- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fipronil Pyrazole Market Size, Share & Growth Report, 2030GVR Report cover

![Fipronil Pyrazole Market Size, Share & Trends Report]()

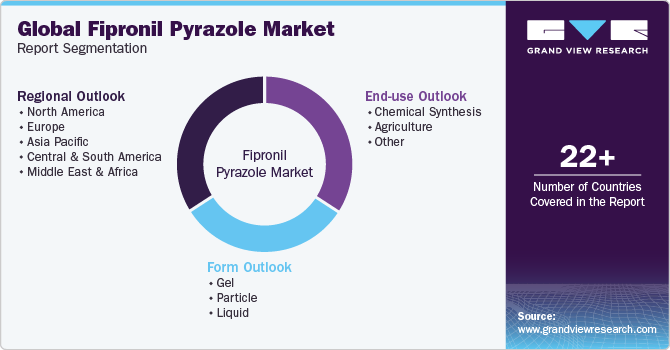

Fipronil Pyrazole Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Gel, Particle, Liquid), By End-use (Chemical Synthesis, Agriculture, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-316-9

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fipronil Pyrazole Market Size & Trends

The global fipronil pyrazole market size was estimated at USD 297.9 million in 2024 and is projected to grow at a CAGR of 3.3% from 2025 to 2030. Increasing agricultural production owing to rising global demand for food is expected to drive the growth of the market during the forecast period. Crops such as corn, wheat, cotton, and soybeans require the usage of insecticides for improved yields. By reducing pest damage to crops, fipronil pyrazole prevents yield losses, thereby increasing overall productivity.

The growth of the global market is primarily driven by rising demand for crop protection chemicals across the globe. Moreover, due to the rising demand for food across the globe had led to rise in demand for crop protection to get high yields. This helps to meet the demand for world demand for food.

Fipronil pyrazole is a type of insecticide that belongs to the phenyl pyrazole group. It has a broad-spectrum effect and is useful against ants, beetles, fleas, termites, etc. It works through both contact and stomach action and is moderately systemic. Fipronil is available in different formulations, including wettable granules, suspension concentrates, baits, ready-to-use products, and ultra-low volume sprays. It can be used alone or combined with other insecticides. The addition of piperonal butoxide can enhance the toxicity of fipronil. It is a white powder with a moldy odor.

The most used method for producing fipronil pyrazole is oxidation. The oxidation reaction is conventionally carried out using organic solvents, particularly halogenated aliphatic and trifluoroacetic acid. Trifluoro acetic acid is a suitable medium for effective oxidation, with good conversion and selectivity to the sulphonyl derivative at minimum levels of sulphonyl derivative formation. Oxidants such as peracids, peroxides, and persulfates have been widely used for such oxidation reactions. However, due to its high melting point, trichloroacetic acid has not been reported as a medium for oxidation.

The unique properties of fipronil pyrazole, including emulsification, foaming, and conditioning, position it as a valuable functional ingredient across diverse industries. Ongoing technological advancements in fipronil pyrazole, such as the use of nanotechnology, are expected to fuel the growth of the market worldwide in the coming years.

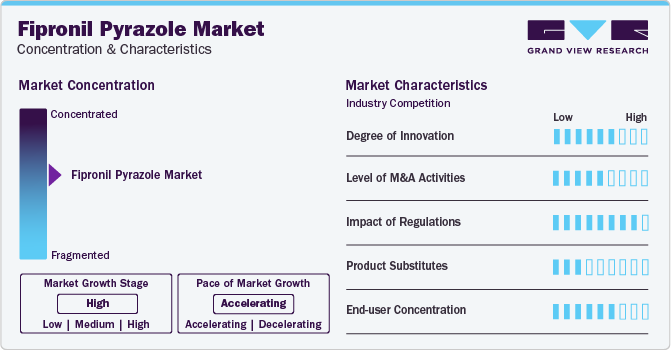

Market Concentration & Characteristics

The market is fragmented with the presence of many manufacturers. Fipronil pyrazole comes in various form, such as gel, particle, and liquid forms.

Manufacturers must adopt the right sales channel to ensure their products are distributed effectively to end consumers. To ensure a smooth supply of goods, manufacturers must establish a good working relationship with their distributing partners. Selection of an ideal sales channel is essential for the secure distribution of the product to end-users.

The preferred distribution channels include third-party distributors, wholesalers, and e-commerce platforms. This ensures a seamless supply of goods to end consumers. Manufacturers often cater to clients/companies across the globe, regardless of their location to establish strong partnerships with product exporters. This leads to a better distribution network amongst the manufacturers and distributors across different geographical areas.

Form Insights

Liquid segment dominated the global market in 2023 and accounted for a revenue share of 47.1% of the market in the same year. The growth of this segment can be attributed to the ability of liquids to distribute and disperse active ingredients over the treated surfaces evenly for effective performance. The liquid carrier helps distribute and disperse the active ingredient evenly over the treated surfaces. It is easier to apply to large areas than particle formulations, providing a quick knockdown effect on pests.

The particle form of fipronil pyrazole is an active ingredient present in a solid particle form, such as powder or granule. This formulation is easier to handle, store, and apply. It also allows a more targeted application to the specific area, reducing non-target exposure risks and minimizing waste. Particle formulations demonstrate better coverage and adherence to surfaces than liquid forms. Apart from agriculture, this form is used in forestry, public health, and household applications to effectively control pests, such as insects, rodents, and flies.

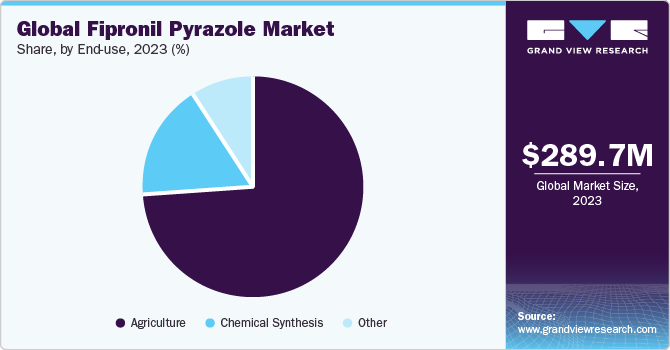

End-use Insights

Agriculture segment dominated the global market in 2023 and accounted for a revenue share of 74.4% of the market in the same year. The effectiveness of fipronil pyrazole against various insect pests makes it a valuable tool for crop protection. It is used in the form of liquid sprays and granules in agricultural applications. Fipronil pyrazole is also used for seed treatment.

In agriculture, fipronil pyrazole can be applied in several forms, such as liquid sprays, granules, or seed treatments. The choice of formulation depends on the target pest, crop, and the desired application method. When used as a foliar spray, fipronil pyrazole is diluted in water and applied directly to the plants, targeting the insects that come into contact with the sprayed solution.

Fipronil pyrazole serves as an intermediate in the synthesis of various organic compounds. It can be utilized to build more complex molecules through organic reactions such as substitution, addition, or condensation reactions. Additionally, fipronil pyrazole’s chemical properties make it suitable for incorporating into molecular frameworks to develop new pharmaceuticals, agrochemicals, or materials with specific properties. Its use in chemical synthesis can vary depending on the desired end product and specific reactions and transformations involved in the synthesis process.

Regional Insights

The North America region is significantly expected to grow during the forecast period due to a rise in the demand for crop protection chemicals and the increase in agricultural production. According to the U.S. Agricultural, Economic, and Foreign Trade outlook, the total wheat production area is projected at 49.5 million acres, the total production area went up by 3.8 million acres from previous year 2022 and the highest wheat producing area since 2016/17.

U.S. Fipronil Pyrazole Market Trends

The U.S. fipronil pyrazole market is expected to grow over the forecast period due to the rising agricultural sector and rising demand for crop protection chemicals, in order to increase the production and to protect the crops has led to a rising demand for pesticides and insecticides such as fipronil pyrazole.

Asia Pacific Fipronil Pyrazole Market Trends

The fipronil pyrazole market in Asia Pacific dominated with a revenue share of 57% in 2023. This is attributable to the growing population and decreasing arable land, which has created pressure to increase the overall crop yield.

Chinafipronil pyrazole market is expected to grow over the forecast period due to increased crop production in the country. Fipronil pyrazole is used to ensure better crop yield and increase production, crop protection, and crop yield. China is increasing the production of crops such as wheat, rice, corn, and rose. In 2022, China’s cereal production was 633.7 million tons with the major cereal crops being wheat, rice, and coarse grains.

Europe Fipronil Pyrazole Market Trends

Europe fipronil pyrazole market is expected to grow, attributable to rising food consumption by 1.3% per annum to 2032, indicating an increase in the share of agricultural commodities used as food, according to the Organization for Economic Co-operation and Development (OECD). The rising food consumption is expected to lead to a rise in crop production, resulting in growth in demand for pesticides and insecticides.

The fipronil pyrazole market in Germany is witnessing significant growth due to the rising agriculture production across the country. This leads to a rise in demand for pesticides and insecticides in order to achieve the highest crop production. The country is also promoting agricultural trade and investing to improve the trade in the least developed countries.

Central & South America Fipronil Pyrazole Market Trends

Central & South America fipronil pyrazole market is expected to grow in the region during the forecast period, attributable to the increased production of crops. The increasing crop production leads to the demand for pesticides and insecticides, such as fipronil pyrazole.

The fipronil pyrazole market in Brazil is growing, due to the rising demand for agriculture to meet the increasing demand for food consumption in the country. This has led to a rise in demand for crop protection chemicals, such as pesticides and insecticides used in crop development.

Middle East & Africa Fipronil Pyrazole Market Trends

Middle East & Africa fipronil pyrazole market is witnessing the growth of crops owing to rising crop production, further leading to rise in demand for fipronil pyrazole to manufacture pesticides and insecticides. This has enabled market players to invest in the region to establish a strong foothold in the Middle East and Africa region.

The fipronil pyrazole market in Saudi Arabia is receiving government support which is aiming to increase the crop production in the region by launching new government initiatives to increase the crop production. This has led to a rise in demand for insecticides and pesticides to increase the crop production. Thus, leading to a rise in the demand for the fipronil pyrazole market.

Key Fipronil Pyrazole Company Insights

Some of the key players operating in the market include BASF SE, Bayer AG among others.

BASF SE is a chemical manufacturer and supplier with a presence across Europe, North America, Asia Pacific, South America, Africa, and the Middle East. The company is involved in the manufacturing of a wide range of products such as solvents, fipronil pyrazole, amines, resins, glues, petrochemicals, thermoplastics, foams, and polymers.

-

The company is a global enterprise with core competencies in the fields of healthcare and agriculture. It is a significant player in the agriculture and chemical industries. Crop Science division of the company provides innovative solutions to farmers worldwide, thereby helping them produce healthy and abundant crops while protecting the environment. Agricultural products of Bayer AG include seeds, and crop protection chemicals that help farmers optimize their yields and enhance the quality of their produce. The company has a global presence with operations in more than 90 countries across the world.

-

BASF SE is a chemical manufacturer and supplier with a presence across Europe, North America, Asia Pacific, South America, Africa, and the Middle East. The company is involved in the manufacturing of a wide range of products such as solvents, fipronil pyrazole, amines, resins, glues, petrochemicals, thermoplastics, foams, and polymers.

HPM Chemicals, Gharda Chemicals Limited, and GSP, among others, are some of the emerging market participants in the Fipronil Pyrazole market.

-

The company is a manufacturer and supplier of high-quality chemicals that cater to various industries. With 26 branches across India, it distributes products through 45,000 retail outlets. It has a global presence, with operations spanning three continents and ten countries worldwide.

-

The company is a leading agricultural company, which specializes in developing, manufacturing, and distributing crop protection products, fertilizers, and seeds. With a commitment to sustainable agriculture, it provides farmers with the best possible services, support, and advice to help them succeed in the agriculture.

Key Fipronil Pyrazole Companies:

The following are the leading companies in the fipronil pyrazole market. These companies collectively hold the largest market share and dictate industry trends.

- Abcam Limited

- BASF SE

- Bayer AG

- Gharda Chemicals Limited

- GSP

- HPM Chemicals

- Peptech Biosciences Ltd.

- Parijat Industries (India) Pvt. Ltd.

- Albaugh LLC

Recent Developments

-

In February 2023, Parijat Industries partnered with African countries in agriculture, such as Parijat Mali, West Africa's pioneering integrated Pesticide Formulation Plant. Parijat Industries offer international quality products that are ethically produced and sourced, contributing to the agricultural sectors of both regions. India, a leading producer of agricultural inputs, collaborates with African countries to improve agricultural productivity and help farmers adapt to the changing climate. Parijat Industries supplies quality, cost-effective crop protection chemicals serving West African farmers.

-

In January 2023, BASF SE started the global registration of its new range of environment-friendly insecticides and active ingredients under the brand name Axalion. This development is anticipated to help the company in strengthening its insecticides portfolio globally by carrying out sustainable agricultural innovations.

Fipronil Pyrazole Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 306.7 million

Revenue forecast in 2030

USD 361.5 million

Growth rate

CAGR of 3.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Abcam Limited; BASF SE; Bayer AG; Gharda Chemicals Limited; GSP; HPM Chemicals; Peptech Biosciences Ltd.; Parijat Industries (India) Pvt. Ltd.; Albaugh LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fipronil Pyrazole Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fipronil pyrazole market report based on form, end-use, and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Gel

-

Particle

-

Liquid

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Chemical Synthesis

-

Agriculture

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fipronil pyrazole market size was estimated at USD 289.7 million in 2023 and is expected to reach USD 297.9 million in 2024

b. The global fipronil market is expected to grow at a compound annual growth rate of 3.3% from 2024 to 2030 to reach USD 361.5 million by 2030

b. Asia Pacific dominated the fipronil pyrazole market with a share of 56.9% in 2023. This is attributable to the flourishing chemicals industry and the increase in polymer consumption. Companies in the region are shifting toward natural gas liquids and other non-oil feedstock to cater to the rising demand for the product, along with strategizing cost-effective methods to increase sales of the products

b. Some key players operating in the fipronil pyrazole market include Abcam Limited; BASF SE; Bayer AG; Gharda Chemicals Limited; GSP; HPM Chemicals; Peptech Biosciences Ltd. (Titan Biotech); Parijat Industries (India) Pvt. Ltd.; and Albaugh LLC.

b. Key factors that are driving the market growth include increasing spending on construction activities globally for the development of residential and commercial. In construction industry, petrochemicals such as polyethylene, polyurethane, styrene, and methanol are used for manufacturing concrete, adhesives, fibers, resins, plastics, etc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.