Filtration & Drying Equipment Market Size, Share & Trends Analysis Report By Technology, By End-use (Food & Beverage, Chemical, Pharmaceutical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-993-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Filtration & Drying Equipment Market Trends

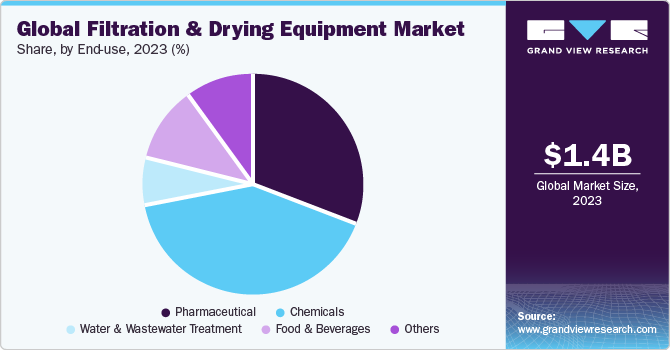

The global filtration & drying equipment market size was estimated at USD 1.39 billion in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 8.5% from 2024 to 2030. The market's expansion can be primarily ascribed to the burgeoning food and beverages, pharmaceutical, and chemical end-use sectors globally. Furthermore, the escalating investments in the water & wastewater treatment industry, aimed at fostering sustainable wastewater management, are anticipated to be key drivers for the rising demand for filtration and drying equipment in the forecast period. Filtration & drying equipment are used for water & wastewater treatment and sewage processing. They are employed for removing particles, such as metal shavings, from industrial lubricants. This equipment is critical for the separation of precious synthetic materials throughout the production process.

In the pharmaceutical industry, Agitated Nutsche Filter-Dyers (ANFD) serve as indispensable equipment with multifaceted applications. These units play a pivotal role in pharmaceutical manufacturing by facilitating efficient product drying, crystallization, filtration, and washing processes. The agitated design ensures superior heat and mass transfer, expediting drying and promoting uniform crystallization. ANFDs also function as effective filters, separating solid particles from liquid components, and their ability to maintain an inert gas atmosphere proves crucial in preserving the quality of sensitive pharmaceutical compounds. The unique integration of dryer and filter units in a single piece of equipment streamlines operations, making ANFDs a preferred choice for pharmaceutical companies seeking versatility, efficiency, and adherence to stringent quality standards.

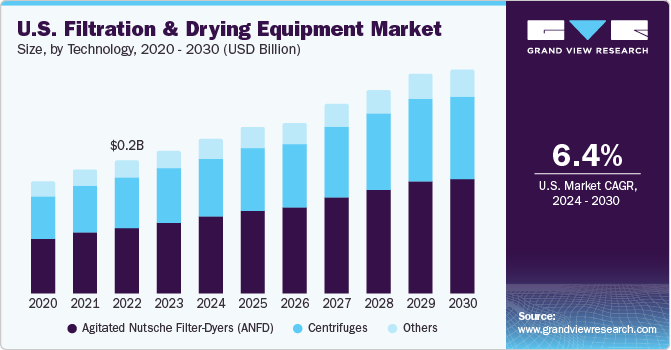

The increasing demand for filtration & drying equipment in the U.S. is driven by various factors such as the stringent quality requirements for pharmaceutical products, the desire for more efficient manufacturing processes, and the emphasis on maintaining product purity. Filtration & drying equipment plays a crucial role in ensuring the production of high-quality pharmaceuticals by facilitating processes like separation, purification, and drying of pharmaceutical compounds. As the pharmaceutical industry continues to advance, the demand for advanced and reliable filtration and drying equipment is expected to persist.

According to the National Health Expenditure Data, U.S. medicare spending increased by 8.4% to USD 900 billion in 2021. Moreover, Medicaid spending has increased by 9.2% to USD 734 billion compared to 2020. Furthermore, in 2021, the U.S. spending for medicines has increased by 12% due to increased demand for COVID vaccines, boosters, treatments, and prescription medication usage was 194 billion daily doses across the U.S. These aforementioned factors are expected to drive the demand for filtration & drying equipment in the pharmaceutical industry over the forecast period.

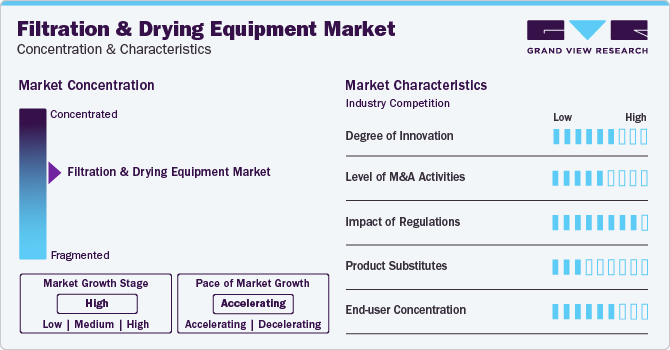

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. THE market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as contracts/agreements, expansions, mergers & acquisitions, investments, and product launches, to strengthen their position in the global market.

In response to increasingly stringent quality standards across diverse industries, including pharmaceuticals, chemicals, and textiles, there is a growing demand for advanced filtration & drying equipment. Moreover, technological advancements play a pivotal role, with the industry witnessing a shift towards more efficient and automated equipment, offering enhanced precision and reliability. Furthermore, sustainability concerns have spurred the development of eco-friendly and energy-efficient systems.

The trend towards modular and compact designs caters to the need for flexibility in manufacturing processes, while the integration of smart technologies, such as real-time monitoring and data analytics, enhances operational efficiency. Market players are also focusing on customization to address specific industry requirements, and strategic collaborations for research and development initiatives are becoming increasingly prevalent. Overall, the market reflects a landscape shaped by innovation, sustainability, and adaptability to evolving industry demands.

The integration of smart technologies is another notable characteristic of the filtration and drying equipment market. Real-time monitoring, data analytics, and predictive maintenance features are becoming standard in modern equipment. These advancements enhance operational efficiency, reduce downtime, and contribute to overall cost-effectiveness. As Industry 4.0 principles gain traction, the market is expected to witness further integration of digital technologies.

Moreover, customization is a key strategy adopted by market players to address specific industry requirements. Manufacturers are increasingly offering tailored solutions to meet the unique needs of different applications and processes. This approach enhances customer satisfaction and allows companies to carve out niche market segments. Additionally, strategic collaborations and partnerships for R&D initiatives are prevalent in the filtration and drying equipment market. Given the complexity of industrial processes and the need for constant innovation, collaborations enable companies to pool resources, share expertise, and accelerate the development of cutting-edge technologies. These partnerships contribute to the overall growth and competitiveness of the market. For instance, in August 2022, GMM Pfaudler entered into a joint venture agreement with JDS Manufacturing to offer a full range of services and components for glass-lined buildings.

Technology Insights

Based on technology, the agitated nutsche filter-dryer technology led the market with the largest revenue share of 50.9% in 2023. The ANFD stands out in industrial applications due to its multifaceted advantages and broad range of uses, as it efficiently combines filtration, washing, and drying processes within a single unit, minimizing the need for multiple pieces of equipment. Its agitated design enhances heat and mass transfer, ensuring swift and effective drying, which is particularly crucial in pharmaceutical and chemical manufacturing. The ANFD's capability to operate in an inert gas atmosphere safeguards sensitive products from reactions, maintaining high purity throughout production.

Centrifuges play a pivotal role in industrial processes for both filtration & drying applications. As efficient filtration devices, centrifuges utilize high-speed rotational forces to separate solids from liquids, offering a rapid and effective means of achieving high levels of clarification. In filtration, centrifuges excel in applications across various industries, including pharmaceuticals, chemicals, and food processing, where the removal of fine particles is essential. Moreover, centrifuges find extensive use in drying processes through techniques like centrifugal drying or spin-drying. By harnessing centrifugal force, these machines expel excess liquid from wet solids, facilitating the drying of materials such as textiles, plastics, and certain chemical products. The dual functionality of centrifuges in filtration and drying underscores their versatility and efficiency in optimizing industrial processes with high-throughput capabilities and reduced cycle times.

End-use Insights

Based on end-use, the chemical segment led the market with the largest revenue share in 2023. Filtration & drying equipment play a crucial and wide-ranging role in the chemical industry, contributing to various processes that are fundamental to the manufacturing of chemical products. The chemical industry widely employs filtration & drying equipment in processes such as crystallization, separation of by-products, and the production of intermediates. These processes are critical for achieving the desired characteristics and specifications of chemical products. Filtration & drying technologies are adaptable to a diverse range of chemical substances, from fine chemicals and speciality products to bulk chemicals, showcasing their versatility.

Filtration & drying equipment find extensive and diverse applications within the pharmaceutical industry, showcasing their indispensable role in various critical processes. These technologies are widely employed in the production of pharmaceuticals to ensure the highest quality standards and compliance with stringent regulations. The pharmaceutical industry relies on advanced filtration and drying technologies for processes such as crystallization, separation, and purification, underscoring their significance in achieving precise and consistent pharmaceutical formulations. Moreover, as the industry places a growing emphasis on efficiency, product safety, and compliance, filtration & drying equipment stand as essential tools to meet these evolving demands in pharmaceutical manufacturing.

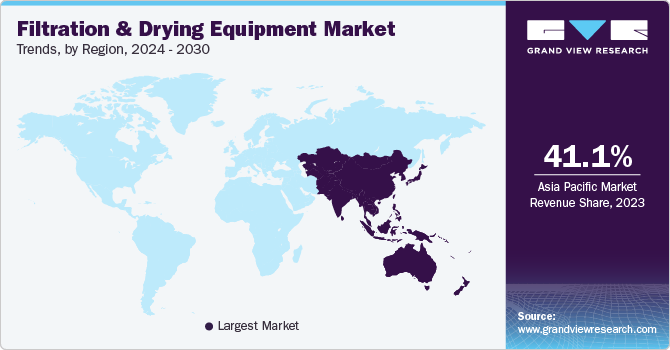

Regional Insights

Asia Pacific region dominated the market with the revenue share of 41.1% in 2023. The demand for filtration & drying equipment in the Asia Pacific region has witnessed substantial growth, driven by several key factors such as the burgeoning industrialization and economic development in countries such as China, India, Japan, and South Korea have led to an increased need for advanced manufacturing processes across various industries. In particular, sectors such as pharmaceuticals, chemicals, food & beverages, and water treatment are experiencing robust expansion, contributing significantly to the demand for filtration and drying equipment. The pharmaceutical industry in the region is undergoing rapid expansion due to rising populations, increasing healthcare awareness, and a growing middle class with greater access to healthcare services. This surge in pharmaceutical manufacturing activities has propelled the demand for efficient filtration & drying equipment to ensure the production of high-quality and compliant pharmaceutical products.

The Central and South American region is experiencing a growing demand for filtration & drying equipment, driven by diverse industrial sectors seeking advanced processing solutions. In this region, pharmaceutical and chemical industries are expanding, prompting an increased need for efficient filtration and drying technologies to meet stringent quality standards. Additionally, the rising focus on environmental sustainability and wastewater management is propelling demand in the water treatment sector, fostering the adoption of advanced filtration equipment. As manufacturing activities in Central and South America continue to evolve, driven by economic development and infrastructure projects, the demand for reliable and high-performance filtration and drying solutions is expected to further rise, contributing to the overall industrial growth in the region.

Canada Filtration & Drying Equipment Market

The Canada market is expected to be driven by growing pharmaceutical and food & beverage industries. After a 2.0% contraction in 2020 and a 4.4% growth in 2021, Canadian food and beverage value-added output grew by about 2.5% in 2022. In terms of the value of production with sales of manufactured items, the food and beverage processing sector is Canada's second-largest manufacturing sector, according to Statistics Canada. The sales of food services, for instance, grew from USD 5,274.1 in January 2022 to USD 8,014.1 in January 2023. Filtration & drying equipment play a key role in ensuring and maintaining proper operational conditions of food and beverage processing equipment, as well as in keeping food and beverages fresh and prolonging their shelf life.

Germany Filtration & Drying Equipment Market

The Germany market is anticipated to be driven by growing production in pharmaceutical industry coupled with stringent regulations regarding good manufacturing practices. The country is home to some of the world’s top pharmaceutical production locations, such as Karlsruhe and Freiburg. For instance, Bachiller signed a new contract for a 3m² Agitated Nutsche Filter Dryer for a pharmaceutical company known throughout the world for its API manufacturing plant in northern Germany. The presence of key players such as Bristol-Myers Squibb and Bayer AG is driving the market for filtration & drying equipment in Germany.

China Filtration & Drying Equipment Market

The China market is expected to be driven by the ageing population, growing health consciousness, and increasing total and per capita healthcare spending all contribute to China's pharmaceutical industry's rise. Due to restrictions on antibacterial medications and stringent guidelines for health insurance reimbursement, China's hospitals are likely to experience significant issues. Furthermore, the presence of major players, such as Lilly, Novartis, Pfizer, and Sanofi, as well as increased government initiatives, are driving the growth of the filtration and drying equipment for pharmaceutical applications.

Brazil Filtration & Drying Equipment Market

The Brazil market is anticipated to be driven by growing chemical industry. The country’s chemical sector is unique due to its strengths in renewable chemicals, agrochemicals, and cosmetics. Brazil is the second-largest producer of ethanol fuels after the U.S. Thus, the growing chemical industry in the country is projected to have a positive impact on the market growth over the forecast period.

Saudi Arabia Filtration & Drying Equipment Market

The Saudi Arabia market is driven by rising urbanization, industry, population increase, and growing problem of water contamination, combined with stringent government regulations related to water treatment to reduce water pollution. Furthermore, increasing industrial waste discharged into rivers and other bodies of water has increased the demand for water treatment systems, which is expected to drive market growth during the forecasted period. Additionally, superior water treatment technology and smart water grid legislation for wastewater processing have been developed, which is positively influencing the market growth in the forecast period.

Key Filtration & Drying Equipment Company Insights

To increase market penetration and cater to changing technological requirements from various end-uses, such as automotive, machine, construction, aerospace, and metalworking, manufacturers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product launches, and geographical expansions. Manufacturers are undertaking strategic acquisitions to gain an edge in the industry and increase their geographic presence.

In May 2023, GEA Group Aktiengesellschaft invested USD 55.4 million in its centrifuge production sites in Germany. The company is aiming for continued growth in its major sectors, which include the food, beverage, and pharmaceutical industries, by investing in sustainable production, digitization, and automation. In May 2022, HLE Glasscoat established its new manufacturing facility in Silvassa to enhance its filtration and drying equipment production capacity. Modern machine shops, essential equipment, and EOT cranes that adhere to the highest safety standards are all included in this manufacturing facility.

Key Filtration & Drying Equipment Companies:

The following are the leading companies in the filtration & drying equipment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these filtration & drying equipment companies are analyzed to map the supply network.

- HEINKEL Process Technology GmbH

- GMM Pfaudler

- Tsukishima Kikai Co., Ltd

- HLE Glascoat

- Amar Equipment Pvt. Ltd.

- Charles Thompson Ltd.

- 3V Tech S.p.A.

- Hosokawa Micron Powder Systems

- Zhejiang Yaguang Technology Co., Ltd

- Little Men Roaring, LLC

- Pope Scientific Inc

- Promas Engineers PVT.LTD

- Chem Flowtronics

- Synovatic India

- Bachiller

- amixon GmbH

- BHS-Sonthofen GmbH

- GEBRÜDER LÖDIGE MASCHINENBAU GMBH

- EKATO HOLDING GmbH

- DE DIETRICH PROCESS SYSTEMS

- ALFA LAVAL

- ANDRITZ

- GEA Group Aktiengesellschaft

- Comi Condor

- Ferrum Ltd.

- Rousselet Robatel

- Flottweg SE

- CEPA

Recent Developments

-

In May 2023, Amar Equipment collaborated with HLE Glasscoat to develop Agitated Nutsche filters dryers (ANFDs). This development aimed at producing state-ofthe-art ANFDs to meet a variety of requirements of customers and carry out advancements in the chemical processing industry

-

In June 2023, Ferrum Ltd. expanded its operations by opening an extension building in Schafisheim, Switzerland, in which USD 46.4 million will be invested

-

In July 2023, ANDRITZ launched decanter centrifuges designed for complex industrial oil recovery applications. ANDRITZ's decanter centrifuge series comprises ATEX Zone 1 and Zone 2 equipment, which are critical for oil and gas applications

Filtration & Drying Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 2.46 billion |

|

Growth rate |

CAGR of 8.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

February 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; South Africa |

|

Key companies profiled |

HEINKEL Process Technology GmbH; GMM Pfaudler; Tsukishima Kikai Co., Ltd; HLE Glascoat; Amar Equipment Pvt. Ltd.; Charles Thompson Ltd; 3V Tech S.p.A.; Hosokawa Micron Powder Systems; Zhejiang Yaguang Technology Co. Ltd; Little Men Roaring; LLC; Pope Scientific Inc; Promas Engineers PVT.LTD; Chem Flowtronics; Synovatic India; Bachiller; amixon GmbH; BHS-Sonthofen GmbH; GEBRÜDER LÖDIGE MASCHINENBAU GMBH; EKATO HOLDING GmbH; DE DIETRICH PROCESS SYSTEMS; ALFA LAVAL; ANDRITZ; GEA Group Aktiengesellschaft; Comi Condor; Ferrum Ltd.; Rousselet Robatel; Flottweg SE; CEPA |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Filtration & Drying Equipment Market Report Segmentation

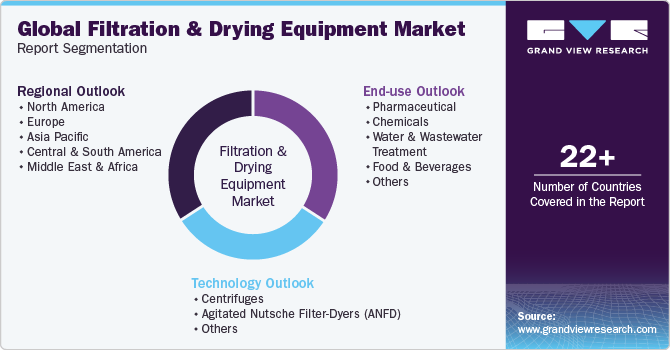

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global filtration & drying equipment market report based on technology, end-use and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Centrifuges

-

Perforate Basket Centrifuge

-

Pusher Centrifuge

-

Peeler Centrifuge

-

Others

-

-

Agitated Nutsche Filter-Dyers (ANFD)

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical

-

Chemicals

-

Water and Wastewater Treatment

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The filtration & drying equipment market size was estimated at USD 1.39 billion in 2023 and is expected to be USD 1.51 billion in 2024.

b. The filtration & drying equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 2.46 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 41.1% share in 2023. The demand for filtration & drying equipment in the Asia Pacific region has witnessed substantial growth, driven by several key factors such as the burgeoning industrialization and economic development in countries such as China, India, Japan, and South Korea have led to an increased need for advanced manufacturing processes across various industries.

b. Some of the key players operating in the filtration & drying equipment market include HEINKEL Process Technology GmbH, GMM Pfaudler, Tsukishima Kikai Co., Ltd, HLE Glascoat Amar Equipment Pvt. Ltd., Charles Thompson Ltd., 3V Tech S.p.A., Hosokawa Micron Powder Systems, Zhejiang Yaguang Technology Co., Ltd, Little Men Roaring, LLC, Pope Scientific Inc, Promas Engineers PVT.LTD, Chem Flowtronics, Synovatic India, Bachiller, amixon GmbH, BHS-Sonthofen GmbH, GEBRÜDER LÖDIGE MASCHINENBAU GMBH, EKATO HOLDING GmbH, DE DIETRICH PROCESS SYSTEMS, ALFA LAVAL, ANDRITZ, GEA Group Aktiengesellschaft, Comi Condor, Ferrum Ltd., Rousselet Robatel, Flottweg SE, CEPA.

b. The key factors that are driving the filtration and drying equipment market include the growth of the market can be primarily attributed to the growing food & beverages, pharmaceutical, and chemical end-use industries across the world. Moreover, the increasing investments in the water and wastewater treatment sector for sustainable wastewater management are expected to drive the demand for filtration & drying equipment over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."