- Home

- »

- Advanced Interior Materials

- »

-

Fire Protection Materials Market Size, Industry Report, 2030GVR Report cover

![Fire Protection Materials Market Size, Share & Trends Report]()

Fire Protection Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sealants, Mortar, Spray, Putty, Sheets/Boards), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-265-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Protection Materials Market Summary

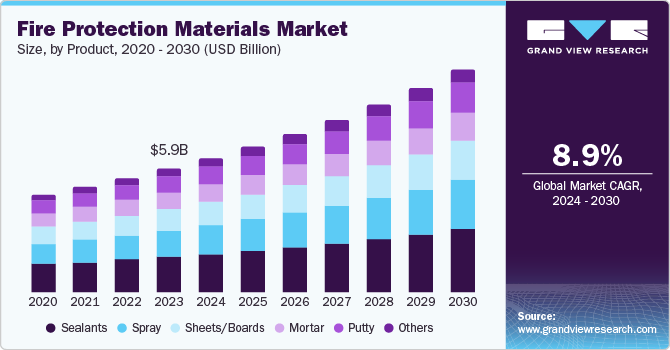

The global fire protection materials market size was estimated at USD 5.87 billion in 2023 and is projected to reach USD 10.63 billion by 2030, growing at a CAGR of 8.9% from 2024 to 2030. Increasing awareness about fire safety regulations and stringent building codes are compelling industries and commercial establishments to invest in advanced fire protection solutions.

Key Market Trends & Insights

- North America dominated the global fire protection materials market with the largest revenue share of 42.9% in 2023.

- By product, the sealants segment led the market with the largest revenue share of 27.9% in 2023.

- By end-use, the residential construction segment is expected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 5.87 Billion

- 2030 Projected Market Size: USD 10.63 Billion

- CAGR (2024-2030): 8.9%

- North America: Largest market in 2023

Technological advancements in fire protection products, such as intumescent coatings and fire-resistant boards, are further propelling market growth. Moreover, the expansion of industries such as oil and gas, manufacturing, and transportation, which require robust fire safety measures, is contributing significantly to the market’s upward trajectory.

Regulations play a crucial role in shaping the fire protection materials market, driving innovation, and ensuring safety standards are met across various industries. In the U. S., the National Fire Protection Association (NFPA) sets comprehensive codes and standards, such as NFPA 101: Life Safety Code, which mandates fire-resistant materials in building construction to enhance occupant safety. Similarly, the International Building Code (IBC) requires fire-resistant materials in specific building components, such as walls and ceilings, to prevent the spread of fire. These regulations compel manufacturers to develop advanced fire protection materials that comply with stringent safety requirements, fostering market growth.

In Europe, the Construction Products Regulation (CPR) enforces the use of fire protection materials in construction projects to ensure high safety standards. The European Union’s EN 13501 standard classifies the fire performance of construction products, influencing the adoption of fire-resistant materials across the region. Additionally, initiatives such as the UK’s Building Safety Programme, launched in response to the Grenfell Tower fire, emphasize the importance of using certified fire protection materials in high-rise buildings.

Product Insights

Sealants accounted for a revenue share of 27.9% in 2023, driven by their effectiveness in maintaining the integrity of fire-rated assemblies and their ability to adhere to various substrates. Additionally, advancements in sealant formulations, such as intumescent sealants that expand when heat exposure, have further boosted their adoption in fire protection applications. The growing emphasis on building safety and compliance with stringent fire safety regulations continues to propel the demand for sealant products in the market.

The putty segment is expected to grow at a CAGR of 9.4% over the forecast period. Its versatility and ease of application make it a preferred choice for new construction and retrofit projects. The increasing awareness of fire safety and the need for effective fire-stopping solutions in commercial, residential, and industrial buildings are key factors driving the growth of the putty segment. Moreover, innovations in putty formulations, such as incorporating fire-retardant additives and improved adhesion properties, enhance their performance and expand their application scope.

End-use Insights

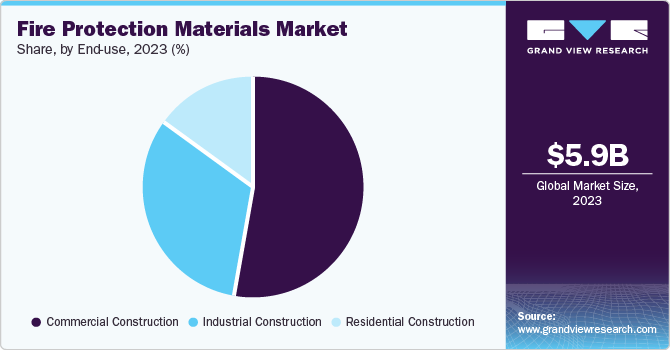

The commercial construction segment dominated the fire protection materials market in 2023, driven by the increasing demand for fire safety solutions in office buildings, shopping malls, hotels, and other commercial establishments. The stringent fire safety regulations and building codes in many countries mandate using fire protection materials in commercial buildings to ensure the safety of occupants and property. Additionally, the rise in commercial construction activities, particularly in emerging economies, has fueled the demand for fire protection materials. The need for advanced fire protection systems in high-rise buildings and large commercial complexes has led to the adoption of innovative fire-resistant materials, such as intumescent coatings, fire-resistant boards, and sealants.

The residential construction segment is expected to grow fastest over the forecast period. This growth is primarily attributed to the increasing awareness of fire safety among homeowners and the implementation of stringent fire safety regulations in residential buildings. The rise in residential construction activities, particularly in urban areas, is driving the demand for fire protection materials. The growing trend of multi-family housing and high-rise residential buildings necessitates the use of effective fire protection solutions to ensure the safety of residents. Innovations in fire protection materials, such as fire-resistant paints, sprays, and putties, are enhancing their application in residential buildings.

Regional Insights

North America held a 42.9% revenue share of the global market in 2023. The region, particularly the U.S. and Canada, boasts strong economies with significant investment in infrastructure and construction. The expanding GDP in the region has increased the demand for fire protection materials in construction and redevelopment projects to ensure compliance with safety regulations. Additionally, North America is home to numerous research organizations and firms that are dedicated to the development of new, high-performance materials.

U.S. Fire Protection Materials Market Trends

The fire protection materials market in the U.S. held a significant market share in 2023. Technological innovations in fire protection materials have been a focal point of development in the U.S. The nation enforces strict regulations on fire safety through various regulatory agencies such as the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency, and state assemblies. Both research institutions and companies allocate substantial funds toward research aimed at identifying new and superior materials that enhance structural performance in fire incidents.

Middle East & Africa Fire Protection Materials Market Trends

The Middle East & Africa fire protection materials market is projected to grow at a CAGR of 12.9% over the forecast period. The MEA region has witnessed significant economic advancement in recent decades, attributed to factors such as improved oil revenues, heightened foreign investment, and extensive infrastructural development. This economic progress has led to increased urbanization, resulting in a rise in construction activities within established urban areas and the development of new cities.

The fire protection materials market in Saudi Arabia is expected to grow during the forecast period. The country has undertaken substantial investment initiatives in infrastructure, notably through the Vision 2030 master plan aimed at decreasing reliance on oil. As a result, there has been a surge in new construction projects, encompassing commercial buildings, residential complexes, and industrial facilities. This surge has augmented the demand for fire protection materials, primarily driven by safety considerations.

Europe Fire Protection Materials Market Trends

The European fire protection materials market held a substantial market share in 2023 due to stringent fire safety regulations in European countries. The European Union has implemented strict directives and regulations to ensure high standards of fire safety in buildings and products.

Germany fire protection materials market is expected to grow steadily during the forecast period. German companies are investing significantly in research and development to innovate in fire protection. Initiatives focus on areas such as intumescent coatings, fire-resistant glass, and composites for structures exposed to high temperatures. These innovations not only enhance structural safety but also improve aesthetics, appealing to architects and builders.

Asia Pacific Fire Protection Materials Market Trends

The Asia Pacific fire protection materials market held a significant market share in 2023. Rapid urbanization is the primary factor fueling the growth of the market in the Asia Pacific region. Countries such as China and India are undergoing immense urbanization, thus increasing construction work. With the increase in the growth of urban societies, there is always a demand for fire protection in residential, business, and industrial properties.

China dominated the Asia Pacific fire protection materials market in 2023. China's rapid industrialization and urbanization have landed them in the top position. The country has undergone economic development in the past few decades, which has led to various construction activities, especially in the residential, commercial, and industrial sectors. This has, in turn, led to a high demand for fire protection materials due to the increased construction.

Key Fire Protection Materials Company Insights

Some key companies in the fire protection materials market include Akzo Nobel N.V., 3M, Sika AG, BASF, Hilti, and Morgan Advanced Materials. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, geographical expansion, and more.

-

Akzo Nobel N. V. is a Dutch-based multinational company that produces paints, coatings, and chemicals. Among its numerous products, the company has a set of fire protection materials that improve safety and conformity to requirements.

-

Morgan Advanced Materials is a worldwide supplier of engineering solutions for utilizing advanced materials. The company has expanded over the years to address different markets and is involved in the aerospace, automobile, medical, and power industries. Fire protection materials are one of the company's areas of specialization.

Key Fire Protection Materials Companies:

The following are the leading companies in the fire protection materials market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- 3M

- Sika AG

- BASF

- Hilti

- Morgan Advanced Materials

- Saint-Gobain

- Henkel AG & Co. KGaA

- Etex Group

Recent Developments

-

In September 2024, Kenny Pipe & Supply acquired Patco Inc., a leading provider of hydraulic and fire safety equipment. This strategic move expands Kenny Pipe's product offerings and market reach, solidifying its position in the industry.

-

In April 2024, Henkel finalized the acquisition of Seal for Life Industries LLC, a prominent global producer of advanced coating and sealing solutions. This tactical acquisition further consolidates Henkel's presence in the coatings sector and broadens its portfolio to encompass heat-shrink sleeves, visco-elastic coatings, and fire protection solutions.

-

In January 2024, Shell U.K. Limited acquired MIVOLT and MIDEL and from M&I Materials Ltd. This acquisition strengthens Shell's position in transformer oils, offering customers improved fire protection and biodegradability through synthetic and natural ester-based fluids.

-

In September 2023, Etex Group acquired Skamol, a leading manufacturer of fire protection and insulation materials. This strategic move aligns with Etex's commitment to sustainable construction solutions and expands its offerings in the growing market for energy-efficient insulation products. Combining Skamol's expertise and Etex's established presence will enable the group to provide a broader range of high-temperature insulation solutions for building and industrial applications.

Fire Protection Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.36 billion

Revenue forecast in 2030

USD 10.63 billion

Growth Rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Saudi Arabia

Key companies profiled

Akzo Nobel N.V.; 3M; Sika AG; BASF; Hilti; Morgan Advanced Materials; Saint-Gobain; Henkel AG & Co. KGaA; Etex Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Protection Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire protection materials market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sealants

-

Mortar

-

Spray

-

Sheets/Boards

-

Putty

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential Construction

-

Commercial Construction

-

Industrial Construction

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Spain

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.