Fiberglass Mold Market Size, Share & Trends Analysis Report By Resin (Epoxy, Vinyl Ester, Polyester), By End Use (Wind Energy, Marine, Aerospace & Defense), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-352-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Fiberglass Mold Market Size & Trends

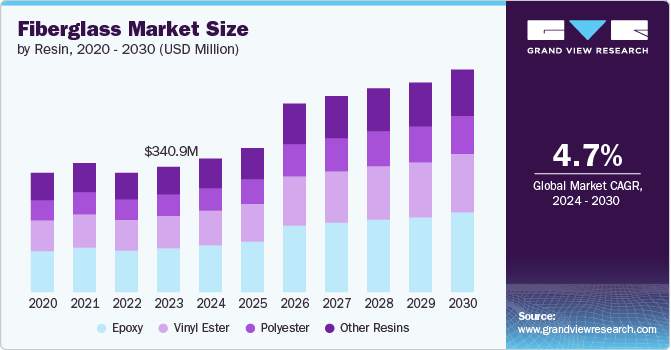

The global fiberglass mold market size was estimated at USD 340.93 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The rising demand within the automotive and transportation industries is a primary driving factor for the market. Fiberglass molds are essential in manufacturing lightweight, high-strength automotive components that help reduce vehicle weight and improve fuel efficiency. In addition, increasing focus on producing electric and hybrid vehicles to meet stringent emission regulations is expected to raise the demand for advanced materials like fiberglass. This is further expected to boost the product demand.

The expansion of the wind energy sector is significantly boosting product demand. Wind turbine blades are commonly manufactured using fiberglass molds due to their superior strength-to-weight ratio and resistance to environmental factors. As global efforts to transition to renewable energy sources intensify, the demand for wind turbines is projected to increase, leading to a higher requirement for fiberglass molds.

Innovations such as automated mold production, 3D printing, and the development of high-performance fiberglass composites have improved the efficiency, precision, and cost-effectiveness of mold manufacturing. These advancements enable manufacturers to produce complex and high-quality molds with shorter lead times and reduced production costs, making fiberglass molds more accessible to a wider range of industries. Continuous research and development in composite materials also enhance the performance characteristics of fiberglass molds, further driving their adoption across various applications.

However, establishing production facilities and acquiring specialized equipment for producing fiberglass molds requires a high initial investment. Skilled labor is also essential to operating these machines and ensuring quality control. This high entry barrier can deter small and medium-sized enterprises from entering the market and limit the expansion of existing players, especially in regions with limited financial resources.

Manufacturers often engage directly with clients in the automotive, aerospace, marine, and construction industries to provide tailored solutions. By maintaining direct relationships, manufacturers can better understand customer needs, offer personalized service, and build long-term partnerships, vital for customer retention and satisfaction. However, online platforms, including manufacturers' websites and third-party marketplaces, offer a wide selection of fiberglass mold products to a global audience.

Resin Insights

In terms of resin, epoxy led the industry with the fastest and largest revenue share of 35.15% in 2023, owing to its high strength, durability, and superior adhesive properties. In addition, epoxy resins provide high mechanical strength and resistance to environmental degradation, making them ideal for producing high-performance molds used in aerospace, automotive, and marine industries.

Vinyl ester resin is forecasted to grow at a CAGR of 4.8% from 2024 to 2030. These molds have high chemical resistance, especially to acids and alkalis, which makes them suitable for chemical processing plants and wastewater treatment facilities. Vinyl ester resins are also more resistant to cracking compared to polyester resins, making them ideal for applications where durability and longevity are critical, such as marine and sporting goods.

Polyester resins are used in large-scale production as they are comparatively less expensive than epoxy and vinyl ester resins. These molds are commonly used in construction, automotive, and marine industries to produce various parts, including boat hulls, automotive body panels, and architectural components.

In addition, polyester resins have higher shrinkage rates, making them more prone to cracking under stress, which can affect the dimensional accuracy and longevity of the molds. Despite these limitations, polyester resin's affordability and versatility make it a popular choice for a wide range of applications where cost-efficiency is prioritized, hence projected to boost the demand over the projected period.

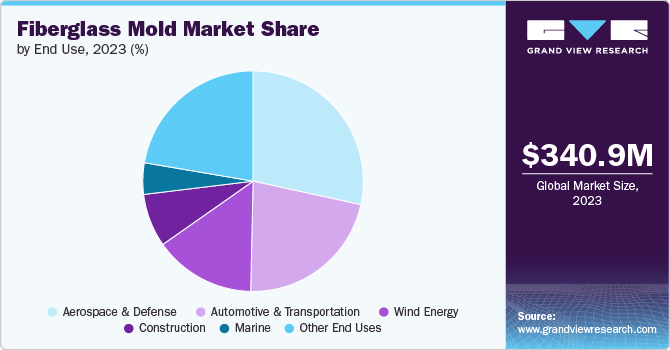

End Use Insights

In terms of end use, aerospace & defense accounted for the largest segment in 2023, with a revenue share of 28.45%. Fiberglass molds produce various aircraft components, including fuselage panels, wing sections, and interior parts. The lightweight yet strong nature of fiberglass makes it an efficient material for aerospace applications where weight reduction is critical for fuel efficiency and performance. The automotive and transportation industries utilize fiberglass molds to produce various vehicle components, such as body panels, bumpers, and interior parts. Fiberglass offers advantages like reduced weight, improved fuel efficiency, and enhanced design flexibility. Moreover, using fiberglass molds ensures that automotive components are manufactured with precision and uniformity, meeting stringent quality and safety standards.

The wind energy segment is expected to grow at the fastest CAGR of 6.0% from 2024 to 2030. As the demand for renewable energy sources grows, the wind energy industry continues to expand, driving the need for high-quality fiberglass molds. Expanding the wind energy industry is crucial for achieving efficiency and reliability in wind turbine operations, contributing to the overall market growth. The marine industry relies heavily on the market for constructing various components of boats, yachts, and other watercraft. The ongoing development of recreational boating, commercial shipping, and naval defense applications in regions like Asia Pacific and Central & South America fuels the market demand. Furthermore, the need for durable, high-performance marine vessels capable of withstanding the rigors of marine environments has fueled the market growth.

Regional Insights

The fiberglass mold market in North America accounted for the largest revenue of USD 74.7 million in 2023, owing to significant demand from diverse industries such as automotive, aerospace, and marine. The region benefits from advanced manufacturing technologies and a robust industrial base, which drives the adoption of fiberglass molds for high-performance applications. However, the region faces challenges from stringent environmental regulations and fluctuating raw material prices, which can impact the production costs and operational efficiency of the region's manufacturers.

U.S. Fiberglass Mold Market Trends

The fiberglass mold market in the U.S. benefits from substantial government and private sector investments in the aerospace, defense, and automotive industries. Furthermore, the U.S. government’s emphasis on infrastructure development and renewable energy projects also boosts the demand for fiberglass molds in the construction and wind energy sectors. Despite these growth opportunities, the market contends with regulatory challenges related to emissions and waste management, necessitating continuous investment in compliance and sustainability measures.

Europe Fiberglass Mold Market Trends

The fiberglass mold market in Europe is expected to grow significantly during the forecast period. The automotive and aerospace industries in Europe are significant consumers of fiberglass molds, driven by the need for lightweight and efficient components. Moreover, the region’s stringent environmental regulations encourage adopting sustainable manufacturing practices and materials, which supports the growth of eco-friendly fiberglass mold production. These factors drive product growth to reach USD 174.3 million by 2030.

Asia Pacific Fiberglass Mold Market Trends

The fiberglass mold market in Asia Pacific accounted for the largest and fastest-growing segment, with a 5.3% CAGR over the projected period. The region benefits from lower production costs and a growing skilled workforce, making it an attractive hub for manufacturing automotive, aerospace, and marine components. In addition, investments in R&D and improvements in manufacturing processes are essential for sustaining growth in the Asia Pacific market.

Key Fiberglass Mold Company Insights

Some of the key players operating in the market include Gurit Holding AG, Janicki Industries Inc., Molded Fiber Glass Cos, and TPI Composites Inc.

-

Gurit Holding AG, headquartered in Wattwil, Switzerland, is a prominent global supplier of advanced composite materials and engineering solutions. The company is significant in the wind energy, marine, automotive, and aerospace industries. It is also known for its comprehensive product range, which includes high-performance fiberglass and carbon fiber products, and its strong engineering expertise.

-

Janicki Industries Inc., based in Sedro-Woolley, Washington, USA, is a leading provider of large-scale precision tooling, composite fabrication, and engineering services. The company serves various industries, including aerospace, marine, and transportation. The company offers advanced manufacturing capabilities and custom solutions.

Dencam Composite A/S, SSP Technology, Indutch Composites Technology Private Limited, andNorco GRP Ltd are a few of the emerging market participants.

-

Dencam Composite, based in Denmark, specializes in designing and manufacturing high-quality composite molds and components for various industries, including wind energy and marine. The company is recognized for its innovative solutions and precision engineering.

-

SSP Technology, headquartered in Denmark, develops and produces composite materials, primarily for the wind energy sector. The company specializes in designing and manufacturing advanced composite molds, positioning itself as an emerging player in the market.

Key Fiberglass Mold Companies:

The following are the leading companies in the fiberglass mold market. These companies collectively hold the largest market share and dictate industry trends.

- Dencam Composite A/S

- SSP Technology

- Gurit Holding AG

- Indutch Composites Technology Private Limited

- Janicki Industries Inc.

- Molded Fiber Glass Cos

- Norco GRP Ltd

- SCHÜTZ GmbH & Co. KGaA

- Shandong Shaungyi Technology Co., Ltd.

- TPI Composites Inc.

Recent Developments

- In April 2022, Gurit Holding AG announced the acquisition of Fiberline Composites A/S, a manufacturer of pultruded carbon and glass fiber products. Gurit Holding AG acquired a 60% equity share of Fiberline Composites A/S for a purchase price of approximately USD 59.0 million and USD 22.0 million of assumed gross debt for the whole company. The initiative helped both companies enhance their current product offerings in the wind energy industry.

Fiberglass Mold Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 445.71 million |

|

Revenue forecast in 2030 |

USD 613.75 million |

|

Growth rate |

CAGR of 4.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia |

|

Key companies profiled |

Dencam Composite A/S; SSP Technology; Gurit Holding AG; Indutch Composites Technology Private Limited; Janicki Industries Inc.; Molded Fiber Glass Cos; Norco GRP Ltd; SCHÜTZ GmbH & Co. KGaA; Shandong Shaungyi Technology Co., Ltd.; TPI Composites Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fiberglass Mold Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fiberglass mold market report based on resin, end use, and region:

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Vinyl Ester

-

Polyester

-

Other Resins

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Wind Energy

-

Marine

-

Aerospace & Defense

-

Automotive & Transportation

-

Construction

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fiberglass mold market size was estimated at USD 340.93 million in 2023 and is expected to reach USD 445.71 million in 2024.

b. The global fiberglass mold market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 613.75 million by 2030.

b. The epoxy segment was the largest market in 2023, with a revenue share of 35.2% due to its high strength, durability, and efficient adhesive properties.

b. Some of the key players operating in the fiberglass mold market include Dencam Composite A/S, SSP Technology, Gurit Holding AG, Indutch Composites Technology Private Limited, Janicki Industries Inc., and Molded Fiber Glass Cos.

b. The key factor driving the fiberglass mold is the rising aerospace and defense industry in emerging economies such as Brazil, India, China, and South Africa.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."