectors, which drive high demand for fire-resistant materials. In addition, the region’s expanding steel and petrochemical industries require advanced fireproof solutions to meet safety standards and operational efficiency, contributing to this dominance. Furthermore, increased investments in infrastructure development and urbanization across the region have surged the need for fireproof ceramics in residential and commercial applications. According to Autodesk Inc., in 2022, the construction industry in Asia Pacific generated approximately USD 4.36 trillion in output, accounting for 45% of the global construction sector.

The China fireproof ceramics market dominated Asia Pacific with a share of 56.7% in 2023 owing to the country's rapid industrial growth and significant investments in the construction and manufacturing sectors. China's extensive steel and petrochemical industries also require advanced fireproof ceramics for high-temperature applications and regulatory compliance, further driving their market dominance. Furthermore, the government's focus on infrastructure development and urban expansion has driven the demand for fireproof ceramics in various building and industrial applications.

Key Fireproof Ceramics Company Insights

Some key companies in the global fireproof ceramics market include Morgan Advanced Materials, ZIRCAR Ceramics, Skamol Group, IBIDEN, Isolite Insulating Products Co., Ltd., Rath-Group, Saffil Ltd., Luyang Energy-saving Materials Co., Ltd., Saint-Gobain Group, and Jagdamba Minerals. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Morgan Advanced Materials specializes in high-performance ceramics and composites, offering innovative solutions primarily for aerospace, automotive, and energy sectors where exceptional durability and thermal resistance are crucial.

-

ZIRCAR Ceramics specializes in creating advanced ceramic materials, focusing on high-temperature insulating and refractory products to improve thermal efficiency and safety in industrial furnaces and kilns.

Key Fireproof Ceramics Companies:

The following are the leading companies in the fireproof ceramics market. These companies collectively hold the largest market share and dictate industry trends.

- Morgan Advanced Materials

- ZIRCAR Ceramics

- Skamol Group

- IBIDEN

- Isolite Insulating Products Co., Ltd.

- Rath-Group

- Saffil Ltd.

- Luyang Energy-saving Materials Co., Ltd.

- Saint-Gobain Group

- Jagdamba Minerals

Recent Developments

-

In June 2024, the Rath-Group installed an advanced insulation system at a European steel plant to boost energy efficiency and safety through superior thermal insulation using fireproof ceramic materials. This installation is a key part of the plant's modernization strategy to adhere to stricter environmental standards and enhance operational efficiency.

Fireproof Ceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.60 billion

Revenue forecast in 2030

USD 11.03 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil

Key companies profiled

Morgan Advanced Materials; ZIRCAR Ceramics; Skamol Group; IBIDEN; Isolite Insulating Products Co., Ltd.; Rath-Group; Saffil Ltd.; Luyang Energy-saving Materials Co., Ltd.; Saint-Gobain Group; Jagdamba Minerals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fireproof Ceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fireproof ceramics market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blanket

-

Module

-

Bulk

-

Board

-

Paper

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Iron & Steel

-

Petrochemicals

-

Ceramics & Glass

-

Aluminum

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."