Field Force Automation Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-276-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Field Force Automation Market Size & Trends

The global field force automation market size was estimated at USD 2.65 billion in 2023 and is expected to grow at a CAGR of 21.4% from 2024 to 2030. The market expansion across different sectors is fueled by the rising demand for efficient and automated solutions to enhance operational efficiency and optimize workforce productivity. The widespread utilization of field force automation for automating scheduling, managing attendance, overseeing staff, and serving geographically diverse clients is a crucial driver of market growth. Furthermore, advancements in the IT industry and the increasing adoption of internet-connected devices with cloud capabilities contribute significantly to the market's upward trajectory.

The rising need to enhance the efficiency of field forces and the increasing use of cost-effective cloud-based solutions are anticipated to be key drivers fueling the expansion of the field force automation market. Moreover, affordable solutions from various providers enable small and medium-sized enterprises with constrained budgets to implement these tools for effectively managing their field operations. Field force automation solutions provide the ability to scale and adjust to evolving business requirements and expanding workforces. They enable organizations to grow their field operations, incorporate new features, and integrate with current systems seamlessly, avoiding significant disruptions.

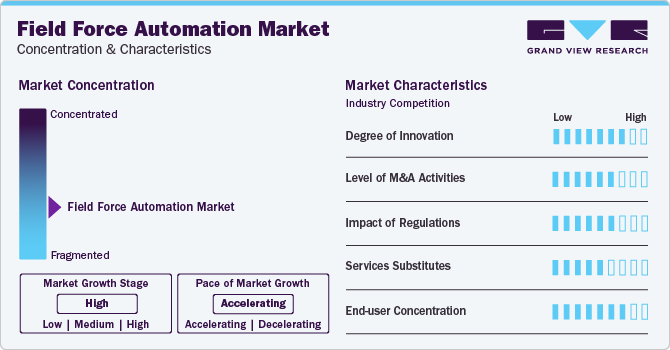

Market Concentration & Characteristics

The field force automation industry is significantly fragmented. However, the growth stage of the industry is high and the pace of growth is accelerating. The industry is characterized by a high degree of innovation as the ongoing technological developments, especially in mobile devices, cloud computing, and the Internet of Things (IoT), have facilitated the creation of sophisticated field force automation solutions. These technological developments have streamlined businesses' adoption and incorporation of field force automation systems. For instance, in December 2022, ServiceMax, Inc. launched Core 22 R4, a cloud-based service management platform. This new release aims to enhance efficiency for dispatchers, field technicians, and customers.

The industry's merger and acquisition level is high as companies strategically increase their market presence, improve their product portfolios, and achieve a competitive advantage. For instance, in November 2023, SAP SE acquired LeanIX, which provides SAP SE with an integrated transformation suite that assists customers in navigating change more effectively and enhancing their business processes permanently. This combined solution will establish a solid groundwork for AI-driven transformation initiatives.

The end-user concentration is high and is influenced by various factors such as market size, competition, product differentiation, and industry specificity. Industries such as healthcare, IT & telecom, manufacturing, retail, and others are the prominent end-users of field force automation.

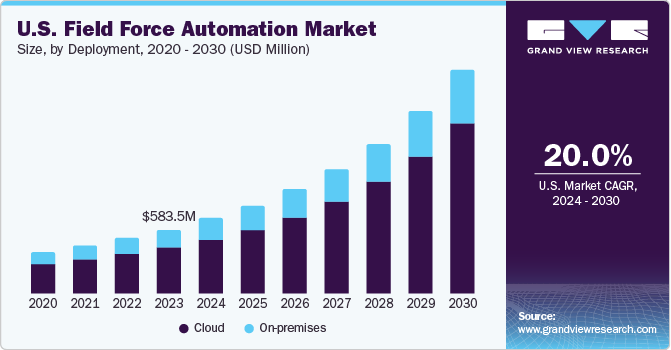

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023 and is anticipated to register the fastest CAGR over the forecast period. Cloud-based solutions provide scalability and adaptability, allowing businesses to adjust their resources flexibly according to demand. It is especially advantageous for field force automation, enabling companies to effectively oversee their mobile workforce and respond to evolving needs. Platforms offer immediate access to essential information and analytics from any location and moment. It empowers field teams to make well-informed decisions while on the move, enhancing efficiency and customer service standards.

The on-premises segment is anticipated to rise significantly over the forecast period. The on-premises segment involves implementing solutions within a company's internal infrastructure instead of utilizing cloud-based hosting services. Organizations, especially in sectors like healthcare, finance, and government, often choose on-premises solutions due to the necessity for heightened data security and adherence to compliance regulations. These industries opt for on-premises deployments to maintain increased control over their data, particularly sensitive information, ensuring strict compliance with regulatory standards.

Organization Size Insights

Large-size enterprises accounted for the largest market revenue share in 2023. Field force automation solutions offer immediate insight into field operations, allowing businesses to enhance customer service quality. Through automated processes, field workers can promptly address customer needs, solve problems, and deliver tailored experiences. Therefore, large enterprises invest in field force automation solutions to enhance customer satisfaction and loyalty.

The small and medium-sized enterprises (SMEs) segment is anticipated to register the fastest CAGR over the forecast period. Field force automation solutions present affordable resources that aid SMEs in optimizing their field activities, cutting down on manual work, and enhancing overall effectiveness. Through adopting these solutions, SMEs can realize cost reductions over time. These tools grant SMEs immediate insight into their field operations, enabling them to monitor their field staff's performance, allocate tasks more efficiently, and enhance route planning for increased productivity. This results in heightened productivity levels across the organization.

End-use Insights

The IT & Telecom sector accounted for the largest revenue share in 2023. Customer experience is a top priority for IT & Telecom companies seeking to differentiate themselves in a crowded marketplace. Field force automation tools help organizations deliver superior customer service by enabling faster response times, personalized interactions, and efficient issue resolution. For instance, in August 2023, Tele2, a Swedish integrated telecommunications services provider, deployed the cloud service of IFS to enhance its fundamental operations and expand opportunities in its 5G services.

The retail sector is anticipated to register the fastest CAGR over the forecast period. In an intensely competitive retail landscape, businesses seek methods to distinguish themselves from competitors. Embracing field force automation solutions enhances operational effectiveness and is a competitive advantage, allowing retailers to provide quicker delivery, enhanced service excellence, and precise order completion.

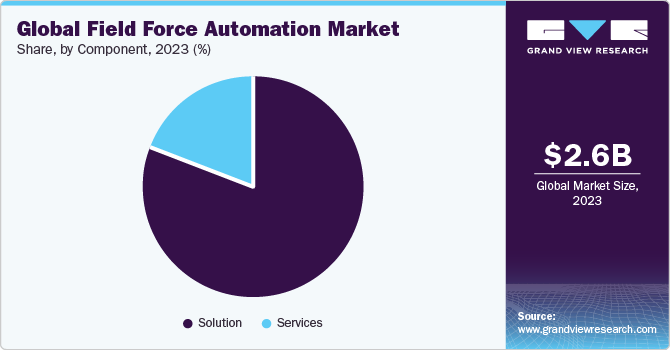

Component Insights

The market is bifurcated into solution and service segments based on component type. The solution segment accounted for the largest market revenue share of 81.2% in 2023. Integration capabilities are vital in field force automation solutions to effectively link with various business systems like CRM software, ERP systems, or IoT devices. This connectivity guarantees uniform data across diverse platforms and boosts operational effectiveness. Real-time monitoring and analytics are crucial in the field force automation solution sector.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing need for effective field service management solutions in telecommunications, healthcare, utilities, and manufacturing sectors is a key factor propelling market growth. Companies progressively embrace field force automation solutions to boost efficiency, lower operational expenses, and enhance customer contentment.

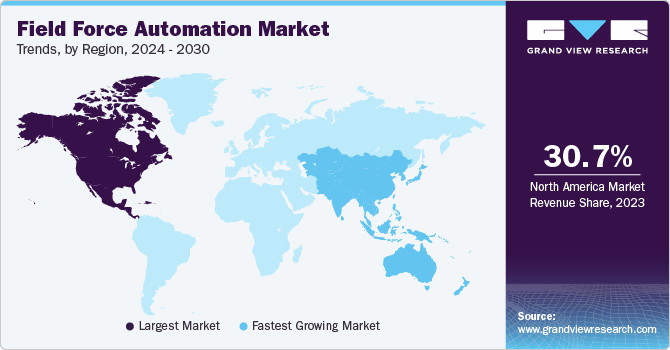

Regional Insights

The North America field force automation market accounted for the largest market revenue share of 30.7% in 2023. The increasing need for operational efficiency and real-time data access across various industries, including telecommunication, healthcare, and others, drive the regional demand for field force automation.

U.S. Field Force Automation Market Trends

The field force automation market of the U.S. accounted for over 20% of the global market in 2023 and is expected to grow significantly over the forecast period. It is attributed to the increase in the mobile workforce and the need for companies to provide real-time data access to fulfill customers' rising expectations. In January 2024, Acumatica, Inc. launched Professional Services Edition, a new field force automation portfolio offering that will leverage Acumatica's project accounting, billing, and scheduling features. This edition aims to empower businesses to enhance client service, manage the complete customer engagement process efficiently, and monitor operations seamlessly within the Acumatica platform in the country.

Asia Pacific Field Force Automation Market Trends

The Asia Pacific field force automation marketis anticipated to register the fastest CAGR over the forecast period. The region's rapid economic development and widespread adoption of smartphones and cloud-based solutions in businesses boost the market. The rise in IoT (Internet of Things) and AI technologies has also played a crucial role in transforming field force operations, making them more efficient and data-driven.

The field force automation market of China dominated the region in 2023. China, a global manufacturing hub with a significant footprint in sectors like e-commerce, logistics, utilities, and services, sees a high demand for field force automation solutions. Furthermore, government initiatives promoting digitalization across industries and developing 5G technology infrastructure are expected to boost the market further. The Government of China announced the "Made in China 2025" policy that reduces the country's technological imports and heavily invests in in-house innovation, further fuelling the growth of the market in China.

The India field force automation market is anticipated to register the fastest CAGR over the forecast period. The growth in the Indian market can be attributed to several industries adopting these solutions, including telecommunications, healthcare, FMCG (Fast-Moving Consumer Goods), and others.

Latin America Field Force Automation Market Trends

The Latin America market is anticipated to grow significantly over the forecast period. The companies in the region are undergoing digital transformation, and a growth in the adoption of field force automation is anticipated. Intense competition among businesses in various sectors is driving the adoption of these solutions as companies seek to gain a competitive edge through improved efficiency and service quality.

Key Field Force Automation Company Insights

Some of the key players operating in the market include Microsoft and Oracle

-

Microsoft has made significant contributions in the market through its range of products and services, notably leveraging its cloud computing services such as Azure, its enterprise resource planning (ERP) and customer relationship management (CRM) solutions under Dynamics 365, and its productivity tools like Microsoft 365.

-

Oracle offers field force automation services through its Oracle Field Service, a part of Oracle Cloud CX (Customer Experience), designed to manage field operations more efficiently. It includes scheduling, routing, customer communication, and job management for technicians and other field workers.

Key Field Force Automation Companies:

The following are the leading companies in the field force automation market. These companies collectively hold the largest market share and dictate industry trends.

- Acumatica, Inc.

- Clik Limited

- FieldEZ

- IFS

- LeadSquared

- Microsoft

- Oracle

- Salesforce, Inc

- SAP SE

- ServiceMax, Inc.

- Trimble Inc.

Recent Developments

-

In March 2024, SAP SE announced the launch of SAP Commerce Cloud. This new payment solution integrates several third-party payment service providers to offer many payment options for customers and retailers, such as buy now and pay later. It enables profitable digital commerce growth across various industries globally by providing a flexible and modular approach through its distinct capabilities.

-

In March 2024, Oracle introduced enhanced generative AI features in the Oracle Fusion Cloud Applications Suite to boost decision-making processes and improve the experiences of employees and customers. These new AI capabilities are integrated into various business workflows within finance, supply chain, HR, sales, marketing, and service.

-

In November 2023, Amazon Web Services, Inc. (AWS) (Amazon.com, Inc.) and Salesforce, Inc. expanded their longstanding partnership, enhancing product integrations in data and artificial intelligence (AI). This expansion allows customers to manage their data easily and securely across both platforms and incorporate the latest generative AI technologies into their applications and workflows safely and responsibly.

Field Force Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.12 billion |

|

Revenue forecast in 2030 |

USD 10.02 billion |

|

Growth rate |

CAGR of 21.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Acumatica, Inc.; Clik Limited; FieldEZ; IFS; LeadSquared; Microsoft; Oracle; Salesforce, Inc; SAP SE; ServiceMax, Inc.; Trimble Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Field Force Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the field force automation market report based on component, deployment, organization size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Sized Enterprises (SMEs)

-

Large Size Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Energy & Utilities

-

Transportation & Logistics

-

Retail

-

Construction & Real Estate

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global field force automation market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 3.12 billion in 2024

b. The global field force automation market is expected to grow at a compound annual growth rate of 21.4% from 2024 to 2030 to reach USD 10.02 billion by 2030

b. North America dominated the field force automation market with a share of 30.7% in 2023. Factors such as the increasing need for operational efficiency and real-time data access across various industries, including telecommunication, healthcare, and others drive the demand for field force automation in the region.

b. Some key players operating in the field force automation market include Acumatica, Inc., Clik Limited, FieldEZ, IFS, LeadSquared, Microsoft, Oracle, Salesforce, Inc, SAP SE, ServiceMax, Inc., and Trimble Inc.

b. Factors such as the enhancement of operational efficiency and optimize workforce productivity drive the demand for field force automation solutions and services

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."