Finance And Accounting Business Process Outsourcing Market Size, Share & Trends Analysis Report By Services (Order-to-Cash, Procure-to-Pay, Record-to-Report), By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-032-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

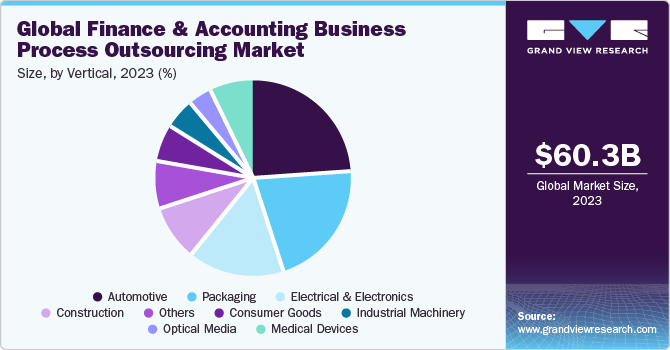

The global finance and accounting business process outsourcing market size was estimated at USD 60.31 billion in 2023 and is expected to grow at a CAGR of 9.3% from 2024 to 2030. The growth can be attributed to the increasing demand for reliable and cost-effective services with advanced technologies, and the growth of the BPO industry in emerging economies. The global F&A BPO market has expanded at a notable pace in recent years due to vast advancements in the field of Information and Communication Technology (ICT). Furthermore, the evolving regulatory landscape and the changes in income tax laws are driving the growth of the finance and accounting BPO market.

Infrastructure and operational capabilities are set up by service providers’ basis contractual agreements. In the finance & accounting business process outsourcing industry, the supplier is generally a developing nation where the services or business operations are conducted whereas the buyers are developed economies. The finance & accounting BPO industry generally caters to standardized operations to reduce fixed operational expenses such as record to report, insurance claim processing, and account & booking services.

Furthermore, Knowledge Process Outsourcing (KPO) enables organizations to expand operations by assisting at a strategic level, offering consulting services, market intelligence services, and legal services, among others to help make strategic business decisions driving the finance & accounting business process outsourcing industry growth.

Cloud computing, social media marketing services, business analytics, and process automation technologies are increasingly adopted by BPO service providers to improve their business processes and lower operational expenses. Incorporating such technologies in finance & accounting BPO’s operating functions enabled it to provide highly valued services to the clients thereby fulfilling their requirements at affordable costs. The inclusion of cloud-based technical support solutions allows finance & accounting BPO vendors to update their CRM service offering greater transparency for customer interactions. These factors would further supplement the growth of the market during the forecast period.

BPO envisages outsourcing various non-core back-office and front-office functions, including call center operations, IT services, financial services, and recruitment services, among others, to a third party. Outsourcing these functions allows companies to reduce their operational expenses and focus on their core competencies. Advances in information and communication technology (ICT) have contributed to the market’s growth. Further, innovation in ICT coupled with the increasingly fragmented production processes is allowing enterprises to outsource labor-intensive services to countries, such as India & Philippines, to leverage the low-cost labor and the advanced IT infrastructure available in these countries. These aforementioned factors would further drive the market growth during the forecast period.

Outsourcing of financial data related to verticals such as banking, and insurance involves sharing critical details such as income statement, account number, contact details, customer name, and social security number among others with the outsourcer to ensure proper implementation of the business process. As such, outsourcing companies are often concerned with the way the outsource handle the information shared and are observed to be reluctant as even a small error can result in a permanent setback concerning the company’s market position. Thus, disinclination to outsource business processes on the part of outsourcers is anticipated to significantly hamper the growth of the finance & accounting BPO market.

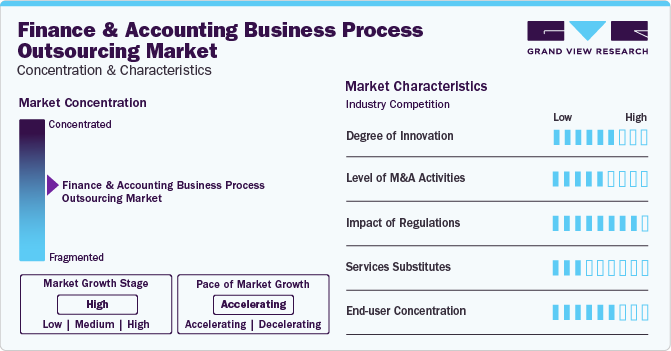

Market Concentration & Characteristics

The growth and expansion of the industry can primarily be attributed to innovation, global competition, and the emergence of new technologies. BPOs in finance and accounting provide businesses with the tools to reduce expenses and boost profits efficiently. Advanced technologies such as Artificial Intelligence (AI), cloud computing, and process automation allow finance and accounting BPOs to further increase the effectiveness of their offerings.

Various outsourcing service providers facilitate advanced technologies to effectively handle skills shortages, improve goods and services, and deal with market difficulties while maintaining low operating costs. Moreover, recent technological advancements such as Robotic Process Automation (RPA) have begun to have an impact on the BPO sector. RPA is gradually permeating all industries and business process types due to its capacity for cost savings, speed, and efficiency.

The threat of substitutes in the market is low. Conducting finance and accounting operations in-house is the only substitute for the market. However, outsourcing financial services is preferred by organizations due to lower operational costs. Moreover, the true potential of finance and accounting BPO services can be realized only by employing core service providers who can integrate systems for optimum performance. Lack of substitutes would thus factor for enhanced market growth.

The accounting and finance departments of enterprises in the highly regulated countries, such as, the US, must ensure to follow all the relevant state and federal regulations drafted by the Federal Reserve, Consumer Financial Protection Bureau (CFPB), and Financial Industry Regulatory Authority, among other agencies. The evolving regulatory landscape and the changes in income tax laws are driving the growth of the finance and accounting BPO market.

The presence of several regional and well-established service providers increases the bargaining power of buyers in the market. However, the demand for BPO services in finance and accounting is increasing with the continuously evolving business operations, which reduces the bargaining power of the buyer. The availability of cost-effective products and services offered by certain solution providers may encourage end-users to turn to these suppliers.

Services Insights

The Order-to-Cash (O2C) segment accounted for the largest market share of 53.6% in 2023. Order-to-cash is a set of business operations and activities that include receiving and achieving customer requests for goods and services. It impacts business operations throughout the organization, such as inventory management, supply chain management, and labor.

Further, the company’s cash inflow and working capital are determined by O2C functions. In addition to cash flow improvements, the major advantages of optimizing the O2C process include customer experience, cost savings, and revenue generation. These factors can have a positive impact on O2C segment growth during the forecast period.

The Source-to-Pay segment is expected to register a CAGR of around 12.9% from 2024 to 2030. Source-to-pay (S2P) is a holistic procurement process that encompasses every step of the procurement lifecycle, from the sourcing and acquisition of goods and services to the administration of suppliers, contracts, and payments. S2P process outsourcing to BPO providers has become more popular in the F&A BPO sector. Businesses can save money by outsourcing S2P processes to BPO companies.

Enterprise Size Insights

Based on the enterprise size, large enterprises segment held the largest market share in 2023. Large enterprises are preferring F&A BPO to incorporate technological improvements into their financial processes and improve accuracy, effectiveness, and the capacity to generate actionable insights from financial data. F&A BPO enables large corporations to concentrate on their core capabilities and strategic objectives. Companies are shifting internal resources and expertise toward activities that fuel creativity, expansion, and competitiveness by delegating ordinary financial duties to specialist providers.

The SMEs segment is expected to register a significant CAGR from 2024 to 2030. Small businesses can focus on their main business functions by outsourcing financial tasks through F&A BPO. Small firms can focus their resources and time on business development, customer interaction, and other essential tasks by outsourcing basic accounting, bookkeeping, and financial reporting to specialized suppliers.

Vertical Insights

Based on the vertical, the IT & telecom segment held the largest market share in 2023. IT and telecommunications firms undergo dynamic company operations as a result of external factors such as rapid technological breakthroughs and shifting market demands. IT and telecommunications firms are at the forefront of adopting innovative technologies. F&A BPO providers incorporate technology solutions such as machine learning, artificial intelligence, robotic process automation, data analytics, and cloud-based platforms into financial operations. They help businesses evaluate market patterns, allowing them to respond quickly to changes in economic situations, customer behavior, and industry dynamics.

The BFSI segment is expected to register a significant CAGR from 2024 to 2030. The increased demand for specialized F&A BPO services in the BFSI sector includes services such as fraud detection, anti-money laundering compliance, and financial analytics. BPO companies that focus on these specialist services are better positioned to meet the specific needs of BFSI businesses. Risk management and compliance are essential parts of the BFSI industry; thus, BPO partners must have an in-depth understanding of legal frameworks and execute effective security measures.

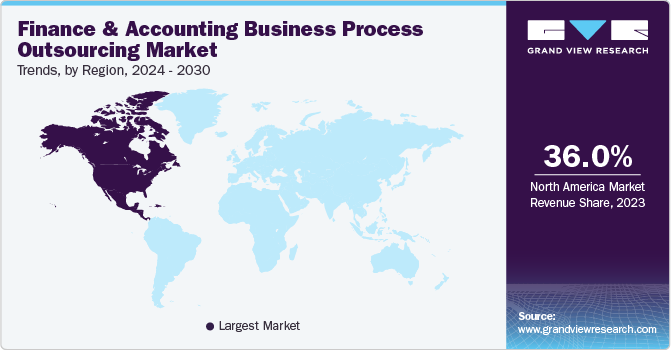

Regional Insights

The finance and accounting business process outsourcing market in North America is growing significantly at a CAGR of 8.8% from 2024 to 2030. The region is expected to retain its dominance due to the rising demand for business process outsourcing services owing to lower costs, higher efficiency, global expansion, and focus on core business functions.

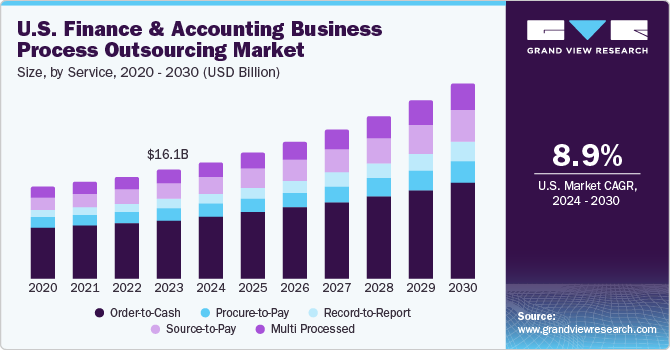

U.S. Finance And Accounting Business Process Outsourcing Market Trends

The finance and accounting business process outsourcing market in the U.S. is expected to grow significantly at a CAGR of 8.9% from 2024 to 2030. Blockchain technology is gaining popularity in the U.S. F&A BPO sector, providing safe and transparent solutions for financial transactions and maintaining records. The decentralized nature of blockchain contributes to increased accuracy, decreased fraud risks, and improved efficiency in financial processes.

Asia Pacific Finance And Accounting Business Process Outsourcing Market Trends

The finance and accounting business process outsourcing market in Asia Pacific is expected to grow significantly at a CAGR of 10.7% from 2024 to 2030. The growth of the Asia Pacific market can be attributed to the implementation of advanced technologies. The adoption of F&A BPO in APAC has continued to be fueled by cost savings. Organizations can lower operating costs by outsourcing the maintenance of internal finance and accounting staff. Major APAC countries, such as China, India, and Japan, have a highly trained labor pool and cutting-edge technology infrastructure, which has made the area appealing as a center for F&A BPO services.

China finance and accounting business process outsourcing market is expected to grow significantly at a CAGR of 10.0% from 2024 to 2030. China is an appealing market for F&A BPO services due to its advanced technology infrastructure and large pool of competent labor. China's service providers have access to highly skilled individuals who are knowledgeable about accounting and finance procedures. Price concerns mostly drive the extensive use of F&A BPO in China.

The finance and accounting business process outsourcing market in India is growing significantly as India's large pool of qualified finance and accounting experts, combined with its powerful technology infrastructure, makes it a desirable option for F&A BPO. To suit the different needs of global organizations, Indian service providers offer a wide range of expertise. Moreover, the supportive efforts of the Indian government are expected to be a significant factor in fueling market expansion over the forecast period.

Japan finance and accounting business process outsourcing market is expected to grow significantly at a CAGR of 7.5% from 2024 to 2030. Japanese organizations analyzing F&A BPO should opt for service providers who have strong data protection procedures in place and adhere to international data privacy regulations. With an increased reliance on digital technology, comprehensive cybersecurity measures will be crucial for F&A BPO in Japan.

Europe Finance And Accounting Business Process Outsourcing Trends

The finance and accounting business process outsourcing market in Europe is expected to grow significantly at a CAGR of 9.6% from 2024 to 2030. European governments have been proactive in establishing robust data privacy and security regulations, notably for the European Union (EU). Moreover, compliance with rules such as the General Data Protection Regulation (GDPR) to secure sensitive financial information is vital for F&A BPO providers.

The UK finance and accounting business process outsourcing market is expected to grow significantly at a CAGR of 9.1% from 2024 to 2030. The U.K. government is encouraging firms to select BPO partners who are committed to long-term sustainability, contributing to broader environmental goals. During times of economic uncertainty or recovery, firms in the U.K. have turned to finance and accounting BPO as a strategic component of their cost-cutting and security plans. Companies that outsource financial functions can handle economic challenges while retaining efficiency in operations.

The finance and accounting business process outsourcing market in Germany is expected to grow significantly at a CAGR of 8.7% from 2024 to 2030. Germany's complex regulatory framework necessitates that enterprises conform to stringent financial laws and reporting standards. F&A BPO services meet the demand for specialized financial expertise. BPO suppliers have in-depth knowledge of German tax rules, accounting concepts, and financial guidelines. Companies leverage this knowledge to improve the accuracy and dependability of their financial processes.

France finance and accounting business process outsourcing market is expected to grow significantly at a CAGR of 10.8% from 2024 to 2030. France businesses align with digital trends to improve their technology capabilities and remain competitive in a fast-changing economic market by outsourcing. Shifting customer support functions helps improve customer experiences. BPO providers, with an emphasis on service quality, assist French businesses in providing effective and prompt customer service, resulting in improved customer loyalty and retention.

Middle East & Africa Finance And Accounting Business Process Outsourcing Trends

The finance and accounting business process outsourcing market in the Middle East & Africa region is growing significantly at a CAGR of 6.5% from 2024 to 2030. The MEA factoring services market is experiencing significant expansion, driven by increasing government investments aimed at the digitization of financial operations, next-generation digital infrastructure rollout, and the growing availability of smart contract facilities in the region.

Key Finance And Accounting Business Process Outsourcing Company Insights

Some of the key players operating in the market include Accenture plc, Capgemini, Infosys Ltd and International Business Machines Corporation.

-

Accenture plc is a consulting firm that provides management consulting technology and Business Process Outsourcing (BPO) services. The company operates through six business units, namely media & technology; communications; financial services; products; resources; and health & public service. Its service segment includes application services, artificial intelligence, business process outsourcing, zero-based budgeting, and others. The company provides solutions for various industries, such as aerospace & defense, automotive, banking, communications & media, and industrial equipment. It works with Fortune 100 companies across 120 countries worldwide.

-

Capgemini provides technological & engineering services across nearly 50 countries worldwide. The company has a significant presence in North America and Europe. It delivers its solutions and services to public sector companies as well as incumbents of sectors such as financial services, manufacturing, consumer goods & retail, energy & utilities, and IT & telecommunications. The company operates through three business segments, including application & technology, operation & engineering, and strategy & transformation.

HCL Technologies Limited and Genpact are some of the emerging market participants in the finance and accounting business process outsourcing market.

-

Tata Consultancy Services Limited is engaged in offering Information Technology (IT) services, consulting, and business solutions to customers worldwide. The company operates through five business segments, namely Banking, Financial Services, and Insurance; Communication, Media & Technology; Retail & Consumer Business; Manufacturing; and Others. The company offers its products and services to various industries, including banking & financial, life sciences & healthcare, travel, transportation & hospitality, insurance, manufacturing, and retail. The company has filed 4,596 patents and has 946 granted patents.

-

Genpact is engaged in business process outsourcing and IT management services. The company offers accounting and finance services, including invoice processing, document management, approval, and resolution management. The company also provides research & analytics services, business consulting, transformation services, and supply chain & procurement services. Its enterprise application services include business intelligence and data services, quality assurance, and enterprise resource planning and technology integration. The company caters to incumbents from various industries, including insurance, financial services, capital markets, life sciences, Consumer Product Goods (CPG), manufacturing, healthcare, and high-tech industry.

Key Finance And Accounting Business Process Outsourcing Companies:

The following are the leading companies in the finance and accounting business process outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Capgemini

- CKH Group

- Cognizant

- Fiserv, Inc.

- Genpact

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Invensis Technologies Pvt Ltd

- Outsourced Bookkeeping

- Sutherland

- Tata Consultancy Services Limited

- Teleperformance SE

- Wipro Limited

Recent Developments

-

In April 2024, CKH Group collaborated with local government across 611 cities in Georgia to facilitate auditing services and staff augmentation. Local governments may face exclusion from specific federal or state funding if they fall behind on their annual financial statement audits. The Government Auditing Division of CKH Group aids local governments, quickly growing as they recognize and address this need in various communities.

-

In August 2023, Genpact entered a partnership with Heubach GmbH, a producer of high-quality pigments, to transform financial and supply chain processes. Through this partnership, the firms aim to enhance financial and supply chain operations by integrating Genpact's skills in intelligent operations and Heubach GmbH's innovative approaches. Genpact has developed Heubach Group Business Services (GBS) facilities, which serve as sites with higher productivity, digital proficiency, and agile operations, aligning with the company’s aim to promote sustainable corporate growth and enhanced customer experiences.

-

In January 2023, Accenture plc acquired consulting company SKS Group. The acquisition encompassed all of SKS Group’s businesses, which help financial institutions in the development, implementation, and operations of SAP solutions. SKS Group helps banks across Switzerland, Austria, and Germany to modernize their technology infrastructure and address regulatory requirements by leveraging SAP S/4HANA solutions. SKS Group also offers an extensive suite of regulatory, risk, and compliance capabilities, including an observatory tool used for mapping regulatory requirements and helping banks manage their reporting processes. Accenture aims to leverage the acquisition to expand its consulting, technology, and regulatory services capabilities and strengthen its ability to cater to specialized banks, such as national promotional banks, which are known for providing development and financial assistance to local communities and businesses.

Finance And Accounting Business Process Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 64.86 billion |

|

Market Value forecast in 2030 |

USD 110.74 billion |

|

Growth rate |

CAGR of 9.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, enterprise-size, vertical, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Singapore; Malaysia; Philippines; Indonesia; Thailand; Australia; South Korea; Brazil; Argentina; KSA; UAE; and South Africa. |

|

Key companies profiled |

Accenture plc; Capgemini; CKH Group; Cognizant; Fiserv, Inc.; Genpact; HCL Technologies Limited; Infosys Limited; International Business Machines Corporation; Invensis Technologies Pvt Ltd; Outsourced Bookkeeping; Sutherland; Tata Consultancy Services Limited; Teleperformance SE; and Wipro Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Finance And Accounting Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global finance and accounting business process outsourcing market report based on service, enterprise size, vertical, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Order-to-Cash

-

Procure-to-Pay

-

Record-to-Report

-

Source-to-Pay

-

Multi Processed

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

Energy & Utilities

-

Travel & Logistics

-

IT & Telecommunications

-

Media & Entertainment

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

Philippines

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global finance and accounting business process outsourcing market size was estimated at USD 60.31 billion in 2023 and is expected to reach USD 64.86 billion in 2024.

b. The global finance and accounting business process outsourcing market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 110.74 billion by 2030.

b. The order-to-cash segment dominated the global financial & accounting business process outsourcing market in 2023 with a revenue share of over 50%. Order-to-cash is a set of business operations and activities that include receiving and achieving customer requests for goods and services. It impacts business operations throughout the organization, such as inventory management, supply chain management, and labor. Further, O2C functions determine the company’s cash inflow and working capital. In addition to cash flow improvements, optimizing the O2C process has major advantages, including customer experience, cost savings, and revenue generation. These factors can positively impact O2C segment growth during the forecast period.

b. Some key players operating in the finance and accounting business process outsourcing market include Accenture, Infosys Limited (Infosys BPM), Wipro Limited, IBM Corporation, and Tata Consultancy Services Limited.

b. Key factors that are driving the market growth include the increasing demand for reliable and cost-effective services with advanced technologies, growth of BPO industry in emerging economies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."