- Home

- »

- Sensors & Controls

- »

-

Fire Protection System Market Size, Industry Report, 2030GVR Report cover

![Fire Protection System Market Size, Share & Trends Report]()

Fire Protection System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Detection, Suppression, Response, Analysis, Sprinkler System), By Service (Managed Service, Maintenance Service), By Application, And Segment Forecasts

- Report ID: GVR-4-68038-797-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Protection System Market Summary

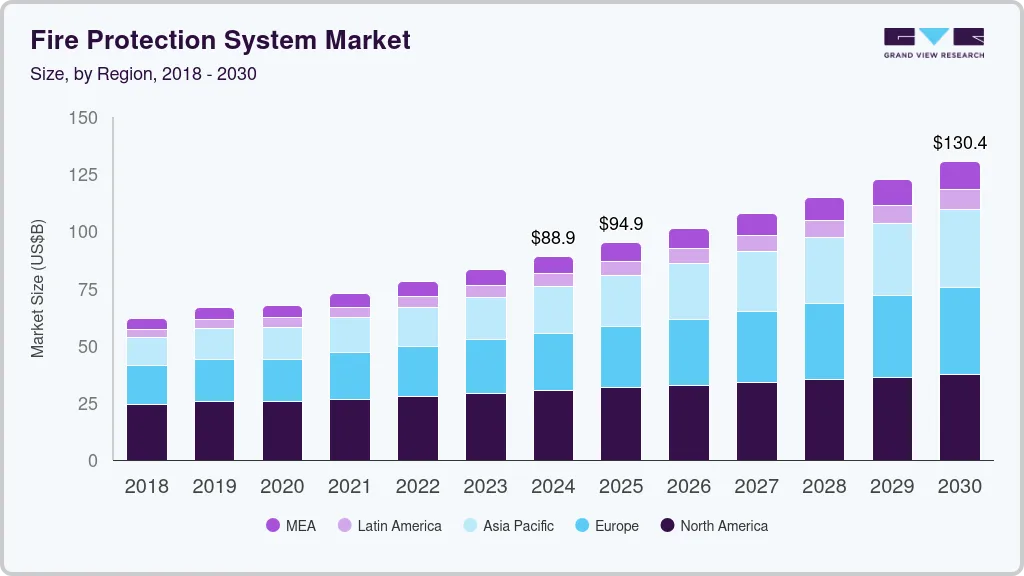

The global fire protection system market size was estimated at USD 88,945.0 million in 2024 and is projected to reach USD 130,369.2 million by 2030, growing at a CAGR of 6.6% from 2025 to 2030. Introduction of strict fire prevention and control requirements by governments throughout the world, the need for fire detection systems in commercial applications across facilities including hospitals, educational institutions, and government offices is growing.

Key Market Trends & Insights

- The North America fire protection system market accounted for over 35.8% revenue share in 2022.

- Asia Pacific is expected to register the highest CAGR over the forecast period.

- Based on the product, fire detection systems hold a revenue share of over 57% in 2022.

- By service, the installation and design service segment accounted for the largest market share of over 43.0% in 2022.

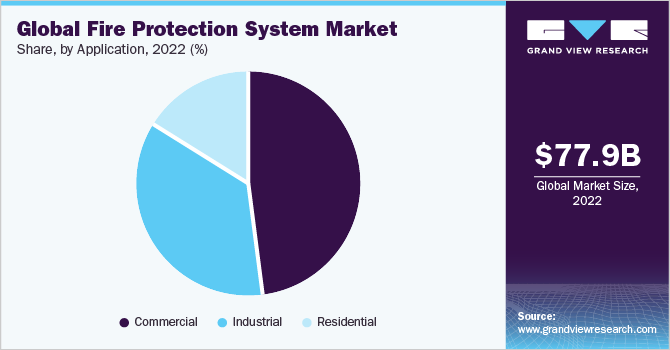

- By application, the commercial application segment dominated the market and accounted for the highest share exceeding 47.0% revenue in 2022.

Market Size & Forecast

- 2024 Market Size: USD 88,945.0 Million

- 2030 Projected Market Size: USD 130,369.2 Million

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Demand for fire alarm and detection systems in commercial applications is predicted to increase as a result of rising investments made by businesses in protecting infrastructure and minimizing a loss of property and life across various applications.

The market is anticipated to be driven by elements such as simple accessibility of technologically upgraded equipment and sophisticated networking capabilities that allow effective communication between fire detection solutions and fire suppression systems. However, lockdown during COVID-19 pandemic have unquestionably had an impact on a market for fire alarms and detection systems.

Furthermore, owing to the rise in the number of COVID-19 cases due to the second wave of the outbreak, a partial lockdown in several countries was observed. This resulted in a further reduction in production of new fire protection systems. The market was also negatively impacted by the supply chain disruption across countries and regions. Growing urban population and need to safeguard life and environment from fire emergencies are expected to boost demand for fire protection systems.

The relatively mature market is likely to be driven by a rising number of laws and regulations mandating installation of fire safety equipment across several industries and sectors over the forecast period. Factors such as easy availability of technologically advanced equipment and advanced networking capabilities that allow efficient communication between fire detection solutions and fire suppression systems or solutions are also expected to drive the market growth. Rising use of the Internet of Things (IoT) technology for interconnecting a variety of devices or objects in smart building systems, increasing demand for analyzing fire and security risks associated with a building through research prior to building structure design, and continuing need for communicating with building occupants in emergency situations are some of the key trends driving industry demand.

Stringent fire safety regulations and standards mandating installation of fire safety equipment in residential as well as commercial areas in a number of countries is also likely to boost market growth. For instance, in-duct smoke detection NFPA Standard 90A and three model Mechanical Codes developed by model building code groups BOCA, ICBO, and SBCCI, all require smoke detectors to be installed in certain ducts of building HVAC systems so these systems can automatically shut down during fires. The market is also likely to benefit from advancements in wireless sensor networks and increased adoption of wireless fire-sensing devices. Growing awareness about combating fire hazards along with a substantial rise in building infrastructure development activities are also expected to be high-impact drivers for the market. Organizations across the globe are increasingly spending on safety and security of infrastructure to reduce human losses. Implementation of fire safety codes for building and renovation activities is further expected to stimulate the demand for fire safety equipment globally.

Safeguarding inventory, infrastructure, and human lives from major losses due to fire can be effectively achieved by implementing fire protection systems such as fire alarm & detection systems. However, the cost associated with installing such advanced fire alarm & detection systems is relatively high as they are custom-designed and installed as per specific requirements. For instance, fire systems installed in a hospital will vary considerably from the ones installed in a kitchen or a data center. Such varied needs contribute to a high overall cost of fire protection systems. Additionally, with the development of sensor technologies and consecutive introduction of smart wireless systems, electronic service usage in fire protection devices has significantly increased. These improved devices have heightened sensitivity and respond quickly to emergencies. As they are manufactured with high precision and enhanced materials, the cost of these services and systems is high.

Market Dynamics

The growing trend of integrating fire alarm systems with building automation systems (BAS) offers vast growth opportunities to fire protection systems market. Connectivity with building automation systems is increasingly becoming a major feature of fire protection systems in commercial, industrial, and residential applications. This can be attributed to the fact that such integration allows for development of systems that are capable of sharing and gathering data, which can help in alerting individuals about fire safety issues on the premises. Apart from these factors, a notable rise in investment in smart building automation technologies across several regions is expected to lead to new opportunities for BASs in industrial and commercial sectors.

Fire protection system market is also strongly driven by numerous standards and codes imposed by national and international regulatory authorities. Growing stringency has compelled commercial and industrial sectors to adopt fire safety systems. With stringent fire safety regulations becoming a norm for the industrial sector, the trend is likely to remain strong in the next few years as well, further driving the market growth. Furthermore, increasing government spending’s on construction activities in Asia Pacific region will contribute to the adoption of fire protection systems in the region. For instance, in the Union Budget 2021, Government of India has given a push to infrastructure sector by allocating USD 32.02 billion in transport infrastructure.

Product Insights

Based on the product, fire detection systems hold a revenue share of over 57% in 2022. The detection system comprises several devices working collectively to detect and warn people through audio and video appliances during an incident involving fire, smoke, carbon monoxide, or other emergencies. Legislative requirements from different countries including National Fire Protection Association, USA, and the Building Code of Australia have mandated the installation of fire detection devices hence bolstering demand for these devices.

Fire suppression systems are used for reduction of heat release of a fire and deterrence of its re-growth by means of sufficient and direct application of water or other materials such as dry chemical powder among others through the fire plume to the burning fuel surface. Increasing adoption of environment-friendly fire suppression agents is expected to trigger the demand for fire suppression systems. The growing pace of construction of commercial units and industrialization is expected to open lucrative growth opportunities for the fire suppressions system market. Moreover, developments and renovations of new infrastructure in recent years require obligatory fire safety codes issued by the government. Players in this region are expected to invest in the market owing to fire safety obligations and regulations.

Service Insights

Installation and design service segment accounted for the largest market share of over 43.0% in 2022. Installation and design services refer to a practice of outsourcing the solution for the design, development, upgrades documentation, and installation processes of the fire protection system. Fire protection systems are being installed across buildings of all sizes as inhabitants increasingly understand the benefits they offer in small, mid-size, and large buildings. Furthermore, installation and design services are increasingly preferred due to the subject-matter expertise offered by vendors.

Maintenance services segment is expected to register the highest CAGR over forecast period. Fire protection systems play a vital role in detecting and alerting people in the event of smoke or fire; however, any fault in a system may lead to accidents and asset losses. Therefore, regular maintenance is necessary to reduce the risks of failure and extend the life of the system. Maintenance service includes timely audit and service of fire protection equipment to ensure that fire protection systems meet all essential fire safety standards during an emergency.

Application Insights

Commercial application segment dominated the market and accounted for the highest share exceeding 47.0% revenue in 2022. The commercial application segment comprises applications for retail, BFSI, government, healthcare, and telecom and IT educational institutions. The demand for fire protection systems in commercial applications is increasing due to the formulation of stringent government rules for fire prevention and control across the globe. Furthermore, increasing investments by companies to reduce loss of property and life and safeguard the infrastructure is expected to fuel the demand for fire protection systems.

Industrial application segment is expected to register the highest CAGR over the forecast period. The industrial application covers major sectors such as oil and gas, mining, energy and power, and manufacturing. The need to safeguard automated systems from fire accidents is expected to fuel the growth of the segment. Furthermore, in fire-prone sector, the emphasis is on installing complete proof protection and prevention systems within industries and on stringent government rules is expected to further drive the industrial segment growth.

Regional Insights

North America fire protection system market accounted for over 35.8% revenue share in 2022. This can be attributed to a rising demand for intelligent houses and smart buildings, which deliver optimum safety. Furthermore, North America has a strong presence of fire protection system manufacturers such as Raytheon Technologies Corporation; GENTEX CORPORATION; and Honeywell International Inc. These companies are actively involved in spreading awareness through marketing programs regarding fire protection systems.

Asia Pacific is expected to register the highest CAGR over the forecast period. Asia Pacific is a developing region and countries such as India, China, and Japan are expected to drive the regional market. Furthermore, growing urbanization and rising awareness among consumers are expected to contribute to the growth of the market in this region over the forecast period.

Key Companies & Market Share Insights

Major players are adopting strategic initiatives and undertaking measures to gain benefits from the opportunities in the emerging market. Companies in the market focus on launching new and advanced products to meet an evolving customer need. For instance, in January 2023, Siemens launched Fire Safety Digital Services, Fire safety systems are connected to the cloud by a first-in-market portfolio of digital and managed services, enabling organizations to switch from a reactive, compliance-driven approach to total protection through intelligent safety. Furthermore, in August 2022, Honeywell International, Inc. announced the launch of fire detection and alarm system named Morley Max. It contributes to enhancing occupant and building safety. A highly sophisticated range of capabilities that are simple to install, commission, and maintain are offered to installers and end users by a small, powerful, performance-driven intelligent fire alarm control panel. Additionally, market players are entering into strategic partnerships with local distributors to expand their customer base and enhance their product offerings in the market. Some prominent players operating in the global fire protection system market include:

-

Eaton

-

GENTEX CORPORATION

-

Halma plc

-

Hitachi Ltd.

-

Honeywell International, Inc.

-

Iteris, Inc.

-

Johnson Controls

-

Raytheon Technologies Corporation

-

Robert Bosch GmbH

-

Siemens AG

Fire Protection System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 94,904.3 million

Revenue forecast in 2030

USD 130,369.2 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corporation; GENTEX CORPORATION; Siemens; Robert Bosch GmbH; Halma plc; Eaton

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Fire Protection System Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire protection system market report based on product, service, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detection

-

Fire Suppression

-

Fire Response

-

Fire Analysis

-

Fire Sprinkler System

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Service

-

Installation and Design Service

-

Maintenance Service

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fire protection system market size was estimated at USD 77.88 billion in 2022 and is expected to reach USD 83.28 billion in 2023.

b. The global fire protection system market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 130.37 billion by 2030.

b. North America dominated the fire protection system market with a share of over 35.0% in 2022. This is attributable to the implementation of stringent fire safety regulations and norms and rapid infrastructural developments.

b. Some key players operating in the fire protection system market include Johnson Controls; Honeywell International, Inc.; GENTEX CORPORATION; Siemens; Robert Bosch GmbH; Halmaplc; Eaton; and Raytheon Technologies Corporation.

b. Key factors that are driving the fire protection system market growth include growth in the adoption of wireless technology in fire detection systems and the development of the construction industry across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.