- Home

- »

- Sensors & Controls

- »

-

Fire Sprinkler Systems Market Size & Share Report, 2030GVR Report cover

![Fire Sprinkler Systems Market Size, Share & Trends Report]()

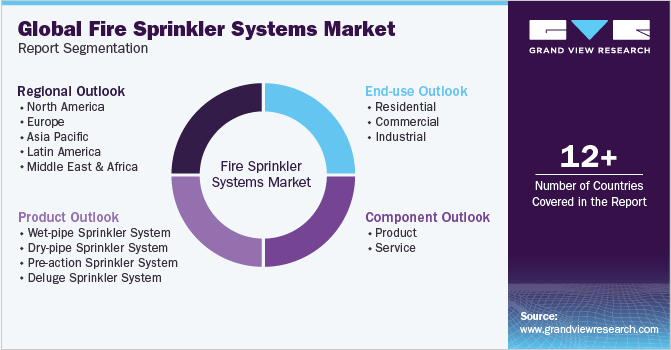

Fire Sprinkler Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Product, Service), By Product (Wet-pipe Sprinkler, Dry-pipe Sprinkler), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-109-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Sprinkler Systems Market Summary

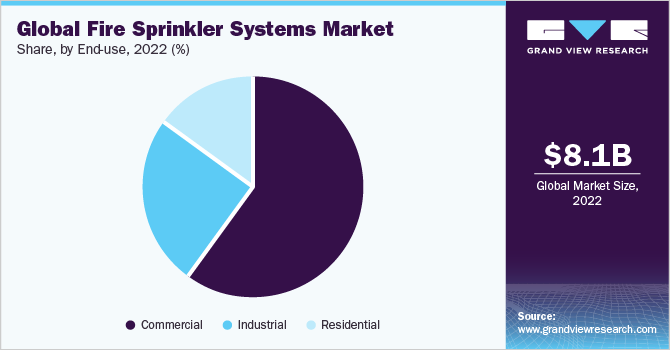

The global fire sprinkler systems market size was estimated at USD 8,110.5 million in 2022 and is projected to reach USD 15,108.2 million by 2030, growing at a CAGR of 8.0% from 2023 to 2030. The market has witnessed substantial growth owing to the rapid expansion of the construction industry globally.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, South Africa is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, product accounted for a revenue of USD 5,937.0 million in 2022.

- Product is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 8,110.5 Million

- 2030 Projected Market Size: USD 15,108.2 Million

- CAGR (2023-2030): 8.0%

- North America: Largest market in 2022

This growth is primarily driven by the ongoing urbanization process, which has sparked a surge in construction activities across diverse sectors, such as commercial and residential buildings, industrial facilities, and infrastructure projects. As these construction projects continue to progress, prioritizing fire safety becomes increasingly crucial, leading to a notable increase in the adoption of fire sprinkler systems.Several governments are making significant investments in infrastructure development, including roads, railways, and airports. For instance, in October 2020, the European Union (EU) set a target of renovating 35 million buildings by 2030. This is part of the EU's Green Deal initiative, which is a plan to make the EU climate-neutral by 2050. In Europe, the demand for fire sprinkler systems is increasing alongside efforts to make buildings more energy-efficient. This is because energy-efficient buildings often incorporate advanced technologies and materials that are prone to fire incidents. To mitigate this risk, fire sprinkler systems are being installed to enhance safety measures in energy-efficient buildings, aligning with the overall goal of creating sustainable and secure structures in Europe.

The demand for effective fire sprinklers has surged due to the growing global awareness and importance of fire safety. This growing awareness has been fueled by a surge in fire-related incidents and their significant consequences for both human life and property. In 2021, the U.S. witnessed approximately 356,600 home fires, resulting in an estimated USD 22.6 billion in property damage and claiming 2,630 lives. Hence, individuals, businesses, and organizations have increasingly acknowledged the significance of investing in advanced fire sprinkler systems to safeguard their properties and mitigate fire-related risks.

This heightened awareness has fueled the expansion and advancement of the fire protection market. People are prioritizing a proactive approach to fire prevention rather than relying solely on firefighting techniques. They recognize the paramount importance of preventing fires and minimizing their destructive impacts. As a result, fire sprinkler systems have gained prominence as a primary means of fire protection. This shift in mindset has paved the way for wider adoption and utilization of these systems across various sectors.

The fire sprinkler systems industry is experiencing fierce competition from various alternative fire suppression systems. These alternatives include gas-based suppression systems and advanced smoke detection technologies. These systems are often preferred in environments where water damage must be minimized or rapid suppression is essential. They are known for their ability to reach confined spaces and their suitability for protecting sensitive equipment. These alternative fire suppression systems, combined with their unique advantages and robust marketing efforts, present a significant challenge for the growth of the fire sprinkler systems industry. The perception of greater technological sophistication and suitability for specific applications may sway customers towards adopting these alternatives instead of traditional fire sprinkler systems.

The field of fire sprinkler technology has witnessed remarkable advancements, leading to significant improvements in the efficiency, reliability, and overall effectiveness of these systems. Modern fire sprinklers are equipped with advanced features such as enhanced thermal sensitivity, improved water distribution patterns, and intelligent activation systems for quicker and more efficient fire suppression. One notable area of progress includes the enhancement of water distribution patterns, which helps to disperse water evenly, ensuring that the fire is adequately suppressed thereby preventing its spread.

A well-designed water distribution pattern ensures sprinklers effectively cover the entire area at risk, minimizing the chances of spreading fire and maximizing the effectiveness of the system in controlling fires. Through innovative design and engineering, fire sprinklers possess the ability to disperse water in a more optimized and targeted manner. This ensures the water reaches the anticipated areas quickly and efficiently, maximizing its firefighting potential and minimizing collateral damage.

Component Insights

In terms of component, the product segment held the largest market share of over 73.0% in 2022 and is anticipated to register the fastest CAGR of 8.7% over the forecast period. The increasing urbanization and construction endeavors worldwide, especially in emerging economies, have bolstered the need for fire sprinklers as modern buildings and infrastructure projects necessitate dependable fire protection measures. Technological advancements have played a significant role in creating more efficient and successful fire sprinkler systems, encompassing innovative designs, enhanced detection capabilities, and improved integration with fire alarm systems. These developments have further accelerated the global demand for these products.

The service segment is anticipated to grow at a significant CAGR of 6.1% over the forecast period. The segment involves installing, maintaining, and inspecting fire sprinkler systems in buildings and structures. Increasing awareness about fire safety and the need for effective fire protection systems has led to a growing demand for fire sprinkler services worldwide. In several countries, fire sprinkler systems are mandated by building codes and regulations, creating a legal requirement for their installation and maintenance. In addition, insurance requirements and risk mitigation strategies play a significant role in promoting the regular maintenance and servicing of fire sprinkler systems, as they can lead to reduced insurance premiums and enhancement of the overall safety and security of the premises.

Product Insights

In terms of product, the wet-pipe sprinkler system segment held the largest market share of approximately 51.0% in 2022 and is expected to register the fastest CAGR of 9.3% over the forecast period. Wet-pipe sprinkler systems are reliable, which makes them highly cost-effective, ensuring widespread adoption across various industries and building types. They offer immediate response capabilities, as they are constantly filled with water, enabling rapid suppression of fires upon activation. In addition, their low maintenance requirements and ease of installation make them attractive to facility owners and operators. The exceptional track record of wet-pipe sprinklers in saving lives, minimizing property damage, and reducing the spread of fires has bolstered their reputation as a dependable and effective fire suppression technology, driving their widespread implementation worldwide.

Dry-pipe sprinkler system segment is anticipated to grow at a significant CAGR over the forecast period. Utilizing pressurized air or nitrogen in the pipes, these systems prevent water from accumulating in the pipes until a fire activates the sprinklers, ensuring the pipes do not freeze and subsequently burst. These systems are suitable in areas where water damage needs to be minimized, such as museums, data centers, or libraries, as they provide an effective means of fire suppression without the immediate release of water. This reduces potential damage to sensitive equipment, valuable assets, or irreplaceable artifacts. As a result, such factors contribute to the growth of the segment.

End-use Insights

In terms of end-use, the commercial sector segment held the largest market share of approximately 60.0% in 2022 and is expected to register the fastest CAGR of 8.7% over the forecast period. Commercial sectors encompass industries such as hospitality, retail, healthcare, manufacturing, and office spaces, and they highly rely on fire sprinklers to safeguard their valuable assets to ensure business continuity. With increasing urbanization, growing awareness of fire hazards, and stringent government regulations pertaining to smart buildings, are the aspects responsible for the increase in the demand for fire sprinkler systems in the commercial sectors.

The residential sector is anticipated to grow at a significant CAGR over the forecast period. With the increasing urbanization and population density, the risk of fire incidents has significantly grown, which is expected to increase demand for fire sprinklers from the residential sector. Increasing multistoried residential building projects globally have resulted in growing concern among contractors about dealing with fire incidents caused by electrical faults. This increasing fire concern has resulted in the deployment of fire sprinklers in residential spaces.

Regional Insights

North America dominated the market with the largest revenue share of over 29.0% in 2022. Stringent building safety regulations from the government have resulted in the installation of fire sprinkler systems in commercial and residential properties. In addition, the increasing importance of fire safety measures and growing concerns over property damage and loss of life due to fires have further accelerated the adoption of fire sprinkler systems.

Moreover, the construction industry's continuous expansion, driven by infrastructure development projects, has fuelled the demand for fire sprinkler systems as an integral part of new building constructions. For instance, in the U.S., the National Fire Protection Association (NFPA) requires the installation of fire sprinklers in all new buildings over 75 feet tall. These building codes are being enforced and adopted, incorporating layers of code changes that reflect modern security threats and concerns.

Asia Pacific is anticipated to register the fastest CAGR of 9.7% over the forecast period. The increasing awareness about fire safety regulations and the need for advanced fire protection systems across commercial, residential, and industrial sectors are propelling the demand for fire sprinklers. Rapid urbanization in countries such as China, India, and Southeast Asian countries has led to the construction of high-rise buildings, commercial complexes, and residential projects.

This surge in construction activities has increased the demand for fire protection systems, including fire sprinklers, to ensure the safety of these structures. In addition, infrastructure development initiatives such as smart cities and industrial parks contribute to the expansion of the market in the region.

Key Companies & Market Share Insights

The companies operating in the market are also involved in mergers & acquisitions to diversify their presence and gain higher market shares. Manufacturers and industry professionals need to invest in research and development to enhance the capabilities and efficiency of fire sprinkler systems, ensuring they remain a viable and attractive choice for fire protection. For instance, WIKA Instruments India Pvt. Ltd., a subsidiary fully owned by WIKA Global, announced the launch of the FSFD model, a fire sprinkler flow detector designed specifically to detect water flow in wet pipe sprinkler systems. The FSFD flow switch is well-suited for various industrial and residential applications, providing the necessary functionality to activate local hooters and control panels upon sprinkler activation. Some prominent players in the global fire sprinkler systems market include:

-

HD Fire Protect Pvt. Ltd.

-

Honeywell HBT

-

Minimax GmbH & Co. KG

-

Potter Electric Signal Company, LLC

-

Rapidrop Global Ltd.

-

Reliable

-

Tyco Fire Protection Products (Johnson Controls)

-

Victaulic Company.

-

Viking Group Inc.

Fire Sprinkler Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.79 billion

Revenue forecast in 2030

USD 15.11 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

HD Fire Protect Pvt. Ltd.; Honeywell HBT; Minimax GmbH & Co. KG; Potter Electric Signal Company, LLC; Rapidrop Global Ltd.; Reliable; Tyco Fire Protection Products (Johnson Controls); Victaulic Company; Viking Group Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Sprinkler Systems Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire sprinkler systems market report based on component, product, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Service

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet-pipe Sprinkler System

-

Dry-pipe Sprinkler System

-

Pre-action Sprinkler System

-

Deluge Sprinkler System

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The fire sprinkler system market size was estimated at USD 8.1 billion in 2022 and is expected to reach USD 8.79 billion in 2023.

b. The fire sprinkler system market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 15.11 billion by 2030.

b. Product segment dominated the fire sprinkler system market with a market share of more than 70% in 2022. The increasing urbanization and construction endeavors worldwide, especially in emerging economies, have bolstered the need for fire sprinklers as modern buildings and infrastructure projects necessitate dependable fire protection measures.

b. Some key players operating in the fire sprinkler system market include HD Fire Protect Pvt. Ltd.; Honeywell HBT.; Minimax GmbH & Co. KG; Potter Electric Signal Company, LLC; Rapidrop Global Ltd.; Reliable; Tyco Fire Protection Products (Johnson Controls); Victaulic Company.; and Viking Group Inc.

b. The fire sprinkler system market growth is primarily driven by the ongoing urbanization process, which has sparked a surge in construction activities across diverse sectors, such as commercial and residential buildings, industrial facilities, and infrastructure projects

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.