- Home

- »

- Advanced Interior Materials

- »

-

Field-erected Cooling Tower Market Size, Share Report, 2030GVR Report cover

![Field-erected Cooling Tower Market Size, Share & Trends Report]()

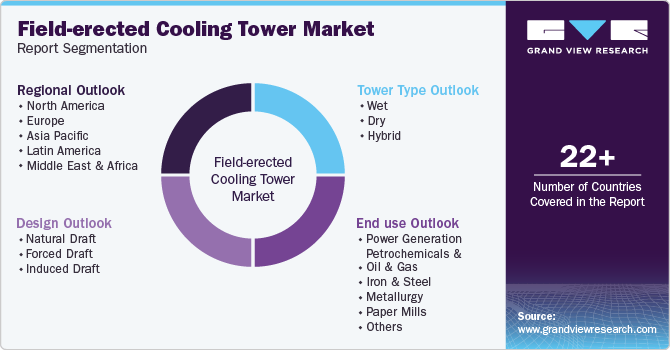

Field-erected Cooling Tower Market (2024 - 2030) Size, Share & Trends Analysis Report By Tower Type (Wet, Dry, Hybrid), By Design (Forced Draft, Natural Draft), By End Use (Power Generation, Metallurgy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-433-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Field-erected Cooling Tower Market Trends

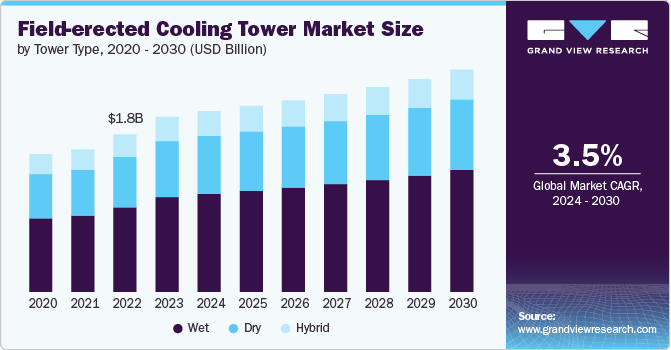

The global field-erected cooling tower market size was estimated at USD 2.10 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. The rising demand for field-erected cooling towers is primarily due to the increasing need for large-scale industrial and power generation cooling solutions. As industries and power plants aim for higher efficiency and productivity, the requirement for effective cooling systems that can handle substantial thermal loads has become paramount. Field-erected cooling towers, known for their customizability and capacity to cool vast amounts of water, are becoming the go-to option for sectors such as power generation, petrochemicals, and heavy manufacturing. This surge in demand is driven by the global expansion of industrial activities and the need for more environmentally friendly cooling processes to better manage water usage and reduce thermal pollution.

The demand for field-erected cooling towers, encompassing dry, wet, and hybrid types, is witnessing a significant evolution, driven by the global need for efficient cooling solutions across various industries such as power generation, petrochemicals, and HVAC systems for large infrastructure projects. Dry cooling towers, favored for their minimal water usage, are becoming increasingly popular in regions facing water scarcity. On the other hand, wet cooling towers remain the choice for their efficiency and cost-effectiveness in applications where water availability is not a concern. Meanwhile, hybrid cooling towers, combining the benefits of both dry and wet systems, are gaining traction for their ability to offer operational flexibility and enhanced cooling efficiency, particularly in varying climatic conditions. This diversification in demand reflects the industry's move towards more sustainable and adaptable cooling solutions, catering to the specific needs and environmental regulations of different markets.

Drivers, Opportunities & Restraints

Field-erected cooling towers are critical components in various industries, from power generation to petrochemicals, where large-scale heat dissipation is necessary. One of the main drivers of their adoption is the increasing demand for energy-efficient cooling solutions amidst rising global temperatures and industrial heat loads. With industries striving for more sustainable operations, field-erected cooling towers, designed to maximize heat transfer efficiency and reduce water consumption, are increasingly favored. Additionally, urbanization and industrial growth, especially in emerging economies, have led to an uptick in the construction of large industrial facilities and power plants, further propelling the need for such cooling systems.

The opportunity for field-erected cooling towers lies in technological advancements and customization. Modern materials and design innovations, such as lightweight, corrosion-resistant composite materials and advanced fill media, offer enhanced cooling efficiency and longevity. The ability to custom-design these cooling towers to meet specific operational requirements of a plant allows for optimal performance. It can contribute to the overall energy efficiency of industrial processes. Moreover, integrating smart technologies for monitoring and control can provide real-time data analysis for predictive maintenance and operational optimization, presenting significant opportunities for efficiency improvements and cost savings.

However, field-erected cooling towers face several challenges. The initial capital investment is considerable, primarily due to the customization and scale of these towers. Additionally, the complexity of their design and construction requires specialized expertise, potentially leading to project delays if skilled professionals are unavailable. Environmental regulations also present hurdles, as these cooling towers must comply with stringent water usage and emissions standards. Moreover, the massive water volumes needed for operation raise concerns about water scarcity and environmental impact, especially in arid regions. Finally, as these towers are exposed to harsh operating conditions, maintaining their efficiency while ensuring minimal environmental impact and water usage is a continual challenge.

Tower Type Insights

“The demand for wet tower type segment is expected to grow at a significant CAGR of 3.7% from 2024 to 2030 in terms of revenue”

The wet tower type segment led the market and accounted for 54.1% of the global market revenue share in 2023. The demand for wet tower type field-erected cooling towers has seen a significant uptick, primarily driven by their superior efficiency in heat dissipation and applicability across a wide range of industries, including power generation, HVAC systems for large industrial complexes, petrochemical plants, and more. This growth stems from increasing industrial activities worldwide, heightened by the ongoing push towards more energy-efficient and environmentally friendly cooling solutions amidst global warming concerns.

The demand for dry tower type field-erected cooling towers is rising, fueled by their unique advantages in water conservation and suitability for environments where water resources are scarce or water use is restricted. Given the increasing global focus on sustainability and the need for industries to adopt more water-efficient processes, dry cooling towers, which utilize air instead of water to dissipate heat, are becoming increasingly attractive. This is particularly relevant in industries like power generation, data centers, and certain manufacturing sectors, where water conservation measures are critical.

Design Insights

“The demand for forced draft design segment is expected to grow at a significant CAGR of 3.9% from 2024 to 2030 in terms of revenue”

The forced draft design segment led the market and accounted for 48.7% of the global revenue share in 2023. The demand for forced draft field-erected cooling towers is largely driven by industries where space constraints and specific environmental conditions dictate the need for more controlled cooling processes. These towers, with fans located at the air inlet, offer the advantage of a more uniform air distribution across the heat exchange surface, enhancing the efficiency of heat rejection. They are particularly favored in scenarios where low noise is a requirement, and in industrial applications where the air needs to be forced through a relatively small area, such as in urban settings or within densely packed industrial complexes. The adaptability of forced draft towers to various operational demands, coupled with their efficiency in cooling, makes them a preferred choice for many small to medium-sized industrial applications, despite their generally higher energy consumption due to fan usage.

The demand for natural draft field-erected cooling towers is primarily anchored in large-scale industrial plants, such as power generation facilities and heavy manufacturing, where the sheer volume of cooling required makes the efficiency and lower operational costs of natural draft systems appealing. These towers utilize the natural convection of air to cool the water without the need for mechanical fans, leading to significant energy savings over their operational lifespan.

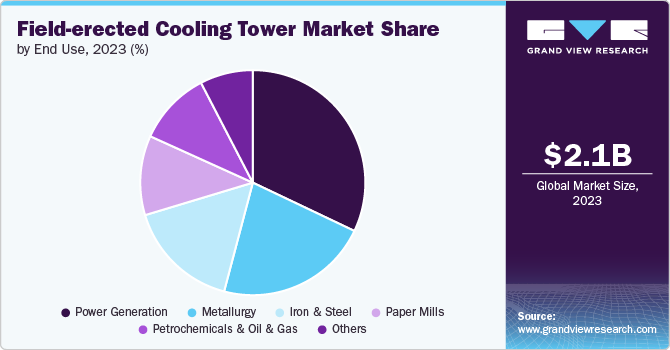

End use Insights

“The demand for petrochemicals and oil & gas end use segment is expected to grow at a significant CAGR of 3.6% from 2024 to 2030 in terms of revenue”

The power generation end use segment accounted for 32.0% of the global field-erected cooling tower market revenue share in 2023. Field erected cooling towers play a pivotal role in power generation, offering a solution for large-scale heat rejection by efficiently removing waste heat from the process or the plant system to the atmosphere. In power generation, these cooling towers are essential for maintaining the optimal operating temperature of thermal power plants, nuclear power stations, and renewable energy plants. They help in conserving water, a critical resource in power generation, by recirculating the cooling water used in the system. The effective cooling provided by these towers enhances the efficiency of the power generation process, ensuring that the plants can sustainably meet the energy demands.

In the petrochemicals, oil, & gas sectors, field erected cooling towers are equally indispensable. These sectors involve highly exothermic reactions and processes that require precise temperature control to ensure safety, efficiency, and the integrity of the products. Cooling towers in these industries not only manage the plant's thermal load but also contribute significantly to minimizing environmental impact by reducing thermal pollution. Their ability to handle high heat loads and to be customized to specific operational requirements makes field erected cooling towers a key component in sustaining the operational efficiency and environmental compliance of petrochemical, oil, and gas operations.

Regional Insights

“India to witness the fastest market growth at 5.1% CAGR from 2024 to 2030”

The demand for field-erected cooling towers in India has seen a significant uptick, primarily driven by the rapid expansion of the power generation sector and industrial growth, particularly in petrochemicals, and oil and gas industries. India's commitment to enhancing its infrastructure and the government's focus on augmenting power generation capacity to meet the increasing energy demands has propelled the need for efficient cooling solutions. Additionally, the country's burgeoning industrial sector, spurred by initiatives like "Make in India," necessitates robust cooling mechanisms to ensure operational efficiency and environmental compliance, further boosting the demand for field-erected cooling towers.

Asia Pacific Field-erected Cooling Tower Market Trends

In the Asia Pacific region, the demand for field-erected cooling towers is burgeoning, underpinned by the region's industrial growth and escalating energy requirements. Countries like China, Japan, South Korea, and Australia are at the forefront, leveraging these cooling systems extensively in power generation, petrochemicals, and other industrial applications. The Asia Pacific's focus on sustainable development and the transition towards cleaner energy sources also contribute to the increasing adoption of field-erected cooling towers, as they play a crucial role in minimizing water usage and reducing thermal pollution.

Europe Field-erected Cooling Tower Market Trends

Europe's demand for field-erected cooling towers is influenced by the region's stringent environmental regulations and the shift towards renewable energy sources. The emphasis on reducing carbon footprints and enhancing energy efficiency has prompted power generation and industrial sectors to adopt advanced cooling solutions that offer higher efficiency and minimal environmental impact. Moreover, the modernization of existing industrial plants and power facilities in Europe necessitates the retrofitting or replacement of old cooling towers with advanced field-erected models, further driving the market demand.

North America Field-erected Cooling Tower Market Trends

North America exhibits a steady demand for field-erected cooling towers, characterized by the need for energy-efficient cooling solutions in power generation, industrial processes, and HVAC applications. The U.S. and Canada are actively focusing on upgrading their aging infrastructure, including power plants and industrial facilities, which directly influences the demand for new and advanced field-erected cooling towers. Furthermore, North America's stringent environmental standards necessitate the adoption of cooling solutions that not only meet the operational demands but also align with environmental sustainability goals, thus propelling the market growth in the region.

Key Field-erected Cooling Tower Company Insights:

Some of the key players operating in the market include SPX Cooling Technologies, Inc., Babcock & Wilcox Enterprises, Inc., among others.

-

SPX Corporation is a global multi-technology provider and supplier of highly engineered products. It operates through HVAC, Detection and Measurement, and Engineered Solutions business segments. HVAC segment of the company offers commercial and industrial refrigeration products, packaged cooling towers, comfort heating solutions, and residential and commercial boilers. The company has several subsidiaries and partners. It operates through more than 150 offices across the world spanning over five continents.

-

Babcock & Wilcox Enterprises, Inc. is a provider of environmental and energy technologies that has expertise in thermal management and emission control solutions used in the power and industrial sectors. It operates through three segments, namely, Babcock & Wilcox Environmental, Babcock & Wilcox Thermal, and Babcock & Wilcox Renewable. The company has over 150 years of experience in providing diversified energy and emission control solutions to a broad range of industrial, municipal, utility, and other customers.

Cycro, Inc. and STAR Cooling Towers are some of the emerging market participants in the field-erected cooling towers market.

-

Cycro, Inc. is a fictional entity, hence providing a detailed company background isn't possible without prior existing information or context. However, if Cycro, Inc. were to be conceptualized as a company involved in the manufacturing and servicing of cooling towers, one could envision it as a leader in providing innovative cooling solutions across various industries including power generation, petrochemicals, and HVAC systems. Its focus would likely revolve around the development of energy-efficient and environmentally friendly cooling technologies that meet the stringent demands of industrial operations. Emphasizing customer service, Cycro, Inc. would be renowned for its bespoke cooling solutions that are tailored to meet the unique needs and challenges of its diverse clientele, ensuring optimal performance and reliability.

-

STAR Cooling Towers, on the other hand, is an established provider of industrial cooling tower services and solutions, with a solid reputation in the field. Specializing in the design, engineering, manufacturing, and maintenance of cooling towers, STAR Cooling Towers serves a wide range of industries including power generation, oil and gas, petrochemical, and more. Their commitment to quality and innovation is evident in their comprehensive suite of services aimed at maximizing the efficiency and lifespan of cooling towers while adhering to environmental regulations. With a customer-centric approach, STAR Cooling Towers is dedicated to delivering excellence in cooling solutions, supported by expert teams with extensive industry knowledge and experience, ensuring that clients' cooling needs are met with the highest standards of service and expertise.

Key Field-Erected Cooling Tower Companies:

The following are the leading companies in the field-erected cooling tower market. These companies collectively hold the largest market share and dictate industry trends.

- SPX Cooling Technologies, Inc.

- ENEXIO Management GmbH

- Hamon & Cie (International) SA

- Baltimore Aircoil Company, Inc.

- Paharpur Cooling Towers Ltd.

- Babcock & Wilcox Enterprises, Inc.

- Brentwood Industries, Inc.

- Delta Cooling Towers P. Ltd.

- Evapco, Inc.

- International Cooling Tower Inc.

- Mesan

- Evaptech, Inc.

- Composite Cooling Solutions, L.P.

- Cycro, inc.

- STAR Cooling Towers

Recent Developments

- In February 2022, Babcock & Wilcox Enterprises, Inc. announced the completion of the acquisition of Fossil Power Systems, Inc., a manufacturer and designer of natural gas, hydrogen, and renewable energy equipment. This likely to augment the installation of cooling tower systems at the power generation facilities.

Field-Erected Cooling Tower Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.17 billion

Revenue forecast in 2030

USD 2.67 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Tower type, design, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

SPX Cooling Technologies, Inc.; ENEXIO Management GmbH; Hamon & Cie (International) SA; Baltimore Aircoil Company, Inc.; Paharpur Cooling Towers Ltd.; Babcock & Wilcox Enterprises, Inc.; Brentwood Industries, Inc.; Delta Cooling Towers P. Ltd.; Evapco, Inc.; International Cooling Tower Inc.; Mesan; Evaptech, Inc.; Composite Cooling Solutions, L.P.; Cycro, Inc.; STAR Cooling Towers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Field-Erected Cooling Tower Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global field-erected cooling tower market based on tower type, design, end use, and region:

-

Tower Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet

-

Dry

-

Hybrid

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Draft

-

Forced Draft

-

Induced Draft

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Petrochemicals & Oil & Gas

-

Iron & Steel

-

Metallurgy

-

Paper Mills

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the field-erected cooling tower market include SPX Cooling Technologies, Inc., ENEXIO Management GmbH, Hamon & Cie (International) SA, Baltimore Aircoil Company, Inc. , Paharpur Cooling Towers Ltd., Babcock & Wilcox Enterprises, Inc., Brentwood Industries, Inc., Delta Cooling Towers P. Ltd., Evapco, Inc., International Cooling Tower Inc., Mesan, Evaptech, Inc., Composite Cooling Solutions, L.P., Cycro, Inc., STAR Cooling Towers.

b. Field-erected cooling towers, known for their customizability and capacity to cool vast amounts of water, are becoming the go-to option for sectors such as power generation, petrochemicals, and heavy manufacturing.

b. The global field-erected cooling tower market size was estimated at USD 2.10 billion in 2023 and is expected to reach USD 2.17 billion in 2024.

b. The field-erected cooling tower market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 2.67 billion by 2030.

b. The power generation end use segment accounted for 32.0% of the global field-erected cooling tower market revenue share in 2023. Field erected cooling towers play a pivotal role in power generation, offering a solution for large-scale heat rejection by efficiently removing waste heat from the process or the plant system to the atmosphere .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.