Filters Market Size, Share & Trends Analysis Report By Product (ICE, Air, Fluid Filters), By Application (Motor Vehicles, Consumer Goods, Industrial & Manufacturing, Utilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-195-5

- Number of Report Pages: 124

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Filters Market Size & Trends

The global filters market size was estimated at USD 79.25 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. Growing emphasis on the reduction of emissions from automotive and industrial applications is expected to drive market growth over the forecast period. An increase in product usage in several consumer goods, such as air and water purifiers, is expected to have a positive impact on the industry’s growth. The rapidly growing adoption of air purifiers in homes, hotels, restaurants, airplanes, and train compartments for killing harmful microbes, such as bacteria and viruses, is expected to open new opportunities for market growth.

The U.S. filters market is expected to exhibit high growth on account of factors rising product demand from the automotive industries as per the environmental regulations laid down by the Environmental Protection Agency (EPA) for the installation of air emission control solutions in vehicles. In addition, economic revival and government initiatives to promote environmental protection are expected to drive market growth in the country. The global market growth is also credited to the increasing focus of the government on water treatment schemes for the construction of water treatment facilities due to factors such as the scarcity of quality drinking water, growing population, and contamination of ground and surface water bodies.

The industry is significantly affected by the availability of raw materials, such as paper, cotton, synthetic textiles & fibers, metals like iron & steel, adhesives, rubber, chemicals, and plastics. Thus, the fluctuations in the raw material prices have a direct impact on the manufacturing costs that limits the industry growth to some extent. The market growth is also expected to be driven by the rise in the global automotive industry on account of the growing population and increasing disposable income levels, especially in the developing regions, such as Asia Pacific, Middle East & Africa, and Central & South America. Filters are used in several applications in the automotive industry, such as oil intake, cabin air filtration, and emission filtration.

Market Concentration & Characteristics

The degree of innovation is higher as the technological developments are aimed at manufacturing products that offer better cleaning properties, longer operational life, and low maintenance, which, in turn, are expected to play an important role in ascending the market over the forecast period.

The market is also characterized by a medium to high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the need to consolidate in a growing market and increasing strategic importance for the distribution of products in various geographies.

Growing environmental concerns and changing consumer behavior have prompted various governments to implement regulations and initiatives in order to safeguard the environment. Stringent implementation of pollution control acts like the Safe Drinking Water Act (SDWA) and Clean Water Act (CWA), coupled with a rise in the number of water treatment plants, have created a wide scope for the utilization of filters. Such a stringent regulatory framework is anticipated to play a key role in shaping the filters market over the forecast period.

End-user concentration is a significant factor in the filters demand. Moderately growing demand for automobiles owing to factors such as rising disposable incomes, rising standards of living, and switching consumer trends for owning a private vehicle in developing regions such as Asia Pacific are likely to positively affect the market growth in the near future.

Product Insights

The ICE filters product segment led the market in 2023 and accounted for the maximum revenue share of more than 40%. This high share was credited to the rapid growth in the automobile industry as ICE filters are widely used in automobiles to improve fuel efficiency. The implementation of environmental regulations, such as the Kyoto Protocol, Euro 5, and Euro 6 to control the release of harmful emissions, is expected to drive the segment further. The usage of ICE filters is expected to rise over the coming years owing to the high adoption of a start-stop system for automatic shutdown & restart of the internal combustion engines, to reduce the emissions & fuel consumption and idling time of engines. The advancements in the automotive industry, such as hybrid and electric vehicles, will also drive the segment growth.

The market growth for fluid filters is expected to be driven by the rising investments by governments in the construction of water treatment plants to provide safe water for various residential, commercial, and industrial filtration market. In addition, wide usage of fluid filters in a variety of other applications, such as cold sterilization of beverages & pharmaceuticals, petroleum refining, and dairy processing, is expected to support the segment growth. The air filtration market size is expected to witness the fastest CAGR from 2022 to 2030 owing to the rising focus of governments on the reduction of pollutants from vehicle emissions. In addition, the rising adoption of air purifiers in recent times is expected to fuel the demand for using cabin air filters that help in removing pollen & allergens from the air in homes, offices, aircraft, and train compartments. Thereby, fueling the growth of air filters market.

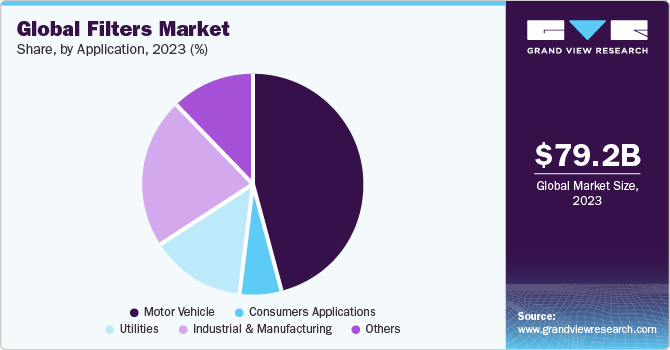

Application Insights

The motor vehicles segment led the market in 2023 and accounted for more than 46% of the global revenue share. The increasing automotive production, primarily in countries such as China, Indonesia, South Korea, Japan, Malaysia, and Taiwan, supports the segment growth. In addition, stringent regulations for the reduction of automotive pollution levels by agencies, such as the U.S. EPA and the Department of Energy, are expected to increase the usage of filters, thus driving the product demand in motor vehicle applications. The usage of filtration equipment in several consumer goods, such as water filters, air purifiers, and air conditioners, is expected to drive the growth of the market over the coming years.

The manufacturing of portable air purifiers by several companies, such as Dyson and Philips, is expected to drive the consumer goods segment. The demand for filters in the industrial & manufacturing segment is expected to be driven by the well-established industrial setup in Europe and North America coupled with stringent regulations in these regions regarding emission from these facilities. Moreover, rapid industrialization in developing countries, such as India, South Africa, Brazil, Thailand, and Indonesia, is expected to drive the market. Other major application industries include pharmaceutical manufacturing and wine production. Microfiltration equipment is widely used in wine industries for the removal of contaminants, such as bacteria, particulates, crystals, and yeasts, to improve the quality of wine and provide stabilization.

Regional Insights

Asia Pacific dominated the market in 2023 and accounted for over 44% share of the global revenue in 2020 owing to the rapid industrialization coupled with stringent regulations by local governments to maintain the environmental quality. Increasing atmospheric pollution levels and growing environmental concerns are anticipated to promote the usage of air filtration and water filtration processes, thereby propelling market growth. The product demand in Europe is driven by the rising adoption of air filtration equipment in several industries, such as cement, chemicals, and metallurgy, to lower their emission levels, as per the directives laid down by several agencies, such as the International Plant Protection Convention (IPPC) by the European Commission.

North America is expected to grow at a steady CAGR from 2024 to 2030 due to the high automobile production levels as a result of the presence of major manufacturers, such as Ford, General Motors, and BMW. In addition, technological advancements, such as the implementation of nanotechnology in the filtration process are anticipated to boost the product demand in the region.

Key Companies & Market Share Insights

Prominent players operating in the filters market are aiming to invest in R&D to enhance the performance of filters they offer and to introduce new filtration technologies in the market. These industrial filtration companies hold a product line that caters to a wide range of industries including automobile, healthcare, industrial, and wastewater treatment to increase the production efficiency and maintain environmental safety. Major players in the market include the 3M Company, Donaldson Company, Inc., Parker Hannifin Corporation, and Freudenberg Filtration Technologies SE & Co. KG and others.

-

In May 2023, 3M collaborated with Svante Technologies for the development of a material to trap and permanently remove carbon dioxide in the atmosphere. 3M’s venture capital division had participated in the Series E fundraising round of Svante earlier to accelerate its carbon capture and removal technology manufacturing. Svante has developed a process to coat solid sorbents onto laminate sheets and stacking into high-performance filters for both direct air capture and industrial point-source capture.

-

In February 2023, Camfil launched its CamPure 8 media in the U.S. for the efficient removal of gaseous contaminants and odors, including sulfur dioxide, hydrogen sulfide, formaldehyde, and ethylene. The molecular filtration media can be utilized extensively in industries such as pulp & paper, oil & gas, wastewater treatment, and mining & metal refining, while also preserving fruits, flowers, and vegetables by removing odors and contaminants.

Key Filters Companies:

- Sika AG

- USG Corporation

- Duraamen Engineered Products, Inc.

- Durabond Products Limited

- Larsen Building Products

- TCC Materials

- MYK Shomburg

- Harricrete Ltd

- Koster Bauchemie AG

- Laticrete International, Inc.

- CTS Cement

- Dayton Superior Corporation

- W.R. Meadows, Inc.

Filters Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 83.23 billion |

|

Revenue forecast in 2030 |

USD 112.87 million |

|

Growth Rate |

CAGR of 5.2% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, MEA |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, Malaysia, Thailand, Australia, Germany, UK, France, Spain, Italy, South Africa, Egypt, Saudi Arabia, Brazil |

|

Key companies profiled |

3M; Airex Filter Corp.; Koch Filter; Freudenberg Filtration Technologies SE & Co. KG; Donaldson Company, Inc.; Camfil AB; Parker Hannifin Corp.; DENSO Corp.; Clark Air Systems; Spectrum Filtration Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Filters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global filters market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fluid Filters

-

ICE Filters

-

Air Filters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Motor vehicle

-

Consumers applications

-

Utilities

-

Industrial & Manufacturing

-

Metals & Mining

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Malaysia

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global filters market size was estimated at USD 79.25 billion in 2023 and is expected to reach USD 83.23 billion in 2024.

b. The global filters market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 112.87 billion by 2030.

b. ICE filters led the filters market and accounted for over 40% share of the global revenue in 2023, owing to growth in the automobile industry, primarily in Asia Pacific, Europe, and North America regions.

b. Some of the key players operating in the filters market include 3M, Airex Filter Corporation, Koch Filter, Freudenberg Filtration Technologies SE & Co. KG, Donaldson Company, Inc., Camfil AB, and Parker Hannifin Corporation.

b. The key factors that are driving the filters market include growing product demand in the automobile industry for the reduction of fuel consumption and emission levels, growing demand for fluid filters in water treatment plants, and growth in the global air filtration industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."