- Home

- »

- Next Generation Technologies

- »

-

Financial Auditing Professional Services Market Report, 2030GVR Report cover

![Financial Auditing Professional Services Market Size, Share & Trends Report]()

Financial Auditing Professional Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (External, Internal), By Offering (Financial Statement, Employee Benefit Plan, Financial Statement, SOC), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-750-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Financial Auditing Professional Services Market Summary

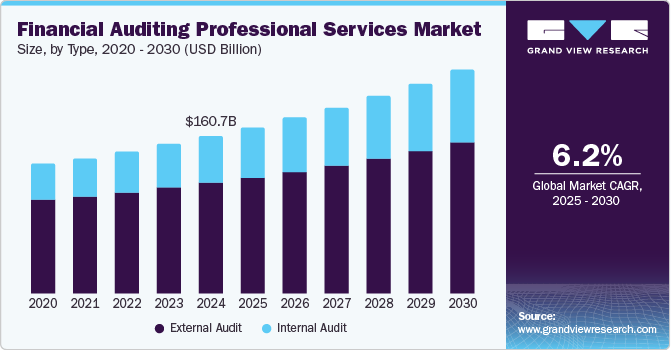

The global financial auditing professional services market was estimated at USD 160.68 billion in 2024 and is projected to reach USD 228.87 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. This growth is attributed to stringent regulatory compliance requirements, globalization, and corporate governance demands.

Key Market Trends & Insights

- North America dominated the market in 2024 with a 37.1% revenue share.

- The Asia Pacific market is expected to grow at a significant CAGR of 8.6% over the forecast period.

- By offering, the financial statement audits led the global financial auditing professional services market and held the largest revenue share of 31.7% in 2024.

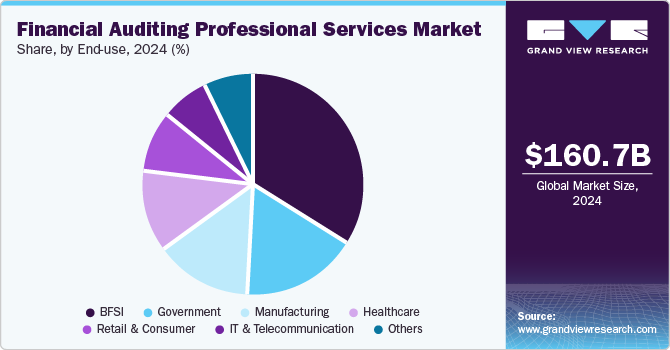

- By end use, the BFSI sector held the dominant position in the global market, with the largest revenue share of 33.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 160.68 Billion

- 2030 Projected Market Size: USD 228.87 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest Market in 2024

Increasing incidences of financial fraud and complex financial instruments necessitate robust auditing practices. In addition, the integration of advanced technologies such as AI, block chain, and data analytics enhances audit precision and efficiency. Furthermore, emerging trends such as ESG audits, sustainability reporting, and remote auditing also expand market opportunities. Moreover, digital transformation and risk management strategies fuel sustained growth in this sector.

Financial auditing professional services involve the systematic examination of an organization’s financial records to ensure accuracy, compliance, and transparency. These services are pivotal in addressing several market drivers that contribute to their growth. Regulatory compliance is a key factor, as governments worldwide impose stricter financial reporting standards, compelling organizations to adopt professional audit services for adherence. The dynamic nature of regulations further necessitates expert auditors who can navigate these complexities effectively. In addition, the increasing intricacy of financial transactions due to globalization and advanced financial instruments has amplified the demand for specialized audits that validate accuracy and mitigate risks.

Furthermore, technological advancements also play a significant role in transforming audit processes. Tools such as artificial intelligence, data analytics, and automation enhance efficiency and precision, allowing firms to deliver forward-looking insights. This technology-driven approach has encouraged businesses to invest more in professional audits, fostering market expansion. Moreover, the rise of environmental, social, and governance (ESG) audits reflects a shift toward sustainability-focused practices, creating new opportunities for audit firms to cater to evolving client needs.

Type Insights

External audits dominated the market and accounted for the largest revenue share of 70.4% in 2024, primarily driven by the increasing need for independent financial verification to meet stringent regulatory requirements. Organizations rely on external audits to ensure compliance with laws and avoid financial penalties. In addition, these audits also enhance corporate governance and transparency, fostering trust among stakeholders and investors. Furthermore, the globalization of businesses further drives demand as companies navigate diverse regulatory frameworks. Moreover, advancements in auditing technologies improve efficiency, making external audits indispensable for accurate financial disclosure.

Internal audits are expected to grow at a CAGR of 7.9% over the forecast period, owing to their critical role in risk management, fraud detection, and operational improvement. Organizations increasingly prioritize internal controls to address vulnerabilities and comply with evolving governance standards. In addition, the complexity of global operations and regulatory environments has heightened the need for proactive internal auditing practices. Furthermore, advancements in technology, such as data analytics and automation, enable more effective process monitoring.

Offering Insights

The financial statement audits led the global financial auditing professional services market and held the largest revenue share of 31.7% in 2024. This growth is attributed tothe increasing demand for accurate and transparent financial reporting to meet regulatory requirements. Companies rely on these audits to ensure compliance with accounting standards, build stakeholder trust, and mitigate risks associated with misstatements or fraud. Furthermore, financial statement audits also provide valuable insights into operational inefficiencies and areas for improvement. Moreover, as businesses expand globally, the complexity of financial reporting increases, further boosting the need for independent verification to maintain credibility and investor confidence.

Employee benefit plan audits are expected to grow the fastest CAGR of 8.9% over the forecast period, due to heightened regulatory scrutiny and the need for compliance with laws. Organizations must ensure that benefit plans are managed accurately and fairly to protect employee interests. In addition, these audits help identify discrepancies, improve plan administration, and prevent legal penalties. Furthermore, the increasing complexity of benefit plans, coupled with evolving regulations, has amplified the demand for specialized audit services.

End-use Insights

The BFSI sector held the dominant position in the global market, with the largest revenue share of 33.7% in 2024. It is driven by stringent regulatory requirements, increasing fraud risks, and the complexity of financial transactions. As banks and financial institutions adopt digital technologies such as AI and blockchain, audits ensure compliance with evolving standards and safeguard against cyber threats. In addition, the sector’s global expansion necessitates audits to address diverse regulations and enhance transparency. Moreover, proactive internal auditing practices help detect fraud and improve operational efficiency, making financial audits indispensable for maintaining trust and regulatory adherence.

The manufacturing sector is expected to grow at a CAGR of 7.4% over the forecast period, attributed to its intricate supply chains, rising global operations, and compliance needs. Audits play a crucial role in verifying financial accuracy, managing risks, and adhering to international trade policies. In addition, the adoption of advanced technologies in manufacturing processes increases the complexity of financial reporting, necessitating detailed audits. Furthermore, audits help manufacturers optimize cost management, improve operational efficiency, and ensure compliance with environmental and labor regulations, reinforcing their importance in this dynamic industry.

Regional Insights

North America financial auditing professional services market dominated the global market and accounted for the largest revenue share of 37.1% in 2024. This growth is attributed to the region's robust regulatory frameworks and the presence of multinational corporations. Companies increasingly adopt advanced auditing technologies, such as AI and data analytics, to ensure compliance and improve efficiency. In addition, the focus on governance and risk management drives demand for auditing services, while corporate investments in transparency further support market growth.

U.S. Financial Auditing Professional Services Market Trends

The financial auditing professional services market in the U.S. held the largest revenue share in 2024, driven by stringent regulations and the dominance of leading audit firms. The complexity of financial reporting standards and rising incidences of fraud necessitate high-quality audits. Furthermore, specialized services, such as SOC audits and employee benefit plan audits, are in high demand across various sectors. The integration of advanced technologies such as blockchain enhances audit precision, while corporate spending on compliance measures continues to fuel market expansion.

Asia Pacific Financial Auditing Professional Services Market Trends

Asia Pacific financial auditing professional services market is expected to grow at a CAGR of 8.6% over the forecast period, owing to the rapid economic growth and globalization. Businesses face diverse regulatory requirements, increasing the need for professional audits to ensure compliance. Furthermore, the adoption of digital technologies, such as blockchain and AI, improves audit accuracy and efficiency.

The financial auditing professional services market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by stringent government policies aimed at enhancing corporate transparency. In addition, the rapid expansion of domestic enterprises globally has increased the demand for audits that meet international standards.

Europe Financial Auditing Professional Services Market Trends

The European financial auditing professional services market is expected to grow significantly over the forecast period. It benefits from a well-established regulatory environment and strong corporate governance practices. In addition, companies adopt innovative audit methodologies to comply with EU directives and international standards. Sustainability reporting and ESG-focused audits are prominent drivers of growth in this region. Furthermore, increasing cross-border transactions within Europe necessitate specialized audits to address diverse regulations, while technological advancements enhance audit efficiency across industries.

Key Financial Auditing Professional Services Company Insights

Key players in the financial auditing professional services market include Ernst and Young, Deloitte, KPMG, and others. These companies employ strategies such as technological innovation, service diversification, and geographical expansion to strengthen their market presence. In addition, they focus on integrating advanced tools such as AI and blockchain to enhance audit efficiency and precision.

-

Deloitte specializes in external and internal audits, risk advisory, and financial reporting services. It leverages advanced technologies such as AI and data analytics to enhance audit precision and efficiency.

-

KPMG specializes in external audits, internal controls evaluation, risk management, and financial reporting advisory services. KPMG uses innovative technologies such as blockchain and AI to improve audit quality and operational efficiency.

Key Financial Auditing Professional Services Companies:

The following are the leading companies in the financial auditing professional services market. These companies collectively hold the largest market share and dictate industry trends.

- Deloitte

- KPMG

- Plante Moran

- Grant Thornton

- CohnReznick

- PricewaterhouseCoopers

- McGladrey

- Baker Tilly

- BDO

- Mazars

- Ernst and Young

- RSM International

- Protiviti

Recent Developments

-

In March 2025, Deloitte unveiled AI Advantage for CFOs, a platform powered by Amazon Bedrock and Anthropic, aiming to revolutionize financial operations. This solution offers Finance Automation Agents that automate financial processes and extract valuable insights from various data types.

-

In April 2024, DataSnipper launched two new suites, the Cloud Collaboration Suite and the Advanced Extraction Suite, designed to transform the audit and finance sectors.

Financial Auditing Professional Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 169.57 billion

Revenue forecast in 2030

USD 228.87 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, offering, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Deloitte; KPMG; Plante Moran; Grant Thornton; CohnReznick; PricewaterhouseCoopers; McGladrey; Baker Tilly; BDO; Mazars; Ernst and Young; RSM International; Protiviti

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Financial Auditing Professional Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global financial auditing professional services market report based on type, offering, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

External Audit

-

Internal Audit

-

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Due Diligence

-

Employee Benefit Plan Audit

-

Financial Statement Audit

-

Service Organization Control (SOC) Audit

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Manufacturing

-

Healthcare

-

Retail & Consumer

-

IT & Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global financial auditing professional services market is expected to grow at a compound annual growth rate of 7.2% from 2020 to 2027 to reach USD 210.77 billion by 2027.

b. North America dominated the financial auditing professional services market with a share of 35.1% in 2019. This is attributable to the Stable regulatory scenario, the presence of several multinational corporations (MNCs), and the voluntary adoption of efficient internal auditing and reporting practices.

b. Some key players operating in the financial auditing professional services market include PricewaterhouseCoopers (PwC), Deloitte Touche Tohmatsu Limited, KPMG International, Grant Thornton International Ltd., Ernst & Young (EY), Binder Dijker Otte (BDO) Global, Mazars, Nexia International Limited, RSM International Association, and Moore Stephens International Limited.

b. Key factors that are driving the financial auditing professional services market growth stringent regulations regarding disclosure & reporting of financial details and an increase in corporate spending on financial auditing & reporting.

b. The global financial auditing professional services market size was estimated at USD 123.32 billion in 2019 and is expected to reach USD 129.95 billion in 2020.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.